- Home

- »

- Advanced Interior Materials

- »

-

Mexico Mining Market Size, Share, Industry Report, 2030GVR Report cover

![Mexico Mining Market Size, Share & Trends Report]()

Mexico Mining Market (2025 - 2030) Size, Share & Trends Analysis Report By Sector (Precious Metals, Non-Ferrous, Non-Metallic Minerals,Others), Drivers, Opportunities & Restraints, And Segment Forecasts

- Report ID: GVR-4-68040-025-5

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

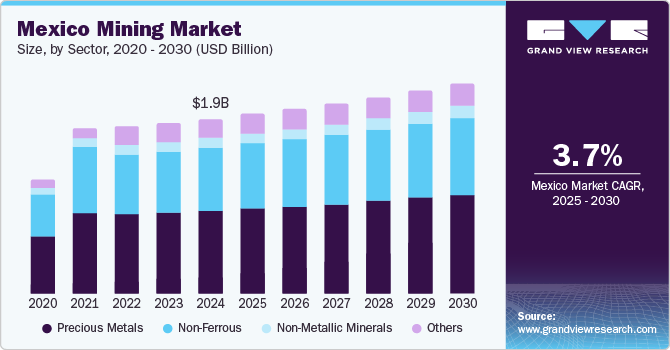

The Mexico mining market size was estimated at USD 1.92 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2030. Increasing demand for precious metals, non-ferrous, and non-metallic products in the end-use industries such as construction, automotive, electrical & electronics, and aerospace & defense are expected to augment the market growth.

Investments in smart technologies to control costs and improve efficiency are projected to remain an important trend over the coming years. The shift toward a low-carbon economy and strict emission regulations is anticipated to have an impact on environmental standards and would lead to the scrutiny of mining activities.

Metals such as copper, zinc, and lead find various uses in electrical & electronic applications. Growing demand for electronics is propelling its production in Mexico. For instance, in July 2022, Samsung announced investing USD 500 million in two of its plants in Mexico. The investment is expected to help the company to boost the production of household appliances.

Drivers, Opportunities & Restraints

Mexico’s mining market’s growth is driven by robust government support for mineral production and increased foreign investment, especially in regions with high mining potential like Sonora and Chihuahua. As demand for critical minerals grows globally for use in EVs and renewable energy, Mexico's rich reserves of metals like copper, silver, and lithium position it as a strategic supplier. Recent expansions in mining infrastructure, coupled with favorable trade policies, enhance Mexico’s global mining competitiveness.

Environmental and social concerns present significant constraints for Mexico's mining sector. Local communities and environmental groups often oppose mining activities due to concerns about land rights and ecological impact. Additionally, regulatory challenges around environmental compliance and shifting government policies on resource management can deter potential investors, creating operational uncertainty for mining companies.

With the global transition to renewable energy and electric mobility, Mexico’s abundant reserves of lithium and other non-ferrous metals provide a major growth opportunity. In 2023, Mexico’s focus on developing its lithium sector opened doors for partnerships in EV battery production and green energy technology. This shift towards sustainable mining practices, supported by both private and public sectors, highlights Mexico’s potential as a key player in the global clean energy supply chain.

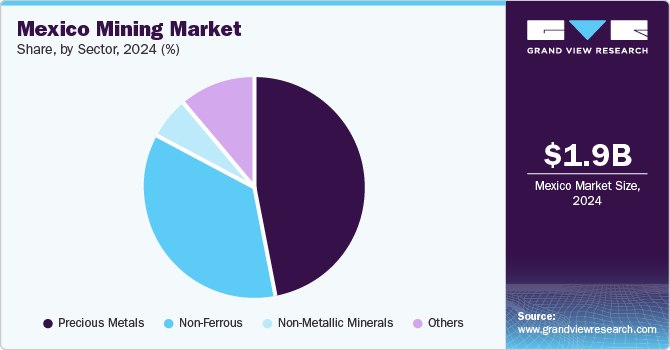

Sector Insights

Growing consumer preference for fashionable and luxurious items is propelling the demand for precious metals. Owing to their rising consumption, key players are spending significantly on the exploration and development of existing green field projects.

In 2023, Mexico was the largest silver producer in the world. Furthermore, growing investments in silver mining are anticipated to boost its production in the country to reach pre-pandemic levels. Fresnillo, Pan American Silver, and First Majestic Silver are some of the prominent silver-producing companies in Mexico. Almost 50% of the silver produced in Mexico finds usage in industrial applications such as electronics, medicine, water purification, manufacturing, and solar.

The non-ferrous segment remained the second largest in the Mexican mining market in 2023, driven by the expanding electric vehicle (EV) and renewable energy sectors. Increasing penetration of EVs is expected to increase the demand for non-ferrous products such as lead, copper, zinc, and molybdenum. These metals find use in EV-related applications such as charging stations, batteries, and wiring for the car.

The increasing demand for computers, mobile phones, EVs, and battery storage has created a demand for lithium. Lithium mining has become crucial for Mexico. According to the U.S. Geological Service, Mexico has the ninth-largest identified lithium reserves (1.7 million tons) in the world. However, there is currently no commercial mining exploitation of lithium in the country.

Key Mexico Mining Company Insights

Some of the key players operating in the Mexico market for mining include Grupo Mexico and Industrias Peñoles

-

Grupo Mexico is one of Mexico's largest mining companies, with extensive operations across the Americas. The company primarily focuses on copper, but also produces silver, gold, and zinc. Grupo Mexico’s significant mining projects are centered in Mexico, particularly in Sonora, and are supported by its vertically integrated business model, which includes rail transport and infrastructure.

-

Industrias Peñoles is a major player in Mexico’s mining market and one of the world’s largest producers of refined silver. Focused on metals like silver, gold, and zinc, Peñoles operates numerous mines throughout Mexico, with prominent facilities in states such as Durango and Zacatecas.

Key Mexico Mining Companies:

- AHMSA

- ArcelorMittal

- Coeur Mining Inc.

- FIRST MAJESTIC

- Fortuna Silver Mines Inc.

- Frestnillo plc

- GRUPO MEXICO

- Industrias Peñoles

- Newmont Corporation

- Pan American Silver Corp

Recent Developments

-

In September 2024, Arzyz Metals, a leading Mexican aluminum producer, announced a USD 650 million plant expansion in Nuevo León. This investment aims to increase production capacity to meet rising aluminum demand across various sectors, supporting the state’s industrial growth and generating new jobs. The project aligns with regional development goals, with significant backing from local authorities, and reflects ongoing growth and investment trends within Mexico’s mining and metals industries.

-

In March 2022, Asia Broadband (AABB), U.S. based resource company announced that it has acquired the Zodiac Gold Mine project in Buen Pais. Jalisco, Mexico. This acquisition is expected to help Asia Broadband (AABB) to enter the Mexico mining market.

Mexico Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Sector

Country scope

Mexico

Key companies profiled

AHMSA; ArcelorMittal; Coeur Mining Inc.; FIRST MAJESTIC; Fortuna Silver Mines Inc.; Frestnillo plc; GRUPO MEXICO; Industrias Peñoles; Newmont Corporation; Pan American Silver Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Mining Market Report Segmentation

This report forecasts revenue growth of country (Mexico) and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico mining market report based on sector:

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Precious Metals

-

Non-Ferrous

-

Non-Metallic Minerals

-

Others

-

Frequently Asked Questions About This Report

b. The Mexico mining market size was estimated at USD 1.92 billion in 2024 and is expected to reach USD 1.97 billion in 2025.

b. The Mexico mining market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030 to reach USD 2.30 billion by 2030.

b. Based on sector, precious metals accounted for the largest revenue share of more than 47.0% in 2024 of the overall market. Growing consumer preference for fashionable and luxurious items is propelling the demand for precious metals and is expected to continue over the projected period.

b. The key players operating in the Mexico Mining market include AHMSA, ArcelorMittal, Coeur Mining Inc., FIRST MAJESTIC, Fortuna Silver Mines Inc., Fresnillo plc, GRUPO MEXICO, Industrias Peñoles, Newmont Corporation, and Pan American Silver Corp., among others.

b. The growth of the electronics & electrical segment is a key driver for the Mexico mining market as metals such as copper, zinc, and lead find various uses in this industry. Rising penetration of metals in electronic utilities, consumer electronics, and general electronics has been witnessing an increase since the last decade.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.