- Home

- »

- Healthcare IT

- »

-

mHealth Services Market Size, Share & Growth Report, 2030GVR Report cover

![mHealth Services Market Size, Share & Trends Report]()

mHealth Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Services (Monitoring Services, Diagnosis Services), By Participants, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-157-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

mHealth Services Market Size & Trends

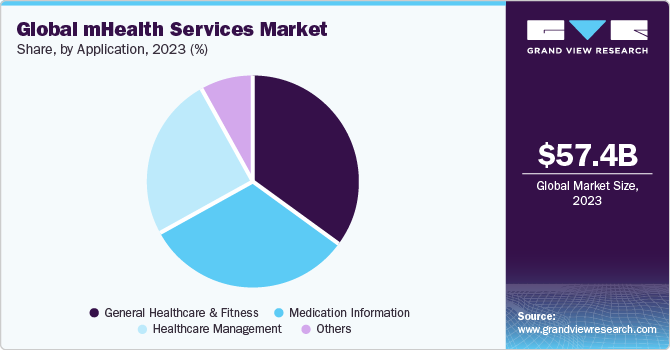

The global mHealth services market size was estimated at USD 57.42 billion in 2023 and is anticipated to grow at a CAGR of 14.7% from 2024 to 2030. Factors, such as rising focus on improving personal health and fitness using smart devices & wearables, rising penetration of smartphones & other mobile platforms, growing adoption of mHealth technology & platforms by physicians & patients, robust penetration of 4G/5G networks, and cost containment in healthcare delivery are expected to drive market growth. Furthermore, growing investment and rising penetration of digital health services for remote patient monitoring are increasing the demand for mobile health apps, which is expected to propel market growth over the forecast period. For instance, in September 2021, the Indian government launched the Ayushman Bharat Digital Health Mission (ABDM), which helps physicians maintain and track patients' health records.

Market Dynamics

The increasing use of smartphones among adults and teenagers is anticipated to drive the growth of mHealth platforms and technologies in the coming years. In addition, the shift from traditional healthcare practices to patient-centric and preventive approaches is anticipated to contribute to industry growth. Furthermore, the growing adoption of mobile health solutions and government initiatives to promote remote digital healthcare is expected to propel market growth. The positive attitude of healthcare professionals toward real-time patient care and high preference for mobile medical platforms are expected to accelerate industry growth.

A rise in the prevalence of heart-related diseases, such as hypertension, stroke, and heart attack, which increase the demand for mHealth devices to monitor cardiac patients, will also boost market growth. For instance, according to the Centers for Disease Control and Prevention (CDC), in the U.S., 695,000 people died from heart disease in 2021. The growing network coverage and constant advancement in network infrastructure are also boosting the demand for mHealth services. Mobile network operators consider mHealth an investment opportunity due to increasing awareness about fitness and rising user adoption of smartphones.

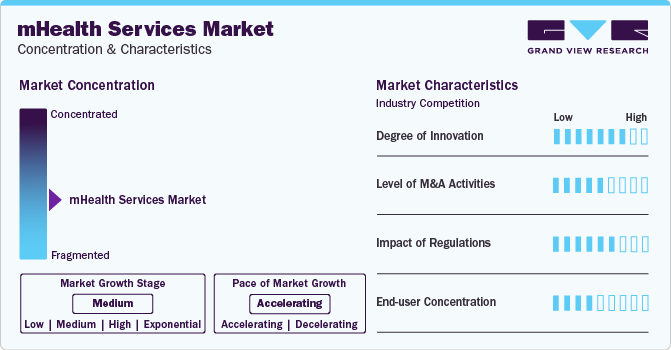

Market Concentration & Characteristics

The global mHealth services market is characterized by a high degree of innovation, with new technologies and apps being developed and introduced regularly. It has become a popular option as these mHealth apps help patients track their health activities and maintain a health record. As a result, market players are investing in innovative technologies and procedures to keep up with the demand

Several market players, such as Google, Inc., Orange, and Apple, Inc., are involved in merger and acquisition activities. Through M&A activities, these companies can expand their geographic reach and enter new territories

Governments and companies invest substantial resources in developing mHealth apps and devices. Some of these apps require regulatory approval from the FDA and respective government bodies intended to diagnose diseases. This may result in increasing the cost of developing new mHealth technologies

Service Insights

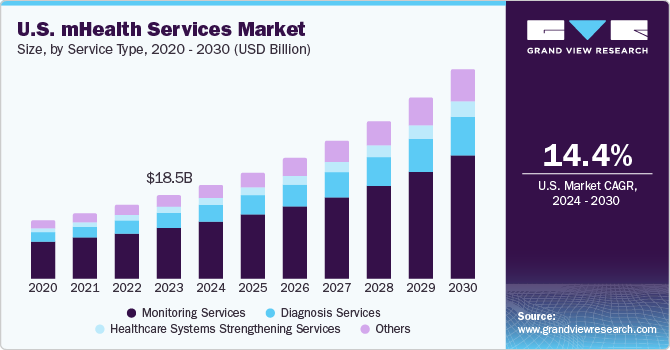

The monitoring services segment accounted for the largest share of 59.4% in 2023. Factors, such as the rising incidence of chronic & infectious diseases and demand for remote monitoring platforms in post-acute care, are driving the segment's growth. In addition, increasing investments for inpatient monitoring by leading players is anticipated to accelerate segment growth. Moreover, a rise in demand for mHealth apps connected with glucometer devices to monitor glucose levels due to an increase in diabetic patients propels the market growth. For instance, according to the WHO, around 422 million people across the globe have diabetes, and 1.5 million people die annually due to diabetes.

The other services segment is anticipated to witness the fastest CAGR from 2024 to 2030. Other services include ensuring the wellness of patients and prevention of diseases through various mHealth applications. The growing health-conscious population and a significant rise in the number of fitness apps are some of the key factors boosting the segment growth. Various apps offering health information tips, fitness monitoring, diet & nutrition information, and drug abuse prevention are paving a path for the development of other services in the industry. For instance, FitStar is a popular video-based mobile app that provides personalized fitness training sessions to its users.

Participants Insights

The mobile operators segment accounted for the largest revenue share in 2023. An increase in the number of mobile subscribers and improvements in network infrastructure are major factors responsible for the highest share of this segment. For instance, in November 2022, according to the International Telecommunication Union, across the globe, around 73% of the population aged 10 years and above owned a mobile phone. In addition, rising 4G & 5G technologies and growing industry consolidation activities by leading players are anticipated to drive the segment growth.

The content players segment is estimated to register the fastest CAGR from 2024 to 2030. Content players' direct involvement in the development of mHealth applications and technologies, documentation handling, remote patient monitoring, health activity tracking, and appointment scheduling are also anticipated to drive segment growth. In addition, these content players are involved in introducing new features to existing health apps, which can help increase their customer pool. For instance, in July 2022, Apple, Inc. announced strategies for enhancing digital health, focusing on providing customers with health & fitness features while engaging with the traditional healthcare system.

End-user Insights

The healthcare providers segment accounted for the largest revenue share in 2023. The widespread accessibility of mobile phones has reached even low- and middle-income countries, enabling virtual screening of chronic conditions and most diseases globally. Chronic disease management requires regular check-ups, lifestyle changes, and frequent hospital visits recommended by healthcare professionals. mHealth effectively enhances patient awareness about their conditions, supports clinical decisions, facilitates lifestyle interventions, promotes medication adherence, provides rehabilitation support, and manages screening regimens. Patients suffering from chronic diseases have sought mHealth as a cost-effective and convenient approach to manage their health effectively.

Thus, such factors are responsible for segment growth. The patients segment has been anticipated to grow lucratively from 2024 to 2030. Factors, such as increased prevalence of chronic diseases and rising adoption of mHealth apps for chronic disease management, are expected to drive the segment growth over the forecast period. For instance, according to the CDC, in the U.S., 6 in 10 people suffer from at least one chronic disease, such as cancer, diabetes, heart disease, and stroke. Thus, rising prevalence of chronic diseases has led to the increased use of mHealth apps by patients to manage their health.

Application Insights

The general healthcare & fitness segment accounted for the largest revenue share in 2023. Factors, such as the growing prevalence of obesity, due to sedentary lifestyles, rising awareness about personal health, and an increase in the number of health-conscious individuals led to a rise in the demand for general healthcare & fitness apps and devices to track their daily activities. For instance, in May 2022, the World Obesity Atlas 2022 anticipated that, by 2030, globally, one billion people, comprising 1 in 7 men and 1 in 5 women, will suffer from obesity. Thus, a rise in the prevalence of obesity is attributed to the segment's growth.

The medication information segment is anticipated to grow at the fastest CAGR from 2024 to 2030. Medication information in mHealth apps typically includes details regarding different aspects of medications that offer users assistance and valuable insights into managing their medication regimens. This helps patients in adhering to their prescribed schedule and identifying medications. In addition, it provides information regarding the side effects and precautions of the medicine.

Regional Insights

The North America mHealth services market dominated the global industry with a revenue share of 40.2% in 2023 owing to factors, such as high healthcare expenditure, increased incidences of chronic diseases, rising geriatric population, and highly developed network infrastructure. The market is projected to expand further on account of favorable government initiatives, a rise in the number of FDA approvals for wearable devices, and increasing adoption of mobile healthcare applications. Moreover, the rising burden of cardiovascular diseases in the region drives the demand for real-time monitoring. The availability of mHealth apps that can provide real-time information related to cardiovascular health can prevent major health issues and reduce the death rate due to sudden cardiac arrest. For instance, in November 2022, Apple, Inc. received FDA approval for its watch-based app released by H2o Therapeutics for monitoring Parkinson’s disease.

U.S. mHealth Services Market Trends

The mHealth services market in the U.S. held a significant share in 2023 owing to the presence of a large number of players operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players in the U.S. are introducing innovative healthcare apps, building network infrastructure, and promoting the adoption of various mHealth services. As per a Demandsage report, in 2023, around 82.2% of the U.S. population owned smartphones, which can be used to access mHealth apps; these devices accounted for 70% of digital media time in the country. Health-related mobile apps are very popular among the U.S. population, which is showing a rise in health consciousness.

Asia Pacific mHealth Services Market Trends

The Asia Pacific mHealth services market is expected to grow at the fastest CAGR from 2024 to 2030. Increasing affordability is leading to a rise in the adoption of smartphones to access various applications for mHealth services. Factors, such as rising healthcare expenditure, increasing incidence of chronic & infectious diseases, ineffective hospital service management, and growing aging population, are motivating governments & healthcare providers to develop new healthcare delivery models. Government bodies are undertaking efforts to promote advancements in mHealth technology by providing improved 3G & 4G network infrastructure and eHealth & telehealth roadmaps and formulating policies that would attract investments in the region. For instance, the Indian government introduced a digital health ecosystem under the Ayushman Bharat Digital Health Mission (ABDM) during the 2022 budget session.

Key mHealth Services Company Insights

Apple Inc., Google Inc., Orange, and AirStrip Technologies, Inc. are some of the dominant players operating in the mHealth services market

-

Apple Inc. has a global presence and features over 40,000 apps delivering healthcare services to medical professionals, patients, and researchers

-

Google Inc. has its operations in about 40 countries. The company designs and offers a variety of solutions and services

-

AirStrip Technologies, Inc. caters to healthcare stakeholders, including healthcare providers, executives, and IT. Its major customers include Capella Healthcare, Children’s of Alabama, Tenet Healthcare, and others

Samsung Electronics Co. Ltd., Veradigm LLC (Allscripts Healthcare Solutions), Qualcomm Technologies, Inc., and Vodafone Group Plc. are some of the emerging market players in the market.

-

Samsung Electronics Co. Ltd. has 248 overseas subsidiaries for manufacturing, sales, and R&D. It has a presence in the U.S., Europe, Asia, and Africa

-

Vodafone Group Plc. has a presence in Europe, Asia Pacific, Africa, and the Middle East and partnership agreements with local mobile operators in over 49 countries across the globe

Key mHealth Services Companies:

The following are the leading companies in the mhealth services market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Veradigm LLC (Allscripts Healthcare Solutions)

- Qualcomm Technologies, Inc.

- Vodafone Group Plc.

- AT&T

- Telefónica S.A.

- SoftServe Inc.

- Orange

Recent Developments

-

In March 2023, Apple Inc., to improve digital health, announced plans to upgrade AirPods with health tracking features, including temperature monitors, motion detectors, and biometric sensors to detect perspiration & heart rate, by 2025

-

In January 2023, Garmin Ltd. introduced the Instinct Crossover Series in India, offering Garmin’s full wellness features, including health monitoring activities, sleep score, and advanced sleep monitoring

mHealth Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 65.20 billion

Revenue forecast in 2030

USD 148.82 billion

Growth rate

CAGR of 14.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, participants, application, end-user, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple Inc.; Google Inc.; AirStrip Technologies, Inc.; Samsung Electronics Co. Ltd.; Veradigm LLC (Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; Vodafone Group Plc; AT&T; Telefónica S.A.; SoftServe Inc.; Orange

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mHealth Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the mHealth services market report on the basis of service, participants, application, end-user, and region:

-

Service Outlook (Revenue in USD Million, 2018 - 2030)

-

Monitoring services

-

Diagnosis services

-

Healthcare systems strengthening services

-

Others

-

-

Participants Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile operators

-

Device vendors

-

Content players

-

Healthcare providers

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

General healthcare & fitness

-

Medication information

-

Healthcare management

-

Others

-

-

End-user Outlook (Revenue, USD Million; 2018 - 2030)

-

Healthcare providers

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mHealth services market size was estimated at USD 57.42 billion in 2023 and is expected to reach USD 65.20 billion in 2024.

b. The global mHealth services market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 148.82 billion by 2030.

b. Monitoring services segment dominated the mHealth services market with a share of 59.4% in 2023. Factors such as the rising incidence of chronic and infectious diseases and demand for remote monitoring platforms in post-acute care are driving the segment's growth.

b. Some key players operating in the mHealth services market include Apple Inc., Google Inc., AirStrip Technologies, Inc., Samsung Electronics Co. Ltd., Veradigm LLC (Allscripts Healthcare Solutions), Qualcomm Technologies, Inc., Vodafone Group Plc., AT&T, Telefónica S.A., SoftServe Inc., Orange

b. Factors such as rising focus on improving personal health and fitness using smart devices and wearables, rising penetration of smartphones and other mobile platforms, growing adoption of mHealth technology and platforms by physicians and patients, robust penetration of 4G and 5G networks, and cost containment in healthcare delivery are expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.