- Home

- »

- Biotechnology

- »

-

Mesenchymal Stem Cells Market Size & Share Report, 2030GVR Report cover

![Mesenchymal Stem Cells Market Size, Share & Trends Report]()

Mesenchymal Stem Cells Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Services, By Workflow Type, By Type, By Source Of Isolation, By Indication, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-361-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mesenchymal Stem Cells Market Summary

The global mesenchymal stem cells market size was estimated at USD 3,124.1 million in 2023 and is projected to reach USD 7,266.4 million by 2030, growing at a CAGR of 12.9% from 2024 to 2030. An increase in prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders coupled with rising implication of stem cells in managing these chronic conditions are anticipated to drive the global market growth for mesenchymal stem cells.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, UK is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, product accounted for a revenue of USD 2,464.5 million in 2023.

- Services is the most lucrative product & services segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,124.1 Million

- 2030 Projected Market Size: USD 7,266.4 Million

- CAGR (2024-2030): 12.9%

- North America: Largest market in 2023

In addition, the increasing popularity of regenerative medicine and the surge in R&D activities by biopharmaceutical companies to develop novel therapies using mesenchymal stem cells is another factor propelling market growth forward.

The versatility of MSCs has boosted their use in therapeutic settings. Apart from using MSCs in regenerative medicine and tissue engineering, scientists are exploring their potential in treating various diseases, including cancer. Several clinical trials and studies are being conducted to test the efficacy and safety of MSCs in diseases such as graft versus host disease, cerebral palsy, systemic lupus erythematosus, type 1 diabetes, and rheumatoid arthritis. For instance, Mayo Clinic researchers are investigating novel therapies for managing discogenic LBP. These therapies comprise biological agents like PRP and mesenchymal stem cells.

In addition, in June 2022, the University of Technology Sydney developed a 3D-printed system for harvesting stem cells from bioreactors. Stem cells treat many diseases and injuries, that include diabetes, arthritis, cancer, etc. This factor is also expected to support market expansion.

Acknowledging the profitable opportunities posed by the market, key industry participants are focused on initiating technological collaborations to strengthen their market presence. In August 2020, NantKwest Inc. collaborated with Generate Life Sciences Co. to develop a mesenchymal stem cell-based treatment against COVID-19. In addition, in September 2021, Cynata Therapeutics Limited announced a strategic partnership with Fujifilm Corporation. Under this partnership, Fujifilm offered commercial and clinical production services for and supply of Cyanta’s therapeutic MSCs products.

Expanding clinical applications of mesenchymal stem cells, strengthening the pipeline of these therapies, and intensifying market competition are key aspects driving the industry expansion of MSCs. The COVID-19 outbreak has propelled the investments made in this market space. For instance, in April 2020, Canada’s Stem Cell Network (SCN) provided funding of USD 300,000 to the project to evaluate the optimal dosage of MSCs to design an effective therapeutic approach to reduce the impacts of respiratory disorders associated with SARS-CoV-2 infection. Moreover, in recent years, mesenchymal stem cell therapies have been investigated for bone-related and cardiovascular disorders.

Most mesenchymal stem cell applications are oriented toward clinical and research settings with comparatively lower penetration across commercial applications. This is due to the lack of regulated and standardized delivery of stem cell therapies and ethical and safety concerns associated with human MSCs. Developments in the regulations and standardization of the mesenchymal stem cell industry are imperative to maintain market growth.

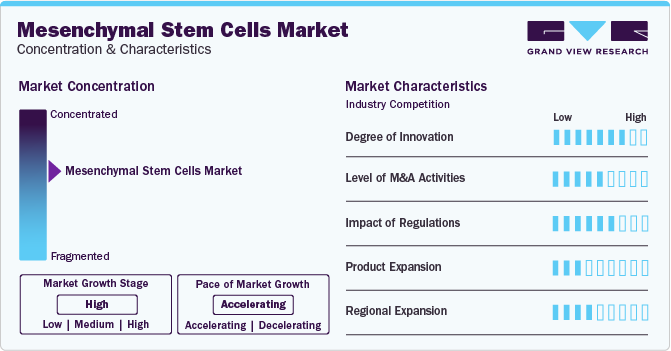

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The MSC industry is characterized by a high degree of innovation owing to the increasing number of pipelines and clinical studies and increasing applications of MSC. Several clinical trials are being conducted to test the efficacy and safety of MSCs in diseases such as graft versus host disease, cerebral palsy, systemic lupus erythematous, type1 diabetes, and rheumatoid arthritis.

The MSC industry is also characterized by moderate merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to strengthen the MSC portfolio, increase the company’s capabilities, expand the customer base, and improve competencies.

The MSC industry is also subject to increasing regulatory scrutiny. It is due to medical tourism and unregulated stem cell clinics promoting unapproved stem cell therapies, leading to inappropriate or even harmful delivery of these advanced treatments. The disconnect between premature public marketing of stem cell products and reputable clinical trials has widened the gap between approved therapies and unregulated clinics, creating confusion and apprehension among potential patients.

The industry is experiencing a moderate level of product expansion. However, the growing number of clinical trials and research initiatives focused on using the regenerative capabilities of MSCs reflects the increasing confidence in their safety and efficacy. Furthermore, product expansion will experience an increase owing to the potential application in the treatment of various diseases, including cancer.

The regional expansion in the MSC industry is at a moderate level. Companies focus on regional expansion to increase the reach of their products and capture the untapped markets. Furthermore, it enables companies to expand their manufacturing facilities and capacity, boosting market growth.

Product & Service Insights

The products segment dominated the market with the largest revenue share of 78.89% in 2023. Under the product category, the cells and cell lines segment has been a key contributor to the segment’s revenue. Several market players are capturing untapped avenues of this market space by undertaking new product development and business expansion initiatives. These players offer mesenchymal stem cells and cell lines to support the research community. For instance, in June 2021, Essent Biologics launched human MSCs (hMSCs) for regenerative medicine, biopharmaceutical, and cell therapy research. These hMSCs are highly characterized and low-passaged, with each vial containing over 1 million cells at thaw and having a low passage number, reflecting the growing potential of MSCs in regenerative medicine and biopharmaceutical research.

The services segment is expected to grow at the fastest CAGR over the forecast period. Companies offering services for MSC research are anticipated to witness lucrative growth owing to the growing number of studies and clinical applications of MSCs as potential treatments for life-threatening diseases. Large-scale laboratories have in-house facilities for different stages of workflow. However, medium- and small-scale research and academic centers prefer Contract Research Organizations (CROs) or specific service providers.

Workflow Type Insights

The culture and cryopreservation segment held the largest revenue share of 44.55% in 2023. The rising demand for cryopreservation services, advanced healthcare infrastructure, and rising research activities in MSCs culture effectiveness are anticipated to drive segment growth. For instance, in June 2020, researchers in Malaysia published a systematic review to assess the application of microcarriers in MSC cultures. As per the study, MSCs could increase in a microcarrier culture system, which further induces cell differentiation. Merck KgaA, R&D systems, and STEMCELL Technologies are some of the major companies operating in this segment.

The differentiation segment is anticipated to exhibit the fastest CAGR over the forecast period. Companies in this segment offer kits that support the complete differentiation of human mesenchymal stem cells into osteoblasts, fat cells, cartilage cells, or bone cells. Thermo Fisher Scientific, Cyagen Biosciences, and ScienCell Research Laboratories are some of the key market players providing various kits to differentiate MSCs. The launch of serum-free and xeno-free hMSC differentiation kits has led to major advancement in this segment and, thus, is expected to drive the segment growth.

Type Insights

The allogeneic MSCs segment held the largest revenue share of 55.60% in 2023. The growth is attributed to the safety profile of allogeneic MSCs in clinical applications. In addition, implantation of allogeneic MSCs is set to emerge as a pioneering cell-based therapeutic approach owing to the associated low immunogenicity coupled with immunosuppressive properties. These properties result in a reduced immune response, contributing to allogeneic MSC implantations’ success.

On the other hand, the use of autologous mesenchymal stem cells has undergone various advances in the past few years. The segment is expected to register the fastest CAGR during 2024 - 2030. Various studies are being conducted using autologous MSCs for the treatment of various diseases, and this is projected to offer exponential growth opportunities for the segment in the coming years.

Source of Isolation Insight

The bone marrow segment led the market in 2023 with the largest revenue share of 24.56% and is expected to grow at the fastest CAGR over the forecast period. Bone marrow is a major source of isolation for MSCs. These cells have multilineage differentiation potential and can differentiate into cartilage, bones, fibroblasts, fat, cardiac muscle cells, tendons, and endothelial cells. The rising need for MSCs and their increasing adoption in disease modeling and drug discovery are projected to drive segment growth.

The cord blood segment is anticipated to grow at a significant CAGR over the forecast period. Umbilical cord blood is the second-most widely used source for the isolation of MSCs for clinical trials. The MSCs derived from umbilical cord blood are allogenic types of cells. These cells have shown great potential as a source of MSCs that can be used for articular cartilage repair. The abovementioned factors are anticipated to drive the segment growth.

Indication Insight

The bone and cartilage repair segment dominated the market with the largest revenue share of 22.23% in 2023. With advancements in regenerative medicine, the focus on MSCs for bone and cartilage repair is growing. MSCs have increased the efficiency of the bone regeneration process. They have demonstrated great potential in cartilage regeneration due to their self-renewal, multi-differentiation, and immunoregulatory capabilities. For instance, a review published in the Journal of Translational Medicine in 2022 discussed the modification of MSCs for cartilage-targeted therapy, emphasizing the importance of direct homing of MSCs for the efficacy of MSC-based cartilage repair. The study further highlighted the potential of MSCs for targeted repair of damaged cartilage and restoration of joint function, offering an effective solution for tissue regeneration & repair.

The inflammatory and immunological diseases segment is expected to grow at the fastest CAGR during the forecast period. MSCs have emerged as a promising alternative for the treatment of inflammatory diseases. Several clinical trials use MSC-based products to evaluate efficacy in treating inflammatory disorders. The therapeutic potential of MSCs is being evaluated in inflammatory diseases such as graft-versus-host disease, Crohn’s disease, organ fibrosis, and diabetic nephropathy.

Application Insight

The disease modeling application segment dominated the market with the largest revenue share of 35.23% in 2023. The use of cellular disease models with patient-specific MSCs provides an ideal tool for pathological research. The mesenchymal stem cells derived from patient-induced pluripotent stem cells serve as a potential disease modeling tool. Many research studies have used mesenchymal stem cell models to analyze the underlying mechanisms of chronic disorders. Moreover, MSCs are also used as models in assessing non-hematological mesenchymal cancers such as sarcomas, which has contributed to the dominance of this segment.

The tissue engineering application segment is anticipated to witness the fastest CAGR from 2024 to 2030. Mesenchymal stem cells have emerged as a promising therapeutic approach in tissue engineering. These cells have widespread applications due to their high capacity for expansion, self-renewal, and reduced tumorigenic capacity. Mesenchymal stem cell encapsulation techniques have gained immense demand in this market in recent years.

Regional Insights

North America dominated the market with the largest revenue share of 45.11% in 2023. A substantial number of clinical trials are underway to assess the efficacy and safety of mesenchymal stem cells as a viable treatment for several life-threatening diseases in the region. Furthermore, many major companies engaged in the supply and commercialization of MSCs are headquartered in North America. In addition, increased funding from government and private organizations is expected to drive the market demand. For instance, in January 2022, Cellino Biotech announced that it raised around USD 80 million through a Series A financing round from 8VC, Felicis Ventures, and other investors. The company plans to use these funds to expand access to stem cell-derived therapies to develop the first independent human cell foundry by 2025. These factors have contributed to the dominance of the region in the market.

U.S. Mesenchymal Stem Cells Market Trends

The mesenchymal stem cells market in the U.S. is expected to grow over the forecast period due to the presence of several market players in the U.S., which are undergoing various strategic initiatives such as collaborations and partnerships.

Europe Mesenchymal Stem Cells Market Trends

The mesenchymal stem cells market in Europe is identified as a lucrative region in this industry. This is attributed to strong government support, advancements in research infrastructure, and the active participation of various key companies and research organizations.

The UK mesenchymal stem cells market is expected to grow over the forecast period due to the presence of several companies operating in the stem cells space.

The mesenchymal stem cells market in France is expected to grow over the forecast period. France is focusing on increasing the number of stem cell clinical trials. Researchers are studying intravenous injection of autologous MSCs therapy for treating ischemic stroke.

The Germany mesenchymal stem cells market is expected to grow over the forecast period due to the presence of public & private institutes involved in translational, regenerative, and cellular medicine increasing the use of stem cell therapies to treat chronic diseases.

Asia Pacific Mesenchymal Stem Cells Market Trends

The Asia Pacific mesenchymal stem cells market is anticipated to witness the fastest CAGR from 2024 to 2030. This growth rate is attributed to the various strategic initiatives undertaken between local players and international companies. The pandemic also resulted in a spur of stem cell therapies for treating the condition. For instance, in August 2022, Panacell Biotech used Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes to treat COVID-19 infection. The clinical trial for the same is expected to start soon.

The mesenchymal stem cells market in China is expected to grow over the forecast period due to the growing scope of MSC R&D and numerous scientific advancements in medical applications.

Japan mesenchymal stem cells market is expected to grow over the forecast period. This is attributed to the technological advancements pertaining to stem cell research and well-defined regulatory policies for research on MSCs.

Middle East and Africa Mesenchymal Stem Cells Market Trends

The mesenchymal stem cells market in the Middle East and Africa (MEA) is at a nascent stage. Stem cell research in MEA relies more on cultural and regional beliefs. Morality and beliefs surrounding the use of stem cells harvested from human embryos are restricting the use of stem cells in the region.

The Saudi Arabia mesenchymal stem cells market is expected to grow over the forecast period. The increasing adoption of stem cell therapies in the country is expected to drive the market.

The mesenchymal stem cells market in Kuwait is expected to grow over the forecast period due to the presence of several multinational and regional pharmaceutical companies in the country.

Key Mesenchymal Stem Cells Company Insights

The market players operating in the market are adopting product approvals to increase the reach of their products in the market and improve their availability in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Mesenchymal Stem Cells Companies:

The following are the leading companies in the mesenchymal stem cells market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- Axol Bioscience Ltd

- STEMCELL Technologies

- Merck KgaA

- Lonza

- Promocell GMBH

- Cyagen

- Celprogen Corporation

- Cellcolabs

- Stemedica Cell Technologies, Inc.

- Cell Applications, Inc.

Recent Developments

-

In November 2023, the U.S. FDA granted a meeting to BrainStorm Cell Limited to discuss the regulatory route ahead for NurOwn in neurodegenerative disease, Amyotrophic Lateral Sclerosis (ALS). NurOwn is a promising investigational therapeutic approach that uses MSCs for therapeutics.

-

In July 2023, PROMOCELL GMBH introduced a new product, PromoExQ MSC Growth Medium XF, for cell therapy manufacturing. Such product launches specifically targeting MSCs are anticipated to drive market growth.

-

In July 2023, Merck KGaA invested USD 24.38 million to boost cell culture media production in the U.S. It expanded the production capacity of the Lenexa facility to manufacture cell culture media.

-

In January 2023, Stemedica Cell Technologies, Inc. initiated phase Iib/III clinical trials for patients with chronic ischemic stroke. This clinical trial evaluates the efficacy, safety, and tolerability of allogeneic MSCs to subjects with ischemic stroke.

Mesenchymal Stem Cells Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.50 billion

Revenue forecast in 2030

USD 7.27 billion

Growth Rate

CAGR of 12.92% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, workflow type, type, source of isolation, indication, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; Sweden; Norway; Denmark; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; Axol Bioscience Ltd; STEMCELL Technologies; Merck KGaA; Lonza; Promocell GMBH; Cyagen; Celprogen Corporation; Cellcolabs; Stemedica Cell Technologies, Inc.; Cell Applications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mesenchymal Stem Cells Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mesenchymal stem cells market report based on products and services, workflow type, type, source of isolation, indication, application, and region.

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Cells & Cell Lines

-

Kits, Media, & Reagents

-

Others

-

-

Services

-

-

Workflow Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Sourcing & Isolation

-

Culture & Cryopreservation

-

Differentiation

-

Characterization

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autologous

-

Allogenic

-

-

Source of Isolation Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone Marrow

-

Cord Blood

-

Peripheral Blood

-

Fallopian Tube

-

Fetal Liver

-

Lung

-

Adipose Tissues

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone And Cartilage Repair

-

Cardiovascular Diseases

-

Inflammatory And Immunological Diseases

-

Liver Diseases

-

Cancer

-

GvHD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Modeling

-

Drug Development & Discovery

-

Stem Cell Banking

-

Tissue Engineering

-

Toxicology Studies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mesenchymal stem cells market size was estimated at USD 3.12 billion in 2023 and is expected to reach USD 3.50 billion in 2024.

b. The global mesenchymal stem cells market is expected to witness a compound annual growth rate of 12.92% from 2024 to 2030 to reach USD 7.27 billion by 2030.

b. The products segment dominated the market and accounted for the largest revenue share in 2023. Under the product category, the cells and cell lines segment has become a key contributor to the segment’s revenue.

b. Some of the key players in the mesenchymal stem cells market include Thermo Fisher Scientific, Inc; Axol Bioscience Ltd; STEMCELL Technologies; Merck KGaA; Lonza; Promocell GMBH; Cyagen; Celprogen Corporation; Cellcolabs; Stemedica Cell Technologies, Inc.; Cell Applications, Inc.

b. Key factors that are driving the mesenchymal stem cells market growth include an increase in the prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders coupled with the rising implication of stem cells in the management of these chronic conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.