- Home

- »

- Next Generation Technologies

- »

-

Metal 3D Printing Market Size, Share & Growth Report, 2030GVR Report cover

![Metal 3D Printing Market Size, Share & Trends Report]()

Metal 3D Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Software, By Component (Hardware, Software, and Services), By Application, By Printing Type, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-811-4

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal 3d Printing Market Summary

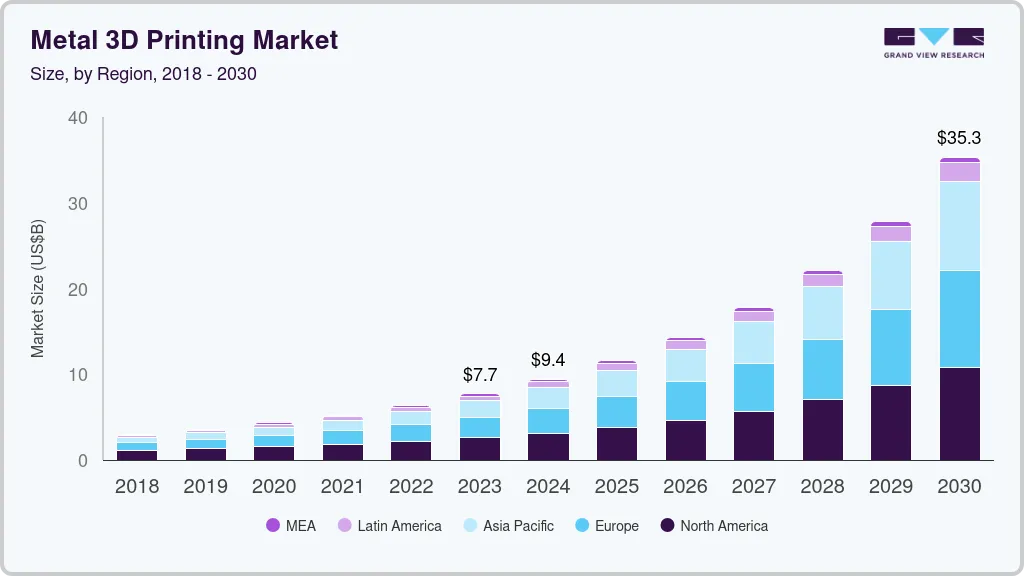

The global metal 3d printing market size was estimated at USD 7.73 billion in 2023 and is projected to reach USD 35.33 billion by 2030, growing at a CAGR of 24.2% from 2024 to 2030. Metal 3D printing is one such market that has benefitted significantly from the growing necessity of rapid prototyping and advanced manufacturing practices.

Key Market Trends & Insights

- North America dominated with a revenue share of 33.81% in 2023.

- Asia Pacific is projected to witness remarkable growth, expanding at the highest CAGR over the forecast period.

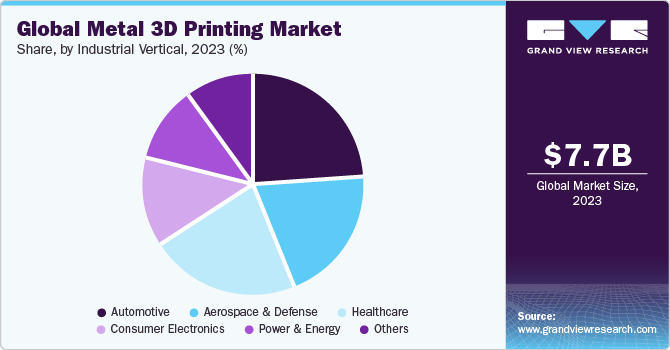

- Based on industrial metal 3D printing vertical, the automotive segment led the market and accounted for more than 23.94% share of the global revenue in 2023.

- In terms of desktop metal 3D printing vertical, the dental segment accounted for the largest revenue share of 22.71% in 2023.

- Based on component, the hardware segment led the market and accounted for a 64.63% share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.73 Billion

- 2030 Projected Market Size: USD 35.33 Billion

- CAGR (2024-2030): 24.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The industry is poised to witness unprecedented growth over the forecast period owing to the rising application of additive manufacturing in various industry verticals. The global market is increasingly advancing towards consolidation to stay ahead of the competition. A substantial growth factor for this market is increasing innovation, which is leading to several benefits through the adoption of metal 3D printing across heavy industry applications.Increasing adoption of metal 3D printers for designing and prototyping products and objects coupled with the reduced manufacturing expenditure and accuracy in the end-product is a key growth proliferating factor. The market is poised to witness high demand arising prominently from the healthcare, automotive, and aerospace & defence sectors. The growing advancements in the healthcare sector to curb physical disabilities and ensure healthy living are influencing the sector to flourish and adopt new innovative methodologies, such as 3D printing.

Additionally, the automotive and aerospace sectors, where prototyping and designing play a vital role in research & development to achieve perfection in their production are leading towards greater opportunities and increasing adoption of the 3D printing process.

However, the prevailing misconceptions concerning the prototyping processes held by small and medium-scale manufacturers are hindering the adoption of additive manufacturing. Companies involved in designing, particularly small-scale and medium-scale enterprises are deliberating before considering investments in prototyping as accountable investments rather than trying to understand the advantages and benefits of prototyping.

The general notion prevailing among these enterprises is that prototyping is merely an expensive phase before manufacturing. Such perceptions regarding prototyping, coupled with the lack of technical knowledge and a looming lack of standard process controls, are expected to hinder the market’s growth.

The outbreak of the COVID-19 pandemic has significantly impacted the overall global economy and, subsequently, the 3D printing industry. Initially, Europe and Asia Pacific were one of the worst affected regions in terms of the number of COVID-19 patients across the globe. Further, the situation worsened in the U.S. as well. Due to the rapid spread of the virus, the government issued an order for the complete lockdown of some key cities.

The complete lockdown affected the production of 3D printing manufacturers. This is attributed to the labor shortage and the complete disruption of logistics and supply chains in the country. The halt in the production of 3D printing adversely impacted the overall market growth in the first and second quarters of 2020.

Market Concentration & Characteristics

The market growth stage in the metal 3D printing market is high, and the pace of the market growth is accelerating. The aerospace and defense industries are major contributors to the demand for metal 3D printing, leveraging the technology for rapid prototyping, tooling, and producing complex components with high precision. Additionally, the medical and dental sectors have embraced metal 3D printing for manufacturing patient-specific implants and prosthetics, capitalizing on its ability to create intricate structures and tailor-made designs.

The metal 3D printing market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain high market share and the need to consolidate in a rapidly growing market.

While metal 3D printing has gained significant traction for its ability to produce complex geometries and functional prototypes, alternative techniques exist for metal component manufacturing. One such technique is traditional subtractive manufacturing, which involves machining metal parts from solid blocks of material using milling, turning, or drilling processes. This method offers high precision and surface finish but may be limited in producing complex shapes compared to 3D printing.

Market concentration plays a pivotal role in the metal 3D printing market. Companies such as EOS GmbH, GE Additive, Renishaw plc, and SLM Solutions Group AG are among the leading providers of metal 3D printing technology and services globally. These companies offer a wide range of metal additive manufacturing solutions catering to various industries such as aerospace, automotive, healthcare, and defense.

Technology Insights

Selective Laser Melting (SLM) technology led the market and accounted for a 5.36% share of the global revenue in 2023. Although the advantages and ease of operations associated with the SLM technology are encouraging the adoption of this technology, advances in technology and aggressive research and development activities undertaken by industry experts and researchers are opening opportunities for several other efficient and reliable technologies.

Other technologies used for metal 3D printing include Selective Laser Sintering (SLS), Direct Metal Laser Sintering (DMLS), Inkjet printing, Electron Beam Melting (EBM), Laser Metal Deposition (LMD), Laminated Object Manufacturing (LOM), and Electron-beam Freeform Fabrication (EBF3).

EBM also accounted for a considerable revenue share in 2023, owing to the extensive adoption of the technology across various metal 3DP processes. The DMLS, EBF3, and SLS are also expected to witness high adoption over the forecast period as these technologies are applicable in specialized additive manufacturing processes. Growing demand from aerospace and defense, healthcare, and automotive verticals would open opportunities for the adoption of these technologies.

Software Insights

Design software led the market and accounted for a major revenue share of the global revenue in 2023. Design software is used for constructing the designs of the object to be printed, particularly in automotive, aerospace and defense, and construction and engineering verticals. Design software acts as a bridge between the objects to be printed and the printer’s hardware.

The scanners software segment is expected to witness rapid growth and generate considerable revenues over the forecast period in line with the growing adoption of scanners. The market size of the segment is projected to grow at the highest CAGR from 2024 to 2030.

Demand for scanning software is estimated to grow on account of the growing trend of scanning objects and storing scanned documents. This ability to store the scanned images of the objects irrespective of their size or dimensions for the 3-dimensional printing of these objects whenever necessary is expected to fuel the growth of the scanner software segment over the forecast period.

Component Insights

The hardware segment led the market and accounted for a 64.63% share of the global revenue in 2023. The hardware segment is anticipated to maintain its lead over the forecast period. The metal 3D printing hardware component segment is bifurcated by technology and application. Similarly, the software segment is further categorized by design software, inspection software, printer software, and scanning software.

The services segment is expected to expand at a significant CAGR from 2024 to 2030. With the adoption of methodology, metal 3D printing services help manufacturers produce complicated and delicate functional parts with greater ease and accuracy. Moreover, production expenditures are being reduced significantly owing to the enhanced prototyping and benefits offered by the technology. As such, the benefits and advantages of 3D printing are gaining greater attention from the players of various industry verticals.

Application Insights

The prototyping segment led the market and accounted for a significant share of the global revenue in 2023 to extensive adoption of the prototyping process across several industry verticals. The automotive and aerospace and defense verticals particularly use prototyping to design and develop parts, components, and complex systems precisely. Prototyping allows manufacturers to achieve higher accuracy and develop reliable end products. Hence, the prototyping segment is expected to continue dominating the market over the forecast period.

Functional parts include smaller joints and other metallic hardware connecting components. The accuracy and precise sizing of these functional parts are of paramount importance while developing machinery and systems.

Vertical Insights

Based on vertical, the industry has been segmented into desktop and industrial metal 3D printing. The verticals considered for desktop metal 3D printing comprise educational purposes, fashion & jewelry, objects, dental, food, and others. The verticals considered for industrial metal 3D printing comprise automotive, aerospace and defense, healthcare, consumer electronics, industrial, power and energy, and others.

Desktop Metal 3D Printing Vertical

The dental segment accounted for the largest revenue share of 22.71% in 2023. Other verticals include education, fashion and jewelry, objects, food, and among others. The use of 3D printing in dentistry has been rapidly growing in recent years, as it provides a convenient and cost-effective way to produce customized dental restorations, orthodontic appliances, and surgical guides. The education, objects, and food verticals are anticipated to contribute significantly toward the growth of metal 3D printing over the forecast period owing to the ability to create highly detailed and intricate designs that would be difficult or impossible to achieve using traditional cooking methods.

The fashion and jewelry segment is expected to expand at the fastest CAGR from 2024 to 2030. Desktop 3D printing has enabled designers and entrepreneurs to create intricate and customizable pieces quickly and affordably, allowing for greater innovation and creativity in the fashion and jewelry industries. With 3D printing, designers can create complex geometries and patterns that are difficult to achieve using traditional manufacturing methods. This allows for unique and personalized designs that can be tailored to individual customers' preferences. In the fashion industry, 3D printing has been used to create custom clothing, footwear, and accessories. 3D printing has also been used to create intricate patterns and designs on textiles, adding a new level of texture and detail to fabrics.

Industrial Metal 3D Printing Vertical

The automotive segment led the market and accounted for more than 23.94% share of the global revenue in 2023. Other verticals include aerospace and defense, healthcare, consumer electronics, industrial, power, and energy, among others. The aerospace and defense, healthcare, and automotive verticals are anticipated to contribute significantly toward the growth of metal 3D printing over the forecast period owing to the active adoption of technology in various production processes associated with these verticals.

The healthcare segment is expected to expand at a significant CAGR of 25.0% from 2024 to 2030. In the healthcare sector, additive manufacturing helps in the development of artificial tissues and muscles, which replicate the natural human tissues and can be used in replacement surgeries. These capabilities are expected to help in driving the adoption of metal 3D printing across the healthcare vertical and contribute significantly towards the growth of the industrial segment.

Regional Insights

North America dominated with a revenue share of 33.81% in 2023 owing to the extensive adoption of additive manufacturing in the region. North American countries, such as the U.S. and Canada, have been some of the prominent and early adopters of these technologies in various manufacturing processes. The regional market is offering lucrative opportunities for metal 3D printing in different applications.

U.S. Metal 3D Printing Market Trends

The metal 3D printing market in the U.S. is expected to account for a significant revenue share in the North America metal 3D printing market. Metal 3D printing in the United States is experiencing significant growth driven by advancements in technology, increasing adoption across various industries, and a growing demand for high-performance and customized metal parts.

Europe Metal 3D Printing Market Trends

Europe happens to be the largest region in terms of its geographical footprint. It is home to several additive manufacturing industry players, which hold strong technical expertise in additive manufacturing processes. Hence, the European regional market happens to be the second largest.

The metal 3D printing market in the UK is expected to account for a significant revenue share in the Europe metal 3D printing market. The UK metal 3D printing market reflects a dynamic landscape characterized by a mix of established players, emerging startups, and research institutions contributing to innovation and growth.

Germany metal 3D printing market is expected to account for a significant revenue share in the Europe metal 3D printing market. Companies such as Renishaw plc, a global leader in metal additive manufacturing, have a significant presence in the Germany metal 3D printing market, offering advanced metal AM systems and services.

The metal 3D printing market in France is expected to account for a significant revenue share in the Europe metal 3D printing market. France boasts a thriving ecosystem of startups and SMEs specializing in metal 3D printing technology, contributing to the market's diversity and innovation. These companies often focus on niche applications, materials development, or novel printing techniques, driving forward the adoption and evolution of metal AM in France.

Asia Pacific Metal 3D Printing Market Trends

Asia Pacific is projected to witness remarkable growth, expanding at the highest CAGR over the forecast period. This rapid adoption of metal 3D printing can be attributed to the developments and upgrades across the manufacturing industry within the region. The region is also emerging as a manufacturing hub for the automotive and healthcare industries. A stronghold on the production of consumer electronics, coupled with rapid urbanization, is also contributing to the rising demand for three-dimensional printing in the region.

The metal 3D printing market in China is expected to account for a significant revenue share in the Asia Pacific metal 3D printing market. The metal 3D printing market in China is experiencing significant growth, driven by a combination of technological advancements, industrial demand, and government support for additive manufacturing initiatives.

India metal 3D printing market is expected to account for a significant revenue share in the Asia Pacific metal 3D printing market. India metal 3D printing market benefits from a vibrant ecosystem of startups and research institutions focused on developing innovative technologies and applications. These entities contribute to the diversification and expansion of the metal AM market in India, particularly in industries such as aerospace, automotive, healthcare, and consumer goods.

The metal 3D printing market in Japan is expected to account for a significant revenue share in the Asia Pacific metal 3D printing market. Government initiatives and policies aimed at promoting advanced manufacturing technologies, including additive manufacturing, have further propelled the growth of the metal 3D printing market in Japan.

South America Metal 3D Printing Market Trends

The metal 3D printing market in South America is gradually gaining traction, driven by the region's growing manufacturing sector and increasing adoption of advanced technologies. Countries like Brazil, Argentina, and Mexico are witnessing a rise in metal additive manufacturing activities, particularly in industries such as aerospace, automotive, healthcare, and consumer goods.

The metal 3D printing market in Brazil is expected to account for a significant revenue share in the South America metal 3D printing market. Strategic investments in research and development, infrastructure, and talent development have helped position Brazil as a global leader in additive manufacturing innovation and production.

Middle East & Africa Metal 3D Printing Market Trends

The metal 3D printing market in the Middle East & Africa is expected to witness noticeable growth in the coming years. Rapidly growing industrial base and expanding adoption of metal 3D printing across various sectors are driving the market's growth.

Key Metal 3D Printing Company Insights

The ecosystem of the metal 3D printing market comprises an original equipment manufacturer, a network of component manufacturers, system integrators, resellers & distributors, and end users.

Some prominent players in the market include Cognex Corporation (U.S.), Basler AG (Germany), Keyence Corporation (Japan), Sick AG (Germany), and ISRA Vision AG (Germany).

-

ISRA VISION GmbH is a manufacturer and provider of surface inspection systems. The company’s products are used for quality and surface inspection, including image processing systems, focused on the arena of metal 3D printing. Its machine vision system comprises lightning components, sensor devices, hardware, software, and mechanical elements such as high-resolution cameras and fast-switching LEDs.

-

Basler AG develops and manufactures digital cameras for medical devices, traffic systems, industrial applications, and video surveillance. The products offered by the company include PowerPack Microscopy equipment; network cameras; 3D cameras for applications in logistics, industrial image processing, imaging, and inspection; area scan cameras for factory automation and traffic monitoring; and line scan cameras for sorting procedures and quality assurance.

ZRapid Tech and UnionTech. are some of the emerging market participants in the target market.

-

ZRapid Tech specializes in metal 3D printing systems and services, offering a range of additive manufacturing solutions tailored to the needs of different industries. The company focuses on developing advanced metal AM technologies and providing customized solutions for high-performance applications.

-

UnionTech is a leading provider of stereolithography (SLA) 3D printing systems, including metal-compatible SLA printers. The company offers a range of high-precision, high-resolution SLA printers that enable the production of intricate metal parts with superior surface quality and dimensional accuracy.

Key Metal 3D Printing Companies:

The following are the leading companies in the metal 3D printing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these metal 3D printing companies are analyzed to map the supply network.

- Cognex Corporation

- Keyence Corporation

- Sick AG

- ISRA Vision AG

- Basler AG.

Recent Developments

-

In October 2021, 3D Systems announced the acquisition of Volumetric Biotechnologies. Volumetric Biotechnologies is a Huston-based biotech company. The acquisition will help 3D Systems to develop manufacturing capabilities for fully bio-compatible human organs using Additive Manufacturing (AM).

-

In November 2019, Renishaw plc announced the collaboration with Sandvik Additive Manufacturing. The collaboration aimed to qualify new additive manufacturing (AM) materials for production applications. This collaboration is expected to help Renishaw plc develop new metal materials for 3D printing.

-

In October 2019, GE Additive announced the cooperative research and development agreement (CRADA) with the US Department of Energy’s Oak Ridge National Laboratory (ORNL). The agreement period was for 5 years and focused on processes, materials, and software to increase customer adaptability towards additive manufacturing from conventional manufacturing.

-

In July 2019, 3D Systems Corporation, a 3D metal printing solution provider was awarded a contract from the Combat Capabilities Development Command Army Research Laboratory (ARL). The contract valued worth USD 15 million with a focus on creating the fastest, and precise 3D printer.

Metal 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.73 billion

Revenue forecast in 2030

USD 35.33 billion

Growth rate

CAGR of 24.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, software, application, printer type, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

The U.S.; Canada; Mexico; The U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Singapore; Brazil

Key companies profiled

Cognex Corporation; Keyence Corporation; Sick AG; ISRA Vision AG; Basler AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global metal 3D printing market report based on component, technology, software, application, printer type, vertical, and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Selective Laser Sintering

-

Direct Metal Laser Sintering

-

Inkjet printing

-

Electron Beam Melting

-

Laser Metal Deposition

-

Laminated Object Manufacturing

-

Electron Beam Freeform Fabrication

-

Selective Laser Melting

-

-

Software Outlook (Revenue, USD Billion, 2017 - 2030)

-

Design Software

-

Inspection Software

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Printer Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Desktop Metal 3D Printer

-

Industrial Metal 3D Printer

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Desktop Vertical

-

Education

-

Fashion & Jewelry

-

Objects

-

Dental

-

Food

-

Others

-

-

Industrial Vertical

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Power & Energy

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global metal 3D printing market size was estimated at USD 6.36 billion in 2022 and is expected to reach USD 7,733.18 million in 2023.

b. The global metal 3D printing market is expected to grow at a compound annual growth rate of 24.2% from 2023 to 2030 to reach USD 35.33 billion by 2030.

b. North America dominated the metal 3D printing market with a share of 34.33% in 2022. This is attributable to the extensive adoption of metal 3DP in the region. Countries, such as the U.S. and Canada, have been prominent and early adopters of these technologies.

b. Some key players operating in the metal 3D printing market include Materialise NV, 3D Systems, Inc., GE Additive, Autodesk Inc., Optomec, Inc.

b. Key factors that are driving the metal 3D printing market growth include increasing adoption of metal 3D printers for designing and prototyping of products & objects coupled with the reduced manufacturing expenditure and accuracy in the end-product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.