- Home

- »

- Medical Devices

- »

-

Medical Writing Market Size & Share, Industry Report, 2033GVR Report cover

![Medical Writing Market Size, Share & Trends Report]()

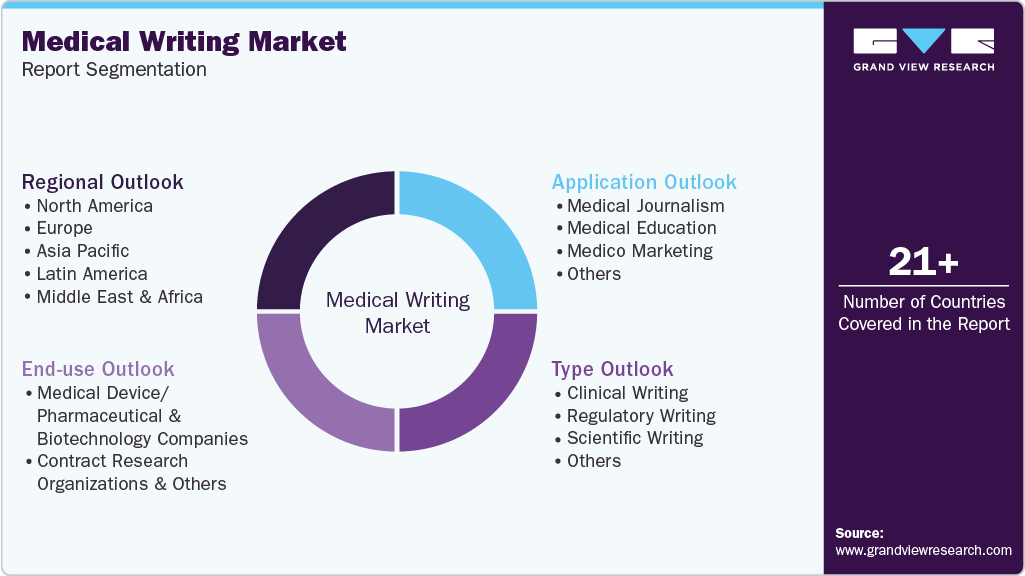

Medical Writing Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Clinical, Regulatory, Scientific), By Application (Medical Journalism, Medical Education, Medico Marketing,), By End Use (Contract Research Organizations & Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-908-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Writing Market Summary

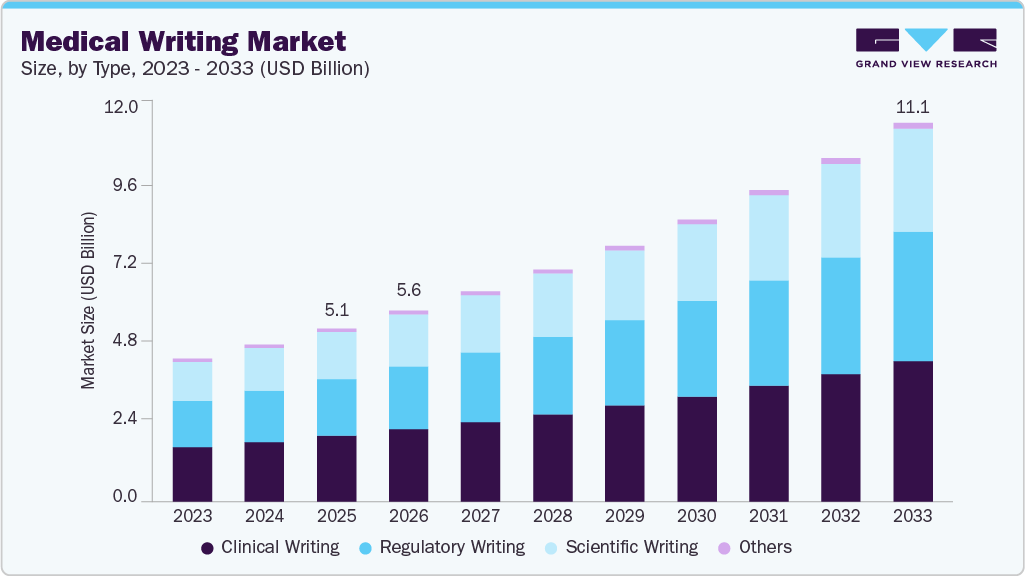

The global medical writing market size was estimated at USD 5.07 billion in 2025 and is projected to reach USD 11.09 billion by 2033, growing at a CAGR of 10.29% from 2026 to 2033. The high demand for medical writers can be attributed to a rise in CRO outsourcing, increased R&D investments by market players, a favorable environment for clinical study in developing countries, and new medical device regulations.

Key Market Trends & Insights

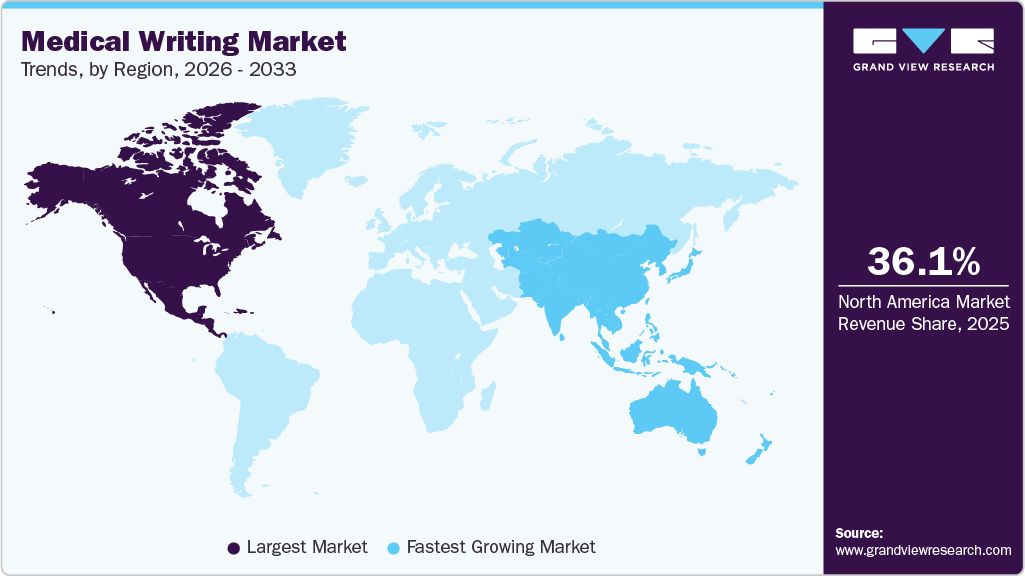

- The North America medical writing industry dominated the global market in 2025, accounting for the largest revenue share of 36.07%.

- The Canada medical writing industry is anticipated to register the fastest growth rate during the forecast period.

- By type, the clinical writing segment held the largest revenue share in 2025.

- By application, the medical journalism segment held the largest revenue share in 2025.

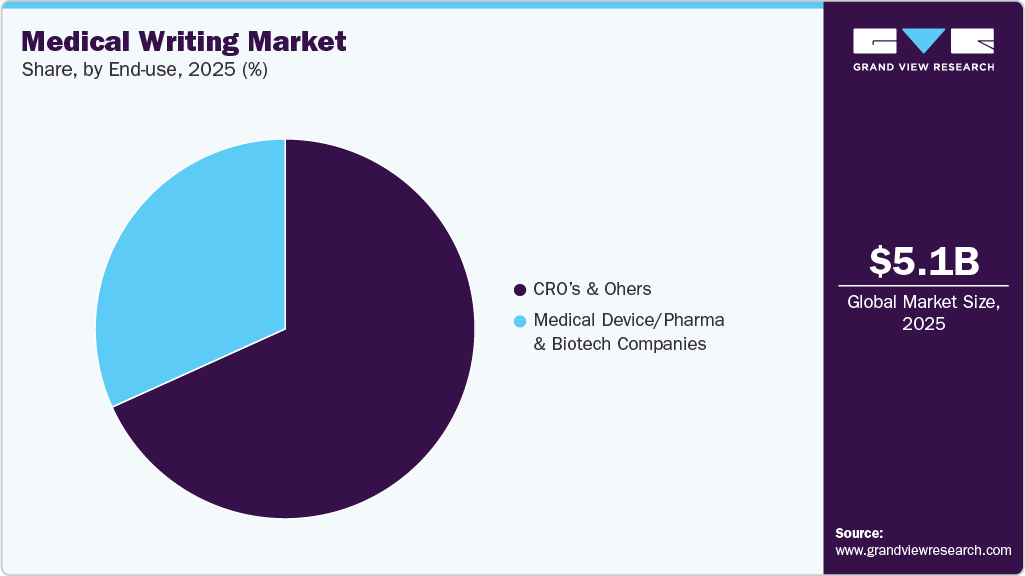

- In terms of the end use segment, the CROs and others segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.07 Billion

- 2033 Projected Market Size: USD 11.09 Billion

- CAGR (2026-2033): 10.29%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In July 2024, Celegence highlighted in The Journal of mHealth that Generative AI (GenAI) could transform pharmaceutical medical writing, with 57% of organizations planning investment. While deployment knowledge is a challenge, controlled experiments and partnerships can boost efficiency, cut costs, and keep companies competitive. Pharmaceutical companies have adapted their advertising strategies to improve patient outreach. In addition, the growing influence of social media on customers’ decisions has compelled pharmaceutical and biotechnology companies to reconsider their marketing strategies. The robust growth of health and wellness-related blogs is expected to boost the demand for scientific writing. In September 2025, an article published in Health Promotion International analyzed the scale of the medical writing industry, identifying 1,148 medical education and communication companies (MECCs) contributing to English-language medical literature. The study found that over 20,000 scientific papers acknowledged medical writing support, with more than 50% sponsored by just ten pharmaceutical companies, highlighting the industry’s size and concentrated funding base.

Regulatory authorities want a thorough methodology for all phases of product development, which complicates the approval process boosting the market growth in the coming years. Insurance companies want drug information to establish reimbursement policies. As a result, pharmaceutical companies are finding it difficult to adhere to industry standards. In June 2024, an article published by the American Medical Writers Association (AMWA) Blog highlighted the expanding medical writing profession, citing U.S. Bureau of Labor Statistics projections of 7% growth in technical writing roles by 2032 and industry data showing nearly 8,000 medicines in development and about 900 FDA approvals since 2000, collectively pointing to sustained demand for medical writers across clinical, regulatory, and commercial activities.

There is a new trend in the market of multiple strategic relationships, wherein each CRO provides a single function and multiple service providers are maintained. Clinical trials are increasing in number as a result of increased R&D investments. In September 2024, the European Journal of Internal Medicine highlighted that AI and large language models are rapidly transforming scientific medical writing, aiding literature review, translation, and statistical analysis.

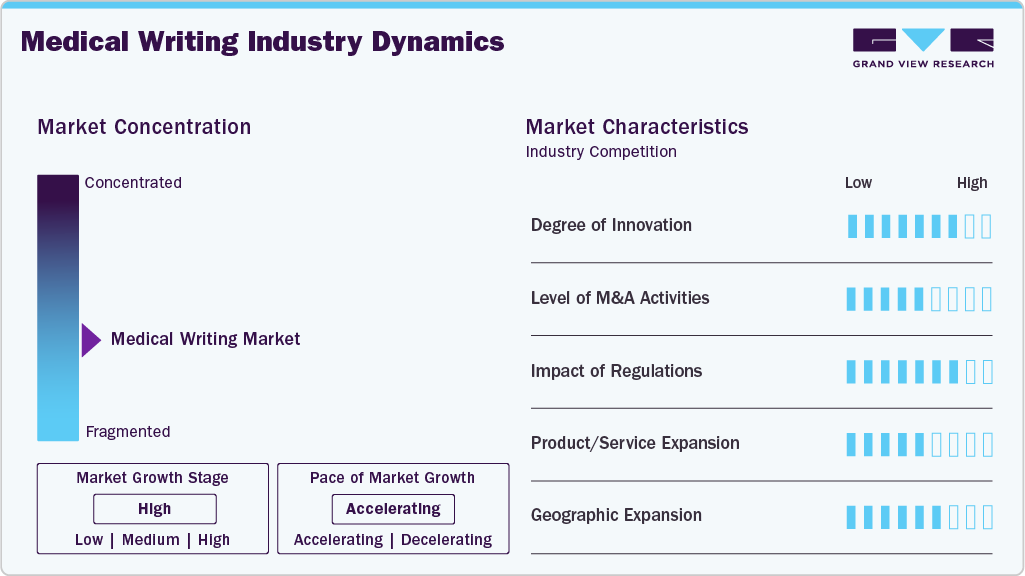

Market Concentration & Characteristics

The medical writing industry is experiencing steady innovation, with a strong focus on automation, artificial intelligence enabled content generation, and standardized authoring platforms. Advancements in regulatory intelligence tools, data visualization, and structured authoring are improving efficiency, consistency, and compliance across clinical, regulatory, and scientific documentation.

The market has witnessed selective merger and acquisition activity, as larger contract research organizations (CROs) and life sciences service providers acquire specialized medical writing firms to expand service portfolios, enhance therapeutic expertise, and strengthen global delivery capabilities. M&A is primarily driven by the need for end-to-end regulatory and clinical development solutions.

Stringent regulatory requirements significantly influence the market, as documentation must comply with evolving global standards set by regulatory authorities such as the U.S. FDA, EMA, and ICH. Frequent updates to clinical trial reporting guidelines, regulatory submission formats, and pharmacovigilance requirements increase demand for specialized medical writing expertise while also extending project timelines.

In-house medical writing teams within pharmaceutical and biotechnology companies act as partial substitutes for outsourced services. In addition, emerging AI-based writing tools may reduce reliance on external providers for routine documentation, although complex regulatory and scientific content continues to require expert human oversight.

Medical writing service providers are expanding geographically by strengthening delivery centers in cost-efficient regions such as Asia-Pacific and Eastern Europe, while maintaining client-facing operations in North America and Europe. This strategy supports scalability, cost optimization, and access to a broader talent pool amid rising global demand for regulatory and clinical documentation.

Type Insights

By type, the clinical writing segment dominated the market in 2025 and accounted for the largest revenue share of 37.92%. Clinical writing is used by health professionals on a regular basis and a clinical writer must have a thorough knowledge of the clinical language as well as culture. An understanding of the target reader and the purpose is required for effective clinical writing. It is used in protocols, consent documents, and clinical study reports for all the phases of clinical trials in product development. It mainly focuses on professionals with a sound comprehension of drug/product development processes and analysis of scientific data. In August 2022, AlphaLife Sciences launched AuroraPrime Create 2.0, enhancing clinical document generation with intelligent content recommendations, structured templates, and lifecycle management to streamline and standardize clinical protocol development.

The regulatory writing segment is anticipated to witness the fastest CAGR over the forecast period. It is used throughout the process of product development for clinical documentation. It is required for describing and reporting data from clinical trials for the purpose of regulatory submissions and approvals. When the product or drug receives approval, post-approval regulatory documentation is required. In October 2023, Certara launched CoAuthor, an AI-enabled regulatory and medical writing platform that uses generative AI and structured authoring to streamline clinical trial documentation and cut development timelines by over 20%.

Application Insights

By application, the medical journalism segment dominated the market in 2025 and accounted for the largest revenue share of 38.09%. The segment is mainly concerned with investigating, reporting, and communicating health issues to a wide audience. This type of journalism targets nonprofessional/non-expert audiences, along with healthcare professionals. Based on application, the global market is segmented into medical journalism, medical education, medico marketing, and others. Health-related issues are of common interest to most people, as they have an impact on the behavior of people. In July 2025, the Journal of Health and Allied Sciences NU highlighted that medical journalism is vital in the digital era to bridge the gap between science and public understanding, combat misinformation, and build trust in healthcare.

The medico marketing segment is anticipated to witness the fastest CAGR over the forecast period. Medico-marketing involves designing marketing content for drugs and other products. The ever-changing product mix in the pharmaceutical & biotechnology industry acts as a driving factor for improved marketing practices. For instance, WorkSure provides medico-marketing services in India, helping healthcare organizations enhance product visibility and brand recall through strategic planning, KOL engagement, scientific communications, and content creation such as product videos, promotional literature, and patient education materials.

End Use Insights

The CRO’s and others segment dominated the market in 2025 with a revenue share of 68.25%. The segment includes medical device/pharmaceutical & biotechnology companies, and CROs & others. Drug manufacturers are under pressure to replace revenue loss specifically due to the introduction of generics post-patent expiration. CROs conduct clinical trials to introduce new products in the market in given timelines. They have the required expertise and infrastructure that give the benefit of cost, time, and efficiency at the same time. CROs have a separate service section for medical writing. In October 2025 , Merigold and Log10 launched the Bloom AI platform, integrating Everest’s AI to streamline medical writing and documentation for clinical trials in North America, enhancing accuracy and regulatory compliance.

The medical device/pharma & biotech companies segment is anticipated to register the fastest CAGR over the forecast period. These companies hire writers or journalists frequently. Established pharmaceutical companies have a separate team of medical writers. In addition, various companies outsource writers. For instance, Freyr provides specialized medical writing services across the biopharmaceutical and medical device sectors, covering regulatory submission documents, scientific publications, educational materials, and content for healthcare websites and magazines, with experienced associates supporting a broad range of therapeutic areas.

Regional Insights

North America medical writing industry dominated the global market in 2025 and accounted for the largest revenue share of 36.07%. Clinical writing in the U.S. for FDA approval requires an in-depth understanding of the requirements laid down by the regulatory authority. The documents for FDA submission must be succinct and accurate. In February 2025, Woven Health Collective, formerly ClinicalMind, consolidated multiple brands in North America to provide integrated medical writing, scientific communications, and strategy services, strengthening capabilities in publications, patient advocacy, and tech-enabled healthcare solutions.

U.S. Medical Writing Market Trends

The medical writing industry in the U.S. held the largest share in the North American region in 2025. This is supported by a strong presence of pharmaceutical and biotechnology companies, high clinical trial activity, and stringent regulatory requirements. Demand for regulatory, clinical, and scientific documentation continues to drive market dominance. In December 2024, MMS highlighted the evolving role of medical writers, noting an industry-low attrition rate of 3.5%, and emphasized flexible work arrangements, training, and process improvements to enhance retention and efficiency; the article references MMS headquarters in Canton, Michigan, U.S., and notes collaboration across remote and global teams.

Europe Medical Writing Market Trends

Europe medical writing industry is anticipated to register a significant growth rate during the forecast period. The presence of established pharmaceutical companies, increasing cross-border clinical trials, and evolving EMA regulatory requirements support sustained demand for medical writing services. In December 2024, Medical Writing highlighted the global scope and diversity of medical writing, covering cross-border collaboration, remote work, multilingual challenges, and inclusive practices, alongside the 58th EMWA Conference held across 10 countries with workshops, seminars, and networking opportunities for medical writers.

Germany medical writing industry is anticipated to grow considerably during the forecast period. Growth is supported by a strong pharmaceutical manufacturing base, rising R&D investments, and increasing regulatory documentation needs across clinical and post-marketing stages. In March 2024, Indegene acquired Germany-based Trilogy Writing & Consulting GmbH, a medical writing consultancy specializing in clinical, regulatory, and medical content. The acquisition strengthens Indegene’s capabilities in Germany and supports high-quality regulatory submissions across multiple therapeutic areas.

Italy medical writing industry is anticipated to grow considerably during the forecast period.Expansion of clinical trial activities and growing adoption of outsourced medical writing services by mid-sized pharmaceutical companies are key growth drivers. In September 2024, a survey published in Medical Writing highlighted the demographics, compensation, and work practices of Italian medical writers. Among 68 respondents, 84% were female, and 72% reported high job satisfaction, underscoring the need for enhanced professional recognition and training in Italy.

Asia Pacific Medical Writing Market Trends

Asia Pacific medical writing industry is anticipated to be the fastest-growing region, driven by increasing clinical trial outsourcing, expanding pharmaceutical manufacturing, and the availability of cost-effective, skilled medical writing professionals. In September 2025, according to Dr. Julia Cooper of PAREXEL, medical writing in Asia is growing, driven by increasing pharmaceutical research and regulatory demands in China, Japan, and India, with writers taking on leadership roles in clinical documentation and regulatory submissions.

Japan medical writing industry is anticipated to register a significant growth rate during the forecast period. Stringent regulatory requirements and increasing focus on localized clinical documentation are supporting demand for specialized medical writing services. The need for high-quality English-language documents for global submissions is further boosting demand. In November 2025, Biz Hits and Craudia launched a dedicated medical writing service in Japan, focusing on accurate, evidence-based content for the healthcare sector. The service ensures compliance with local pharmaceutical and medical device regulations while producing clear, digestible material for clients.

China medical writing industry is anticipated to register a significant growth rate during the forecast period. Rapid expansion of pharmaceutical R&D, increasing clinical trial approvals, and evolving regulatory standards are driving demand for medical writing support. Growing adoption of CRO outsourcing is also contributing to the market’s expansion. In October 2025, according to Nature Index, China’s research hospitals are increasingly producing high-quality health research, strengthening the country’s presence in global medical research. This rise highlights China’s growing influence, although questions about publishing integrity remain under scrutiny.

Latin America Medical Writing Market Trends

Latin America medical writing industry is anticipated to grow over the forecast period, fueled by increasing clinical trial activity and rising participation in global drug development programs. Demand for regulatory documentation is gradually expanding across the region. In January 2025, PRO PHARMA Research Organization highlighted trends in medical writing for bio-pharma, including regulatory submissions, clinical study reports, scientific publications, and multilingual support. The organization emphasized AI-assisted drafting, patient-focused content, and localized writing for Brazil and LATAM to ensure accuracy, compliance, and cultural relevance.

Brazil's medical writing industry is projected to grow over the forecast period. Growth is supported by expanding pharmaceutical research activities and increasing regulatory compliance requirements. Growth is supported by expanding pharmaceutical research activities and increasing regulatory compliance requirements. Rising demand for patient-centric and multilingual content is driving the need for skilled medical writers. Integration of digital platforms and AI tools is enhancing productivity and quality in medical writing services.

MEA Medical Writing Market Trends

MEA medical writing industry is anticipated to grow over the forecast period, driven by gradual expansion of clinical research infrastructure and increasing adoption of outsourced medical writing services. In September 2025, BMJ expanded its Research to Publication program in the Middle East, providing medical writing training to 14 rheumatologists in the UAE and 99 participants in Qatar on research design, manuscript preparation, and ethical use of generative AI; both sessions received high feedback ratings of 9.5/10, with the program offering over 200 hours of online medical writing courses across 52 modules.

UAE medical writing industry is anticipated to grow over the forecast period. The country’s role as a regional clinical trial hub and increasing regulatory documentation needs are contributing to steady market growth. In January 2025, IROS, an Abu Dhabi-based CRO, and Halia Therapeutics launched a clinical trial in the UAE on obesity, involving 60 patients with type 2 diabetes. The study aims to advance medical knowledge on obesity treatment and generate high-quality clinical data for global research.

Key Medical Writing Company Insights

Key participants in the medical writing industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Medical Writing Companies:

The following are the leading companies in the medical writing market. These companies collectively hold the largest Market share and dictate industry trends.

- Parexel International Corporation

- Premier Research

- Freyr

- IQVIA Holdings Inc.

- Certara Inc.

- Quanticate

- Soterius, Inc.

- Alimentiv

- Syneos Health

- EVERSANA

Recent Developments

- In November 202 , QInscribe unveiled an AI-powered medical writing service aimed at transforming regulatory submissions by cutting clinical study report draft timelines by up to 90%. The new provider combines generative AI with expert medical writers to deliver accurate, submission-ready regulatory documents at scale, reducing traditional 50-100 hour workflows to as little as five hours.

“Medical writing can benefit from the AI revolution that is reshaping industries worldwide. It can still uphold the highest quality standards that you would expect, but in a fraction of the time,”

-Associate Director of Medical Writing at QInscribe

- In July 2025, Indegene launched NEXT Medical Writing Automation, a GenAI-powered platform designed to accelerate the creation of compliant, high-quality medical and regulatory documents across clinical development and submissions.

“We see this platform as more than automation-it’s about elevating the entire practice of medical writing,Writers can now focus on strategic tasks and critical thinking, while the platform manages the heavy lift of data and formatting.”

-Enterprise Medical Solutions, Indegene

- In January 2025, AINGENS introduced the Medical Affairs Content Generator (MACg), an AI-driven platform designed to simplify medical writing, research, and reference management for life sciences teams. Powered by GPT-4, the tool combines writing assistance, PubMed access, and automated citations to reduce content development time and lower medical writing costs.

Medical Writing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.59 billion

Revenue forecast in 2033

USD 11.09 billion

Growth rate

CAGR of 10.29% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Parexel International Corporation; Premier Research; Freyr; IQVIA Holdings Inc.; Certara Inc.; Quanticate; Soterius, Inc.; Alimentiv; Syneos Health; EVERSANA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Medical Writing Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes industry trends in each sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global medical writing market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Writing

-

Regulatory Writing

-

Scientific Writing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Journalism

-

Medical Education

-

Medico Marketing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Device/Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical writing market size was estimated at USD 5.07 billion in 2025 and is expected to reach USD 5.59 billion in 2026.

b. The global medical writing market is expected to grow at a compound annual growth rate of 10.29% from 2026 to 2033 to reach USD 11.09 billion by 2033.

b. The CRO’s and others segment held the largest share of 68.25% in 2025.

b. Some of the key players in the medical writing market are Parexel International Corporation, Premier Research, Freyr, IQVIA Holdings Inc., Certara Inc., Quanticate, Soterius, Inc., Alimentiv, Syneos Health, and EVERSANA.

b. The high demand for medical writers can be attributed to a rise in CRO outsourcing, increased R&D investments by market players, a favorable environment for clinical study in developing countries, and new medical device regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.