- Home

- »

- Advanced Interior Materials

- »

-

Mining Waste Management Market Size, Share Report, 2030GVR Report cover

![Mining Waste Management Market Size, Share & Trends Report]()

Mining Waste Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Mining Method (Surface Mining, Underground Mining), By Metal/Mineral (Thermal Coal, Coking Coal, Iron Ore, Gold, Copper, Lead, Zinc), By Waste Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-380-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Waste Management Market Trends

The global mining waste management market size was estimated at USD 228.5 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The increasing environmental concerns and crucial demand for sustainable waste management for the hazardous and non-hazardous waste types from mining activities are expected to propel the market growth. The demand for metals and minerals is rapidly increasing due to the rising demand for consumer products, electrical and electronic goods, and other decorative objects. Further, technological advancements in electric vehicles and the demand for lithium mining and other precious metals are gaining traction, which is anticipated to positively impact the mining industry and create opportunities for companies in mining waste management.

Industrial growth facilitated by the rising population and consequent increase in demand for manufacturing, automobiles, oil & gas, processing, etc. is driving the demand for metal parts and machinery. This increasing demand is leading to rising mining for iron and steel ores. The mining activities lead to the generation of toxic and hazardous waste such as heavy metals, metalloids, acidic water (mine water) and radioactive substances.

Safe and secure disposal of these hazardous waste materials is necessary to avoid water and land contamination. Contamination of water bodies and land area with this waste leads to imbalance in ecosystems as well as severe health impacts. Implementing measures to prevent or control the leaching of harmful substances from waste sites into the surrounding environment is critical and boosting the market growth.

Drivers, Opportunities & Restraints

The mining waste management market growth is driven by the crucial requirement for sustainable waste management for minimizing the environmental footprint of mining activities. This can include lining waste storage facilities, monitoring groundwater quality, and implementing treatment systems to manage contaminated water. Rising awareness regarding environmental impacts due to overmining such as soil erosion, loss of biodiversity, emission of toxic chemicals in groundwater or surface water is expected to boost the market growth.

Regulations and preventive policies are increasingly playing a significant role in driving the growth in sustainable waste management in the mining industry. For instance, in Mineral Conservation and Development Rules 2017 (MCDR) of India regulate environmental aspects of mining and provides for sustainable mining guidance.

Technological innovation is a significant driver in the evolution of mining waste management. Advances in technology have enabled more efficient and effective ways to reduce, treat, and monitor waste. The waste largely encompasses waste rock, mine water, and tailings.

Mining Method Insights

“The demand for surface mining Method segment is expected to grow at a significant CAGR of 4.8% from 2024 to 2030 in terms of revenue”

The surface mining method segment led the market, accounting for 80.2% of the global revenue share in 2023. Surface mining, particularly open-pit mining, tends to generate more waste compared to underground mining due to the extensive overburden removal. This type of mining method is largely adopted worldwide to extract metals and minerals owing to less expensive and fewer requirements for labor and mining equipment.

The underground mining method segment is expected to grow at a lucrative CAGR over the forecast period, owing to increasing investments. Hard minerals such as gold, copper, zinc, lead, etc. are excavated using underground mining, mostly room and pillar mining and block caving. Underground mining generates tailings that pose significant management challenges, particularly regarding containment and prevention of water contamination.

Metal/Mineral Insights

“The demand for copper segment is expected to grow at a significant CAGR of 5.0% from 2024 to 2030 in terms of revenue”

The thermal coal segment accounted for 32.5% of the global revenue share in 2023. Thermal coal, also known as steam coal, remained a significant source of energy generation in 2023, leading to one of the major mined ores worldwide. Asia Pacific’s growing energy needs continue to drive demand for thermal coal, with countries like China and India depending substantially on coal-fired power plant capacities. This is anticipated to drive thermal coal mining activities over the forecast period.

The copper segment is anticipated to grow at a significant CAGR of 5.0% over the forecast period. The rising mining of copper ores such as Cuprite, Malachite, Azurite, etc. to mitigate the rising demand for copper in the electrical and electronic industry is likely to drive the segment's growth over the forecast period.

Waste Type Insights

“The demand for tailings segment is expected to grow at a significant CAGR of 5.0% from 2024 to 2030 in terms of revenue”

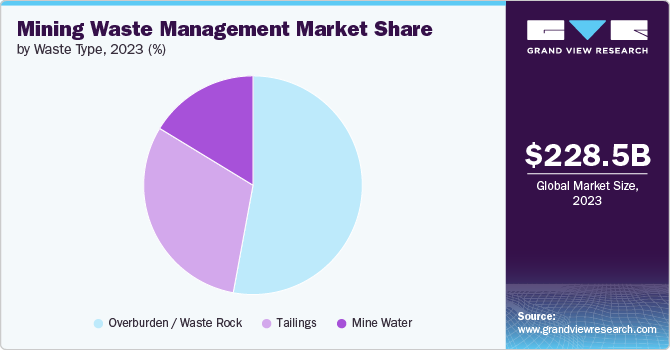

The overburden/waste rock segment dominated the global mining waste management market with a revenue share of 53.1% in 2023. Effective waste management for overburden/waste rock is critical for sustainable environmental practices and for complying with regulations. Overburden/waste rock can sometimes be used for construction materials, in landscaping, or for creating barriers or fills in other mining projects.

The tailings segment is anticipated to grow at a CAGR of 5.0% over the forecast period. Tailings are a common type of waste from mining operations, consisting of finely ground rock and processing fluids. Enhancing tailings management through methods like dewatering to remove excess water, and secure storage in designated facilities can mitigate environmental hazards.

Regional Insights

“Asia Pacific to witness fastest market growth at 5.7% CAGR”

The mining waste management market in Asia Pacific accounted for the largest revenue share of 53.7% in 2023. The extensive mining activities in China, India, Indonesia, Australia, etc., are attributed to large waste generation in the region. According to the International Organizing Committee for the World Mining Congresses, World Mining Data 2024 report, Asia Pacific accounted for over 60% of the total mining production in 2022, which includes iron and ferro-alloy metals, non-ferrous metals, precious metals, industrial metals, and mineral metals.

The mining waste management market in China is estimated to grow at a significant CAGR of 5.9% over the forecast period. Ambitious efforts by the government and waste management companies’ strategic initiatives to provide effective waste management solutions is likely to drive the growth of the market over the forecast period.

Europe Mining Waste Management Market Trends

Europe mining waste management market is driven by stringent environmental regulations and the presence of advanced infrastructure and solution for sustainable waste management. The European Union's (EU) directives, including the Waste Framework Directive (2008/98/EC) and the Mining Waste Directive (2006/21/EC) regulates the development of the market for mining waste management.

North America Mining Waste Management Market Trends

North America mining waste management is anticipated to witness lucrative growth over the forecast period owing to the evolving efforts with a focus on sustainability, technological innovation, and regulatory compliance.The push towards a circular economy and the increasing demand for minerals vital for the transition to renewable energy sources emphasize the importance of efficient and environmentally responsible waste management in the mining industry.

Key Mining Waste Management Company Insights

Some of the key players operating in the market include Veolia Environment S.A., Cleanaway Environmental Services, and Interwaste Holding Ltd.

-

Veolia Environment S.A. has been actively involved in providing innovative and sustainable solutions for mining waste management. It specializes in the treatment and recovery of mine tailings, water treatment solutions for the mining industry, resource recovery valuable resources from mining waste, etc.

-

Cleanaway Environmental Management Solutions, Inc. is a key player in environmental services, offering comprehensive waste management solutions that encompass a variety of industries, including the mining sector. The services offered by the company include tailing management, recovery and recycling, and water treatment.

Averda, Ramboll Group, Amec Foster Wheeler., are some of the emerging participants in the mining waste management market.

-

Averda is a global provider of integrated waste management services, offering solutions to a variety of sectors including municipal, commercial, industrial, and residential clients. The company’s operational footprint spans across several countries, with significant activities in the Middle East, Africa, and parts of Asia, which also includes mining waste management services.

-

In the mining industry, Amec Foster Wheeler provided a range of services including mine planning, engineering, project management, and environmental services. They worked on projects involving precious metals, base metals, and minerals. Its services for waste management in the mining industry comprises of tailing management and waste rock management, water treatment and management, and mine reclamation, etc.

Key Mining Waste Management Companies:

The following are the leading companies in the mining waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Amec Foster Wheeler

- Ausenco

- EnviroServ

- Interwaste Holding Ltd.

- Veolia Environment S.A.

- Tetronics International

- Golder Associates Inc.

- John Wood Group plc

- Ramboll Group

- Tetra Tech Inc.

- Cleanaway Environmental Services

- Seche Environment Company

- Aevitas

- Averda

- Hatch Ltd.

Recent Developments

-

In September 2022, Suez and its partners announced the completion of the acquisition of EnviroServ, a South African based waste management company. EnviroServ acquisition is expected to strengthen the company’s portfolio in petrochemicals, manufacturing, metallurgical and mining sectors for waste management.

-

In November 2023, Clean TeQ announced expansion into mine tailing management at global level. The company announced a 50/50 joint venture with Future Element Pty Ltd, which is known as Future Element Operations Pty Ltd.

Mining Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 239.6 billion

Revenue forecast in 2030

USD 315.1 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Mining method, metal/mineral, waste type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Italy; Germany; Spain; Russia; China; India; Japan; South Korea; Australia; Saudi Arabia; South Africa

Key companies profiled

Amec Foster Wheeler; Ausenco; EnviroServ; Interwaste Holding Ltd.; Veolia Environment S.A.; Tetronics International;

Golder Associates Inc.; John Wood Group plc; Ramboll Group; Tetra Tech Inc.; Cleanaway Environmental Services; Seche Environment Company; Aevitas; Averda; Hatch Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the mining waste management market report based on mining method, metal/mineral, waste type, and region:

-

Mining Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surface Mining

-

Underground Mining

-

-

Metal/Mineral Outlook (Revenue, USD Billion, 2018 - 2030)

-

Thermal Coal

-

Coking Coal

-

Iron Ore

-

Gold

-

Copper

-

Lead

-

Zinc

-

Other

-

-

Waste Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Overburden/ Waste Rock

-

Tailings

-

Mine Water

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Germany

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining waste management market size was estimated at USD 228.5 billion in 2023 and is expected to reach USD 239.6 billion in 2024.

b. The global mining waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 315.1 billion by 2030.

b. Asia Pacific dominated the mining waste management market with a revenue share of 53.7% in 2023. The mining waste management market in Asia Pacific is experiencing substantial growth due to increasing mining activities and regulatory development.

b. Some of the key players operating in the mining waste management market include Amec Foster Wheeler, Ausenco, EnviroServ, Interwaste Holding Ltd., Veolia Environment S.A., Tetronics International, Golder Associates Inc., John Wood Group plc, Ramboll Group, Tetra Tech Inc., Cleanaway Environmental Services, Seche Environment Company, Aevitas, Averda, Hatch Ltd.

b. The demand for mining waste management market is attributed to the increasing industrialization and growing demand metals and minerals across the world leading to rising necessity for the sustainable mining waste management services over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.