- Home

- »

- Semiconductors

- »

-

Micro Server IC Market Size, Share & Growth Report, 2030GVR Report cover

![Micro Server IC Market Size, Share & Trends Report]()

Micro Server IC Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Processor (Intel, Arm), By Application (Web Hosting & Enterprises, Analytics & Cloud Computing), By End Use, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-366-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Server IC Market Size & Trends

The global micro server IC market was estimated at USD 1.49 billion in 2023 and is expected to grow at a CAGR of 12.8% from 2024 to 2030. The market is currently experiencing dynamic growth driven by several key trends and drivers including rising demand for energy efficiency, increasing adoption of cloud services, and proliferation of IoT devices.

Micro servers are compact, energy-efficient servers designed for lightweight workloads, and have gained traction due to their ability to support diverse applications such as cloud computing, edge computing, and data analytics in a cost-effective manner. One significant trend shaping the market is the increasing adoption of cloud services and the proliferation of data centers globally. As enterprises and service providers seek scalable and efficient computing solutions, micro servers offer an attractive option due to their low power consumption and high density, which helps in maximizing space utilization within data centers.

Moreover, advancements in technology and the growing demand for computational power are fueling innovation within the micro server IC market. Manufacturers are developing more powerful and energy-efficient ICs that cater specifically to the needs of micro servers, thereby enhancing overall performance while reducing operational costs. This trend is complemented by the rising popularity of hyperscale computing environments, where large-scale data processing and storage requirements necessitate scalable and flexible server solutions.

In addition to these technological advancements, the market benefits from the increasing deployment of edge computing infrastructure. Edge computing, which involves processing data closer to the source of generation, is driving the demand for micro servers at the network edge. These servers facilitate real-time data processing and analytics, supporting applications ranging from IoT (Internet of Things) devices to autonomous vehicles and smart cities.

Component Insights

The hardware segment dominated the market in 2023 and accounted for more than 62% share of global revenue. This is because hardware encompasses the critical physical components necessary for server infrastructure. This includes processors, memory units, storage devices, and network interfaces, which form the backbone of any server setup. The continuous advancements in hardware technology, such as the development of more powerful and energy-efficient processors, significantly contribute to this dominance. Additionally, the increasing deployment of micro servers in data centers and enterprise environments necessitates robust and reliable hardware solutions, driving consistent demand. As businesses strive to improve performance and efficiency, investment in cutting-edge hardware remains a priority, reinforcing its leading position in the market.

The software segment is projected to witness significant growth from 2024 to 2030. The rapid growth is fueled by the escalating demand for sophisticated software solutions that enhance server management, optimize performance, and ensure security. With the increasing complexity of server environments, software tools for virtualization, cloud management, and analytics are becoming indispensable. These tools help enterprises manage resources efficiently, reduce operational costs, and achieve scalability. Furthermore, the rise of software-defined networking (SDN) and software-defined storage (SDS) paradigms underscores the critical role of software in modern data centers. As these trends continue to evolve, the software segment is expected to witness sustained and robust growth.

Processor Insights

The Intel processor segment dominated the market in 2023. Intel processors dominate the market, owing to its long-standing reputation for delivering high-performance, reliable processors. Intel's processors are widely adopted across various applications, from enterprise servers to data centers, due to their superior performance and extensive support ecosystem. The company's continuous innovation, such as the development of newer generations of Xeon processors, ensures that it stays ahead in terms of processing power, energy efficiency, and integrated features. Intel's strong relationships with major OEMs and its comprehensive product portfolio further solidify its leadership position in the market.

The ARM processors segment is the fastest-growing segment in the market, driven by its innovative approach to low-power, high-efficiency designs. Arm processors are increasingly being adopted for applications requiring energy-efficient solutions, such as edge computing and IoT devices. The architecture's scalability and flexibility make it ideal for a wide range of server environments, from small-scale micro servers to large data centers. Additionally, the growing interest in Arm-based solutions from major tech companies and cloud service providers highlights its rising prominence. As the demand for efficient, high-performance processors continues to grow, Arm is poised to capture an increasing share of the market.

Application Insights

The web hosting and enterprises segment dominated the market in 2023. The web hosting and enterprises segment dominates due to the critical role servers play in managing vast amounts of data, hosting websites, and running enterprise applications. Micro servers offer a cost-effective, energy-efficient solution for handling these tasks, making them a popular choice for businesses looking to optimize their IT infrastructure. The scalability and flexibility of micro servers allow enterprises to efficiently manage varying workloads and quickly adapt to changing business needs. Additionally, the ongoing digital transformation and the increasing reliance on online services further drive the demand for robust server solutions, ensuring the dominance of this application segment.

The edge computing segment is experiencing significant growth in the market, propelled by the exponential growth of IoT devices and the need for real-time data processing. Unlike traditional centralized data processing, edge computing involves processing data closer to the source, reducing latency and improving efficiency. Micro servers are well-suited for edge computing environments due to their compact size, energy efficiency, and adequate processing power. Industries such as healthcare, automotive, and smart cities are increasingly adopting edge computing to enhance operational efficiency and enable advanced applications like autonomous driving and real-time analytics. This rapid adoption is driving significant growth in the edge computing segment.

End Use Insights

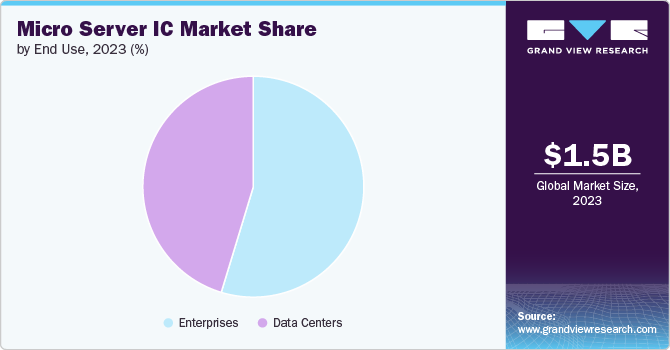

The enterprises segment dominated the market in 2023 driven by the need to support diverse and demanding IT workloads. Micro servers are increasingly favored by enterprises for their ability to provide high performance while maintaining energy efficiency and cost-effectiveness. These servers are used in various applications, including data storage, network management, and application hosting. The scalability of micro servers allows enterprises to expand their IT infrastructure in response to growing business needs without incurring substantial costs. As businesses continue to digitalize and leverage big data, the reliance on efficient server solutions ensures the dominance of the enterprise segment in the market.

The data centers segment is experiencing significant growth in the market, due to the global surge in data generation and the shift towards cloud computing are increasing. The demand for high-density, energy-efficient servers in data centers is escalating as businesses and consumers increasingly rely on cloud services for storage, applications, and computing power. Micro servers, with their compact design and low power consumption, are ideal for maximizing space and energy efficiency in data centers. Furthermore, the expansion of hyperscale data centers by tech giants and cloud service providers is driving significant demand for micro server ICs, contributing to the rapid growth of this segment.

Regional Insights

North America held a prominent position in the market in 2023, driven by the presence of major technology companies, advanced IT infrastructure, and a strong emphasis on innovation. The region's robust demand for high-performance computing solutions across various industries, including IT, telecommunications, and finance, fuels the market. Additionally, the rapid adoption of cloud computing and edge computing technologies further boosts the demand for micro server ICs. The U.S., in particular, plays a pivotal role due to its large base of data centers and tech giants investing heavily in advanced server technologies.

U.S. Micro Server IC Market Trends

The market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030 due to its status as a global leader in technology and innovation. The country's extensive network of data centers, coupled with significant investments by tech giants and cloud service providers, drives the demand for high-performance micro server solutions. The U.S. market is characterized by early adoption of advanced technologies, robust R&D activities, and a strong focus on energy-efficient computing solutions. As the digital economy grows and the need for scalable, efficient server infrastructure increases, the U.S. is expected to maintain its leadership position in the market.

Asia Pacific Micro Server IC Market Trends

Asia Pacific is the fastest-growing region in the Micro Server ICs market, driven by rapid industrialization, expanding IT infrastructure, and significant investments in data center development. Countries like China, Japan, South Korea, and India are at the forefront of technological innovation, with increasing adoption of IoT, AI, and cloud computing driving the demand for efficient server solutions. The region's large population base and growing digital economy further contribute to the burgeoning demand for micro server ICs. As Asia Pacific continues to evolve as a global technology hub, the market for micro server ICs is expected to expand rapidly.

Europe Micro Server IC Market Trends

Europe represents a significant market for characterized by a mature IT sector and strong regulatory frameworks supporting technological advancements. The region's emphasis on energy efficiency and sustainability drives the adoption of micro servers, known for their low power consumption and compact design. Key industries such as automotive, healthcare, and manufacturing are increasingly deploying micro server solutions to enhance operational efficiency and support digital transformation initiatives. Additionally, the growth of data centers and the expansion of cloud services in Europe contribute to the rising demand for micro server ICs.

Key Micro Server IC Company Insights

The key companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024,Supermicro, Inc., a prominent provider of IT solutions specializing in Cloud, AI/ML, Storage, and 5G/Edge technologies, introduced its latest X14 server lineup. These servers are specifically designed to accommodate the forthcoming Intel Xeon 6 processor. Leveraging Supermicro's Building Block Architecture, rack plug-and-play capabilities, and liquid cooling options alongside the Intel Xeon 6 processors, the company aims to deliver optimized solutions capable of handling diverse workloads and scaling requirements, ensuring enhanced performance and efficiency. To expedite customer deployment, Supermicro offers early access to these systems through its Early Ship program for eligible customers, along with complimentary remote access for testing and validation via the JumpStart Program.

-

In March 2024, NVIDIA unveiled the NVIDIA Blackwell platform, enabling global organizations to create and implement real-time generative AI using trillion-parameter large language models with substantial reductions in costs and energy consumption compared to earlier technologies. The Blackwell GPU architecture integrates six cutting-edge technologies for accelerated computing. These innovations are expected to drive notable progress across multiple industries such as data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing, and generative AI. These fields represent emerging sectors offering new avenues for NVIDIA's advancements.

Key Micro Server IC Companies:

The following are the leading companies in the micro server ic market. These companies collectively hold the largest market share and dictate industry trends.

- Intel Corporation

- Advanced Micro Devices, Inc. (AMD)

- ARM Holdings (acquired by NVIDIA)

- Applied Micro Circuits Corporation (AMCC)

- Marvell Technology Group

- Broadcom Inc.

- Cavium (acquired by Marvell)

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Super Micro Computer, Inc

- Quanta Computer Inc.

- NVIDIA Corporation

- Fujitsu Limited

- Cisco Systems, Inc.

- NEC Corporation

- Samsung Electronics

- MediaTek Inc.

- Ampere Computing

- NXP Semiconductors

- Qualcomm Technologies, Inc

Micro Server IC Market Report Scope

Attribute

Details

Market size value in 2024

USD 1.63 billion

Revenue forecast in 2030

USD 3.37 billion

Growth rate

CAGR of 12.8% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, processor, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Intel Corporation; Advanced Micro Devices, Inc. (AMD); ARM Holdings (acquired by NVIDIA); Applied Micro Circuits Corporation (AMCC); Marvell Technology Group; Broadcom Inc.; Cavium (acquired by Marvell); Hewlett Packard Enterprise (HPE); Dell Technologies; Super Micro Computer, Inc; Quanta Computer Inc.; NVIDIA Corporation; Fujitsu Limited; Cisco Systems, Inc.; NEC Corporation; Samsung Electronics; MediaTek Inc.; Ampere Computing; NXP Semiconductors; Qualcomm Technologies, Inc

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro Server IC Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro server IC market based component, processor, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Processor Outlook (Revenue, USD Million, 2018 - 2030)

-

Intel

-

Arm

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Web hosting and enterprises

-

Analytics and cloud computing

-

Edge Computing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprises

-

Small Scale Enterprises

-

Medium Scale Enterprises

-

Large Scale Enterprises

-

Data Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micro server IC market size was estimated at USD 1.49 billion in 2023 and is expected to reach USD 1.63 billion in 2024.

b. The global micro server IC market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030 to reach USD 3.37 billion by 2030.

b. North America dominated the micro server IC market with a share of over 36.0% in 2023. driven by the presence of major technology companies, advanced IT infrastructure, and a strong emphasis on innovation. The region's robust demand for high-performance computing solutions across various industries, including IT, telecommunications, and finance, fuels the market.

b. Some key players operating in the micro server IC market include Intel Corporation, Advanced Micro Devices, Inc. (AMD), ARM Holdings (acquired by NVIDIA), Applied Micro Circuits Corporation (AMCC), Marvell Technology Group, Broadcom Inc., Cavium (acquired by Marvell), Hewlett Packard Enterprise (HPE), Dell Technologies, Super Micro Computer, Inc Quanta Computer Inc., NVIDIA Corporation, Fujitsu Limited, Cisco Systems, Inc., NEC Corporation, Samsung Electronics, MediaTek Inc., Ampere Computing, NXP Semiconductors, and Qualcomm Technologies, Inc..

b. Key factors driving market growth include rising demand for energy efficiency, increasing adoption of cloud services and proliferation of IoT devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.