- Home

- »

- Medical Devices

- »

-

Microbiome Skincare Products Market, Industry Report, 2030GVR Report cover

![Microbiome Skincare Products Market Size, Share & Trends Report]()

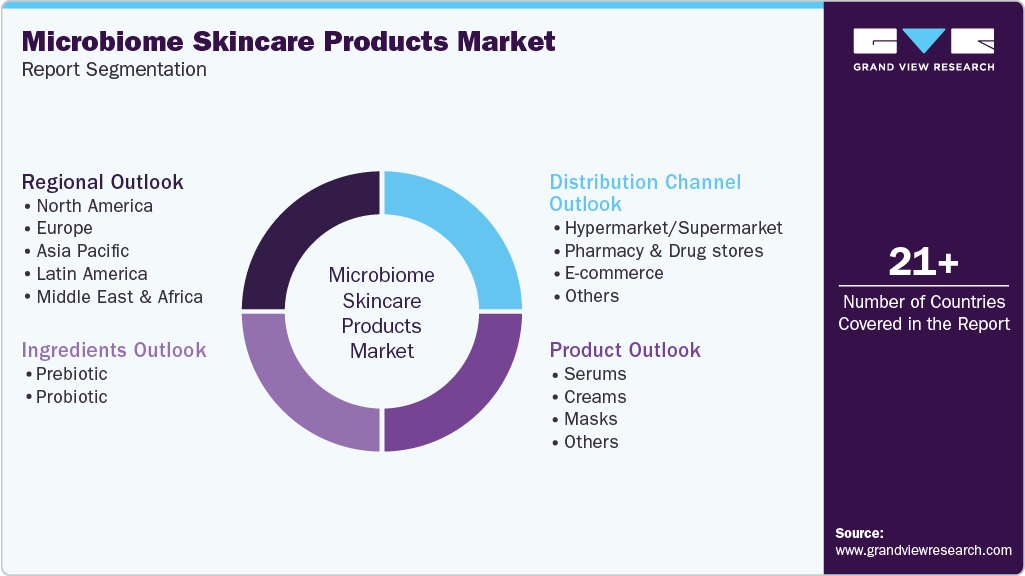

Microbiome Skincare Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Serums, Creams, Masks), By Ingredients (Prebiotic, Probiotic), By Distribution Channel (Hypermarket/Supermarket, E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-051-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microbiome Skincare Products Market Summary

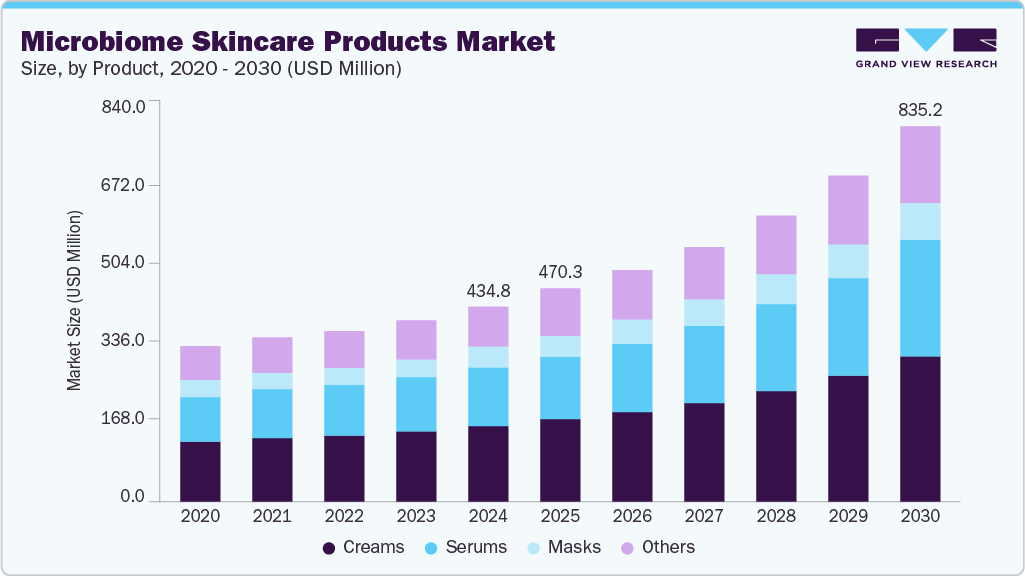

The global microbiome skincare products market size was estimated at USD 434.8 million in 2024 and is projected to reach USD 835.2 million by 2030, growing at a CAGR of 12.2% from 2025 to 2030. Various factors, including genetics, age, diet, lifestyle, and environmental exposures, influence the development of skin microbiomes.

Key Market Trends & Insights

- North America’s microbiome skincare products industry held the largest share of 40.14% of the global market in 2024.

- The U.S. microbiome skincare products industry is expected to grow significantly over the forecast period.

- By product, the creams segment held the highest market share of 38.2% in 2024.

- By ingredients, the probiotic held the leading market share in 2024.

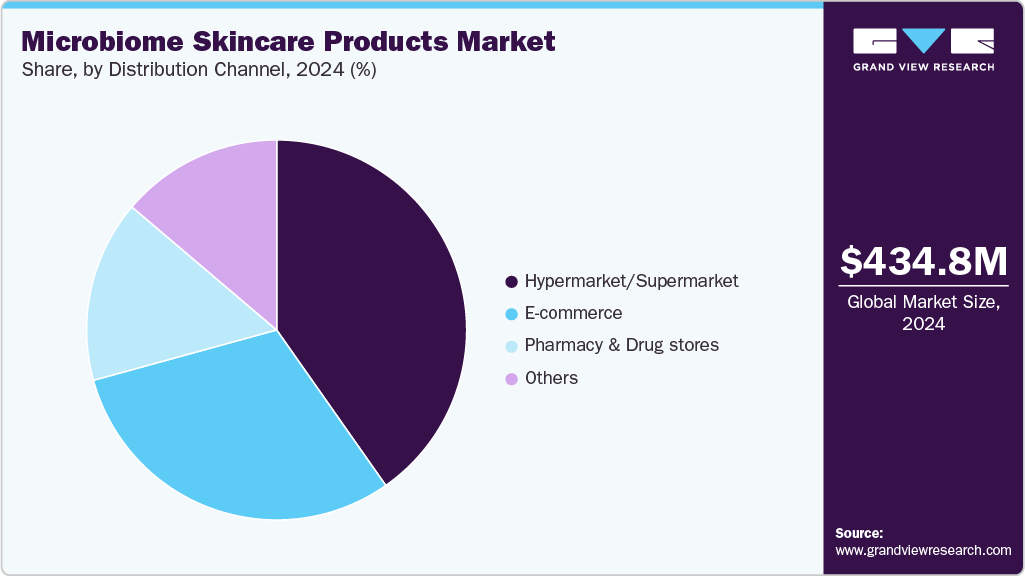

- By distribution channel, the hypermarket/supermarket held the leading market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 434.8 Million

- 2030 Projected Market Size: USD 835.2 Million

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Certain health conditions, such as acne, eczema, and psoriasis, can disrupt the skin microbiome. As per the National Institute of Allergy and Infectious Diseases, 10-30% of children and 2-10% of adults in the U.S. have eczema. The skincare microbiome plays a crucial role in maintaining healthy skin by protecting against harmful pathogens and helping to regulate the skin's immune and inflammatory responses. Thus, a growing number of eczema cases are projected to propel the demand for microbiome skincare products over the forecast period.Various skincare products on the market are designed to support a healthy skin microbiome such as prebiotics, probiotics, microbiome friendly cleansers, barrier repairing products, and moisturizers. For instance, in January 2023, Crown Aesthetics announced launch of its new skin biome brand BIOJUVE that uses living microbe technology to improve skin health. Thus, the growing adoption of these skincare microbiome products and the continuously evolving cosmetic industry is anticipated to drive market growth during the forecast period.

Another major driver increasing microbiome skincare adoption is rising trend of clean beauty among the population. The users of such products are steering clear of ingredients such as paraben, and sulfates that may harm the skin's natural flora. Instead, consumers are more leaning towards natural components, prebiotics, probiotics, and postbiotics, which feed the good bacteria. The compatibility of microbiome skincare with the 'clean' and 'green' beauty trend has not only befitted consumers' demand for healthy skin but also pushed companies to introduce products that are eco-conscious.

Research on skin microbiomes is a growing field, and several studies have investigated the role of skin microbiomes in skin health and disease. Many research studies have examined the effects of different skincare products on skin microbiomes. For instance, published in June 2024, a group of scientists in the U.S. National Institute of Allergy and Infectious Diseases (NIAID) have studied that the topical application of Roseomonas mucosa, a bacterium from the natural skin flora, has considerably alleviated eczema symptoms in children and adults. Results from such research studies are anticipated to increase attention to skincare microbiome products, thereby driving market growth.

Moreover, several strategic initiatives are undertaken by major players, such as partnerships, collaborations, and licensing agreements, to strengthen their product portfolio and expand their business presence. For instance, in September 2024, Beiersdorf entered a partnership deal with Macro Biologics, Inc. for the development of biodegradable antimicrobial peptides showcasing wider application potential in skin care and healthcare. This partnership further underlines Beiersdorf’s aim to constantly develop transformative and eco-friendly innovations for its users.

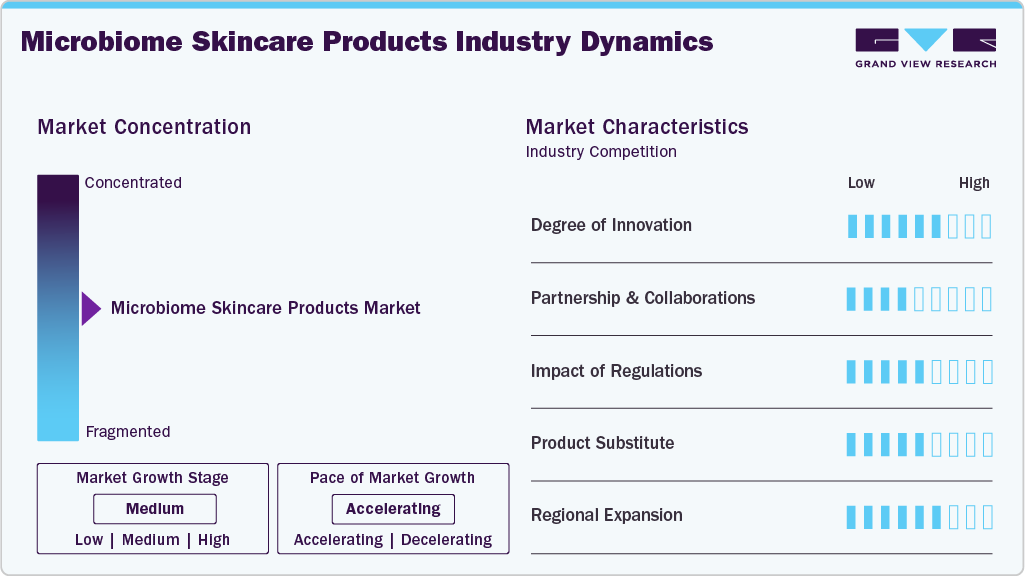

Market Concentration & Characteristics

The microbiome skincare products industry demonstrates a moderate level of industry concentration, with key players investing in innovative formulations and advanced technologies. For instance, in April 2025, one of the professors of the Faculty of Science at Chulalongkorn University came up with a formula to maintain healthy skin using microbiome and 4P-biotics technology, resulting in serum and sunscreen lotion products under the brand THANARA, which not only balances the facial skin microbiome but also keeps it healthy, young, bright, and free of acne. These developments highlight the market’s steady global expansion driven by innovation and rising demand for skincare.

The microbiome skincare products industry is going through significant changes, new formulations, and manufacturing processes being the main reasons for this change. The manufacturers have already implemented leading-edge biotechnological procedures, such as using AI technology to produce microbiome skincare of high efficacy and personalized without contamination. All these technological breakthroughs signify a new period in dermatology, where scientific accuracy and customer-specific delivery methods result in better regenerative and anti-aging effects.

The microbiome skincare products industry has experienced increased partnerships and collaborations as companies seek to boost product innovation and broaden clinical applications. Many manufacturers are working with biotechnology firms, academic institutions, dermatology specialists, and others to create next-generation formulations that offer better efficacy and safety. For instance, in April 2023, HelloBiome, a microbiome innovation company specializing in personal care customization using the microbiome, partnered with K18, Inc., a science-backed hair-care company. This partnership claims to build a strong hair care product that would promote healthy hair and improve the overall health of the scalp microbiome. Such a partnership is estimated to widen the application of microbiome skincare products.

Regulatory oversight is vital in the microbiome skincare products industry due to the emerging technology and the safety of users. In countries like the U.S., the European Union (EU), and India, microbiome skincare production is subject to strict quality standards and certification processes to guarantee safety and effectiveness. Manufacturers follow Good Manufacturing Practices (GMP) accompanied by the ISO 22716 (cosmetic GMP) and often obtain MyMicrobiome certification, indicating strong quality management.

Rigorous testing protocols such as microbiological safety assessments and clinical evaluations further enhance product reliability. For instance, by August 2025, MyMicrobiome have successfully partnered with over 150 brands globally across cosmetics, hygiene, pharmaceutical, textile, and pet care industries for the microbiome-safety certification. This proves the rising penetration of microbiome skincare technology worldwide. In addition, manufacturers pursue approval from global regulators such as the FDA and EMA, which helps foster worldwide consumer loyalty. Although regulatory processes may delay market entry, they ensure high-quality products and offer a competitive edge for compliant manufacturers domestically and internationally.

While microbiome skincare offers healthier skin barriers and anti-aging benefits, they face partial competition from alternative treatments such as barrier-repair formulations, anti-inflammatory skincare products and traditional skincare products. These substitute formulations are widely used for skin hydration, volume restoration, and wrinkle reduction, while microbiome skincare products provide resolution of root cause and offer long-term resilience. For instance, a randomized study carried out in February 2023 showed significant improvement in the biophysical and microbiome parameters of skin, wherein conventional skincare could onlyimprove the roughness of skin over the period of 3 weeks. This limits the threat of product substitutes for microbiome skincare products.

The microbiome skincare products industry is witnessing significant regional expansion, particularly in countries such as India, the UK, and other Asian markets, where demand for skincare and personal care treatments is growing. Increasing regulatory approvals and clinical adoption are expected to drive further market penetration. In addition, collaborations between local manufacturers and international partners enhance production capabilities and technology exchange. For instance, in India, in June 2024, MyMicrobiome entered into a distribution deal and certification expansion with a specialty chemicals distributor, “Vimal LifeSciences”. The partnership will offer certified microbiome-friendly products that maintain the balance and diversity of the microbiome and become accessible to Indian consumers. This will accelerate product presence and innovation in emerging markets.

Product Insights

The creams segment dominated the market and accounted for the largest revenue share of 38.2% in 2024. The increasing approval and launch of new creams to maintain and prevent disruption of the healthy microbiome on the skin is a key factor driving the demand for the product. As per OPS Publishes, creams are highly adopted due to their lightweight formulation and hydration effects, and, therefore, it is the largest contributor to the segmental revenue.

The serum segment is anticipated to witness lucrative growth during the forecast period. This growth can be attributed to extended serum approval to prevent skin microbiome disruption. Several serums on the market are formulated to support a healthy skin microbiome, including probiotic and prebiotic serums, Niacinamide serums, and Vitamin C serums. For instance, iORA Prebiotic Radiant, Vichy Minéral 89 Probiotic Fractions Repairing, and Murad Prebiotic 3-in-1 Multimist have widely used serums available in the market. The introduction of highly effective and long-lasting effects-providing serums in the market is projected to drive market growth.

Ingredient Insights

Based on ingredient, the probiotics segment dominated the market with a revenue share of 71.6% in 2024 and is expected to grow at the fastest CAGR of 12.4% over the forecast period. Probiotics, the live microorganisms that provide health benefits when applied to the skin, help enhance the skin's protective barrier, reduce inflammation, and promote overall skin health. This segment has gained popularity as more consumers recognize the importance of a balanced skin microbiome in achieving healthier, more resilient skin. With the growing interest in skin health and microbiome science, probiotic-enriched skincare products are increasingly featured in facial masks, serums, moisturizers, and cleansers.

Distribution Channel Insights

Based on distribution channel, the hypermarket/supermarket segment dominated the market and accounted for the largest revenue share of 40.3% in 2024. This dominance can be attributed to purchasing skincare microbiome products in the supermarket, and it is proven to be a convenient and accessible way to incorporate these products into a skincare routine. According to the Food Industry Association, there were around 45,575 supermarkets available in the U.S., as of 2024. Supermarkets carry well-known brands that many people trust, and these brands often have a wide range of skincare products that cater to different skin types and concerns. Thus, opening new supermarkets offering skincare microbiome products is expected to fuel market growth.

The e-commerce segment is anticipated to grow significantly during the forecast period, owing to increased buyer preference to purchase beauty products through online platforms. The pandemic shut down the entire world; however, mid-pandemic and post-pandemic consumers started easy shopping over online platforms. The difference between online and offline stores was evident as soon as the economy opened. For instance, in 2024, the Black Friday sale on the TikTok shop registered over USD 100 million in fashion and beauty product sales, accounting for most of it. “Canvas Beauty confirmed over 100,000 product sales and crossed USD 3 million in revenue sales in a single livestream with a content creator”. Currently, Shopify Plus, Banuba, Argano, and nopCommerce are some major e-commerce platforms engaged in providing various beauty products, including skincare microbiome, operating worldwide.

Regional Insights

North America microbiome skincare products industry dominated the global market and accounted for the largest revenue share of 40.14% in 2024. This can be attributed to supportive regulatory policies regarding the clearance and approval of new products for sale in the market. Codex Labs announced in April 2025 that its Bia Eczema Relief Lotion - the only OTC topical eczema therapy- received Microbiome-friendly certification from the MyMicrobiome Standard and National Eczema Association (NEA) Seal of Acceptance. This certification evaluates skincare products based on their impact on the skin microbiome. It ensures that the products are formulated with ingredients that are beneficial to the skin microbiome and do not contain any harmful substances. This achievement demonstrates Codex Beauty's commitment to producing safe and effective clean beauty skincare products, driving North America’s market growth.

U.S. Microbiome Skincare Products Market Trends

The U.S. microbiome skincare products industry is driven by the rising prevalence of skin diseases, such as psoriasis, eczema, vitiligo, and acne, which is expected to boost the market. According to the American Academy of Dermatology in October 2024, the incidence of skin diseases in the U.S. remains notably high, impacting a substantial portion of the population. Acne, for instance, affects up to 50 million Americans annually, making it the most common skin condition in the country. In addition, skin cancer, including melanoma, continues to pose significant health risks, with thousands of new cases diagnosed each year. Growing expenditure on skincare demonstrates strong consumer interest and investment in skincare products. For instance, a US Census and Simmons National Consumer survey stated that an American spends more than USD 320 each year on skin care. This is expected to boost the growth of microbiome skincare products in the country during the forecast period.

Europe Microbiome Skincare Products Market Trends

The microbiome skincare products industry in Europe is expected to witness lucrative growth over the forecast period, owing to the region's focus on ethical cosmetic shopping, increasing demand for natural and organic skincare products, and technological advancements in skincare product formulations, which have propelled its market growth. In addition, the presence of leading players like L'Oréal S.A., Procter & Gamble Co., and Estée Lauder Companies, Inc., along with a strong emphasis on eco-friendly beauty products, has further solidified Europe's position as a key player in the microbiome skincare sector.

The German microbiome skincare products industry is growing significantly due to the rising incidence of acne in the country. According to the Sky UK article published in September 2024, it revealed that nearly 16% (15.98%) of Germans have been diagnosed with acne, highlighting the widespread prevalence of the condition in the country. With rising awareness of skin health and the long-term effects of acne, German consumers are increasingly seeking advanced skincare solutions. This growing demand has contributed to expanding the market, as more individuals turn to scientifically backed formulations that support a balanced skin microbiome. The shift toward dermatologically tested and probiotic-infused skincare is further driven by consumers' preference for non-invasive, effective treatments that address acne and overall skin health.

The UK microbiome skincare products industry growth is driven by the growing consumer interest in skincare, and the rise in spending on skincare products. According to the Hollywood Mirror article published in April 2024, while 38% of Brits report not spending on beauty treatments and products, a significant portion actively invests in skincare. Around 33% allocate between £1 and £15 per month (£12-£180 annually or approximately USD 13-195), indicating a steady demand for affordable skincare solutions. In addition, 3% of consumers spend between £51 and £100 per month (£612-£1,200 annually or approximately USD 662-1,298), and 1% exceed £100 per month, showcasing a niche but lucrative segment willing to invest in premium and innovative skincare solutions, such as microbiome-focused products. The awareness of skin health and microbiome benefits increases; this trend is expected to further drive market growth in the UK.

Asia Pacific Microbiome Skincare Products Market Trends

Asia Pacific microbiome skincare products industry is anticipated to register the fastest CAGR of 13.4% during the forecast period. The key factors driving the market in the region include an increasingly aging population, a growing prevalence of skin diseases, and a rise in per capita disposable incomes. Age, gender, and ethnicity are the most important factors specific to individual hosts and affect skin microbiomes. As per an article published by Clinical Trials Arena, eczema (atopic dermatitis) is one of the top concerns among South Korean individuals. To tackle this in April 2024, Kolmar Korea announced the development of a skin microbiome-derived sun care product. The introduction of such novel products is expected to boost market growth.

The China microbiome skincare products industry is driven bycollaborations among companies to increase awareness and self-management of acne, a key trend in the market. For instance, L’Oréal partnered with retail giant Alibaba Group in 2023 to make an AI-based app to aid acne sufferers in finding proper treatment and effectively managing their condition. According to L’Oréal, through this AI technology, people suffering from acne can better understand the state of their skin and decide the right skincare solutions for them without leaving their homes.

The Indian microbiome skincare products industry is growing due to widespread skin concerns. Acne is a high concern among the inflammatory skin conditions in India, particularly among adolescents. According to the NCBI article published in July 2024, studies indicate that 73% of individuals aged 11-19 years experience acne, with cases ranging from mild (82%) to moderate (17%) and severe (1%). This high prevalence has fueled the demand for microbiome-focused skincare products that promote a balanced skin ecosystem. Consumers are shifting towards probiotic and prebiotic-based formulations that help regulate the skin’s microbiota, reduce breakouts, and support long-term skin health. As awareness of microbiome skincare grows in India, the market is witnessing increased adoption of products designed to address acne through a gentler, science-backed approach.

Latin America Microbiome Skincare Products Market Trends

The Latin America microbiome skincare products industry is expected to grow during the forecast period. Some growth factors, such as shifting consumer preferences and increased skin health awareness, also contribute to the growth. The rise in skin health issues, the expanding middle class, and their willingness to invest in personal care drive market growth. Furthermore, the increasing acceptance of advanced skincare products and the presence of international brands contribute to market expansion.

Brazil's microbiome skincare products industry is expected to grow due to consumers' increasing demand for natural and eco-friendly skincare solutions, as highlighted by a study from the Federal Technological University of Paraná. Factors such as higher earners preferring natural or eco-friendly cosmetic creams, a significant rise in personal hygiene, perfumery, and cosmetic products sales, and a growing awareness of the benefits of sustainable beauty products are driving this market expansion.

Middle East & Africa Microbiome Skincare Products Market Trends

The Middle East & Africa microbiome skincare products industry is expected to grow at a lucrative rate due to the increasing consumer demand for natural and eco-friendly skincare solutions in the region. Factors such as rising awareness of the benefits of microbiome-friendly products, a shift towards sustainable beauty choices, and the influence of changing lifestyles and preferences are expected to drive the market's expansion. In addition, key players focusing on innovative skincare formulations and the region's evolving skincare trends contribute to the promising growth prospects of the MEA market.

Saudi Arabia's microbiome skincare products industry is witnessing steady growth due to the rising prevalence of acne-related complications, including scarring and post-inflammatory hyperpigmentation (PIH. According to the Dove Medical Press Ltd article published in January 2025, a recent retrospective study conducted at King Abdulaziz Medical City, Jeddah for 417 participants, analyzing data from 2016 to 2023, revealed that 22.8% of acne patients experienced scarring, 22.3% had PIH alone, and 36.2% suffered from both conditions.

The UAE microbiome skincare products industry is driven by the rising disposable income among the UAE population and the growing acceptance of beauty & personal care treatments, which is expected to boost the market during the forecast period. A considerable volume of imported products characterizes the UAE’s beauty and skincare market. According to Pen My Paper, the growth of social media and other means of communication has increased the importance & exposure to personal & skincare treatments in the country.

The Kuwait microbiome skincare products industry is estimated to register significant growth in the forecast, owing to the consumer shift towards organic and eco-friendly skincare, which is driving the expansion of microbiome-focused skincare products in Kuwait. According to the Medium article published in October 2024, consumers increasingly prioritize formulations free from harmful chemicals, opting for products that support skin health while being environmentally sustainable. This trend aligns with the rising demand for microbiome skincare, which harnesses natural ingredients to maintain skin balance, enhance barrier function, and reduce sensitivity.

Key Microbiome Skincare Products Company Insights

Key market players are undertaking various strategic initiatives, such as signing the new partnership agreement, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their services, thus providing a competitive advantage. In January 2023, Symbiome, a top skincare company, partnered with Sequential, a skin microbiome testing company. This collaboration aims to incorporate the latest advances in microbiome science into the beauty industry by developing and testing innovative skincare products tailored to an individual's unique skin microbiome. This partnership will enable both companies to build products that are tailored to the specific needs of each person's skin, leading to more effective and personalized skincare solutions.

Key Microbiome Skincare Products Companies:

The following are the leading companies in the microbiome skincare products market. These companies collectively hold the largest market share and dictate industry trends.

- Vichy Laboratoires

- L'Oréal Paris

- OUTIN FUTURES INC.

- Missha

- Eminence Organic Skin Care

- La Roche-Posay

- Aveeno (J&JCI)

- Elizabeth Arden

- Glowbiotics LLC

- GALLINÉE

- Murad LLC

Recent Developments

-

In September 2025, Leucine Rich Bio Pvt. Ltd., the microbiome company based in India, has introduced the first skin microbiome test of the region - BugSpeaks facial skin microbiome test. This revolutionary invention will change the beauty and well-being industries by customizing science-based and skin-derived microbiome insights, which are the unique microbial ecosystem of the skin.

-

In September 2025, following the announcement of a partnership between YUN NV and Bausch Health. Bausch Health, a pharmaceutical manufacturer, announced the launch of the YUN ACN skincare product portfolio in Poland, which includes probiotic and prebiotic products formulated for acne-prone skin. The product line includes YUN ACN Repair Cream, Micellar water, and Wash gel all aiding the natural microbiome of skin

-

In September 2024, Terra Quantum and Unilever joined forces to examine complex skin microbiome data through quantum machine learning methods to discover novel skin biology and health insights. This partnership is solid proof of concept for quantum AI use in consumer health and skincare, where it can lead to the creation of new products and a further understanding of the skin microbiome's interaction with health and beauty lines for eczema

Microbiome Skincare Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 470.3 million

Revenue forecast in 2030

USD 835.2 million

Growth rate

CAGR of 12.2% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, ingredients, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Vichy Laboratoires; L'Oréal Paris; OUTIN FUTURES INC.; Missha; Eminence Organic Skin Care; La Roche-Posay; Aveeno (J&JCI); Elizabeth Arden; Glowbiotics LLC; GALLINÉE; Murad LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbiome Skincare Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes industry trends in each of the sub-segments from 2025 to 2030. For the purpose of this study, Grand View Research has segmented the microbiome skincare products Market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Serums

-

Prebiotic

-

Probiotic

-

-

Creams

-

Prebiotic

-

Probiotic

-

-

Masks

-

Prebiotic

-

Probiotic

-

-

Others

-

Prebiotic

-

Probiotic

-

-

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotic

-

Probiotic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/Supermarket

-

Pharmacy and Drug stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbiome skincare products market size was estimated at USD 434.8 million in 2024 and is expected to reach USD 470.3 million in 2025.

b. The global microbiome skincare products market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 835.2 million by 2030.

b. North America dominated the microbiome skincare products market, accounting for the largest revenue share of 40.1% in 2024. This can be attributed to supportive regulatory policies regarding the clearance and approval of new products for sale in the market.

b. Some key players operating in the microbiome skincare products market include L'Oréal Paris, Missha, Eminence Organic Skin Care, Aveeno (J&JCI), Elizabeth Arden, Glowbiotics LLC, GALLINÉE, Murad LLC, and Amorepacific

b. Key factors that are driving the market growth include Key market players are undertaking various strategic initiatives such as signing the new partnership agreement, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their services, thus providing a competitive advantage

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.