- Home

- »

- Electronic Devices

- »

-

Membrane Air Dryers Market Size And Share Report, 2030GVR Report cover

![Membrane Air Dryers Market Size, Share & Trends Report]()

Membrane Air Dryers Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Porous, Non-Porous), By Application (Food & Beverage, Medical, Industrial, Telecommunication, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-392-8

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Membrane Air Dryers Market Size & Trends

The global membrane air dryers market size was valued at USD 885.6 million in 2022 and is expected to expand at a CAGR of 7.9% from 2023 to 2030. These air dryers provide several benefits, such as lowering the dew point of air and removing contaminants that may negatively impact the air compressor. These membranes allow the system to run more efficiently and prolong the system’s life by reducing rust and corrosion caused by contaminated air or air with high moisture content. Air that travels along the membrane is dry and clean. Therefore, it does not promote the growth of rust and helps mitigate corrosion, which is also expected to propel market demand over the next few years.

Surging demand across several application areas and the growing need for clean and dry air in the medical, food & beverage, and telecommunication industries are expected to be key driving forces for the market over the next six years. Furthermore, increased adoption to improve the operational efficiency of a system and thereby reduce maintenance costs is also expected to impact market growth over the forecast period positively.

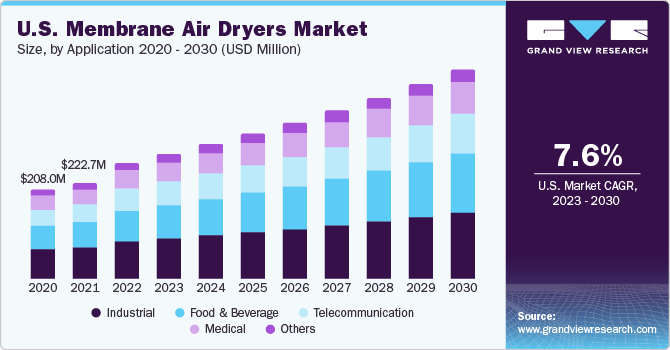

Application Insights

Based on application, the market is segmented into food & beverage, medical, industrial, telecommunication, and others. The industrial segment accounted for the largest revenue share of around 34.1% in 2022. The industrial segment is sub-segmented into pneumatic equipment, electronics/semiconductors, feed gas preparation, and others. The growing industrial automation trend is playing a significant role in driving the demand for membrane air dryers. The need for reliable and contaminant-free compressed air has become critical with the increasing use of automated systems and machinery in industries. Membrane air dryers offer consistent performance and help maintain the integrity of automated processes, ensuring smooth operations and minimizing downtime.

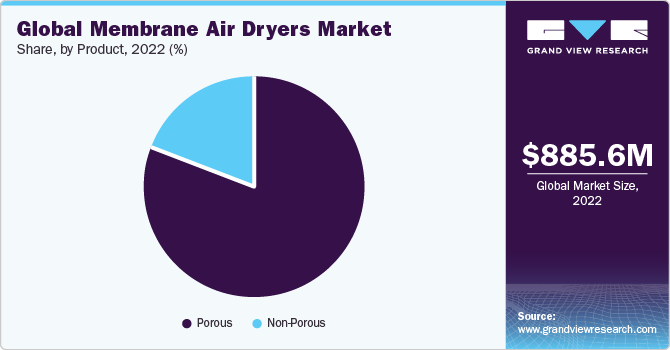

Product Insights

Based on product, the market is segmented into porous and non-porous. The porous segment accounted for the largest revenue share of around 81.0% in 2022 and is estimated to register the fastest CAGR of 8.0% over the forecast period. The rising focus on energy efficiency and sustainability is also boosting the market. Compared to traditional air-drying methods, porous segment and membrane air dryers offer advantages such as low energy consumption, compact size, and minimal maintenance requirements. These factors make them attractive options for industries looking to reduce their environmental footprint and operational costs.

The non-porous segment is estimated to grow significantly over the forecast period. The increasing demand for clean and dry compressed air in food and beverage, pharmaceuticals, electronics, and automotive industries is a major driving factor. These industries require high-quality compressed air to maintain product quality, prevent contamination, and enhance operational efficiency.

The food & beverage is estimated to register the fastest CAGR of 8.3% over the forecast period. The presence of water vapor or moisture in compressed air or steam employed in food processing may lead to significant problems, thereby driving the market demand. The meat and dairy industry must comply with several hygiene requirements in food preparation areas, providing avenues for market growth.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 37.4% in 2022, owing to growing telecommunication, medical, and food & beverage demand. Standards and regulations governing the food processing sector, particularly in North America, favorably impact the regional membrane air dryers market demand over the forecast period. For instance, 3-A Sanitary Standards, in collaboration with the European Hygienic Engineering & Design Group and the U.S. Public Health Service, developed practices that define filtering systems for compressed air in contact with dairy products and culinary steam.

Asia Pacific is expected to register the highest CAGR of 8.7% over the forecast period. The booming electronics industry in the Asia Pacific drives market growth. The production of electronic devices, semiconductors, and printed circuit boards requires contaminant-free and dry compressed air to ensure the quality and reliability of the telecommunication processes. Furthermore, the increasing industrialization and rapid economic development in countries across the Asia Pacific have increased the demand for efficient and reliable air drying solutions.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in May 2023, Air Products and Chemicals, Inc. announced a USD 10 million investment to expand membrane production capacity at its St. Louis location. This initiative is in response to the growing demand for nitrogen and dehydration products from clients in the biogas and hydrogen recovery industries, as well as the aerospace sector. The increase in capacity will directly impact product lines such as the membrane dryer and the membrane separator.

Key Membrane Air Dryers Companies:

- Atlas Copco AB

- Ingersoll Rand

- MIKROPOR MAKINA SAN.TIC.A.S.

- PARKER HANNIFIN CORP

- Pentair

- Compressed Air Parts Company

- Donaldson Company, Inc.

- Gardner Denver

- Graco Inc.

- Hankison

- Industrial Air Power

- Rainer Lammertz

- Sullair, LLC

Recent Developments

-

In October 2022, PARKER HANNIFIN CORP's Engine Mobile Filtration EMEA Division and the Fraunhofer Institute for Microengineering and Microsystems announced a partnership to advance and test a new exclusive technology involving hollow fiber membranes. This technology is specifically designed for fuel cell humidification purposes. The collaboration is anticipated to last for a maximum of two years. It will encompass various activities such as evaluating the efficiency of existing fuel cell humidifiers developed by Parker, creating and utilizing a specialized testing setup, and conducting performance simulations to assess the impact of factors like fiber length, diameter, and permeability on the humidifiers.

-

In August 2022, GMM Pfaudler announced the acquisition of Hydro Air Research Italia. Hydro Air Research Italia has developed water-recycling plants that meet strict environmental regulations by obtaining reusable or dischargeable water. Hydro Air Research Italia gain access to GMM Pfaudler's global sales and service organizations through the acquisition. Simultaneously, GMM Pfaudler will benefit from enhanced expertise in process and wastewater engineering, expanding its portfolio of membrane separation systems. This strategic acquisition aligns with GMM Pfaudler's goal of profitable growth and long-term shareholder value.

Membrane Air Dryers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 955.7 million

Revenue forecast in 2030

USD 1.63 billion

Growth Rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Mexico, United Arab Emirates, Saudi Arabia, South Africa

Key companies profiled

Atlas Copco AB, Compressed Air Parts Company, Donaldson Company, Inc., Gardner Denver, Graco Inc., Hankison, Industrial Air Power, Ingersoll Rand, MIKROPOR MAKINA SAN.TIC.A.S.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

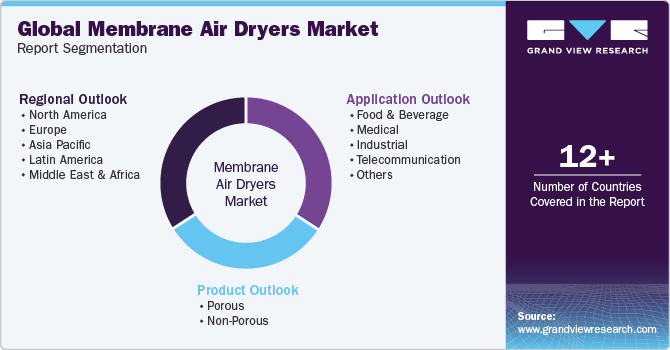

Global Membrane Air Dryers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global membrane air dryers market on the basis of product, application, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Porous

-

Non-Porous

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Food & Beverage

-

Medical

-

Dental

-

Breathing Equipment

-

MIT(Minimally Invasive treatment)

-

-

Industrial

-

Pneumatic Equipment

-

Electronics/Semiconductor

-

Feed Gas Preparation

-

Others

-

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane air dryers market size was estimated at USD 885.6 million in 2022 and is expected to reach USD 955.7 million in 2023.

b. The global membrane air dryers market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 1.63 billion by 2030.

b. North America dominated the membrane air dryers market with a share of over 37.2% in 2022. This is attributable to growing demand across multiple end-use verticals and stringent regulations governing the food processing sector.

b. Some key players operating in the membrane air dryers market include Atlas Copco Corp, Compressed Air Parts Company, Donaldson Company, Inc., Gardner Denver, Inc., Graco Inc., Hankison, Industrial Air Power, Ingersoll-Rand, Mikropor, Parker Hannifin Manufacturing Limited, and Pentair.

b. Key factors that are driving the membrane air dryers market growth include surging demand across several application areas and the growing need for clean and dry air in medical, food & beverage, and manufacturing industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.