- Home

- »

- Medical Devices

- »

-

Medical Waste Containers Market, Industry Report, 2030GVR Report cover

![Medical Waste Containers Market Size, Share & Trends Report]()

Medical Waste Containers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Type of Waste (General, Infectious, Hazardous), By End-use (Hospitals & Private Clinics, Diagnostic Laboratories, Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-228-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Waste Containers Market Trends

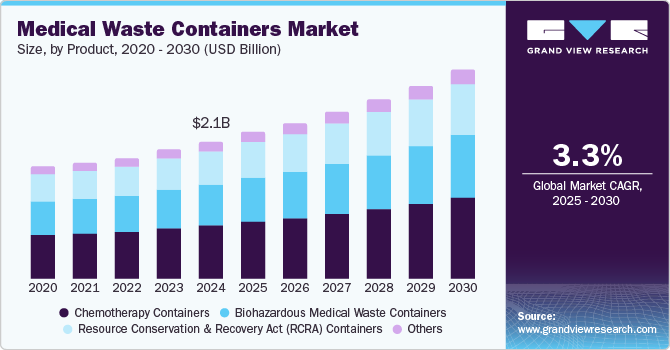

The global medical waste containers market size was estimated at USD 2.14 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. Projections from the WHO indicate that by 2050, the number of individuals aged 60 and older will reach 2 billion. This demographic change is expected to result in higher healthcare utilization and, consequently, greater volumes of medical waste generated from hospitals and healthcare facilities. For instance, the American Hospital Association reported approximately 6,093 hospitals in the U.S. as of 2022, each contributing to substantial medical waste output. This rising demand for effective waste management solutions further propels the market for specialized medical waste containers, as healthcare providers prioritize reliable containment options for safety and regulatory compliance.

According to the Centers for Disease Control and Prevention (CDC), over 1 billion laboratory tests are performed annually in the U.S. This surge in diagnostic testing directly correlates with heightened medical waste generation, necessitating specialized waste disposal solutions. The National Institutes of Health (NIH) has highlighted that enhancements in laboratory procedures are further compelling healthcare facilities to adopt specific waste containers designed to manage various hazardous materials safely. As testing continues to expand, so does the demand for compliant and effective medical waste containers.

Furthermore, rising awareness regarding infection control has intensified the focus on effective medical waste management. The CDC’s 2023 National and State Healthcare-Associated Infections Progress Report revealed that hospital-acquired infections (HAIs) affect approximately 1 in 31 hospital patients daily, underscoring the critical need for proper waste disposal practices. Consequently, healthcare facilities are increasingly investing in compliant medical waste containers to mitigate infection risks, thereby driving demand for solutions that meet stringent safety standards.

In addition, strict regulations governing medical waste disposal compel healthcare providers in North America to utilize specialized containers to comply with legal requirements. For instance, California’s Medical Waste Management Act mandates specific handling practices for hazardous waste, while the U.S. Environmental Protection Agency (EPA) enforces guidelines affecting waste management practices across the healthcare sector. Collectively, these regulatory frameworks drive the adoption of innovative waste management solutions and enhance market growth.

Product Insights

Chemotherapy containers dominated the market and accounted for a share of 38.2% in 2024. The WHO has reported significant rises in cancer cases, necessitating specialized containers for the safe disposal of hazardous chemotherapy waste. Moreover, stringent regulations mandate compliance with safety standards, compelling healthcare facilities to adopt effective waste management solutions.

Resource Conservation and Recovery Act (RCRA) containers are expected to grow at the fastest CAGR of 8.1% over the forecast period. The elevated demand for RCRA containers is driven by stringent regulatory requirements governing the safe disposal of hazardous medical waste. These regulations compel healthcare facilities to use compliant containers throughout the waste management process, prompting investments in RCRA-certified solutions to mitigate legal risks and improve safety standards.

Type Of Waste Insights

General medical waste led the market with a revenue share of 35.3% in 2024, owing to the substantial volume of non-hazardous waste produced in healthcare settings, which accounts for approximately 85% of all medical waste. This growth drives the need for effective disposal solutions and increased demand for general medical waste containers.

Infectious medical waste is expected to register the fastest CAGR of 7.9% over the forecast period due to the rising incidence of infectious diseases and the imperative for rigorous infection control in healthcare facilities. The WHO estimates that approximately 15% of all medical waste is highly infectious, necessitating specialized containers for safe disposal. This increasing awareness of infection risks compels healthcare providers to implement effective waste management practices, thereby elevating the demand for infectious medical waste containers.

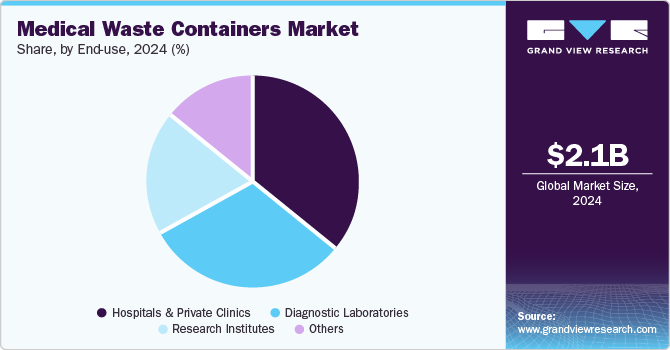

End Use Insights

Hospitals & private clinics held the largest market share of 36.2% in 2024 due to their status as major generators of medical waste. Their need for dependable containment solutions to comply with regulatory standards and ensure patient safety significantly drives the demand for diverse types of medical waste containers within the industry.

Diagnostic laboratories are projected to experience significant growth over the forecast period. The rising volume of annual laboratory tests generates significant medical waste. With over 1 billion tests conducted each year in the U.S., these laboratories necessitate specialized containers for the safe management and disposal of hazardous materials produced during testing. This increase in testing highlights the demand for tailored medical waste management solutions.

Regional Insights

North America medical waste containers market dominated the global market with a revenue share of 45.7% in 2024. Market growth in the region is supported by stringent regulations, particularly the RCRA, governing medical waste disposal. These regulations promote the safe handling and disposal of hazardous materials, compelling healthcare facilities to adopt compliant waste management solutions. The high volume of medical waste from numerous hospitals and clinics further drives demand for specialized containers.

U.S. Medical Waste Containers Market Trends

The medical waste containers market in the U.S. dominated the North America medical waste containers market with the largest revenue share in 2024, aided by the country’s extensive healthcare infrastructure. Strict regulatory requirements for waste disposal and heightened awareness of infection control are prompting healthcare providers to invest in specialized containers. Moreover, ongoing innovations in waste management technologies enhance the safety and effectiveness of medical waste disposal practices.

Europe Medical Waste Containers Market Trends

Europe medical waste containers market held substantial market share in 2024, driven by increasing regulatory pressures on healthcare facilities to manage waste responsibly. The European Union has implemented stringent guidelines for medical waste disposal, facilitating the adoption of specialized containers. Furthermore, rising awareness of environmental sustainability and infection control is propelling demand for efficient waste management solutions in hospitals and clinics throughout the region.

The medical waste containers market in Germany is expected to grow in the forecast period, fueled by stringent healthcare regulations such as the Extended Producer Responsibility and Updated Packaging Act, which mandate safe medical waste disposal practices. Germany’s dedication to environmental sustainability and public health has spurred increased investments in advanced waste management technologies. In November 2024, the German Parliament passed a law to restructure its hospital sector, reducing hospitals, enhancing clinics, and digitalizing processes, with gradual implementation planned from January 2025 to 2029. The rising number of healthcare facilities and diagnostic laboratories in the country further contributes to the escalating demand for specialized medical waste containers.

Asia Pacific Medical Waste Containers Market Trends

Asia Pacific medical waste containers market is expected to register the fastest CAGR of 8.2% in the forecast period. Growing awareness of effective waste disposal practices, coupled with government initiatives advocating for safe medical waste management, is significantly driving the demand for specialized containers in the region. In 2024, the World Health Organization emphasized comprehensive waste management frameworks in Asia, while Southeast Asian nations enhance regulatory measures to curb illegal waste trafficking and promote sustainable waste practices across healthcare settings.

The medical waste containers market in China is expected to register the fastest growth in the Asia Pacific market. The country is experiencing an increase in healthcare services prompted by an aging population and a rise in chronic diseases. The Chinese government has imposed stringent regulations on medical waste management, necessitating the use of compliant containers. Furthermore, ongoing investments in healthcare infrastructure are boosting the demand for effective waste disposal solutions across hospitals and clinics in the country.

Key Medical Waste Containers Company Insights

Some key companies operating in the market include BD; Bemis Manufacturing Company; BWAY Corporation; and Bondtech Corporation; among others. Companies are prioritizing strategic initiatives such as product innovation, expanding distribution networks, and improving regulatory compliance.

-

Bemis Manufacturing Company specializes in a comprehensive range of medical waste containers, including those for sharps, chemotherapy, and pharmaceuticals. Their Sentinel by Bemis product line meets stringent safety standards, ensuring puncture resistance and compliance with OSHA, NIOSH, and CDC regulations.

-

Bondtech Corporation is dedicated to delivering innovative medical waste management solutions, including durable and compliant waste containers. Their products are designed for safe containment of hazardous materials while prioritizing sustainability and regulatory compliance to meet healthcare industry demands.

Key Medical Waste Containers Companies:

The following are the leading companies in the medical waste containers market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Bemis Manufacturing Company

- BWAY Corporation

- Bondtech Corporation

- Daniels Sharpsmart Inc.

- EnviroTain, LLC.

- Thermo Fisher Scientific Inc.

- Cardinal Health

- Henry Schein, Inc.

- Sharps Medical Waste Services

Recent Developments

-

In October 2024, Mun Australia launched innovative Sharps Containers made with up to 75% recycled plastic, enhancing safety and sustainability in healthcare while reducing environmental impact and meeting compliance standards.

-

In October 2024, Urbaser confirmed its acquisition of Stericycle’s assets in Spain and Portugal, expanding its biomedical waste services, while the pending Canadian antitrust review delayed WM’s acquisition of Stericycle.

-

In June 2024, Thermo Fisher Scientific Inc. introduced innovative bio-based films for bioprocessing containers, promoting sustainability by reducing carbon emissions from plastic resin, while earning ISCC PLUS certification for circular products.

-

In March 2024, BD and a Danish healthcare consortium developed a method to recycle used blood collection tubes, diverting 33 tonnes of plastic from incineration annually while ensuring hygiene and quality.

Medical Waste Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.28 billion

Revenue forecast in 2030

USD 3.28 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type of waste, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

BD; Bemis Manufacturing Company; BWAY Corporation; Bondtech Corporation; Daniels Sharpsmart Inc.; EnviroTain, LLC.; Thermo Fisher Scientific Inc.; Cardinal Health; Henry Schein, Inc.; Sharps Medical Waste Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Waste Containers Market Report Segmentation

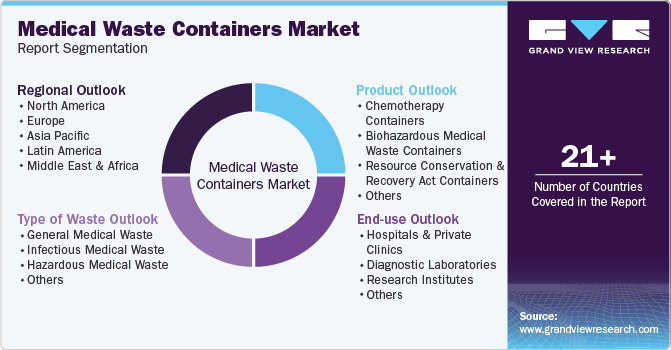

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical waste containers market report based on product, type of waste, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy Containers

-

Biohazardous Medical Waste Containers

-

Resource Conservation and Recovery Act (RCRA) Containers

-

Others

-

-

Type of Waste Outlook (Revenue, USD Million, 2018 - 2030)

-

General Medical Waste

-

Infectious Medical Waste

-

Hazardous Medical Waste

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Private Clinics

-

Diagnostic Laboratories

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical waste containers market size was estimated at USD 1.64 billion in 2019 and is expected to reach USD 1.72 billion in 2020.

b. The global medical waste containers market is expected to grow at a compound annual growth rate of 6.1% from 2020 to 2027 to reach USD 2.61 billion by 2027.

b. North America dominated the medical waste containers market with a share of 45.34% in 2019. This is attributable to an increase in the number of surgeries, healthcare workers, rising cases of hospital-acquired infections, and the outbreak of COVID-19.

b. Some key players operating in the medical waste containers market include BD, Bemis Manufacturing Company, Mauser Packaging Solutions, Bondtech Corporation, and Thermo Fisher Scientific Inc.

b. Key factors that are driving the medical waste containers market growth include increasing patient population, the rising volume of diagnostic and lab testing samples, and growing awareness of the benefits of hospital waste management in curbing the spread of infection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.