- Home

- »

- Agrochemicals

- »

-

Molluscicide Market Size, Share And Growth Report, 2030GVR Report cover

![Molluscicide Market Size, Share & Trends Report]()

Molluscicide Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Chemical, Biological), By Form (Pellets, Liquid & Gel), By Application (Agricultural, Non-Agricultural), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-077-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molluscicide Market Size & Trends

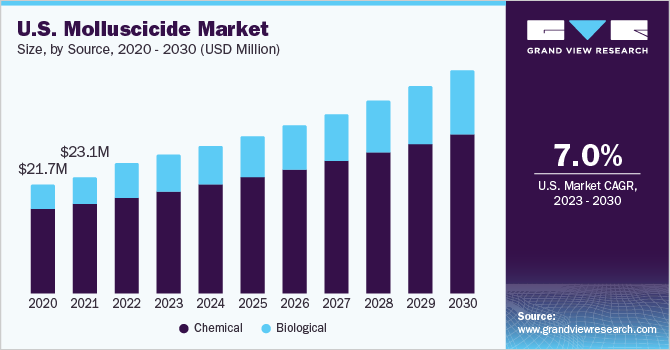

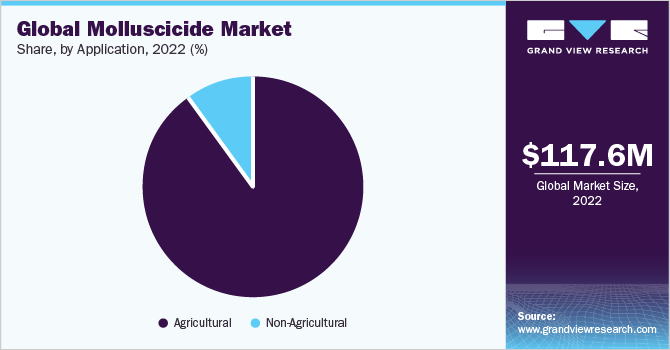

The global molluscicide market size was valued at USD 117.57 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This is attributed to increasing adoption and demand for the product due to its rainfast characteristic. Moreover, factors such as rising demand to boost yields of horticulture crops and increased cultivation of high-value crops are also expected to drive product market growth. Molluscicides are chemicals or substances used to kill or control the population of mollusks, such as snails and slugs, which can cause damage to crops and plants.

These pests can be a major problem in agriculture, causing substantial losses to farmers and reducing crop yields. There are different types of products, including chemical and biological. Chemical products are synthetic or natural substances that are directly toxic to the mollusks, while biological products are living organisms, such as bacteria and fungi, which can infect the mollusks and cause their death.

Chemical products include metaldehyde, which is widely used as bait to control slugs and snails in home gardens and commercial agriculture. Metaldehyde is known to be highly toxic to mollusks, but it can also be toxic to other non-target organisms, such as birds and mammals if ingested in large quantities. Another chemical molluscicide is copper sulfate, which is commonly used in aquaculture to control snail populations in fishponds and other aquatic environments. Copper sulfate works by disrupting the respiratory processes of snails, leading to their death.

Biological products, on the other hand, are a safer and more environmental-friendly alternative to chemical molluscicides. One example of a biological product is a strain of bacteria called Pseudomonas aeruginosa, which can infect and kill snails and slugs.

Biological products can be used in conjunction with other pest-management practices, such as crop rotation, to reduce the reliance on chemical pesticides and promote sustainable agriculture.

Molluscicides present both advantages and disadvantages. The primary benefit of using these substances is their effectiveness in controlling snails and slugs. They also offer a cost-effective solution to controlling these pests, compared to other methods such as manual removal. However, the use of the product may lead to the buildup of resistance among snail and slug populations, reducing their effectiveness in the long run. Additionally, some products may have adverse effects on non-target organisms, including beneficial insects, birds, and mammals.

Source Insights

The chemical segment dominated the market with the highest revenue share of over 67% in 2022. This is due to their ability to eliminate snail and slug infestations quickly. The most commonly used chemical products include metaldehyde, methiocarb, and iron phosphate. Metaldehyde is a contact molluscicide that works by causing dehydration and damage to the mollusk's nervous system, leading to its death. It is generally available in granules or can be applied as a liquid spray.

Methiocarb is a contact molluscicide and a stomach poison. It works by causing damage to both the mollusk's nervous and digestive systems. Methiocarb can be formulated in granular shapes or pellet bait. It is ideal for use in controlling slugs and snails that feed on plant leaves and flowers.

Iron phosphate, on the other hand, is a stomach poison that works by inhibiting the mollusk's digestive enzymes. It is toxic to snails and slugs, but it is non-toxic to humans and pets, making it an eco-friendly option for eliminating infestations.

The use of chemical products presents advantages and disadvantages. They offer an effective and quick way of eliminating snails and slugs, leading to the protection of crops from their damage. They also have low application rates, making them cost-effective for large-scale applications.

However, the use of chemical products may have adverse ecological effects, affecting non-target organisms. They may also lead to the development of resistance among the targeted pests, reducing their efficiency in future applications.

Form Insights

The pellet form dominated the product market with a revenue share of over 60% owing to the easy, convenient application and its conventional status as the most commonly used method for delivering molluscicides for mollusks control in the agricultural industry.

Metaldehyde and iron phosphate are frequently used as pellets. These are spread across the affected area to target pests such as slugs and snails. Pellet form is also helpful in addressing specific issues such as rodent attacks in under-developed countries.

Application Insights

Agriculture dominated the product market with the highest revenue share of over 90% in 2022. This is attributed to the increasing usage of molluscicide for fruits and vegetable crops. These crops remain a high-frequency target for mollusk attacks. Moreover, some of the crops where molluscicides are regularly applied include fruits (such as strawberries) and vegetables (such as lettuce and cabbage).

Cereals and grains accounted for a prominent revenue share in the product market in 2022, owing to the increasing consumption of cereals & grains, such as wheat, barley, oats, rice, corn, and sorghum due to their nutritional benefits. Moreover, the molluscicide industry is projected to benefit from the increasing focus of farmers on oilseed production. Oilseeds and pulses comprise a diverse range of seeds, including sunflower seeds, soybean, and leguminous seeds (pulses).

The United States Department of Agriculture (USDA) reported an increase of one million metric tons in global oilseed production in 2020/2021 due to the revised soybean harvest in Brazil for 2021. Leading oilseed producers are Brazil, China, and the U.S. Thus, high demand for Molluscicide is expected from these countries in the near future.

Regional Insights

Asia Pacific dominated the product market with the highest revenue share of 38.90% in 2022. This is attributed to the increasing adoption rates of molluscicides in countries such as China and India, which are major producers and consumers of agricultural products. The market for the product is expected to continue to grow in the Asia Pacific region in the coming years.

According to the Organization for Economic Co-operation and Development (OECD), the Asia Pacific region is the largest producer of agricultural commodities and is expected to produce approximately 53% of the total global agricultural output by 2030. Despite a concurrent decrease in available arable land, the region's increasing population has led to rising demand for food, prompting farmers to increasingly utilize the product to enhance crop yields.

The Asia Pacific region is known for its affordability of labor and abundance of raw materials, yet it faces significant hurdles related to water scarcity, climate change, and the degradation of arable land.

Key Companies & Market Share Insights

Molluscicide market players are involved in research and development activities related to the creation and evaluation of new products and methods for controlling pests such as slugs and snails. This includes the development of polyherbal extracts with molluscicidal effects and the investigation of fungal volatile organic compounds as potential repellents or molluscicides.

Moreover, players have been adopting strategies like mergers and acquisitions, and product launches, aimed at enhancing the product portfolio, expanding the customer base, and increasing the market share of the companies in the Molluscicide industry. Some prominent players in the global molluscicide market include:

-

Lonza

-

Certis USA L.L.C.

-

Bayer

-

Zagro

-

Agchem Manufacturing Corporation

-

Adma Agricultural Solutions

-

AMGUARD Environmental Technologies

-

Neudorff

-

Philagro

-

Marrone Bio Innovations

Molluscicide Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 122.91 million

Revenue forecast in 2030

USD 198.83 million

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Regional scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa

Market Players

Lonza, Certis USA L.L.C.; Bayer; Zagro.; Agchem Manufacturing Corporation; Adma Agricultural Solutions; AMGUARD Environmental Technologies; Neudorff; Philagro; Marrone Bio Innovations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molluscicide Market Report Segmentation

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global molluscicide market report based on source, form, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Biological

-

Chemical

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pellet

-

Liquid/Gel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agricultural

-

Fruits and Vegetables

-

Oilseed and Pulses

-

Cereals & Grains

-

Others

-

-

Non-Agricultural

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molluscicide market size was estimated at USD 117.57 million in 2022 and is expected to reach USD 122.91 million in 2023.

b. The global molluscicide market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 198.83 million by 2030.

b. Asia Pacific dominated the molluscicide market with a share of 38.90% in 2022. This is attributable to increasing adoption rates of molluscicides in countries such as China and India, which are major producers and consumers of agricultural products.

b. Some key players operating in the molluscicide market include Lonza, Certis USA L.L.C., Bayer, Zagro., Agchem Manufacturing Corporation, Adma Agricultural, Solutions, AMGUARD Environmental Technologies, Neudorff, Philagroa & Marrone Bio Innovations

b. Key factors that are driving the molluscicide market growth include rising demand to boost horticulture crops and increasing cultivation of high-value crops are also expected to drive the product market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.