- Home

- »

- Plastics, Polymers & Resins

- »

-

Metal Foil Tapes Market Size, Share, Industry Report, 2030GVR Report cover

![Metal Foil Tapes Market Size, Share & Trends Report]()

Metal Foil Tapes Market (2024 - 2030) Size, Share & Trends Analysis Report By Metal Type (Aluminum, Copper, Lead), By Adhesive Type (Acrylic, Silicone, Rubber), By End Use (Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-971-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Foil Tapes Market Size & Trends

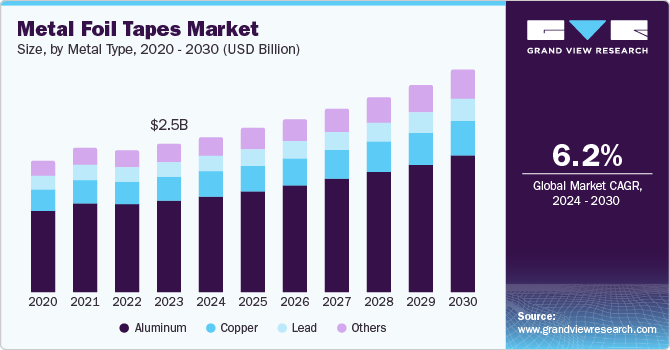

The global metal foil tapes market size was valued at USD 2.45 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. This growth is attributed to the increasing demand from diverse industries such as electronics, automotive, aerospace, and construction drives the need for metal foil tapes, known for their excellent heat and moisture resistance, electrical conductivity, and adhesive properties. Furthermore, the growing focus on energy efficiency and sustainability in manufacturing processes is propelling the adoption of these tapes. Expanding infrastructure projects and technological advancements further contribute to the global market's robust growth trajectory.

Metal foil tapes possess excellent electrical and thermal conductivity, along with heat and light reflectivity. They serve as effective measures for moisture, gas, and vapor, and their aging resistance and strong adhesive properties make them suitable for permanent applications. Constructed with a metal foil backing, these durable tapes are high-tensile and commonly used in construction, electrical work, and packaging. These foils are specifically engineered for sealing, grounding, shielding, and resistance applications, and foil tapes possess unique characteristics that are highly valuable in metal finishing, automotive, aerospace, and appliance industries. Most foil tapes are well-suited for electrical and thermal conductive shielding and grouping, ensuring maximum adhesion.

In addition, the global metal foil tapes market is primarily driven by the increasing demand for metal foil tapes in the aerospace and automotive industries, where strict HVAC system requirements demand for tapes with specific qualities such as conductivity, malleability, and fire resistance, is a key factor driving the global market. The emergence of advanced acrylic adhesive coatings has greatly boosted the market by improving durability, longevity, cohesion, and thermal stability as compared with others. This technological development broadens the use of metal foil tapes, making them well-suited for construction & buildings, especially in house wraps and foil-faced insulation, where high heat resistance and electrical conductivity are necessary.

Furthermore, the worldwide focus on sustainability and energy efficiency in construction continues to drive the need for these tapes, which play a crucial role in improving the effectiveness and durability of insulation systems. As industries focus on innovation and meeting changing standards, the market is set to experience continuous growth, supported by its ability to be used in many different ways and its important role in maintaining the effectiveness and longevity of various industrial operations, further influencing the market expansion of metal foil tapes made from aluminum, copper, stainless steel, lead, and many others as per necessity.

Metal Type Insights

Aluminum foil tapes dominated the market and accounted for the largest revenue share of 62.0% in 2023 as they are known for their excellent thermal resistance, durability, and conductivity, which can improve efficiency and support sustainability goals by decreasing air distribution loss. In addition, aluminum tapes are resistant to oil and acids and can withstand temperatures ranging from -40°C to 160°C, making them perfect for connecting and sealing thermal insulation, ducts, and pipes. Aluminum foil tapes are ideal for a wide range of uses in industries such as aerospace, automotive, and construction due to their lightweight and resistance to corrosion. They are especially well-suited for HVAC systems, insulation, and sealing. Furthermore, with a growing demand for lightweight, durable, and flexible materials in various industries, aluminum foil tapes can meet these requirements. These key drivers particularly depict the unique properties of strength and lightness that contribute to its market growth.

Copper foil tapes are expected to witness substantial growth over the forecast period. Copper foil tape, which has a three-layer structure with copper, conductive adhesive, and a removable silicon paper liner, is commonly used in the electrical/electronics sector for RFI/EMI shielding. It is suitable for both electronic and non-electronic components, and the adhesive can be applied to one or both sides of the tape for use in printed circuit board prototyping, layout, design, circuit repairs, and other applications. Its versatility and importance in the industry are highlighted by its effectiveness in shielding small electromagnetic components and cable splices and repairing, modifying, and prototype-designing wiring boards.

Adhesive Type Insights

Acrylic-based tapes led the market and accounted for the largest revenue share of 40.8% in 2023. The exceptional versatility, durability, and ability to withstand extreme conditions of acrylic adhesive metal foil tapes make them highly sought after in various industries. These tapes are commonly used in HVAC systems to seal ducts and guard against moisture, in construction for bonding to fiberglass and electrical cables, in packaging for sealing and safeguarding shipped items, and in the aerospace and automotive sectors for their thermal and electrical conductivity, chemical resistance, and flame resistance. Acrylic adhesive metal foil tapes are favored for various applications needing durability in critical environments due to their exceptional cohesion, thermal stability, and resistance to UV light exposure and temperature changes, surpassing other adhesives.

Silicone-based tape is expected to grow significantly over the forecast period. Silicone adhesive metal foil tapes are in high demand in multiple industries due to their distinctive characteristics that make them well-suited for challenging tasks. These tapes have remarkable durability in wide temperature ranges of -75°C to 260°C, making them perfect for electronics, aerospace, automotive, and medical sectors. Silicone tapes in electronics act as insulation from heat and electricity, safeguarding delicate components from outside elements.

Silicone tapes are used in the aerospace industry for vibration damping and flame resistance and are also employed in the automotive sector for noise reduction and sealing. Their ability to be safe for use in wearable devices and microfluidic applications in the medical field is due to their biocompatibility and chemical resistance, guaranteeing a secure and flexible bond.

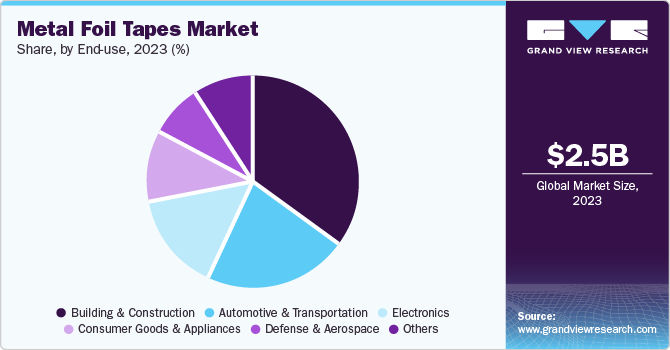

End Use Insights

Building & construction applications dominated the market and accounted for the largest revenue share of 35.3%. Metal oil tape is commonly used in construction projects to strengthen fiberglass and insulate thermal mineral wood. Foil tape, equipped with a strong adhesive that works on any surface, is useful for repairing various issues with roofs and metal gutters. In addition, the tape's longevity and resistance to corrosion make it well-suited for construction tasks.

In the building sector, aluminum foil is used as the outermost layer for insulation products such as stone wool, foam insulation panels, and lamellar mats, effectively improving building insulation, working as a vapor barrier to stop water vapor from getting through the insulation, reducing the chances of mold and moisture damage. Furthermore, metal foil is highly efficient for thermal insulation in construction, augmented by rising construction and urbanization worldwide. Its ability to be easily shaped or covered with a protective coating expands its versatility in different construction projects, leading to demand for metal foil tapes in forecast years.

Automotive & transportation applications are predicted to experience significant growth during the forecast period. Metal foil tapes are highly sought after in the automotive sector due to their versatility and ability to shield heat, seal, and insulate, effectively controlling thermal and electrical conductivity within vehicles. These tapes have functioned in wire harness assembly to guard against heat and moisture and to guarantee dependable electrical connections.

In addition, due to the increasing energy costs, automakers are increasingly using aluminum as a lighter and more fuel-efficient alternative than steel and other heavy materials. Their ability to withstand high temperatures, chemicals, and UV exposure makes them better implemented in vehicles, ensuring that cars perform better and remain durable in different environmental situations. Their ability to reflect heat makes them ideal for use when heat needs to be dispersed around exhaust systems and engine parts.

Regional Insights & Trends

Asia Pacific metal foil tapes marketdominated the global market and accounted for the largest revenue share of 38.1% in 2023. The demand for metal foil tapes in the Asia Pacific region is driven by several key factors, notably the rapid growth of the construction industry fueled by urbanization and industrialization in countries such as China, India, and Japan. Increased construction activities, particularly in HVAC systems, significantly enhance the need for these tapes due to their superior insulation, sealing, and bonding properties. The substantial investments in infrastructure development and technological advancements contribute to the market's expansion, positioning Asia-Pacific as a leading market for metal foil tapes.

China Metal Foil Tapes Market Trends

The metal foil tapes market in Chinadominatedthe Asia Pacific market with the highest revenue share in 2023. The demand for metal foil tapes in China is primarily driven by the rapid growth of the construction industry, bolstered by urbanization and large-scale infrastructure projects under the government's New Infrastructure plan. This initiative focuses on developing 5G networks, transportation systems, and energy vehicle charging stations, significantly increasing the need for metal foil tapes in HVAC systems and insulation applications. China's emphasis on energy efficiency, stringent building regulations, and its status as a hub for technological innovation further enhance the adoption of high-performance metal foil tapes, contributing to market expansion.

North America Metal Foil Tapes Market Trends

The North America metal foil tapes marketis expected to experience substantial growth over the forecast period. North America is a key market for metal foil tapes, driven by strong industrial activity, technological advancements, and strict quality standards. The HVAC, and construction sectors extensively utilize these tapes for bonding, insulation, and sealing applications. Moreover, the well-established aerospace and automotive industries further boost demand, particularly in HVAC systems where the tapes' exceptional properties are essential.

The metal foil tapes market in the U.S. is expected to experience significant growth in the upcoming years. The regional focus on energy efficiency and sustainability in construction, coupled with stricter building codes and environmental regulations, drives the adoption of high-performance metal foil tapes. The emphasis on advanced materials and technological innovation ensures continuous development of tape formulations, adhesives, and manufacturing processes, further propelling market growth. As industries prioritize energy conservation, the demand for metal foil tapes contributing to this goal is rising, solidifying the country's position as a prominent market for these versatile products.

Europe Metal Foil Tapes Market Trends

Europe metal foil tapes market is estimated to grow substantially over the forecast period. The automotive sector seeks lightweight materials for improved fuel efficiency, contributing to demand. The demand for metal foil tapes in Europe is driven by the growing need for high-performance materials in the construction, automotive, and aerospace sectors. The construction industry prioritizes energy efficiency and sustainability, leading to increased use of these tapes for insulation and vapor barrier applications in HVAC systems. Advancements in adhesive technologies, particularly high-temperature acrylic adhesives, enhance the durability and application range of metal foil tapes, making them essential across various European industries.

Key Metal Foil Tapes Company Insights

Some of the key companies in the metal foil tapes market include 3M., Saint-Gobain S.A., Scapa Group Ltd, Advance Tapes International., Maxell, Ltd., All Foils, Inc., Nova Films & Foils, Inc.in the market focusing on development in quality of products and services to customers.

-

Nova Films & Foils, Inc. is a manufacturer and distributor of metal foil tapes, specializing in aluminum, copper, and stainless steel foils. The company offers a wide range of adhesive tapes for various applications, including packaging, construction, automotive, electrical, and electronics. Nova Films & Foils is known for its high-quality products, innovative solutions, and excellent customer service. With a strong focus on research and development, the company continuously introduces new products to meet the evolving needs of its customers across diverse industries.

-

All Foils, Inc. provides comprehensive material purchasing, processing, converting, and customizing solutions. The company offers a wide range of metal foils, including aluminum, copper, nickel, stainless steel, and carbon steel. All Foils is a leading foil converter and distributor, offering custom slitting, coating, sheeting, and printing services to meet the specific requirements of its customers. With an experienced staff and in-house lab services, All Foils ensures consistent quality and timely delivery of its products to various industries such as automotive, electronics, food & beverage, and HVAC.

Key Metal Foil Tapes Companies:

The following are the leading companies in the metal foil tapes market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Saint-Gobain S.A.

- Scapa Group Ltd

- Advance Tapes International.

- Shurtape Technologies, LLC

- Nitto Denko Corporation

- CMS Group of Companies

- Maxell, Ltd.

- All Foils, Inc.

- Nova Films & Foils, Inc.

Recent Developments

- In February 2024, Saint-Gobain S.A. announced the acquisition of a specialized manufacturer of insulation materials, enhancing its portfolio of metal foil tapes used in energy-efficient applications. This acquisition was expected to strengthen its market position in the construction and automotive sectors. Furthermore, Saint-Gobain launched a new line of high-performance metal foil tapes designed for thermal insulation and sealing applications, catering to the increasing demand for energy-efficient building materials.

Metal Foil Tapes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.56 billion

Revenue forecast in 2030

USD 3.67 billion

Growth Rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Metal Type, adhesive type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Brazil

Key companies profiled

3M.; Saint-Gobain S.A.; Scapa Group Ltd; Advance Tapes International.; Shurtape Technologies, LLC; Nitto Denko Corporation.; CMS Group of Companies; Maxell, Ltd.; All Foils, Inc.; Nova Films & Foils, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Foil Tapes Market Report Segmentation

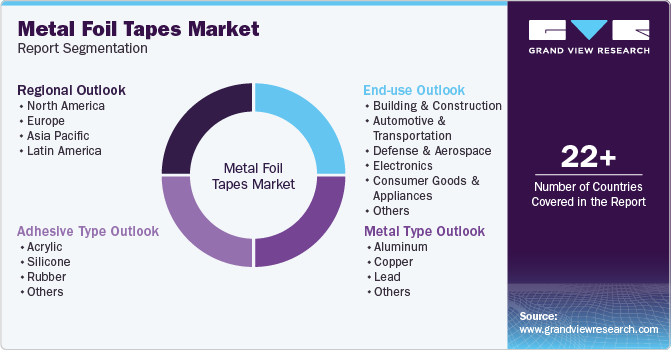

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global metal foil tapes market report based on metal type, adhesive type, end use, and region:

-

Metal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Copper

-

Lead

-

Others

-

-

Adhesive Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Silicone

-

Rubber

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Defense & Aerospace

-

Electronics

-

Consumer Goods & Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.