- Home

- »

- Pharmaceuticals

- »

-

Multiple Sclerosis Therapeutic Market, Industry Report, 2030GVR Report cover

![Multiple Sclerosis Therapeutic Market Size, Share & Trends Report]()

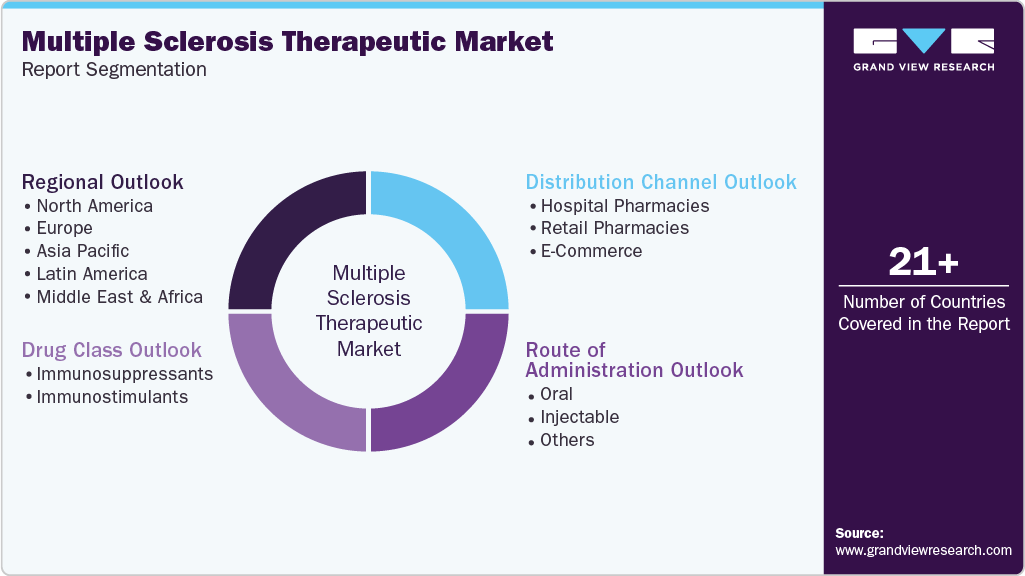

Multiple Sclerosis Therapeutic Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Immunosuppressants, Immunostimulants), By Route Of Administration (Oral, Injectable), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-833-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multiple Sclerosis Therapeutic Market Summary

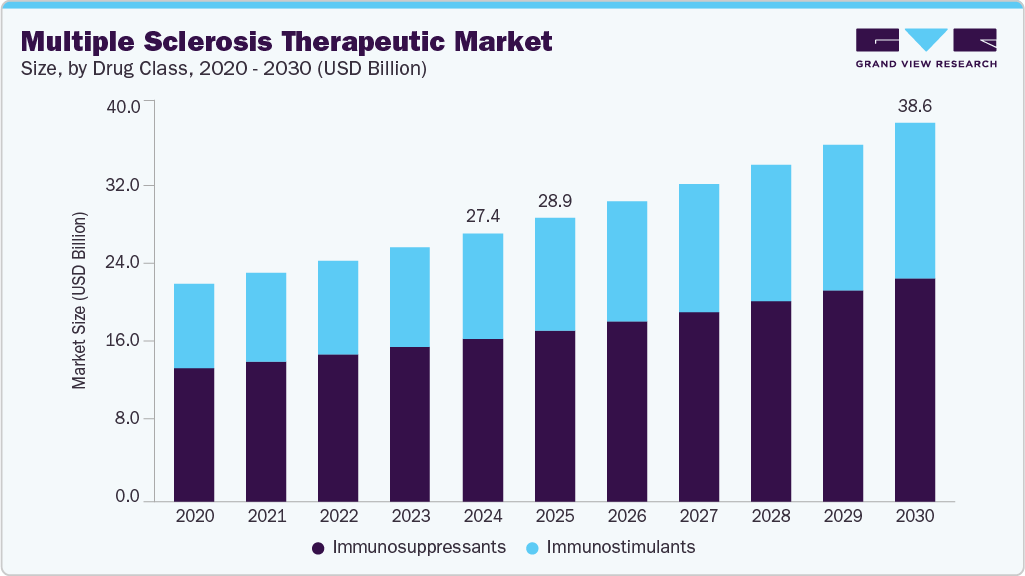

The global multiple sclerosis therapeutic market size was estimated at USD 27.39 billion in 2024 and is projected to reach USD 38.62 billion by 2030, growing at a CAGR of 5.93% from 2025 to 2030. The market growth is due to the rise in the global prevalence of the disease, and the advancements in the treatment which have led to the development of disease-modifying therapies (DMTs) that slow the progression and manage the symptoms more effectively.

Key Market Trends & Insights

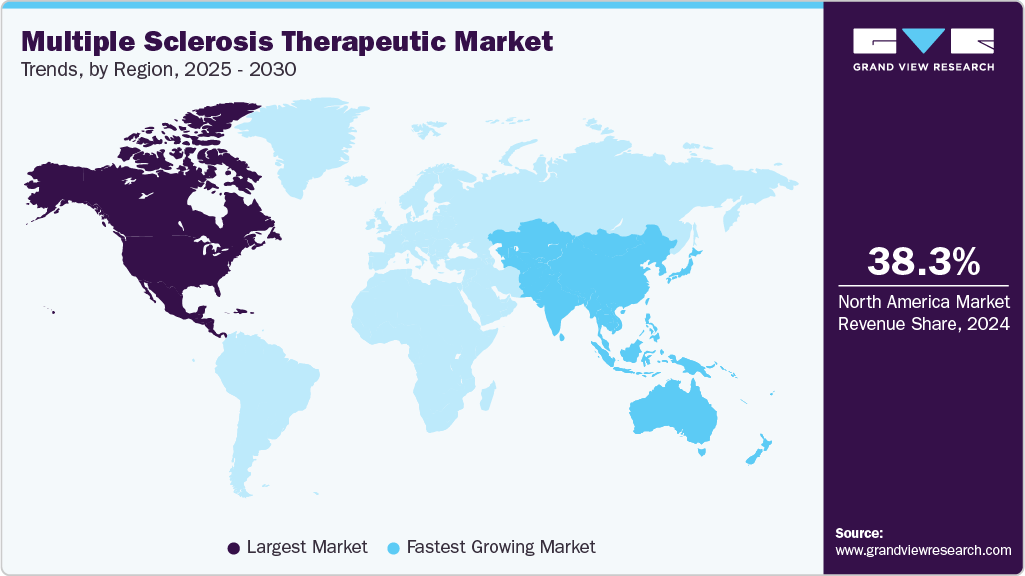

- North America leads the global multiple sclerosis therapeutic market with a share of 38.28% in 2024.

- The U.S. dominated the North America multiple sclerosis therapeutic market in 2024.

- By drug class, the Immunosuppressants segment held the largest revenue share of 60.50% in 2024.

- By route of administration, the injectable segment held the largest share of 52.50% in 2024.

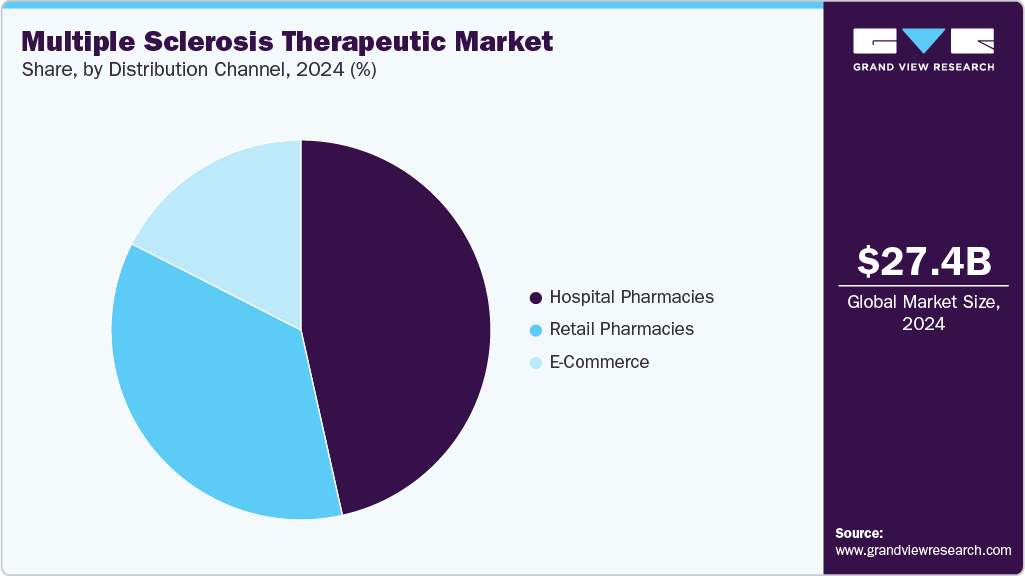

- By distribution channel, the hospital pharmacies segment held the largest share of 46.50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.39 Billion

- 2030 Projected Market Size: USD 38.62 Billion

- CAGR (2025-2030): 5.93%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Recent technological advancements are significantly enhancing the quality of life for individuals with multiple sclerosis (MS) and are poised to create substantial growth opportunities in the therapeutic market during the forecast period. Innovations such as assistive robotic arms, smartphone applications, voice-command interfaces, and neurotherapeutic techniques like transcranial direct current stimulation (tDCS) have revolutionized patient care and symptom management.The increasing global prevalence of MS, alongside rising demand for effective and novel drug therapies, is a major driver of market growth. According to the MS International Federation, the number of people living with MS has grown from 2.3 million in 2013 to 2.8 million in 2020, reaching 2.9 million in 2023. This upward trend underscores the urgent need for advanced treatment options and supports the expansion of the MS therapeutics market.

The multiple sclerosis therapeutic industry growth is further fueled by increased investment in research and development, particularly by leading pharmaceutical companies striving to introduce innovative drugs. Additionally, new product launches, expanding government initiatives to enhance access to treatment, and improved healthcare infrastructure are contributing to global market expansion.

Technological progress in clinical diagnostics and rising healthcare expenditures are also accelerating market development. The availability of effective oral medications and injectables with minimal side effects has allowed patients to manage symptoms more efficiently, driving strong demand. This trend has encouraged the entry of new players into the market, particularly in the generics and biosimilars segments.

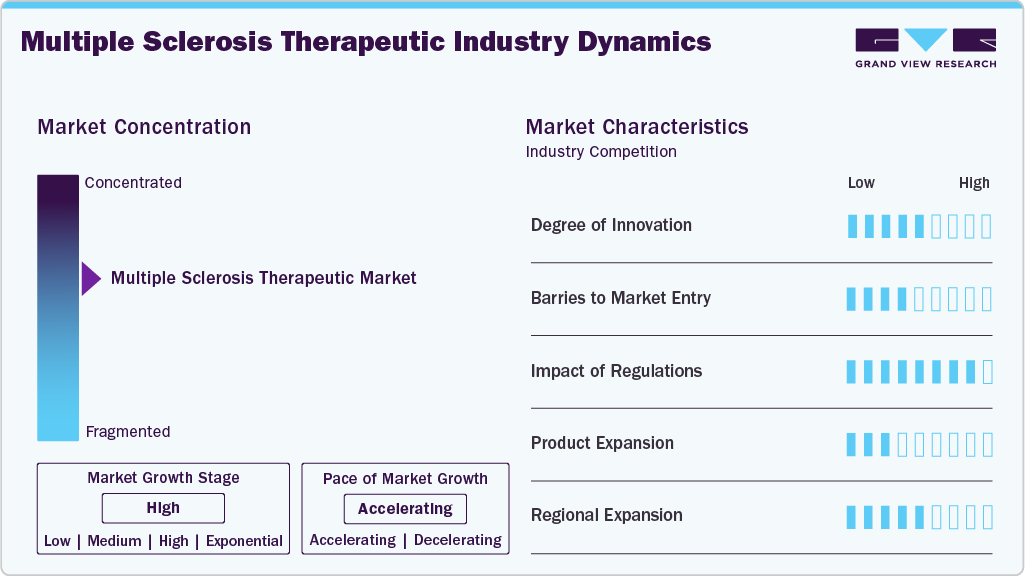

Market Concentration & Characteristics

The Multiple Sclerosis (MS) therapeutics market is undergoing rapid transformation with the emergence of next-generation immunomodulators, monoclonal antibodies, and S1P receptor modulators. Disease-modifying therapies (DMTs) are expanding beyond traditional injectables to include oral agents and long-acting biologics, enhancing patient adherence and quality of life. Innovative therapies like B-cell depleting agents (e.g., ocrelizumab, ofatumumab) and BTK inhibitors are significantly improving outcomes in relapsing-remitting MS (RRMS) and progressive forms. Advances in biomarkers and precision medicine are enabling more personalized treatment regimens based on disease activity and genetic profiles, further improving long-term disease management.

Entering the MS therapeutics space poses scientific, clinical, and regulatory challenges, particularly due to the complex and chronic nature of the disease. Developing novel DMTs requires extensive long-term studies to demonstrate efficacy in reducing relapse rates, slowing disease progression, and preserving neurological function. Manufacturing complexities for biologics, combined with stringent pharmacovigilance requirements, increase the entry burden. Moreover, entrenched competition from established companies like Biogen, Novartis, and Roche, who have strong brand loyalty and established neurologist networks, makes it difficult for new players to gain significant market share.

Regulatory bodies such as the FDA and EMA require robust clinical trial data demonstrating both short-term efficacy and long-term safety, especially in progressive MS subtypes where treatment options are limited. Orphan drug designations have accelerated approval of certain high-need therapies, but manufacturers must fulfill post-marketing commitments, including registries and real-world data collection. Health Technology Assessments (HTAs), particularly in Europe and Canada, heavily influence market access based on cost-effectiveness, patient-reported outcomes, and quality-adjusted life years (QALYs), particularly important for high-cost monoclonal antibodies and new oral therapies.

MS treatment strategies vary by disease type and severity. Traditional injectable DMTs (e.g., interferons, glatiramer acetate) remain in use, especially for mild to moderate RRMS. However, oral drugs like fingolimod, dimethyl fumarate, and teriflunomide are gaining preference due to ease of administration. High-efficacy monoclonal antibodies (e.g., natalizumab, alemtuzumab) are often reserved for aggressive MS but come with higher risk profiles. The emergence of biosimilars for older biologics and generics for oral agents is intensifying price competition, challenging the uptake of newer, premium-priced therapies unless they demonstrate clear clinical superiority or better tolerability.

Leading pharmaceutical companies such as Sanofi, Novartis, and Merck & Co. are strategically expanding their MS treatment portfolios into emerging markets in Asia-Pacific, Latin America, and the Middle East. These expansions are supported by regulatory harmonization, physician education programs, and partnerships with local health authorities. Infrastructure development for diagnostic imaging (e.g., MRI) and infusion centers is enabling wider access to both high-efficacy biologics and maintenance therapies. Simultaneously, distribution models are evolving to support both hospital-based infusions and community-based oral or subcutaneous therapies, improving reach and adherence in underserved regions.

Drug Class Insights

The Immunosuppressants segment dominated the multiple sclerosis therapeutic market with the largest revenue share of 60.50% in 2024. Immunosuppressants play a role in the treatment of multiple sclerosis (MS) by reducing immune system activity and limiting the inflammatory damage to myelin and nerve fibers. These drugs are generally used in progressive or treatment-resistant cases, where first-line disease-modifying therapies may not be sufficient. Common agents in this category include azathioprine, methotrexate, mitoxantrone, and cyclophosphamide. Although they are not as commonly prescribed as newer biologics or oral therapies, immunosuppressants remain relevant for certain patient subgroups due to their cost-effectiveness and broad immunomodulatory effects.

The immunostimulants segment is emerging as a vital driver in the multiple sclerosis therapeutic industry, propelled by their ability to enhance the body’s immune response against malignant plasma cells. Agents such as interleukins, checkpoint inhibitors, and novel T-cell engagers are gaining traction for their role in boosting immune surveillance and efficacy when used in combination therapies. As immunotherapy becomes central to MS treatment, especially in relapsed or refractory cases, ongoing clinical trials and FDA approvals are expanding therapeutic options. Growing investment in immune-based research and increasing adoption of personalized medicine further accelerate the demand for immunostimulants in the MS treatment landscape.

Route of Administration Insights

The injectable segment dominated the multiple sclerosis therapeutic market with the largest revenue share of 52.50% in 2024. The injectable segment is a key driver in the market growth, fueled by the rising adoption of monoclonal antibodies, proteasome inhibitors, and immunotherapies that require parenteral administration. Injectables offer rapid bioavailability and targeted delivery, which are critical in managing aggressive or relapsed cases. The increasing number of hospital and clinic-based infusion centers, coupled with patient preference for long-acting formulations that reduce treatment frequency, is further boosting demand. Additionally, pharmaceutical advancements enabling subcutaneous formulations are enhancing patient convenience and adherence. As a result, the injectable segment continues to gain traction as a preferred modality in advanced MS treatment regimens.

The oral segment is expected to grow at the fastest CAGR rate over the forecast period, propelled by increasing patient preference for convenient, home-based treatment options. Oral therapies, including immunomodulating agents like lenalidomide and pomalidomide, offer improved quality of life by reducing hospital visits and infusion-related complications. Advances in oral proteasome inhibitors and combination regimens are further enhancing efficacy and adherence. As healthcare systems shift toward patient-centric care, the demand for oral formulations continues to rise. Additionally, expanding approval of oral drugs for both newly diagnosed and relapsed/refractory patients is accelerating market penetration, especially in regions with limited infusion infrastructure.

Distribution Channel Insights

The hospital pharmacies segment dominated the MS therapeutic market with the largest revenue share of 46.50% in 2024. Hospitals have the infrastructure and resources necessary to manage complex cases of multiple sclerosis effectively. Hospitals have specialized medical professionals, including oncologists and hematologists, who have expertise in diagnosing and treating multiple sclerosis. This specialized care ensures that patients receive the most appropriate and effective treatment for their condition. Also, they have access to advanced treatment options such as stem cell transplants, targeted therapies, and immunotherapy which is leading to the segment growth.

The E-Commerce segment is expected to grow at the fastest CAGR of 6.0% over the forecast period, propelled by the growing adoption of online pharmacies is emerging as a key growth driver. These platforms offer enhanced accessibility to critical medications, particularly for elderly or immunocompromised patients who face mobility challenges. Online pharmacies provide convenience, home delivery, and often lower costs, making it easier for patients to adhere to complex treatment regimens involving immunomodulators, proteasome inhibitors, or supportive therapies. Additionally, digital platforms facilitate medication management and patient education, improving compliance and outcomes. As telehealth expands and healthcare digitalization advances, online pharmacies are poised to play an increasingly vital role in the distribution of MS treatments.

Regional Insights

North America leads the global multiple sclerosis therapeutic market with a revenue share of 38.28%, driven by advanced healthcare infrastructure, high disease awareness, and widespread use of modern therapies. The U.S. dominates the region, with increasing adoption of proteasome inhibitors, immunomodulating agents, monoclonal antibodies, and stem cell transplants for active and smoldering multiple sclerosis cases. Hospitals and specialty clinics serve as primary treatment hubs, supported by robust reimbursement frameworks. Major players like Johnson & Johnson, Amgen Inc., and Bristol-Myers Squibb fuel innovation and market growth through novel drug combinations and next-generation therapies.

U.S. Multiple Sclerosis Therapeutic Market Trends

The U.S. dominated the North America multiple sclerosis therapeutic industry in 2024. This is attributed to well-developed healthcare infrastructure and significant investment in research and development which has led to the development of innovative therapies and treatment options for the patients. The prevalence of multiple sclerosis in the U.S. population is relatively high compared to other regions, leading to a larger market size for therapeutics. Moreover, increased awareness about the disease among patients and healthcare providers drives demand for advanced treatments. In March 2023, Janssen Pharmaceuticals launched a campaign, That’s My Word, to increase awareness and health outcomes for the population at risk of developing multiple sclerosis.

Europe Multiple Sclerosis Therapeutic Market Trends

The Europe multiple sclerosis therapeutic industry growth can be attributed to increasing research & development activities, technological advancements, and growing awareness of multiple sclerosis disease and treatment. Government support through initiatives and funding for cancer research also plays a crucial role in driving the market growth.

The UK multiple sclerosis therapeutic market is experiencing steady growth driven by technological advancements in early detection and treatment options, increasing prevalence of the disease the country, government initiatives supporting healthcare expenditure, ongoing research efforts, and advocacy from patient groups which are dedicated to raising awareness about multiple sclerosis and advocating for improved access to care have also influenced market growth.

The multiple sclerosis therapeutic market in Germany is witnessing substantial growth over the forecast period. This is owing to increasing incidence rates of the disease, advancements in diagnosis and treatment options, government initiatives supporting cancer care, healthcare infrastructure development, and ongoing research and development activities focused on finding new and effective therapies for multiple sclerosis.

The France multiple sclerosis therapeutic market is expected to grow during the forecast period. Centralized health policies and hospital dominance ensure high uptake of chemotherapy alternatives. Pediatric and early-stage moldering sclerosis care are expanding.

Asia Pacific Multiple Sclerosis Therapeutic Market Trends

The multiple sclerosis therapeutic industry in Asia Pacific is expected to witness the fastest CAGR over the forecast period. Factors such as an aging population, improved healthcare infrastructure, and increasing awareness about cancer have contributed to the market expansion.

Japan's multiple sclerosis therapeutic market is experiencing growth driven by factors such as increasing disease prevalence, advancements in treatment options, rising healthcare expenditure, a growing geriatric population, government approval, and technological innovations.

The multiple sclerosis therapeutic market in China is expected to witness a robust growth driven by factors such as improvement in diagnosis technology, advancements in treatment options, rising healthcare expenditure, growing awareness about multiple sclerosis, and government support through initiatives aimed at improving cancer care services. In March 2024, The National Medical Products Administration (NMPA) approved CAR-T therapy (CARsgen Therapeutics), based on LUMSICAR STUDY 1 results, a China based phase II clinical trial.

Latin America Multiple Sclerosis Therapeutic Market Trends

The Latin American multiple sclerosis therapeutics industry is undergoing significant transformation due to increasing awareness of hematologic malignancies and improved healthcare infrastructure. Advancements in diagnostic capabilities and treatment options are expanding the adoption of both traditional and innovative therapies.

Brazil multiple sclerosis therapeutic market is anticipated to grow during the forecast period. Brazil leads the Latin American MS market due to a well-developed healthcare network and government backing for cancer treatment initiatives.

Middle East & Africa Multiple Sclerosis Therapeutic Market Trends

The MEA region is showing progressive development in MS care, driven by investments in oncology infrastructure and better awareness of hematological cancers. Use of traditional chemotherapy persists in several countries, but monoclonal antibodies, proteasome inhibitors, and immunomodulators are increasingly adopted in tertiary care hospitals. Access to HDAC inhibitors and stem cell transplant is limited to specialized centers in high-income countries.

Saudi Arabia multiple sclerosis therapeutic market is expected to witness growth over the forecast period. Saudi Arabia is a leader in MS care in the MEA region, owing to strong government investment in oncology and rare disease care.

Key Multiple Sclerosis Therapeutic Company Insights

Some of the key companies in the multiple sclerosis therapeutic market include Sanofi; Takeda Pharmaceutical Company Limited; Merck & Co.; AbbVie Inc. Key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Multiple Sclerosis Therapeutic Companies:

The following are the leading companies in the multiple sclerosis therapeutic market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Biogen

- Bayer AG

- Sanofi

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Takeda Pharmaceutical Company Limited.

- Horizon Therapeutics plc

Recent Developments

-

In February 2024, Roche Pharma India announced the launch of Ocrevus for the treatment of MS. It is expected to cater to the requirements of patients suffering with MS in India. Ocrevus is one of its leading products and is available in more than 100 countries and in India it is approved for primary progressive & relapsing forms of MS.

-

In February 2024, Neuraxpharm Group announced the launch of BRIUMVI in Europe to treat adult patients suffering with relapsing MS.

-

In August 2023, the U.S. Food and Drug Administration (USFDA) approved Tyruko. Tyruko is the first biosimilar of Tysabri injection for treating adults suffering with relapsing form of MS. It is approved to treat relapsing-remitting disease, active secondary progressive disease and clinically isolated syndrome.

Multiple Sclerosis Therapeutic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.95 billion

Revenue forecast in 2030

USD 38.62 billion

Growth rate

CAGR of 5.93% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Teva Pharmaceutical Industries Ltd.; Pfizer Inc.; Biogen; Bayer AG; Sanofi; F. Hoffmann-La Roche Ltd; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Takeda Pharmaceutical Company Limited.; Horizon Therapeutics plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multiple Sclerosis Therapeutic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multiple sclerosis therapeutic market report based on drug class, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunosuppressants

-

Immunostimulants

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

E-Commerce

-

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global multiple sclerosis therapeutic market is expected to grow at a compound annual growth rate of 5.93% from 2025 to 2030 to reach USD 27.39 billion by 2024.

b. Immunosuppressants dominated the multiple sclerosis therapeutic market with a share of 60.50% in 2024. This is attributable to higher prescription rates, brand loyalty, and the presence of a wide range of drug alternatives

b. Some key players operating in the multiple sclerosis therapeutic market include Teva Pharmaceutical Industries Ltd.; Pfizer Inc.; Biogen; Bayer AG; Sanofi; F. Hoffmann-La Roche Ltd; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Takeda Pharmaceutical Company Limited.; and Horizon Therapeutics plc.

b. Key factors that are driving the market growth include the rising base of the target population suffering from relapsing-remitting and secondary progressive multiple sclerosis coupled with the increasing demand for novel potent drugs.

b. The global multiple sclerosis therapeutic market size was estimated at USD 27.39 billion in 2024 and is expected to reach USD 38.62 billion in 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.