Market Size & Trends

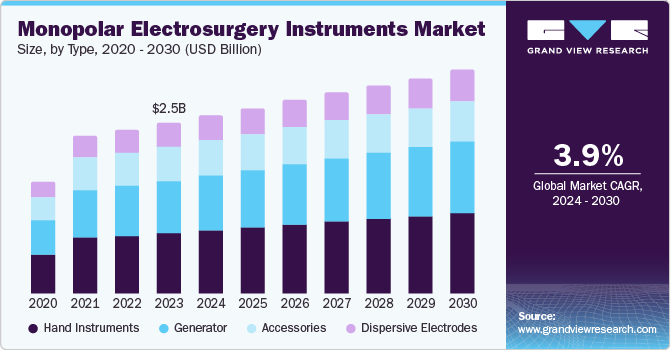

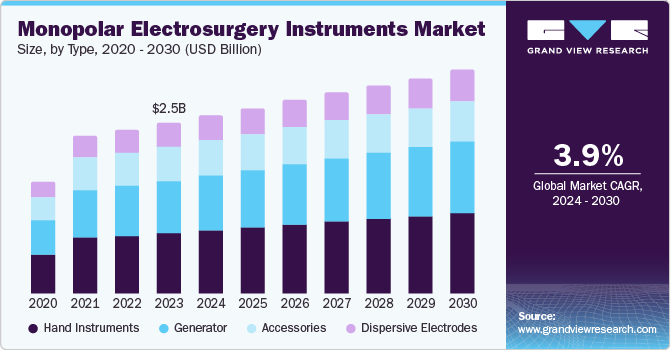

The monopolar electrosurgery instrument market size was valued at USD 2.51 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. Increasing adoption of these instruments by laparoscopic surgeons, preference for minimally invasive surgeries (MIS), and growing prevalence of chronic conditions are some of the major factors driving the market.

Growing prevalence of chronic diseases such as diabetes, cancer, heart diseases, and others is leading to increased demand for surgical procedures. According to World Health Organization, Non-Communicable Diseases (NCDs) are responsible for approximately 41 million deaths each year. Increasing use of tobacco, growing alcohol consumption, lack of physical activity, unhealthy lifestyle and diets are increasing the prevalence of these diseases. This scenario is expected to generate greater demand for monopolar electrosurgery instrument market in coming years.

Minimally invasive surgeries help in minimizing post-surgical complications, offer faster recovery and lower readmittance rates, thus reducing overall treatment cost. A study in The Journal of the American Medical Association stated that open surgery requires an average hospital stay of 7.4 days, while the hospital stays for laparoscopic and thoracoscopic surgeries is for 4.5 days. The study further stated that the total cost of care for minimally invasive surgeries was 23.0% less than open surgery. According to the researchers at Johns Hopkins, preventing post-surgical complications saved about USD 300 million annually by opting for minimally invasive procedures.

Type Insights

The hand instrument segment dominated the market and accounted for a share of 35.5% in 2023. Introduction of monopolar hand instrument by players has expanded the market growth for monopolar electrosurgery instrument. In October 2019, Apyx Medical Corporation announced the U.S. FDA approval to market a single-use monopolar device, Apyx Plasma/RF Handpiece. The device is an addition to the Renuvion product portfolio. In June 2023, Apyx Medical announced the U.S. FDA 510(k) clearance for Renuvion Micro Handpiece. It is intended to be used with Apyx Medical owned compatible electrosurgical generators.

The generator section is expected to register the fastest CAGR during the forecast period. This can be attributed to the increasing reliance of professionals to perform advanced therapeutic procedures and product launches. The generators supply high-frequency electric current required for the functioning of endoscopic devices. Additionally, the devices offer features that enhance patient safety and ease of use. In May 2018, Olympus launched the ESG-300 electrosurgery generator for GI and pulmonary devices.

Application Insights

The general surgery segment accounted for the largest market revenue share in 2023. Continuous increase in the geriatric population has resulted in a drastic increase in surgical procedures. According to the National Council of Aging, nearly 95% of adults aged 60 and above suffer from at least one chronic health condition, while nearly 80% of them have two or more.

The cardiovascular surgery segment is expected to register the fastest CAGR during the forecast period. The novel monopolar devices avoid electrosurgical burns in minimally invasive surgeries and upgrade surgical execution by lessening procedural complexities. Extensive use of monopolar electrosurgery instrument in cardiac surgeries, changing lifestyles leading to higher number of cardiac problems, and rising inclination towards surgeries over other ways of treatment are some of the aspects likely to propel the market growth during forecast period.

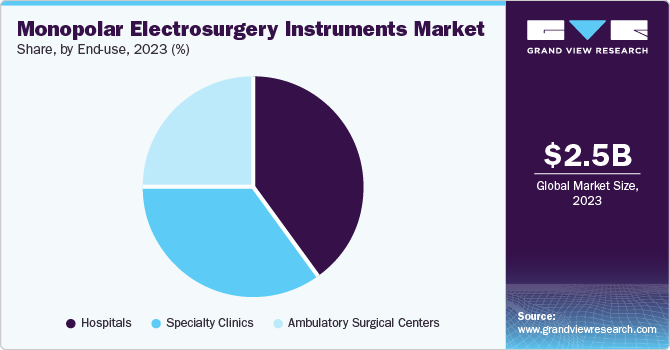

End-use Insights

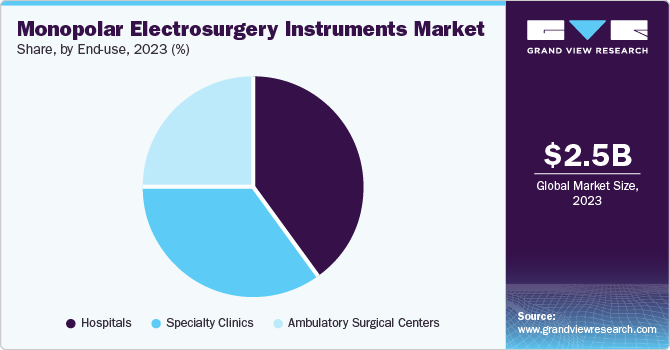

The hospital segment dominated the market in 2023. This can be attributed to the increasing adoption of technologically advanced products, patient awareness, and increasing focus on positive medical outcomes. Also, the medical settings are adopting minimally invasive procedures to reduce post-operative complications and accelerate the recovery rate.

The ambulatory surgical centers segment is projected to grow at the fastest CAGR over the forecast period. This can be attributed to rising number of emergency surgery situations, inclination in geriatric population to reduce the hospital stays as much as possible, and surgeries performed for patients that are already part of home care services provided by other vendors. According to Ambulatory Surgery Center Association, there are 6,100 Medicare-certified Ambulatory Surgery Centers (ASCs) in the U.S. approximately and nearly 22.5 million procedures are performed every year.

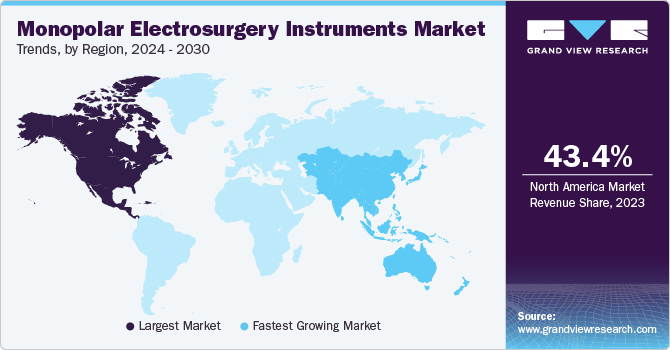

Regional Insights

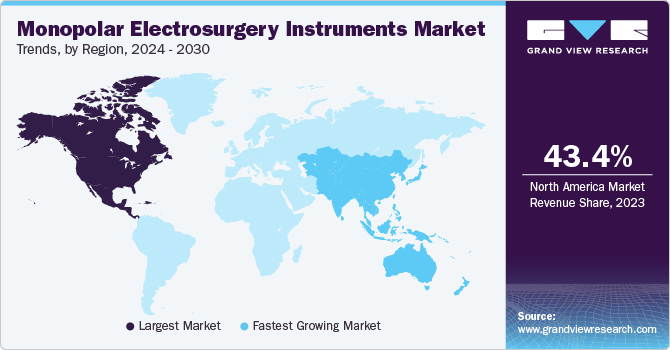

The North America monopolar electrosurgery instrument market dominated the industry and accounted for revenue share of 43.4% in 2023. This dominance is attributed to increasing chronic diseases, developed healthcare infrastructure, and high per capita expenditure. Increasing incidence of chronic diseases and rising awareness related to the advantages of electrosurgical devices is expected to fuel the growth of the market for monopolar electrosurgery instruments in the region.

U.S. Monopolar Electrosurgery Instrument Market Trends

The U.S. monopolar electrosurgery instrument market is expected to experience a CAGR of 3.9% from 2024 to 2030. The rising preference towards minimally invasive surgeries, increasing adoption of electrosurgery instruments by reputed professionals including laparoscopic surgeons and presence of key market players in the country are driving market growth.

Asia Pacific Monopolar Electrosurgery Instrument Market Trends

Asia Pacific monopolar electrosurgery instrument market is anticipated to experience the fastest CAGR during forecast period. High growth rate is attributed to the rise in cardiovascular diseases and the growing geriatric population. However, scarcity of skilled professionals and low awareness is the factor impeding the market growth for monopolar electrosurgery instruments in the region.

Key Monopolar Electrosurgery Instrument Company Insights

Some of the key companies in the monopolar electrosurgery instrument include Medtronic; LivaNova PLC; Abbott Laboratories; and others. The monopolar electrosurgery instrument market is highly fragmented with the presence of various large, medium, and small-scale vendors. Product launch, strategic acquisitions, and innovation are the major strategies adopted by the market players to retain their market share.

- Medtronic provides healthcare technology solutions for healthcare industry and invest significantly in R&D activities. Its electrosurgical hardware portfolio includes Electrosurgical Generator Accessories, Electrosurgical Accessories, Valleylab FX8 Energy Platform, Electrosurgical Pencils and others.

Key Monopolar Electrosurgery Instrument Companies:

The following are the leading companies in the monopolar electrosurgery instrument market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- LivaNova PLC

- Abbott Laboratories

- Terumo Corporation

- Braille Biomedica Ltd.

- Getinge

- 3M

- Baxter International

Recent Developments

-

In January 2024, Olympus Corporation, a medical technology company, announced full market availability of ESG-410 Surgical Energy Platform. It is asurgical energy platform for monopolar and bipolar & energy applications, including hybrid energy and ultrasonic dissection.

Monopolar Electrosurgery Instrument Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 2.62 billion

|

|

Revenue forecast in 2030

|

USD 3.29 billion

|

|

Growth Rate

|

CAGR of 3.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, application, end-use, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Arabia, Kuwait, UAE, and South Africa

|

|

Key companies profiled

|

Medtronic; LivaNova PLC; Abbott Laboratories; Terumo Corporation; Braille Biomedica Ltd.; Getinge; 3M; Baxter International

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

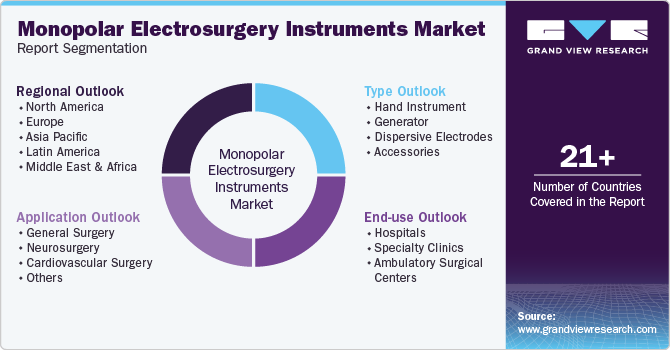

Global Monopolar Electrosurgery Instrument Market Report Segmentation

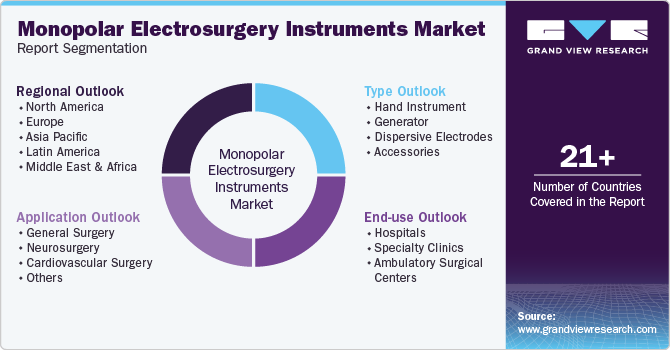

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the monopolar electrosurgery instrument market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hand Instrument

-

Generator

-

Dispersive Electrodes

-

Accessories

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

General Surgery

-

Neurosurgery

-

Cardiovascular Surgery

-

Others

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait