- Home

- »

- Renewable Energy

- »

-

Middle East Plastic To Fuel Market, Industry Report, 2033GVR Report cover

![Middle East Plastic To Fuel Market Size, Share & Trends Report]()

Middle East Plastic To Fuel Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Pyrolysis, Depolymerization, Gasification), By Plastic Type, By Source, By End Fuel (Sulfur, Hydrogen, Crude Oil), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-728-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Plastic To Fuel Market Summary

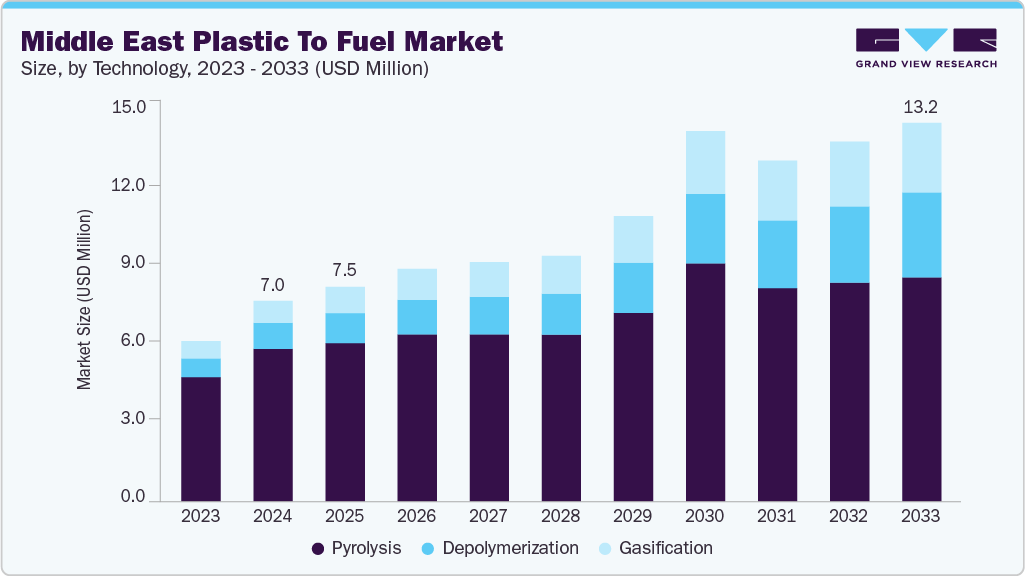

The Middle East plastic-to-fuel market size was estimated at USD 7.0 million in 2024 and is projected to reach USD 13.23 million by 2033, growing at a CAGR of 7.4% from 2025 to 2033. With rising concerns over plastic waste management and increasing demand for alternative fuels, plastic-to-fuel (PTF) technology is gaining traction as a dual-solution approach that addresses environmental and energy challenges.

Key Market Trends & Insights

- Saudi Arabia Plastic To Fuel market held the largest share of 32.50 % of the Middle East market in 2024.

- By technology, Pyrolysis held the highest market share of 75.97% in 2024.

- By plastic type, Polyethylene segment held the highest market share in 2024.

- By source, Municipal Solid Waste (MSW) segment held the highest market share in 2024.

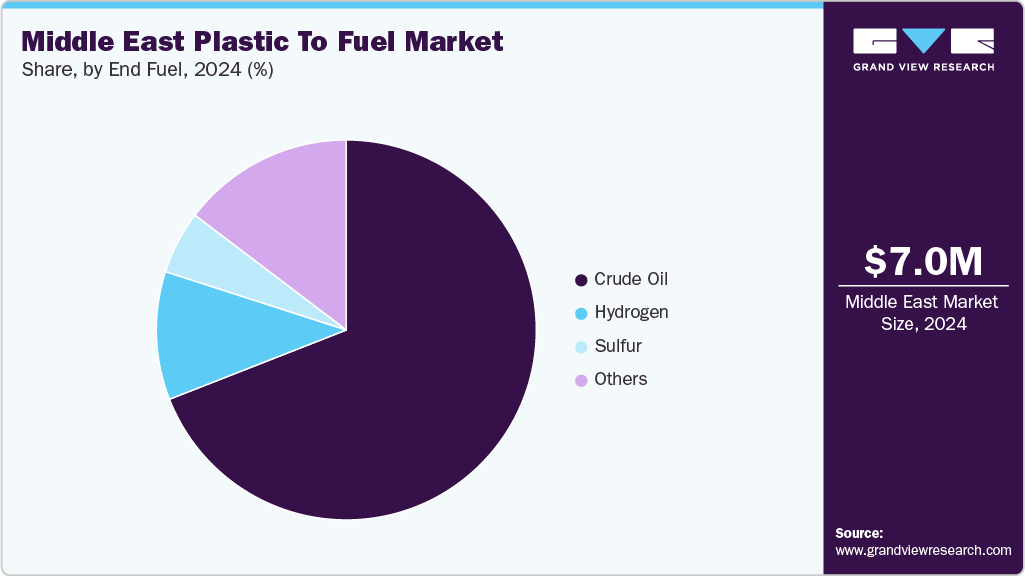

- By end fuel, Crude Oil segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.0 Million

- 2033 Projected Market Size: USD 13.23 Million

- CAGR (2025-2033): 7.4%

- Saudi Arabia: Largest market in 2024

- Qatar: Fastest growing market

By converting non-recyclable plastics into usable fuels such as diesel, kerosene, and gasoline, PTF projects provide an innovative pathway to reduce landfill dependency while enhancing regional energy security. National agendas such as Saudi Vision 2030, the UAE’s Circular Economy Policy 2031, and Qatar’s National Vision 2030 create favorable policy environments that encourage investment in waste-to-energy projects, including advanced plastic conversion facilities. Market growth is further propelled by the GCC’s rising plastic consumption, high per capita waste generation, and mounting pressure on municipalities to reduce carbon emissions from conventional waste management practices.

Industrial sectors, particularly petrochemicals and transportation, increasingly recognize PTF as a supplementary fuel source supporting decarbonization goals while reducing reliance on imported fossil fuels. Integrating advanced pyrolysis technologies, AI-driven process optimization, and blockchain-enabled supply chain tracking enhances operational efficiency and fuel quality. Public-private partnerships, green financing initiatives, and collaborations between technology providers and regional energy companies are accelerating deployment. With global players such as Plastic Energy, Agilyx, and Brightmark joining hands with regional champions such as SABIC, Tadweer, and Bee’ah, the Middle East plastic-to-fuel market is positioned to emerge as a critical enabler of the circular economy, sustainability, and energy diversification over the next decade.

Drivers, Opportunities & Restraints

The plastic-to-fuel (PTF) market in Middle East is primarily driven by rising concerns over plastic waste accumulation, increasing demand for alternative fuels, and ambitious national sustainability and circular economy strategies. Countries such as Saudi Arabia, the UAE, and Qatar are prioritizing advanced waste-to-energy solutions to reduce landfill dependence and cut greenhouse gas emissions. The region’s high per capita plastic consumption and mounting pressure on municipalities to manage waste sustainably have created a favorable environment for PTF adoption. Additionally, growing energy security concerns and efforts to diversify fuel sources encourage governments and industries to view PTF as a viable complement to traditional fossil fuels. Declining costs of pyrolysis and catalytic conversion technologies, alongside ongoing R&D in fuel upgrading, further enhance the appeal of PTF solutions across industrial and transportation sectors.

Opportunities in the market are expanding across municipal solid waste management partnerships, industrial-scale pyrolysis plants, and integration of PTF fuels into downstream petrochemical and transportation value chains. Adopting AI-enabled process control systems, blockchain-based waste tracking, and advanced pyrolysis reactors opens new pathways to improve fuel yields, quality, and supply chain transparency. Hybrid waste-to-fuel facilities that combine PTF with renewable energy inputs or carbon capture technologies are particularly well-suited to the GCC’s push for low-carbon industrial growth. Moreover, supportive financing mechanisms, circular economy investment funds, and corporate net-zero commitments are unlocking new capital inflows for PTF deployment. However, the market faces challenges such as high upfront capital requirements, a lack of uniform regulatory frameworks for alternative fuels, and logistical complexities in plastic waste segregation and collection. Dependency on imported conversion technologies and concerns over emissions from sub-optimal PTF operations also present barriers, potentially slowing the pace of large-scale commercialization in the region.

Technology Insights

Pyrolysis emerged as the dominant technology in the Middle East plastic-to-fuel (PTF) market, accounting for 75.97% of total revenue in 2024. This leadership is driven by the technology’s proven efficiency in converting mixed and contaminated plastic waste streams into valuable liquid fuels such as diesel, gasoline, and naphtha. Unlike other methods such as gasification or depolymerization, pyrolysis offers greater flexibility in handling diverse plastic feedstocks, including polyethylene, polypropylene, and polystyrene, which comprise the bulk of municipal solid waste in the region. Its relatively lower operating costs and scalability have made it the preferred choice for pilot projects and industrial-scale plants across Saudi Arabia, the UAE, and Oman.

The strong presence of regional players and government-backed initiatives to establish advanced pyrolysis plants further reinforces this segment’s dominance. Companies are investing in catalyst-assisted pyrolysis and process optimization technologies that enhance fuel quality, reduce emissions, and improve overall conversion efficiency. In addition, integrating digital monitoring systems and AI-driven controls enables predictive maintenance and higher plant reliability, making pyrolysis an increasingly cost-effective and sustainable option. With the Middle East intensifying efforts to divert plastic waste from landfills and align with decarbonization strategies, pyrolysis is expected to remain the backbone of PTF market growth, supporting the region’s dual waste management and energy diversification goals.

Plastic Type Insights

The polyethylene segment held the largest market share of 32.80% in 2024 in the Middle East plastic-to-fuel (PTF) market. This dominance is attributed to the high consumption of polyethylene-based plastics across the region's packaging, consumer goods, and construction sectors. Polyethylene waste, which includes high-density (HDPE) and low-density (LDPE) forms, is widely available and represents a major portion of municipal solid waste streams in countries such as Saudi Arabia, the UAE, and Qatar. Its chemical structure makes it particularly suitable for pyrolysis and thermal conversion technologies, yielding higher-quality liquid fuels than other plastic types. With rising urbanization and consumer demand driving plastic packaging use, polyethylene remains the most significant feedstock for PTF projects across the Middle East.

Growing investments in advanced waste segregation systems and collection infrastructure further strengthen polyethylene's market role. Regional governments and private players are increasingly partnering to establish large-scale pyrolysis plants that process polyethylene waste into alternative fuels such as diesel, gasoline, and naphtha. Technology advancements, including catalyst-assisted pyrolysis and AI-driven process optimization, enhance fuel yields and quality from polyethylene conversion, making it a preferred input for industrial-scale operations. While polypropylene and polystyrene also hold potential in the PTF space, polyethylene's widespread availability, lower processing complexity, and high calorific value ensure its continued dominance in the Middle East market. This entrenched position positions polyethylene as a key driver of PTF growth, supporting waste management goals and the region's push toward energy diversification.

Source Insights

The municipal solid waste (MSW) segment held the largest market share of 64.04% in 2024 in the Middle East plastic-to-fuel (PTF) market. This dominance stems from the sheer volume of plastic waste generated through urbanization, rising consumerism, and increasing use of packaged goods across the region. Countries such as Saudi Arabia, the UAE, and Kuwait report some of the world's highest per capita waste generation rates, with plastics accounting for a significant portion of MSW streams. The abundance and accessibility of mixed plastic waste in landfills and collection systems make MSW the most practical and cost-effective source for PTF projects. Governments across the Middle East also implement strict landfill diversion targets and national recycling mandates, further encouraging the conversion of MSW-derived plastics into fuel.

Investments in integrated waste management facilities and waste-to-energy initiatives are accelerating the dominance of the MSW segment. Advanced sorting technologies, AI-enabled segregation systems, and smart collection networks are improving the efficiency of extracting plastics from municipal waste streams for pyrolysis and thermal conversion. Public-private partnerships are also rising, with utilities and private companies collaborating to establish PTF plants adjacent to major urban centers with the highest MSW volumes. While industrial and agricultural plastic waste streams contribute to the PTF market, MSW remains the backbone due to its continuous supply, scalability, and alignment with national sustainability strategies. Its strong role ensures sustained leadership in fueling the Middle East's environmental management and renewable energy production.

End Fuel Insights

The crude oil segment held the largest revenue share of 69.06% 2024 in the Middle East plastic-to-fuel (PTF) market and is expected to maintain its dominance throughout the forecast period. This strong market position is primarily due to the region’s established refining infrastructure, high demand for crude-derived products, and the compatibility of PTF output with conventional oil upgrading systems. The conversion of waste plastics into synthetic crude oil provides a versatile feedstock that can be refined into gasoline, diesel, kerosene, and petrochemical intermediates, making it the most commercially attractive end fuel option. For Middle Eastern economies heavily reliant on hydrocarbons, crude oil from plastics supplements the domestic supply and aligns with circular economy goals by reducing landfill dependency and utilizing non-recyclable plastics.

Government-backed energy diversification strategies and increasing investments in waste valorization projects across Saudi Arabia, the UAE, and Oman further reinforce the dominance of the crude oil segment. Strategic partnerships between technology providers and national oil companies drive large-scale adoption of pyrolysis and depolymerization plants designed to generate crude-like outputs from mixed plastic waste. This allows seamless integration into existing refineries, lowering costs and enhancing scalability. While other PTF outputs such as diesel and synthetic gas are gaining traction, crude oil remains the backbone of the market due to its higher demand flexibility, established downstream infrastructure, and strong export potential. As regulatory pressure to manage plastic waste intensifies and the region accelerates its transition to sustainable energy models, crude oil from plastics is expected to remain the leading segment, offering economic and environmental advantages for the Middle East.

Country Insights

Saudi Arabia Plastic To Fuel Market Trends

Saudi Arabia held the largest revenue share of 32.50% in the Middle East Plastic-to-Fuel market in 2024, establishing itself as the regional leader. The Kingdom’s dominance is underpinned by strong government backing for waste-to-energy projects under Vision 2030, which emphasizes sustainability, circular economy initiatives, and diversification of energy sources. With rising plastic consumption and mounting waste management challenges, Saudi Arabia is accelerating investments in pyrolysis and advanced recycling plants to convert non-recyclable plastics into crude oil and refined fuels. Key mega-projects such as NEOM incorporate plastic-to-fuel facilities into their broader sustainability frameworks, ensuring resource efficiency and emissions reduction. Supported by sovereign wealth funds, public-private partnerships, and strategic collaborations with global technology providers, Saudi Arabia is expected to remain the cornerstone of PTF growth in the Middle East.

UAE Plastic To Fuel Market Trends

The UAE accounted for 24% of the Middle East Plastic-to-Fuel market in 2024, ranking as a close second after Saudi Arabia. The country’s leadership in the sector is driven by ambitious clean energy and circular economy policies under the UAE Energy Strategy 2050, which targets reduced waste-to-landfill and improved recycling rates. Flagship projects in Dubai and Abu Dhabi are exploring large-scale PTF facilities integrated with existing oil refining and petrochemical infrastructure. The Al Dhafra and Dubai Municipality waste-to-fuel initiatives highlight the UAE’s commitment to transforming waste into valuable energy resources while reducing environmental impacts. Backed by strong regulatory frameworks, growing private sector involvement, and sustainability-linked financing, the UAE is positioned as a key hub for advancing PTF technologies and scaling commercial adoption across the Gulf.

Israel Plastic To Fuel Market Trends

Israel is emerging as a technology-driven player in the Middle East Plastic-to-Fuel market, leveraging its advanced R&D ecosystem and innovation-focused industrial base. The country is piloting several pyrolysis and gasification projects to transform plastic waste into synthetic crude oil and alternative fuels, emphasizing urban waste management and export-oriented fuel production. Israel’s startups and research institutes are at the forefront of developing efficient catalytic processes and AI-driven optimization systems to improve fuel yield and reduce operational costs. Supportive regulatory frameworks and international partnerships further reinforce Israel’s role as a regional innovation hub, enabling it to pioneer scalable, digitally enabled PTF solutions. This positions Israel as an important growth market, particularly in the context of urban sustainability and technology-led fuel production.

Oman Plastic To Fuel Market Trends

Oman is steadily developing its Plastic-to-Fuel market as part of its Vision 2040 sustainability strategy and broader renewable energy transition. The country is exploring pyrolysis and hybrid waste-to-fuel plants, particularly in regions such as Dhofar and Al Wusta, where waste management challenges are prominent. Oman’s focus on industrial diversification and waste valorization is supported by public-private partnerships and international collaborations that aim to integrate PTF technologies with existing refining capacities. The government’s Hydrogen Oman (Hydrom) initiative indirectly supports PTF by fostering innovation in clean fuel production and long-term energy supply contracts. Although Oman’s market share remains smaller than that of regional leaders, its proactive regulatory reforms and investment drive position it as an emerging growth market in the Middle East PTF sector.

Qatar Plastic To Fuel Market Trends

Qatar is gradually expanding its footprint in the Middle East Plastic-to-Fuel market, supported by its National Vision 2030 and ongoing sustainability programs. While natural gas remains the cornerstone of the Qatari energy mix, the government is increasingly investing in waste-to-energy projects to diversify resources and address mounting plastic waste. Pilot PTF facilities are being developed to process municipal plastic waste into crude oil substitutes, with integration potential into Qatar’s strong refining and petrochemical sectors. Projects like the Al Kharsaah solar initiative complement the country’s broader circular economy ambitions. PTF solutions provide an additional pathway to reduce landfill use and support ESG-linked global standards. Though still in its early stages, Qatar’s PTF market offers significant growth potential as it diversifies beyond hydrocarbons.

Key Middle East Plastic To Fuel Company Insights

Some of the key players operating in the Middle East plastic to fuel market include Plastic Energy, Agilyx Corporation, Brightmark Energy, Plastic2Oil Inc., RES Polyflow / Vadxx Energy LLC, SABIC, Veolia Middle East, Bee’ah, Enviroserve, and Middle East Plastic Industries (MEPICO). These companies are leading the development and commercialization of advanced plastic-to-fuel technologies, focusing on pyrolysis, depolymerization, and chemical recycling methods to convert plastic waste into crude oil, diesel, and other valuable fuels.

Key Middle East Plastic To Fuel Companies:

- Plastic Energy

- Agilyx Corporation

- Brightmark Energy

- Plastic2Oil Inc.

- RES Polyflow

- SABIC

- Veolia Middle East

- Bee’ah

- Enviroserve

- Middle East Plastic Industries (MEPICO)

Recent Developments

-

In February 2025, Plastic Energy expanded its presence in the Middle East plastic-to-fuel market by announcing a strategic partnership with SABIC to establish an advanced chemical recycling facility in Saudi Arabia’s Jubail Industrial City. The project, aimed at converting end-of-life plastics into recycled feedstock for circular polymers, aligns with the Kingdom’s Vision 2030 sustainability goals and SABIC’s circular economy roadmap.

Middle East Plastic To Fuel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.48 million

Revenue forecast in 2033

USD 13.23 million

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, plastic type, source, end fuel, country

Country scope

UAE; Saudi Arabia; Israel; Oman; Qatar

Key companies profiled

Plastic Energy; Agilyx Corporation; Brightmark Energy; Plastic2Oil Inc.; RES Polyflow; SABIC; Veolia Middle East; Bee’ah; Enviroserve; Middle East Plastic Industries (MEPICO)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Plastic To Fuel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East plastic to fuel market report based on technology, plastic type, source, end fuel, and country:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Pyrolysis

-

Depolymerization

-

Gasification

-

-

Plastic Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal Solid Waste (MSW)

-

Commercial & Industrial Waste

-

-

End Fuel Outlook (Revenue, USD Million, 2021 - 2033)

-

Sulfur

-

Hydrogen

-

Crude Oil

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Israel

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East plastic to fuel market was estimated at USD 7.0 million in 2024 and is expected to reach USD 7.48 million in 2025.

b. The Middle East plastic to fuel market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 13.23 million by 2033.

b. Based on the plastic type segment, Polyethylene held the largest revenue share of 32.80% in the Middle East Plastic to Fuel (EaaS) market in 2024, owing to its widespread use in packaging, consumer goods, and construction materials.

b. Some of the key vendors operating in the Middle East plastic to fuel market include Plastic Energy, Agilyx Corporation, Brightmark Energy, Plastic2Oil Inc., RES Polyflow, SABIC, Veolia Middle East, Bee’ah, Enviroserve, and Middle East Plastic Industries (MEPICO), among others.

b. The key factors driving the Middle East plastic to fuel market include the rising volumes of plastic waste generation, increasing pressure on landfill capacity, and the growing emphasis on circular economy practices across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.