- Home

- »

- Medical Devices

- »

-

Negative Pressure Wound Therapy Market Size Report, 2033GVR Report cover

![Negative Pressure Wound Therapy Market Size, Share & Trends Report]()

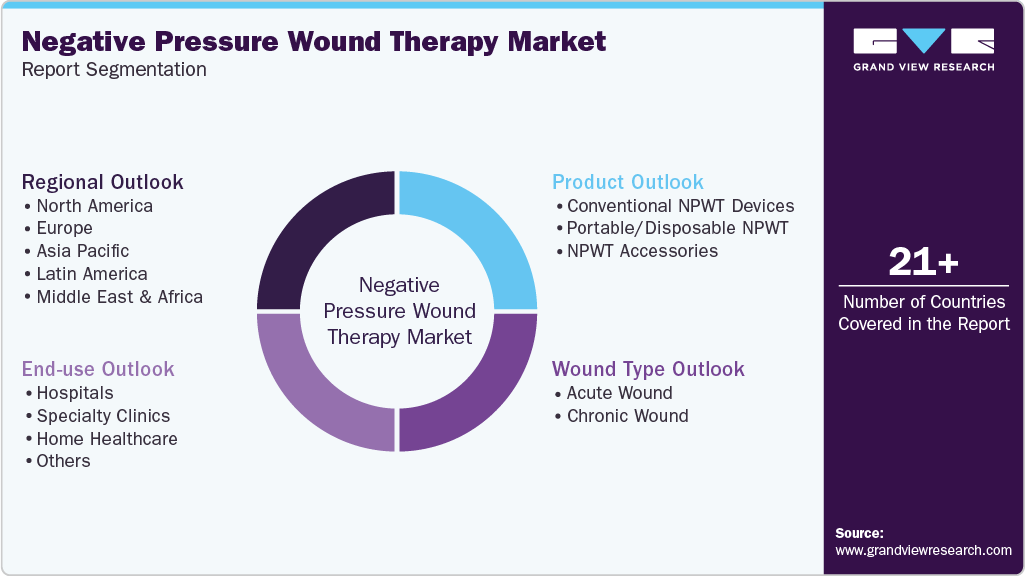

Negative Pressure Wound Therapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Portable/Disposable NPWT, Conventional NPWT Devices), By Wound Type (Acute Wound, Chronic Wound), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-208-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Negative Pressure Wound Therapy Market Summary

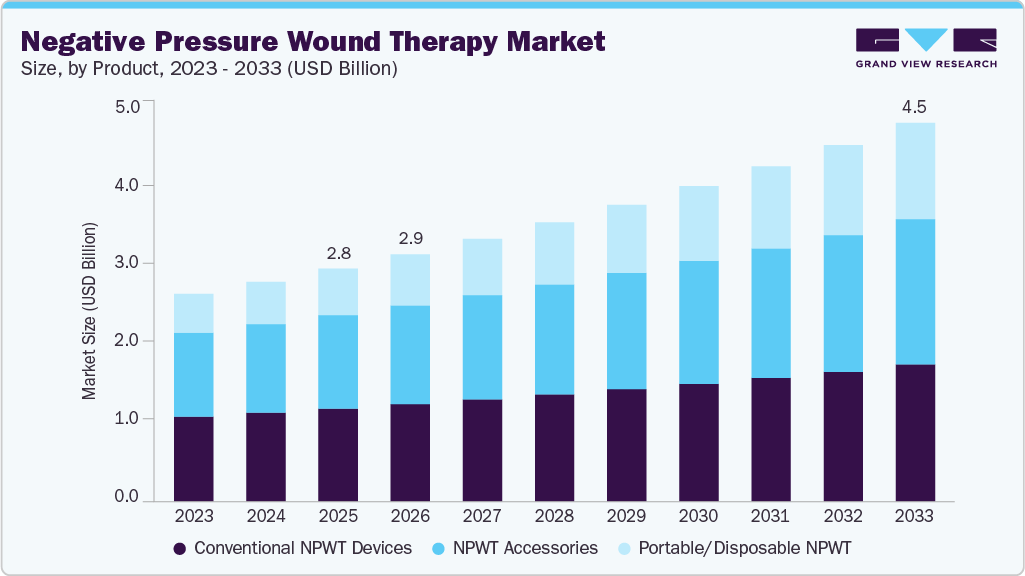

The global negative pressure wound therapy market size was estimated at USD 2.79 billion in 2025 and is projected to reach USD 4.54 billion by 2033, growing at a CAGR of 6.29% from 2026 to 2033. The market is primarily driven by the rising incidence of chronic wounds and surgical procedures, particularly among aging populations and patients with diabetes or obesity.

Key Market Trends & Insights

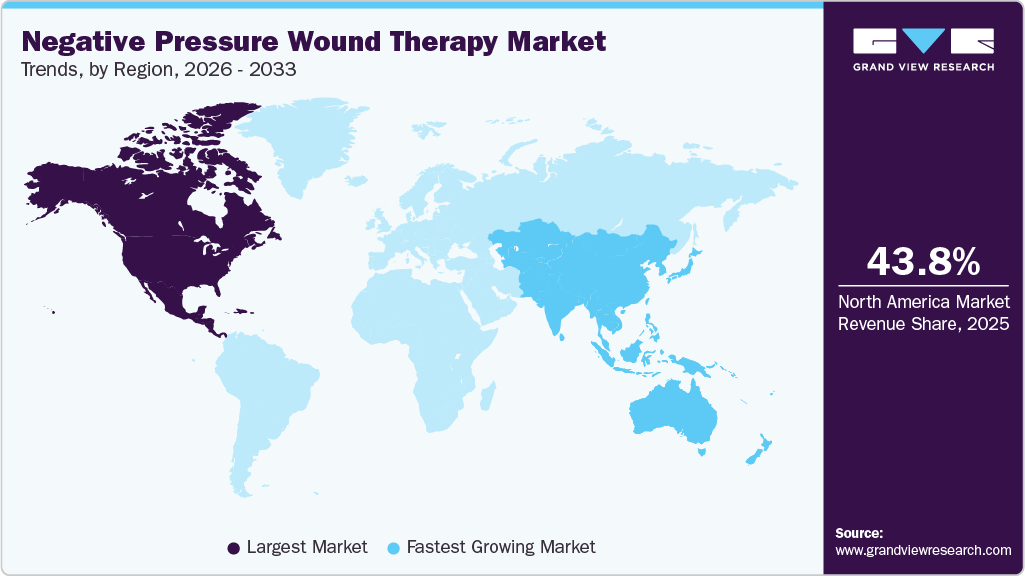

- North America dominated the global negative pressure wound therapy market with the largest revenue share of 43.81% in 2025.

- The negative pressure wound therapy industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By type, the NPWT accessories segment accounted for the largest market revenue share in 2025.

- By wound type, the chronic wounds segment accounted for the largest market revenue share in 2025.

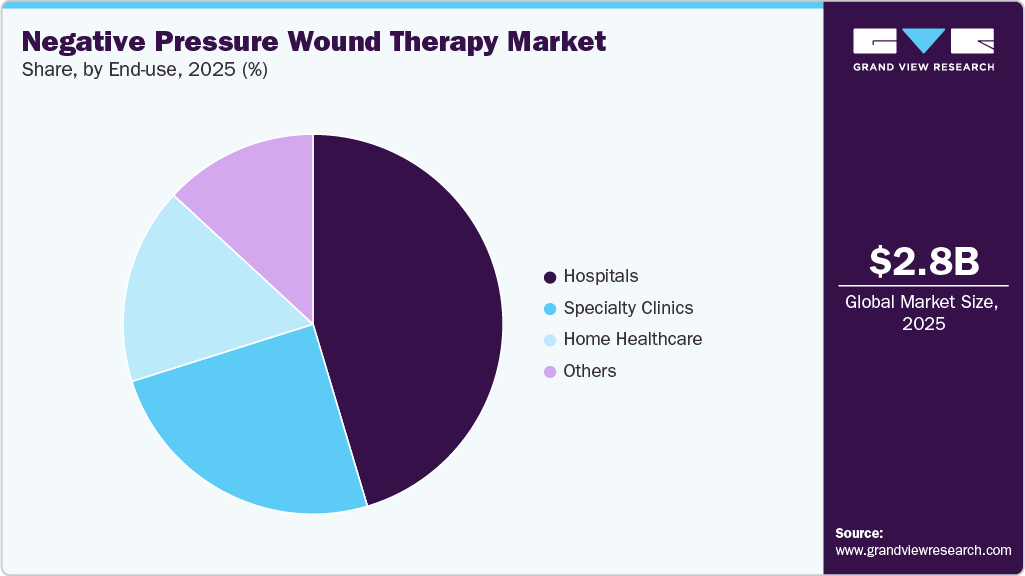

- By end use, the hospitals segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.79 Billion

- 2033 Projected Market Size: USD 4.54 Billion

- CAGR (2026-2033): 6.29%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing clinical preference for advanced wound care solutions that accelerate healing, reduce infection risk, and shorten hospital stays is further supporting their adoption. In addition, technological advancements, such as portable and disposable NPWT systems, are expanding use beyond hospitals into home-care settings. Increasing healthcare expenditure and greater awareness of evidence-based wound management are also contributing to sustained market growth.

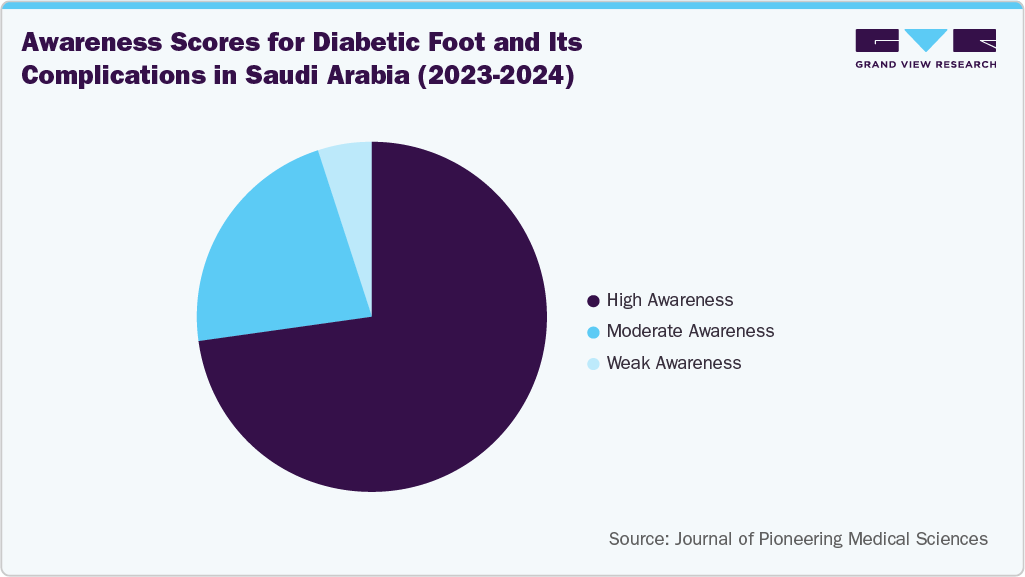

The rising incidence of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a key driver of the negative pressure wound therapy industry. The increasing diabetes prevalence and an aging population lead to more complex, slow-healing wounds that often respond poorly to conventional care. NPWT offers improved healing outcomes and lower complication risks, encouraging greater adoption by healthcare providers and driving sustained demand for NPWT devices and dressings.

Key Statistics on Diabetic Foot Ulcers (DFUs) in Saudi Arabia (2024)

Parameter

Statistic

Lifetime risk of developing DFU in diabetes patients

19-34%

Mortality within 12 months of DFU

~5%

Mortality within 5 years of DFU

~42%

Amputation risk

Higher in patients with diabetes compared to non-diabetics

Source: NCBI

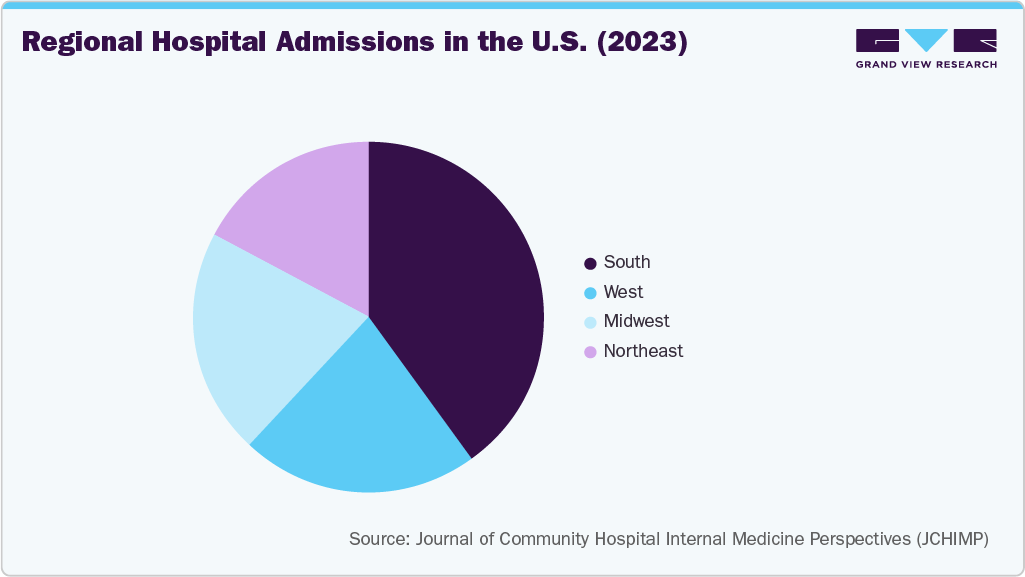

The rising number of hospital admissions is a key driving factor in the negative pressure wound therapy industry, as it expands the number of patients requiring advanced wound management for surgical incisions, trauma, pressure ulcers, and chronic wounds. Higher admission rates lead to greater volumes of complex procedures and post-operative care, where NPWT is commonly used to reduce complications and speed healing. As hospitals prioritize shorter length of stay and better outcomes, NPWT adoption increases as a standard component of inpatient wound care.

Number Of Surgical Operations & Procedures in EU (2022)

Country

Cataract surgery

Caesarean section

Transluminal coronary angioplasty

Hip replacement

Repair of inguinal hernia

Laparoscopic repair of inguinal hernia

France

1 493.0

221

292

256

228

104

Sweden

1 295.8

188

173

265

160

13.3

Denmark

1 289.4

199

156

283

174

116

Germany

1 153.7

275

379

325

191

130

Spain

1 043.7

166

126

137

220

30.4

Italy

979

216

224

212

198

11.8

Norway

398

161

204

255

108

74.7

Source: Eurostat

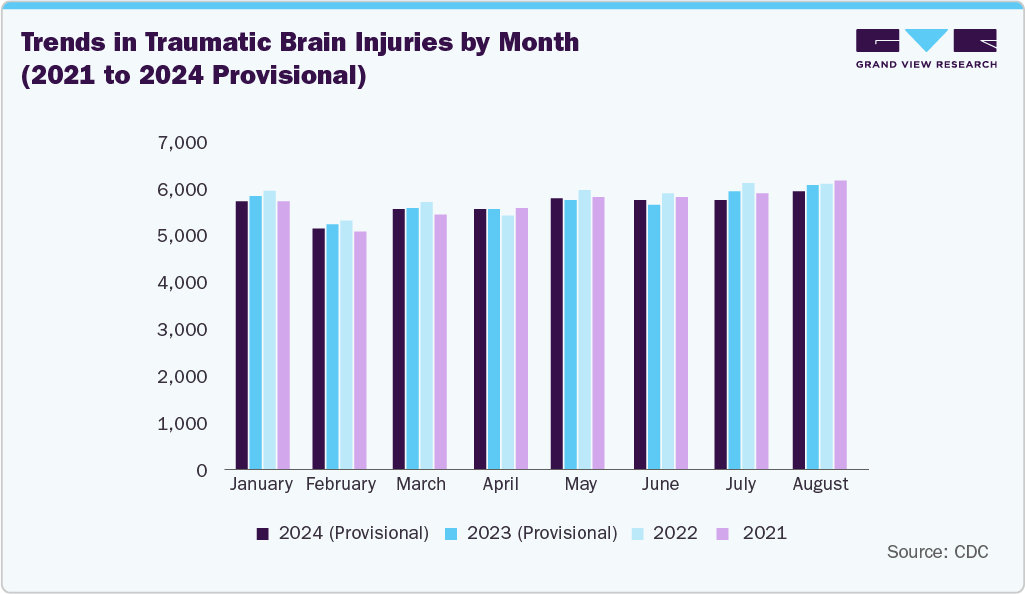

The increasing volume of surgical procedures and traumatic injuries is another factor driving growth in the negative pressure wound therapy industry, as such wounds often require advanced management to prevent complications. NPWT promotes faster healing, lowers infection risk, and improves post-operative outcomes, making it a preferred solution across surgical and trauma care settings.

According to the World Population Review, in 2024, the number of surgical procedures was approximately 2.0 million, while non-surgical procedures accounted for about 4.2 million cases.

The growing clinical evidence highlighting the effectiveness of negative pressure wound therapy is a key driver of market growth. Numerous trials and real-world studies have demonstrated that NPWT promotes faster wound closure, improves granulation tissue formation, and reduces infection risk compared with traditional dressings. This strong clinical validation has increased clinician confidence, leading to broader adoption across hospitals, outpatient centers, and home care settings, and supporting its inclusion in standard wound care protocols.

The expansion of wound care manufacturing facilities is correlated with the growing evidence supporting the efficacy of NPWT. For instance, in September 2025, Mölnlycke Health Care, a global MedTech provider headquartered in Gothenburg, Sweden, announced the groundbreaking of a major expansion of its wound care manufacturing facility in Brunswick, Maine, U.S. This milestone marks the beginning of a USD135 million investment aimed at substantially expanding Mölnlycke’s manufacturing capacity in the U.S.

“This expansion is a bold step forward for Mölnlycke in the U.S. It reinforces our mission to free patients and caregivers from the burden of wounds, strengthens supply resilience, and helps us to deliver high-quality wound care solutions faster, smarter, and more sustainably,” says Zlatko Rihter, CEO of Mölnlycke. “I’m proud to mark this milestone for Mölnlycke, for Maine, and for the future of MedTech.”

“Today isn’t just about breaking ground. It’s about being bold, embracing partnerships and leading with passion,” says Chris Biddle, General Manager of U.S. Manufacturing, Wound Care. “Thank you to everyone who helped bring this vision to reality. The expansion is a win for Mölnlycke, for the local community and, ultimately, for the patients we serve.”

Market Concentration & Characteristics

The negative pressure wound therapy industry demonstrates a moderate to high degree of innovation, driven by the shift from bulky conventional systems to compact, disposable, and single-use devices. Continuous advancements in smart pressure control, portable designs, and improved dressing materials are expanding NPWT use across outpatient, home care, and post-surgical settings while improving patient comfort and clinical outcomes. For instance, in April 2024, Smith+Nephew, a global medical technology company, announced the launch of its RENASYS EDGE Negative Pressure Wound Therapy (NPWT) System in the U.S., designed as a patient-centric solution for chronic wound management. The lightweight and compact system can be easily worn or carried, features a discreet canister, and operates quietly to support patient comfort and minimize disruption to daily activities.

“When designing the RENASYS EDGE System we kept patients and their needs in the forefront of our minds. It’s the very definition of our purpose - Life Unlimited - allowing patients to continue with their daily lives while receiving prescribed negative pressure wound therapy,” stated Laura Ackerman, Vice President and General Manager, NPWT at Smith+Nephew. “And now with SunMED in the commercial healthcare market and First Nation Group supporting our veterans, RENASYS EDGE will be able to create a lasting impact on the way patients experience the benefit of negative pressure wound therapy in the comfort of their home.”

In addition, in November 2024, privately held Guard Medical Inc. announced that it had received the 2024 American Association of Hip and Knee Surgeons (AAHKS) Industry Innovation Award for NPseal, its next-generation Negative Pressure Wound Therapy (NPWT) dressing designed for the management of closed surgical incisions.

“We’re grateful for AAHKS’s recognition of our breakthrough NPseal technology. Winning this award highlights how NPseal addresses a significant need in the orthopedic space for both providers and patients,” stated Machiel van der Leest, CEO of Guard Medical, “and this is evidenced by the swift adoption of NPseal in hospital systems and practices across the nation.”

“The AAHKS Innovation Award is now in its third year, and we have had a record number of submissions,” stated Cory Calendine, MD, Chair of AAHKS Industry Relations Committee. “It is a competitive company award recognizing cutting-edge technologies in the field of arthroplasty.”

The negative pressure wound therapy industry exhibits a moderate level of merger and acquisition activity, as established companies acquire emerging players to enhance their technology offerings and expand their market presence. This targeted consolidation supports portfolio expansion and scale efficiencies, and maintains a competitive landscape with opportunities for specialized innovators. For instance, in January 2024, Lion Street Medical announced the successful acquisition of Pensar Medical, a recognized medical device company focused on wound care solutions. The transaction, completed in October 2023, introduces new leadership for the established Pensar Medical and WoundPro brands, reinforcing their position in the wound care market.

"We see a complete product portfolio for NPWT at Pensar," said Jason Bandy, who led the acquisition and will join as Pensar Medical's CEO. "Pensar has an established presence in traditional NPWT and a market-ready solution in MicroDoc to combat incidences of surgical site infections and improve healing with the use of NPWT for closed incisions."

"The annual market for sNPWT is approximately $400mm and growing more than 20% per year," Benjamin Ostrow, the company's new Chief Financial Officer, who co-led the acquisition with Bandy. "The growth is driven by the adoption of NPWT for closed incisions as well as the simplicity and economics of disposable devices."

"Already the standard of care in mature markets, Negative Pressure Wound Therapy represents a more than $3 billion total addressable market that continues to grow at 6% to 8% per year," Bandy continued. "We see immense potential for growth and enhancing health outcomes. We're excited to start this new phase alongside our dedicated distributors and employees."

In December 2025, Solventum announced that it had completed the acquisition of Acera Surgical, a privately held bioscience company specializing in the development and commercialization of fully engineered materials for regenerative wound care.

"Announcing and completing our first strategic acquisition is a significant milestone and the successful completion of another commitment made as part of our three-phased transformation plan," said Bryan Hanson, chief executive officer of Solventum. "The addition of Acera's innovative synthetic tissue matrix technology complements our existing advanced wound care portfolio, enhancing the solutions our specialized commercial team can provide to clinicians and decision makers in acute care settings. We are excited to welcome the Acera team to the Solventum family and look forward to our work together to accelerate growth and create significant value for patients, clinicians, and shareholders."

The regulations in the negative pressure wound therapy industry play an essential role in ensuring patient safety and product efficacy, often requiring rigorous clinical testing and adherence to strict compliance protocols. The standards can increase development costs and extend time to market, also help build trust among healthcare providers and users, supporting long-term adoption and market stability. NPWT systems are classified as Class II medical devices in most regulatory markets, reflecting a moderate risk associated with their intended use. They require regulatory clearance and adherence to safety and performance standards, with advanced systems subject to additional clinical and post-market oversight.

Pressure Ulcer Prevalence Across Care Settings in the U.S. and Canada

Care Setting

Pressure Ulcer Prevalence Range (%)

Hospitals

4.7% - 29.7%

Community Settings

19.2% - 29.0%

Nursing Homes

15.3% - 20.7%

Source: NCBI

The end-user concentration in the negative pressure wound therapy industry is diversified, with significant demand coming from hospitals, specialty wound care centers, and growing adoption in home healthcare settings. While hospitals remain the largest user group, increasing awareness and reimbursement support are expanding among outpatient facilities and patients managing chronic wounds at home.

Product Insights

The NPWT accessories segment accounted for the largest market revenue share in 2025, due to their recurring use and essential role in therapy delivery across both conventional and single-use systems. Components such as dressings, canisters, and tubing require frequent replacement, driving sustained demand. The growing number of NPWT procedures and expansion into home and outpatient care further strengthened the dominance of accessories in overall market revenue.

The portable/disposable segment is anticipated to grow at the fastest CAGR during the forecast period. These devices offer greater convenience, ease of use, and mobility compared with traditional stationary systems, enabling patients to receive effective wound care in outpatient, home, and ambulatory settings. The growing emphasis on reducing hospital stays and lowering healthcare costs further drives demand for portable/disposable NPWT, as they support early discharge and continuous therapy outside hospital environments.

Wound Type Insights

The chronic wounds segment accounted for the largest market revenue share in 2025. Driven by the growing prevalence of diabetes, vascular diseases, and aging populations that require long-term wound management. NPWT is widely adopted for chronic wounds such as diabetic foot ulcers and pressure ulcers because it promotes faster healing and reduces infection risk. Consistent clinical outcomes and increasing use across hospitals and outpatient settings further reinforced the dominance of chronic wound applications.

The acute wounds segment is expected to grow at the fastest CAGR during the forecast period. Driven by rising surgical volumes and increasing use of NPWT for post-operative incision management. Greater adoption of trauma and orthopedic procedures is supporting faster healing and lower complication rates. The availability of single-use and prophylactic NPWT systems is further accelerating uptake across hospitals and outpatient surgical centers.

End-use Insights

The hospitals segment led the market with the largest revenue share of 45.38% in 2025, due to their high volume of surgical procedures, trauma cases, and complex chronic wounds that require advanced wound management. The availability of skilled healthcare professionals and integrated care pathways supports widespread NPWT use in inpatient settings. Furthermore, hospital-based reimbursement structures and access to advanced NPWT systems underscore their leading role compared to outpatient and home care environments.

The home healthcare segment is expected to grow at the fastest CAGR during the forecast period, driven by the shift toward outpatient care and early hospital discharge. Portable, single-use NPWT devices are making therapy easier to manage outside clinical settings while improving patient comfort and adherence. Supportive reimbursement trends and rising preference for cost-effective, home-based wound management are further accelerating adoption.

Regional Insights

North America dominated the global negative pressure wound therapy market with the largest revenue share of 43.81% in 2025. North America’s NPWT market is shifting toward greater portability and patient-centric care, with lightweight and single-use systems facilitating wider adoption in outpatient and home healthcare settings. Payers and hospitals are focusing on cost-effectiveness and shorter hospital stays, which is pushing manufacturers to offer bundled solutions and clearer outcomes data. Furthermore, innovation in dressing materials and smart monitoring, alongside selective mergers and acquisitions, continues to reshape competition and expand access across care settings.

U.S. Negative Pressure Wound Therapy Market Trends

The negative pressure wound therapy market in the U.S. accounted for the largest market revenue share in North America in 2025. The market is evolving with a strong shift toward portable and user-friendly device that support care beyond traditional hospital settings, especially in home health and outpatient wound clinics. Healthcare providers are emphasizing value-based care, driving demand for cost-efficient therapies with demonstrated healing outcomes. The technological advancements in smart pressure control and disposable systems are fostering broader adoption and heightened interest from payers and clinicians.

Prevalence and Recurrence Rate of VLU in U.S. (2023)

Country

Population Group

Prevalence

Recurrence Rate (3 Months)

Recurrence Rate (12 Months)

Recurrence Rate (3 Years)

United States

People aged 65 and above

4%

22%

57%

78%

Source: Wiley Online Library

Europe Negative Pressure Wound Therapy Market Trends

The negative pressure wound therapy market in Europe is growing emphasis on integrating advanced wound care into standardized treatment pathways, supported by strong healthcare infrastructure and reimbursement frameworks in key countries. Clinicians are increasingly adopting portable and single-use NPWT systems to improve patient mobility and reduce hospital stays. In addition, sustainability and cost-containment pressures are encouraging manufacturers to innovate with more efficient materials and streamlined care solutions across diverse healthcare settings.

The UK negative pressure wound therapy market is shaped by the transition of wound care from hospitals to community and home-based settings to ease capacity constraints. Greater focus on value-driven care and proven clinical outcomes is accelerating the uptake of simplified and single-use NPWT devices. In addition, wider implementation of standardized care pathways is supporting more uniform adoption across NHS facilities. According to the JMIR Research Protocol, in 2024, more than 4.3 million people in the UK were diagnosed with diabetes, and it is estimated that 19%-34% of these individuals will develop diabetes-related foot ulcers (DFUs) at some point during their lifetime.

The negative pressure wound therapy market in Germany is characterized by the widespread integration of advanced wound care solutions across hospital and outpatient settings, driven by a strong emphasis on clinical quality and efficiency. The growing use of portable and user-friendly NPWT systems supports earlier discharge and continuity of care beyond the hospital setting. Furthermore, alignment with reimbursement policies and cost accountability is fostering steady adoption and encouraging ongoing product innovation.

Asia Pacific Negative Pressure Wound Therapy Market Trends

The negative pressure wound therapy market in the Asia Pacific is expanding rapidly as healthcare infrastructure improves and awareness of advanced wound care grows across emerging and developed economies. Adoption of portable and cost-effective NPWT systems is increasing, driven by rising chronic wound prevalence and demand for efficient outpatient and home-based care. Local manufacturers are also entering the market, fostering competition and encouraging innovation tailored to regional needs and resource settings.

The China negative pressure wound therapy market is exhibiting strong performance, driven by expanding hospital infrastructure and growing demand for advanced wound management in both surgical and chronic care settings. The market is driven by a rising aging population, a higher incidence of diabetes-related wounds, and a growing awareness among clinicians of the benefits of faster healing. In addition, government-led healthcare modernization and improving access to cost-effective, locally manufactured NPWT systems are accelerating adoption across urban and secondary care facilities. According to an article published in 2025 by the National Library of Medicine, the prevalence of diabetic foot (DF) is estimated at 6.3% (95% CI: 5.4%-7.3%), while the reported annual incidence ranges from 0.1% to 11%.

Latin America Negative Pressure Wound Therapy Market Trends

The negative pressure wound therapy market in Latin America is experiencing significant growth as healthcare systems increasingly adopt advanced wound care solutions to enhance clinical outcomes. Market performance is supported by rising surgical procedures, an increasing prevalence of chronic wounds, and the expansion of private healthcare facilities, particularly in countries such as Brazil and Argentina. Growing clinician awareness, along with improvements in reimbursement and access to portable NPWT systems, are further supporting the adoption of these systems across hospital and outpatient settings.

MEA Negative Pressure Wound Therapy Market Trends

The negative pressure wound therapy market in MEA is expanding as healthcare providers invest in advanced wound care to address the rising number of chronic wound cases and post-surgical care needs. Market performance varies across the region, with stronger uptake in countries such as Saudi Arabia and the UAE, where healthcare infrastructure and funding are more developed. Key drivers include increasing awareness of NPWT benefits, government initiatives to modernize care, and the growing availability of portable, cost-effective systems suitable for both hospital and outpatient use.

Diabetic Foot Ulcers (DFUs) in Saudi Arabia (2024)

Parameter

Statistic

Lifetime risk of developing DFU in diabetes patients

19-34%

Mortality within 12 months of DFU

~5%

Mortality within 5 years of DFU

~42%

Amputation risk

Higher in patients with diabetes compared to non-diabetics

Source: NCBI

Key Negative Pressure Wound Therapy Company Insights

The key negative pressure wound therapy industry is led by a mix of well-established medical device companies and innovative smaller players, creating a moderately competitive landscape. Large manufacturers generally command higher market shares due to strong brand presence and extensive distribution channels, while emerging companies are increasing their share by offering focused, cost-effective, and user-friendly solutions.

Key Negative Pressure Wound Therapy Companies:

The following are the leading companies in the negative pressure wound therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Smith & Nephew

- Direct Healthcare Group

- Convatec

- DeRoyal Industries, Inc.

- Medela (Medaxis LLC)

- Paul Hartmann AG

- Mölnlycke Health Care AB

- 3M (Solventum)

- Cardinal Health

- Genadyne Biotechnologies, Inc.

- Pensar Medical (Lion Street Medical, LLC)

- Alleva Medical Ltd.

- Guard Medical

- Triage Meditech Pvt. Ltd

- L&R Group

- Essity Aktiebolag (publ)

Recent Developments

-

In December 2025, Solventum announced the consensus recommendations issued by an international, multidisciplinary panel of surgeons and wound care experts regarding the clinical use of closed incision negative pressure therapy (ciNPT) with reticulated open-cell foam (ROCF) dressings.

-

In December 2025, Solventum announced that it had completed the acquisition of Acera Surgical, a privately held bioscience company specializing in the development and commercialization of fully engineered materials for regenerative wound care.

-

In November 2025, Mölnlycke Health Care announced the commencement of its new wound care manufacturing facility in Changshu, China. This milestone represents a strategic step in the company’s global expansion, marking its first localized production site in one of the world's fastest-growing MedTech markets. The investment enhances regional manufacturing capacity, strengthens supply chain resilience, and supports the increasing demand for advanced wound care solutions across China and the wider Asia-Pacific region.

-

In October 2025, Smith+Nephew released results from a comparative study indicating that PICO sNPWT (-80 mmHg) demonstrated superior outcomes in reducing wound dehiscence and lowering overall healthcare costs in cardiovascular and orthopedic surgeries, compared with Prevena sNPWT (-125 mmHg).

-

In October 2025, Convatec announced plans to invest more than USD 1 billion over the next decade to accelerate its global research and development initiatives. This long-term commitment aims to strengthen the company’s innovation pipeline and advance next-generation healthcare solutions across its core therapeutic areas. The investment underscores the strategic role of the U.S. and the UK as key hubs supporting Convatec’s future growth, technological progress, and leadership in chronic care management.

-

In September 2025, Mölnlycke Health Care announced the groundbreaking of a USD 135 million expansion of its wound care manufacturing facility in Brunswick, Maine. This development marks a significant milestone in strengthening the company’s U.S. manufacturing footprint and expanding production capacity to meet the growing demand for advanced wound care solutions.

-

In September 2025, Cardinal Health announced the opening of its newest distribution center in Fort Worth, Texas, dedicated solely to its at-Home Solutions business, which supplies medical products to more than 6 million people across the U.S. annually. The company also disclosed plans to break ground on an additional at-home solutions distribution facility in Sacramento, California, later in the same fiscal year.

Negative Pressure Wound Therapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.96 billion

Revenue forecast in 2033

USD 4.54 billion

Growth rate

CAGR of 6.29% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wound type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Norway; Denmark; Sweden; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Smith & Nephew; Direct Healthcare Group; Convatec; DeRoyal Industries, Inc.; Medela (Medaxis LLC); Paul Hartmann AG; Mölnlycke Health Care AB; 3M (Solventum); Cardinal Health; Genadyne Biotechnologies, Inc.; Pensar Medical ( Lion Street Medical, LLC); Alleva Medical Ltd.; Guard Medical; Meditech Pvt. Ltd; L&R Group; Essity Aktiebolag (publ)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Negative Pressure Wound Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global negative pressure wound therapy market report based on the product, wound type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional NPWT Devices

-

Portable/Disposable NPWT

-

Disposable Portable NPWT

-

Reusable Portable NPWT

-

-

NPWT Accessories

-

-

Wound Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Acute Wound

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wound

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Sweden

-

Denmark

-

Norway

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the negative pressure wound therapy market growth include increasing demand for advanced wound care, rising prevalence of chronic and acute wounds, rising number of surgeries, and technological advancements.

b. Some key players operating in the negative pressure wound therapy market include Smith & Nephew, Direct Healthcare Group, Convatec, DeRoyal Industries, Inc., Medela (Medaxis LLC), Paul Hartmann AG, Mölnlycke Health Care AB, 3M (Solventum), Cardinal Health, Genadyne Biotechnologies, Inc., Pensar Medical ( Lion Street Medical, LLC), Alleva Medical Ltd., Guard Medical, Meditech Pvt. Ltd, L&R Group, Essity Aktiebolag (publ) and Others

b. The global negative pressure wound therapy market size was estimated at USD 2.79 billion in 2025 and is expected to reach USD 2.96 billion in 2026.

b. The global negative pressure wound therapy market is expected to grow at a compound annual growth rate of 6.29% from 2026 to 2033 to reach USD 4.54 billion by 2033.

b. North America dominated the hydrocolloid dressings market in 2025 during the forecast period and is expected to witness a growth rate of 5.24% over the forecast period. This can be attributed to the presence of key players, the presence of well-developed healthcare infrastructure, and rising demand for advanced treatment options, owing to the increasing prevalence of wounds, and growing efforts by the government to reduce the overall treatment duration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.