- Home

- »

- Pharmaceuticals

- »

-

Migraine Drugs Market Size & Share, Industry Report, 2030GVR Report cover

![Migraine Drugs Market Size, Share & Trends Report]()

Migraine Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Acute, Preventive), By Therapeutic Class, By Route Of Administration, By Age Group (Pediatric, Adult, Geriatric), By Availability, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-559-5

- Number of Report Pages: 159

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Migraine Drugs Market Summary

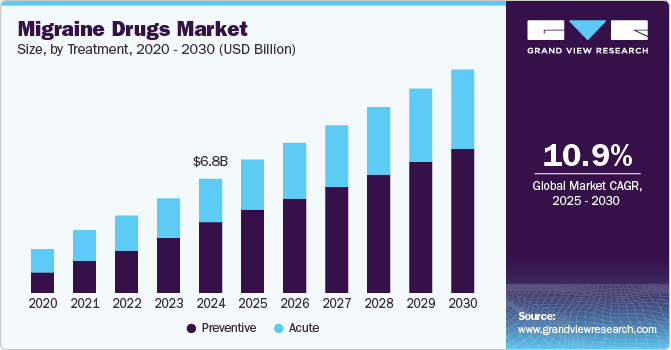

The global migraine drugs market size was estimated at USD 6.81 billion in 2024 and is projected to reach USD 13.34 billion by 2030, growing at a CAGR of 10.9% from 2025 to 2030. Increasing prevalence of migraines is a major factor contributing to the market growth.

Key Market Trends & Insights

- North America dominated the migraine drugs market with the largest revenue share of 45.89% in 2024.

- The migraine drugs market in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- Based on treatment, the preventive segment led the market with the largest revenue share of 62.03% in 2024.

- Based on therapeutic class, the CGRP monoclonal antibodies segment led the market with the largest revenue share of 56.68% in 2024.

- Based on route of administration, the injectable segment led the market with the largest revenue share of 69.48% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.81 Billion

- 2030 Projected Market Size: USD 13.34 Billion

- CAGR (2025-2030): 10.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Migraines are the sixth-leading cause of disability-adjusted life years (DALY) worldwide. According to an article of 2024, NIH migraine ranks as the second leading cause of disability after back pain worldwide.

According to an article of National Institute of Neurological Disorders and Stroke published on January 2025, adult females are more likely affected than adult males . Headache disorders consistently rank among the top three most frequent neurological conditions across various age groups, beginning as early as age 5 and maintaining this status until the age of 80. Advancements in drug development and a growing awareness and diagnosis in the market. Moreover, increasing investment by public and private organizations is further propelling growth.

Advancements in drug development fuel the market growth.CGRP monoclonal antibodies, such as fremanezumab (Ajovy), erenumab (Aimovig), and galcanezumab (Emgality), are among the latest preventative drug therapies for migraines. According to the WebMD article published in February 2023, these drugs are administered via self-injection about every month, providing a targeted approach to treating migraines by blocking the release of CGRP, a neuropeptide implicated in migraine pain. Another drug in this class, eptinezumab (Vyepti), is given via intravenous injection every three months. The FDA has granted approval for small molecule CGRP antagonists, such as rimegepant (Nurtec) and atogepant (Qulipta), marking significant advancements in migraine treatment. These approvals represent a breakthrough in the management of migraine, offering new options for both acute and preventive therapy .

Adoption of the small molecule CGRP antagonists. According to the NCBI article published in September 2022, Ubrogepant and rimegepant, colloquially referred to as gepants, have completed phase III studies and are now FDA-approved for the acute treatment of migraine with or without aura. These small-molecule CGRP-receptor inhibitors have shown efficacy and safety, with no signs of hepatic injury. Rimegepant is also approved for the prevention of migraine.

Another inhibitor, atogepant, approved in 2021, is a daily oral medication used for EM prevention. There has been a significant push towards improving the delivery and tolerability of these treatments. This includes the development of intranasal forms for proven treatments and non-invasive neuromodulation techniques. These advancements aim to address the limitations of current therapies, such as adverse events, medication overuse, and intolerance to certain delivery methods or regimens.

Growing awareness and diagnosis of migraine disease requires a comprehensive strategy that encompasses various elements, including education, advocacy, and the establishment of support networks. According to American Migraine Foundation article published in June 2023, during Migraine and Headache Awareness Month, the American Migraine Foundation launched the "GET HEADUCATED" campaign, which underscores the significance of educating both oneself and others about migraine. This initiative is geared towards rallying the community to combat stigma surrounding the condition and to promote understanding of the disease.

Moreover, for instance, in January 2023, the International Classification of Headache Disorders (ICHD-3) offers a thorough framework for the diagnosis of migraine, organizing it into six distinct categories and outlining specific criteria for each classification. This system provides detailed guidelines for healthcare professionals to accurately identify migraine based on symptoms, duration, frequency, and associated features. In addition, tools like the ID Migraine Screener are utilized within this diagnostic framework to assess key migraine-related symptoms such as photophobia, functional impairment, and nausea. These screening tools aid in the efficient and accurate diagnosis, facilitating appropriate management and treatment strategies for individuals affected by this condition.

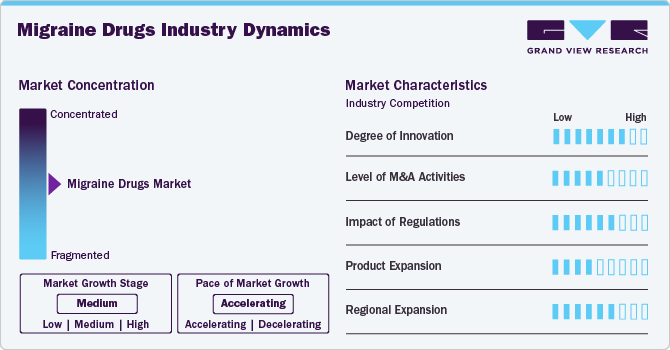

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of research and development. For example, according to National Institute of Neurological Disorders and Stroke (NINDS) article of 2025, researchers are exploring new medications and treatments, including those targeting the kappa opioid receptor in the brain, which is associated with stress a known trigger for migraine attacks. Researchers are also involved in identifying the biomarkers to predict and explain outcomes of body and medicine collectively work. Also in January 2023 , innovations in migraine drug development have evolved beyond traditional triptans, introducing new medication classes targeting specific migraine triggers. One such advancement is eptinezumab, a humanized IgG1 monoclonal antibody that targets both α and β isoforms of CGRP. Administered quarterly via intravenous infusion, eptinezumab has demonstrated efficacy in reducing days and improving functionality in chronic patients.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in May 2022, Pfizer acquired Biohaven Pharmaceuticals for USD 11.6 billion, securing access to Nurtec, a CGRP inhibitor used to treat acute pain, and zavegepant, a nasal spray migraine drug candidate. This acquisition aligns with Pfizer's strategy to enhance its commercialization capabilities and broaden the availability of migraine treatments.

Regulations in the migraine drugs industry set standards for safety, efficacy, and accessibility. They govern approval processes, manufacturing standards, labeling, and surveillance. Compliance is vital for companies to introduce and sustain their drugs. Regulations protect patients by minimizing risks and ensuring accurate information. Despite posing challenges, regulations maintain trust and enhance patient outcomes. In February 2025, the American College of Physicians (ACP) released updated guidelines for preventing episodic migraines in non-pregnant adults within outpatient settings. These recommendations are based on systematic reviews of pharmacologic treatments' effectiveness, patient preferences, and economic considerations.

Product substitutes include non-pharmacological treatments, alternative therapies, and lifestyle modifications. These substitutes offer relief without relying solely on medication. For instance[ , biofeedback therapy teaches relaxation techniques to manage migraine symptoms, serving as a substitute for traditional drug treatments.

Regional expansion for migraine drugs involves expanding market reach to new geographical areas beyond current operations. For example: Organon expanded its agreement with Eli Lilly to become the sole distributor and promoter of Emgality (galcanezumab) in 11 additional markets and Europe since February 2024. This expansion strategy aims to tap into previously untapped markets and increase accessibility to migraine treatments. For example, a pharmaceutical company may expand its distribution network to include regions in Asia or South America where the prevalence is high, but access to effective treatments may be limited.

Treatment Insights

Based on treatment, the preventive segment led the market with the largest revenue share of 62.03% in 2024. Preventive treatment involves medications and strategies aimed at reducing the frequency, severity, and duration of migraine attacks.Recent drug approvals for treatment have highlighted advancements in preventive therapies, offering new options for patients suffering from migraine. For instance in April 2023, Atogepant, an oral medication taken daily, received approval from the US FDA in 2021 for preventing episodic migraines. It marks a novel class of preventive therapy for migraine, presenting an alternative to conventional preventive treatments.

The Acute segment held the second largest market revenue share in 2024. Acute treatment encompasses various medications and strategies designed to alleviate the symptoms experienced during a migraine attack. Advancements in acute treatment have undergone significant evolution, introducing novel options characterized by enhanced efficacy, delivery methods, and tolerability. For instance, Rimegepant and Erenumab were the global first in class drugs CGRP antagonists approved in 2024, where Rimegepant was used for both acute and preventive migraine. There are other treatments including CGRP antibodies, a 5-HT1F receptor agonist, and innovative delivery methods like intranasal formulations and non-invasive neuromodulation. These advancements aim to overcome current treatment limitations such as adverse events, medication overuse, and challenges with certain delivery methods.

Therapeutic Class Insights

Based on therapeutic class, the CGRP monoclonal antibodies segment led the market with the largest revenue share of 56.68% in 2024. CGRP monoclonal antibodies (mAbs) have proven highly effective in preventing migraine attacks, often demonstrating efficacy rates comparable to or even higher than those of currently used preventive drugs. For instance, in July 2024,Teva Pharmaceutical Industries Ltd. announced positive results from its Phase 3 study, which evaluated the efficacy and safety of AJOVY (fremanezumab) for preventing episodic migraine in children and adolescents aged 6 to 17 years. In December 2024, AbbVie announced that the Canadian Headache Society's (CHS) updated 2024 Migraine Prevention Guideline strongly recommends atogepant for treating both episodic and chronic migraines, and onabotulinumtoxinA for chronic migraine treatment.

In May 2024, QULIPTA (atogepant) was approved by Health Canada for the preventive treatment of chronic migraine in adults. It is the first and only oral calcitonin gene-related peptide (CGRP) receptor antagonist (gepant) authorized for migraine prevention across all frequencies, including both episodic and chronic migraine . This effectiveness is supported by numerous randomized clinical trials involving large patient populations. Moreover, their excellent tolerability and emerging long-term safety data highlight a remarkable balance between efficacy and adverse effects. Compared to standard prophylactic drugs for prevention, CGRP mAbs offer a more favorable profile, indicating a significant advancement in prevention by effectively reducing attack frequency and severity while minimizing common side effects associated with traditional preventive medications.

Moreover, in January 2023, CGRP monoclonal antibodies (mAbs) are associated with higher costs, yet they offer substantial benefits in terms of increasing migraine-free days and improving health-related quality of life compared to no treatment. These mAbs also lead to reductions in both direct and indirect migraine-related costs. Estimates suggest that each migraine-free day achieved with CGRP mAbs can result in savings ranging from approximately USD 130 to USD 340.

In January 2025, U.S. Food and Drug Administration (FDA) approved Symbravo, an oral combination medication developed by Axsome Therapeutics for the acute treatment of migraines. Symbravo combines meloxicamnonsteroidal anti-inflammatory drug (NSAID), with rizatriptan, a 5-HT1B/1D agonist to provide rapid and sustained relief from migraine pain .

The CGRP small molecule antagonist diagnostics segment is anticipated to grow at the fastest CAGR over the forecast period. CGRP small molecule antagonists are a class of drugs used in migraine treatment. Unlike CGRP monoclonal antibodies, which are large protein molecules administered via injections, small molecule antagonists are orally administered medications. Recent advancements in CGRP small molecule antagonists, known as gepants, for these treatment have been remarkable. For instance, in April 2023, Several drugs have received approval in recent years. Ubrelvy (ubrogepant) was approved on December 23, 2019, followed by Nurtec ODT (rimegepant sulfate) on February 27, 2020. Later, Qulipta (atogepant) received approval on September 28, 2021. Most recently, Zavzpret (zavegepant) in intranasal and oral formulations was approved on March 10, 2023. These approvals mark significant progress in preventive treatment, offering new options for managing these symptoms.

Route Of Administration Insights

Based on route of administration, the injectable segment led the market with the largest revenue share of 69.48% in 2024. Injectable migraine drugs often provide rapid and effective relief from migraine symptoms, making them a preferred choice for individuals experiencing severe or acute attacks.According to an article of NIH 2024, Satsuma Pharmaceuticals and SNBL resubmits the new drug application a new nasal formulation known as STS101, which was accessed for its safety and tolerability for acute treatment of migraine. STS101 is an investigational drug-device combination comprising a dry-powder formulation of dihydroergotamine mesylate (DHE) preloaded into a single-use nasal delivery device. Designed for ease of use, this device requires no assembly or priming and can be stored at room temperature, offering a convenient and portable option for acute migraine treatment .

Injectable medications offer a convenient option for migraine treatment, particularly for individuals who have difficulty swallowing pills or experience nausea and vomiting during migraine attacks. For instance, in February 2022, Sumatriptan injection is a medication used to offer immediate relief from migraines and cluster headache attacks. It serves as a beneficial alternative for individuals who encounter difficulty swallowing pills and can demonstrate its effectiveness in as little as 10 minutes. Available either in a vial or a kit containing all necessary supplies for injection, sumatriptan provides a convenient and rapid treatment option for those experiencing acute or cluster headache symptoms.

According to an article of April 2025, Tonix Pharmaceuticals has introduced TONIX ONE, a comprehensive digital platform aimed at enhancing migraine management. This platform integrates partnerships with UpScript Telemedicine, ProModRx, Blink Health, and a leading migraine diary app to streamline the patient journey from symptom tracking to prescription fulfillment. TONIX ONE offers educational resources on migraine, connects patients with specialists via telehealth, and facilitates e-prescription requests, simplifying and accelerating access to treatment.

The oral segment is projected to witness at a significant CAGR over the forecast period. Oral medications are widely accessible and convenient for patients to use, contributing to their popularity as a preferred treatment option for migraine.Oral drugs have been shown to effectively relieve symptoms for many individuals, providing relief from pain, nausea, and other associated symptoms.There is a wide variety of oral drugs available, including over-the-counter medications such as ibuprofen or acetaminophen, as well as prescription medications such as triptans and preventive medications like beta-blockers or anticonvulsants. For instance, in February 2023 , Rimegepant (Nurtec) and ubrogepant (Ubrelvy) are both CGRP receptor antagonists approved for the acute treatment of migraine with or without aura. These medications function by blocking the CGRP receptor, which plays a role in the sensory nerves supplying the head and neck, thereby preventing these attacks.

Age Group Insights

Based on age group, the adult segment led the market with the largest revenue share of 52.92% in 2024 and is anticipated to grow at a significant CAGR over the forecast period. Modern lifestyles characterized by stress, irregular sleep patterns, poor dietary habits, and sedentary behavior contribute to the exacerbation of migraine symptoms in adults. The need for effective treatment options to manage these symptoms drives the market growth.On November 2024, first USFDA approved, drug-free therapy of Nerivio REN wearable device which proved to transform pediatric migraine as the sole migraine-specific preventive therapy approved for children aged 8 and above. It offers benefits over traditional medications by enhancing accessibility, minimizing classroom disruptions, reducing social stigma, and promoting independence .

In September 2024, Click Therapeutics conducted the ReMMi-D trial to assess the efficacy and safety of CT-132, an investigational prescription digital therapeutic, for preventing episodic migraine in adults aged 18 and older. CT-132 is designed to be used alongside existing acute and preventive migraine treatments.

According to the NCBI article published in February 2024, a meta-analysis involving 23 case-control studies revealed that adults with migraine exhibited higher PSQI scores compared to control groups, indicating poorer sleep quality among migraine sufferers. Furthermore, findings from a randomized controlled trial (RCT) involving 31 adults in the U.S. with chronic migraine and insomnia demonstrated that participants who underwent insomnia cognitive-behavioral therapy experienced a lower frequency of headache events compared to the control group. These results suggest a potential correlation between improving sleep quality and reducing the frequency and intensity of migraine attacks in affected individuals.

The geriatric segment is anticipated to grow at a significant CAGR over the forecast period. There is growing recognition of migraine in the geriatric population, fueled by improved awareness among healthcare providers and older adults themselves. For instance, in April 2021, In older individuals, migraines can manifest differently than in younger people. Headaches associated with migraines are more likely to occur bilaterally and may exhibit less sensitivity to light and sound. In addition, migraine aura, which includes visual disturbances, can occur without the typical headache pain, necessitating careful assessment to rule out stroke, transient ischemic attack, and seizure. The occurrence of aura not including headache can increase from 6% to 16% in individuals after the age of 55. Moreover, migraine attacks in the elderly tend to start more often at night or in the early morning, with up to 60% of cases initiating during these times.

Availability Insights

Based on availability, the prescription drugs segment led the market with the largest revenue share of 62.38% in 2024 and is anticipated to grow at a significant CAGR over the forecast period. The rising prevalence of migraines globally is a significant driver for the growth of prescription drugs. As more people are diagnosed with migraines, there is a higher demand for effective medications. For instance, in February 2023, FDA-approved prophylactic agents for migraine include divalproex sodium, propranolol, topiramate, and timolol. These medications are prescribed to prevent these attacks and are taken daily. Treatment is usually initiated in patients experiencing four or more headaches per month and should be continued for at least two to three months consistently. The primary drug classes used for migraine prophylaxis are beta-blockers, calcium channel blockers, and anticonvulsants.

The Over-the-Counter (OTC) drugs segment is anticipated to grow at the fastest CAGR over the forecast period. OTC drugs are readily available without a prescription, making them convenient for consumers to purchase and use without needing to visit a healthcare provider. This accessibility encourages more people to try OTC options for managing their migraines. For instance, in August 2023, Over-the-Counter (OTC) medications can be effective, particularly when taken early during a moderate migraine attack without nausea. In addition, Sana Pharma Medical has introduced Glitinum, an over-the-counter (OTC) herbal medicine developed for the preventive treatment of migraine in adults. Glitinum contains powdered feverfew (Tanacetum parthenium), a plant traditionally used to reduce the frequency and intensity of migraine attacks .

Studies indicate that NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) are widely used for headache and migraine relief without a prescription. Among them, naproxen, ibuprofen, and acetaminophen have strong evidence supporting their effectiveness in treating acute migraine attacks, especially when taken promptly after onset. In addition, a combination of acetaminophen, aspirin, and caffeine is recognized as highly effective for treating these attacks. These OTC options provide accessible and reliable relief for individuals experiencing migraine symptoms.

Regional Insights

North America dominated the migraine drugs market with the largest revenue share of 45.89% in 2024, owing to migraine is a dominant neurological disorder in North America, affecting millions of people. The rising incidence of these cases in the region contributes to the market growth. For instance, in January 2024 , Migraines affect over 39 million Americans, with women being three times more likely to experience them than men. This high prevalence highlights the significant impact of migraines on the overall health and well-being of the population. The majority of those affected fall within the 35 to 45 age range, and it's estimated that 1 in every 4 American households has a member who suffers from migraines. However, despite the widespread prevalence, only half of Americans experiencing these sought medical attentions for headache-related issues in the previous 12 months. This highlights a gap in healthcare access and emphasizes the need for increased awareness and treatment options.

U.S. Migraine Drugs Market Trends

The migraine drugs market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to improved awareness about migraines and their impact on quality of life prompts more individuals to seek medical treatment. In December 2024, Asheville-based Olfax Medical has been advancing its migraine treatment program, Relaspen, with plans to initiate clinical trials in 2025. Relaspen is a self-administered, intra-nasal therapy designed to rapidly alleviate acute migraine or cluster headaches, potentially providing relief in as little as 15 minutes. The company has secured significant funding, including a USD 5.6 million grant from the U.S. Department of Defense, to support the pre-clinical development of this innovative treatment.

Europe Migraine Drugs Market Trends

The migraine drugs market in Europe was identified as a lucrative region in this industry. The growth of the market in the region can be attributed to a significant population affected by migraines, contributing to a substantial market size for these drugs.

The UK migraine drugs market is expected to grow at a significant CAGR over the forecast period due to the presence has a well-developed healthcare infrastructure with access to a wide range of medical services and prescription medications. This facilitates the distribution and availability of migraine drugs, supporting market expansion. According to an article in January 2025, Panadol introduced Panmigrol, a triple-action formulation sub-brand offering tablets designed to provide faster and more effective migraine relief compared to standard ibuprofen tablets This innovation was aimed to be carried out at 10 million people in UK .

The migraine drugs market in France is expected to grow at a substantial CAGR over the forecast period, attributed to the stringent regulatory standards for pharmaceuticals, ensuring the safety and efficacy of drugs on the market.

The Germany migraine drugs market is expected to grow at a significant CAGR over the forecast period due to the rising number aging population, which is more susceptible to chronic conditions like migraines. As the population ages, the demand for drugs is expected to increase, driving market growth.

Asia Pacific Migraine Drugs Market Trends

The migraine drugs market in Asia Pacific is anticipated to witness at the fastest CAGR during the forecast period. Growing prevalence of the Migraine disease contributing to the growth of the market. For instance, in October 2023, across all countries, South Asia reported the highest incidence of migraine, with 12,041,286 cases, along with the highest migraine-associated Disability-Adjusted Life Years (DALYs) at 5,570,590.8. Overall, countries with higher Socio-demographic Index (SDI) values exhibited a greater disease burden of both migraine and Tension-Type Headaches (TTH).

The China migraine drugs market is expected to grow at a significant CAGR over the forecast period. For instance, in August 2023 , Migraine is a significant public health concern in China, impacting approximately 65 million individuals, which constitutes the largest migraine population in the world. This high prevalence highlights the substantial burden of on the population's health and well-being. In January 2025, Teva Pharmaceutical Industries Ltd. announced positive Phase 3 trial results for AJOVY (fremanezumab) in China, demonstrating significant efficacy in reducing monthly migraine days among adult patients. This achievement positions AJOVY to address the substantial unmet need for effective migraine treatments in a market with the largest migraine population worldwide.

In October 2024, CUHK Medical Centre (CUHKMC), FWD Hong Kong, and Pfizer Hong Kong have collaborated to enhance migraine awareness and support in Hong Kong. They have developed a health information platform on FWD's MAX lifestyle experience platform, offering a series of migraine-related resources, including a free online assessment. This initiative aims to encourage early professional consultation and effective management of migraines.

The migraine drugs market in Japan is expected to grow at a substantial CAGR over the forecast period due to the presence of one of the world's most rapidly aging populations. Migraines are more prevalent among older adults, and as the population ages, the demand for drugs is expected to increase, driving market growth. In November 2024, HUTCHMED (China) Limited announced that its partner, Takeda, has launched FRUZAQLA (fruquintinib) in Japan for patients with previously treated metastatic colorectal cancer (CRC). This follows approval by the Japanese Ministry of Health, Labour and Welfare in September 2024. FRUZAQLA is the first novel oral targeted therapy approved for metastatic CRC in Japan in over a decade. HUTCHMED will receive a milestone payment from Takeda in connection with this launch. Fruquintinib has also been approved in regions including the United States, Europe, and China[Mu41] .

Latin America Migraine Drugs Market Trends

The migraine drugs market in Latin America market was identified as a lucrative region in this industry. Advancements in healthcare technology and pharmaceutical innovation. These advancements lead to the introduction of new and improved migraine drugs, meeting the evolving needs of patients and driving market expansion.

The Brazil migraine drugs market is expected to grow at a significant CAGR over the forecast period. Improved awareness about migraines and advancements in diagnostic techniques lead to earlier and more accurate diagnoses in Brazil.

Middle East & Africa Migraine Drugs Market Trends

The migraine drugs market in MEA was identified as a lucrative region in this industry. The prevalence of migraines is increasing in the MEA region, driven by various factors such as lifestyle changes, stress, and genetic predisposition.

The Saudi Arabia migraine drugs market is expected to grow over the forecast period owing availability of health insurance coverage in Saudi Arabia helps increase access to medical treatments, including migraine drugs

Key Migraine Drugs Company Insights

Some of the leading players operating in the migraine drugs industry in include AbbVie Inc., Amgen Inc. and Teva Pharmaceutical Industries Ltd. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced Therapeutic Class and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Impel Pharmaceuticals Inc., Tonix Medicines, Inc., Currax Pharmaceuticals LLC. and Lundbeck are some of the emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Migraine Drugs Companies:

The following are the leading companies in the migraine drugs market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Eli Lilly and Company

- Pfizer Inc.

- Bausch Health Companies Inc.

- Gensco Pharma

- Impel Pharmaceuticals Inc.

- Tonix Medicines, Inc.

- Currax Pharmaceuticals LLC.

- Lundbeck

Recent Developments

-

In January 2025, Axsome Therapeutics received FDA approval for Symbravo, its new oral medication for the acute treatment of migraines. Symbravo combines meloxicam, a nonsteroidal anti-inflammatory drug, and rizatriptan, a serotonin receptor agonist, to provide rapid and sustained relief from migraine symptoms. This approval, following earlier regulatory setbacks, marks a significant advancement in Axsome's migraine treatment portfolio.

-

In April 2025, Teva Pharmaceuticals announced that the U.S. Food and Drug Administration (FDA) accepted its supplemental Biologics License Application (sBLA) for AJOVY® (fremanezumab-vfrm), aiming to expand its use for the prevention of episodic migraine in pediatric patients aged 6 to 17 years weighing at least 45 kilograms. If approved, AJOVY would become the first calcitonin gene-related peptide (CGRP) antagonist available for both adult and pediatric migraine prevention. The application is supported by positive results from the Phase 3 SPACE trial, which demonstrated significant reductions in monthly migraine and headache days among pediatric patients, with a safety profile comparable to that observed in adults.

-

In September 2024, Tonix Pharmaceuticals announced the issuance of a U.S. patent covering the subcutaneous delivery of Zembrace® SymTouch®, an FDA-approved medication for the acute treatment of migraines. This patent strengthens Tonix’s intellectual property portfolio and supports the continued development and commercialization of innovative delivery methods for migraine therapeutics, potentially enhancing convenience and efficacy for patients who require rapid symptom relief.

-

In December 2023 , Organon, a global healthcare company specializing in women's health, has entered into an agreement with Eli Lilly and Company (Lilly) to exclusively distribute and promote the migraine medications Emgality (galcanezumab) and RAYVOW (lasmiditan) in Europe.

-

In August 2023, Ajanta Pharma Ltd has obtained final approval from the U.S. Food and Drug Administration (USFDA) to sell topiramate extended-issue capsules in strengths of 25 mg, 50 mg, 100 mg, and 200 mg.

-

In July 2023, the American Heart Association has allocated USD 2.1 million in funding to support seven new scientific research studies focused on investigating the potential link between migraines and the risk of stroke and cardiovascular disease.

Migraine Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.97 billion

Revenue forecast in 2030

USD 13.34 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2018 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, therapeutic class, route of administration, age group, availability, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

AbbVie Inc.; Amgen Inc.; Teva Pharmaceutical Industries Ltd.; GSK plc; Eli Lilly and Company; Pfizer Inc.; Bausch Health Companies Inc.; Gensco Pharma; Impel; Pharmaceuticals Inc.; Tonix Medicines, Inc.; Currax Pharmaceuticals LLC.; Lundbeck

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Migraine Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global migraine drugs market report based on treatment, therapeutic class, route of administration,age group, availability, region.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute

-

Preventive

-

-

Therapeutic Class Outlook (Revenue, USD Million, 2018 - 2030)

-

CGRP monoclonal antibodies

-

CGRP small molecule antagonists

-

Acetylcholine inhibitors/ neurotoxins

-

Triptans

-

Ditans

-

Ergot alkaloids

-

NSAIDs

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Availability Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

Over-the-Counter (OTC) Drugs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global migraine drugs market size was estimated at USD 6.81 billion in 2024 and is expected to reach USD 7.97 billion in 2025.

b. The global migraine drugs market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2030 to reach USD 13.34 billion by 2030.

b. Based on treatment, the preventive segment accounted for the largest revenue share of 62.03% in 2024. Preventive treatment involves medications and strategies aimed at reducing the frequency, severity, and duration of migraine attacks.

b. Key players operating in the market are AbbVie Inc., Amgen Inc., Teva Pharmaceutical Industries Ltd., GSK plc, Eli Lilly and Company, Pfizer Inc., Bausch Health Companies Inc., Gensco Pharma, Impel, Pharmaceuticals Inc., Tonix Medicines, Inc., Currax Pharmaceuticals LLC., Lundbeck.

b. The migraine drugs market driven by factors such as increasing prevalence of migraines, advancements in drug development, and growing awareness and diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.