- Home

- »

- Medical Devices

- »

-

Medical Imaging Outsourcing Market Size, Share Report 2030GVR Report cover

![Medical Imaging Outsourcing Market Size, Share & Trends Report]()

Medical Imaging Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Computed Tomography, Magnetic Resonance Imaging), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-558-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Imaging Outsourcing Market Trends

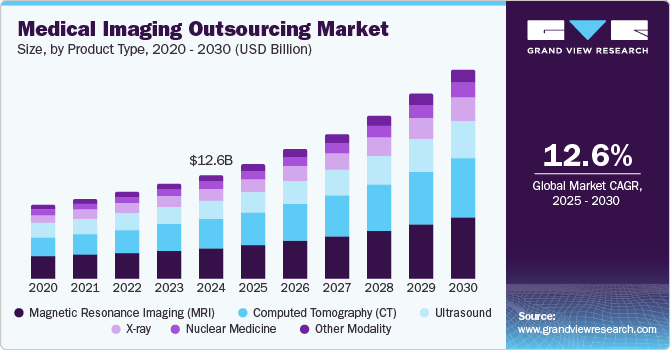

The global medical imaging outsourcing market was estimated at USD 12.61 billion in 2024 and is anticipated to grow at a CAGR of 12.6% from 2025 to 2030. The increasing demand for cost-effective solutions in healthcare has led many organizations to consider outsourcing medical imaging services. By outsourcing, healthcare providers can significantly reduce operational costs, such as expenses related to maintaining in-house imaging departments, hiring skilled personnel, and managing expensive equipment. As a result, medical facilities can streamline their operations while maintaining high-quality imaging services. The medical imaging outsourcing industry has thus become a viable solution for healthcare providers aiming to optimize their resources and improve service efficiency.

The increasing use of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing medical imaging. Outsourcing companies are incorporating these technologies to improve image analysis, minimize errors, and speed up diagnoses. AI and ML algorithms help to identify patterns and abnormalities, enhancing diagnostic accuracy quickly. In addition, the growth of telemedicine has led to a higher demand for remote image processing, archiving, and consulting services. Outsourcing companies are expanding their offerings to meet this demand, providing solutions that support telehealth practices. These advancements are reshaping the medical imaging outsourcing industry.

In addition, the increasing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurological conditions, is driving the need for more advanced imaging services. As these diseases become more common, healthcare providers require higher volumes of diagnostic imaging to detect and monitor them. Moreover, the global aging population contributes to the demand for imaging services, as older individuals typically require more frequent medical scans. This growing demand for diagnostic imaging puts pressure on healthcare facilities to seek efficient solutions. Outsourcing medical imaging services has become a practical option to meet these needs. Hence, the medical imaging outsourcing industry continues to expand.

Product Type Insights

The Magnetic Resonance Imaging (MRI) segment dominated the market with a revenue share of 30.7% in 2024, driven primarily by the increasing prevalence of chronic diseases, particularly cancer and neurological disorders. MRI is recognized for its ability to provide high-resolution images without ionizing radiation, making it a preferred choice for diagnostic imaging. In addition, advancements in MRI technology, such as the integration of AI and improved imaging techniques, have enhanced its diagnostic capabilities, further boosting its adoption in healthcare.

The Computed Tomography (CT) segment is projected to grow at the highest CAGR of 13.3% over the forecast period, fueled by its rapid imaging capabilities and cost-effectiveness. CT scans are essential for diagnosing a variety of conditions, including trauma and internal bleeding, which require immediate attention. The ongoing development of advanced CT technologies, such as dual energy and spectral CT, is expected to improve image quality and expand its applications in clinical settings, thereby driving market growth.

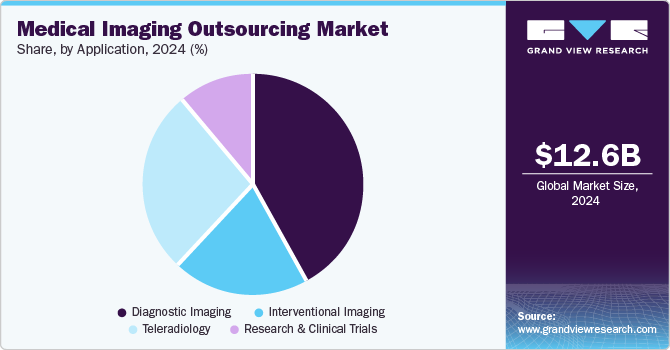

Application Insights

The diagnostic imaging segment dominated the market with the largest revenue share in 2024, driven by the growing demand for early disease detection and monitoring. Healthcare providers emphasize preventative care and diagnostic imaging, essential in identifying potential health issues early. The use of advanced imaging technologies has further enhanced diagnostic accuracy, helping to improve patient outcomes. This has increased reliance on diagnostic imaging services, driving market growth. Therefore, the medical imaging outsourcing industry benefits from this rising demand for precise and timely imaging solutions.

The teleradiology segment is projected to grow at the highest CAGR over the forecast period due to the rising demand for remote diagnostics and consultations. Teleradiology allows healthcare facilities to access specialized radiological expertise regardless of geographical location, which speeds up diagnosis and treatment decisions. This is particularly important in areas with a shortage of radiologists. The increasing adoption of telemedicine and digital health solutions further fuels this trend, improving access to quality healthcare services. Hence, the medical imaging outsourcing industry is experiencing significant growth in teleradiology.

End-use Insights

The hospitals & clinics segment dominated the market with the largest revenue share in 2024, fueled by the increasing installation of advanced imaging equipment and a growing patient population requiring diagnostic services. Hospitals are investing significantly in upgrading their imaging facilities to provide comprehensive care and improve patient outcomes. The presence of skilled professionals and specialized departments within hospitals also contributes to their dominance in the market.

The interventional imaging centers segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to the rising demand for minimally invasive procedures. These centers use imaging guidance for various interventions, such as biopsies and catheter placements, which are becoming increasingly popular due to their reduced recovery times and complications compared to traditional surgeries. This trend is likely to drive further investment in interventional imaging technologies.

Regional Insights

North America medical imaging outsourcing market held the highest revenue share of 42.3% in 2024, driven by high healthcare expenditure and an advanced medical infrastructure that supports extensive diagnostic services. The region's strong emphasis on technological innovation in medical imaging has led to increased outsourcing of these services as healthcare providers seek cost-effective solutions while maintaining high-quality standards.

U.S. Medical Imaging Outsourcing Market Trends

The U.S. medical imaging outsourcing market dominated North America with a significant revenue share in 2024 due to its robust healthcare system characterized by high demand for diagnostic services. The increasing prevalence of chronic diseases necessitates efficient imaging solutions that outsourcing can provide. Moreover, integrating digital technologies in imaging processes enhances service delivery efficiency, further propelling growth in the U.S. market.

Europe Medical Imaging Outsourcing Market Trends

Europe medical imaging outsourcing market held a substantial market share in 2024, driven by an aging population that requires more frequent diagnostic testing. The region's focus on improving healthcare accessibility through outsourcing allows providers to leverage specialized expertise while managing operational costs effectively. In addition, technological advancements continue to enhance service quality within this Europe medical imaging outsourcing market.

Asia Pacific Medical Imaging Outsourcing Market Trends

Asia Pacific medical imaging outsourcing market is expected to register the highest CAGR of 13.8% over the forecast period, which can be attributed to rapid economic growth and increasing healthcare investments in countries such as India and China. The rising prevalence of chronic diseases, coupled with a growing population, drives demand for efficient diagnostic services that outsourcing can effectively fulfill.

The China medical imaging outsourcing market dominated the Asia Pacific, with a significant revenue share in 2024 due to its vast population and rising healthcare needs. The country's ongoing improvements in healthcare infrastructure and increased investments in advanced medical technologies are enhancing service delivery capabilities. This environment encourages an expanding market for outsourced medical imaging services as providers seek efficient solutions for growing patient demands.

Key Medical Imaging Outsourcing Company Insights

Some key companies operating in the market are Alliance Medical Limited; Flatworld Solutions Inc; MetaMed; North American Science Associates, LLC, and Shields MRI. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in medical imaging outsourcing market.

-

Alliance Medical Limited provides various imaging services, including MRI, CT, PET-CT, X-ray, DXA, and ultrasound scans, at fixed locations and mobile units. It also operates community diagnostic centers to improve patient access and reduce waiting times and radioactive isotope production facilities to support PET-CT scanning.

-

Flatworld Solutions Inc. offers various services for the medical imaging outsourcing market, including MRI, CT scans, ultrasound, mammography, and teleradiology, supported by a custom-built PACS for efficient image management. It prioritizes data security and HIPAA compliance, ensuring confidentiality and quality control.

Key Medical Imaging Outsourcing Companies:

The following are the leading companies in the medical imaging outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Alliance Medical Limited

- Flatworld Solutions Inc

- MetaMed

- North American Science Associates, LLC

- Shields MRI

- ProScan Imaging, LLC

- RadNet Inc.

- TOSHIBA CORPORATION

- Hitachi High-Tech Corporation

- CANON MEDICAL SYSTEMS CORPORATION

Recent Developments

-

In September 2024, Flatworld Solutions opened a new office in Ahmedabad, India, marking an important milestone in its 18-year history of providing high-quality services to international clients. The new office is expected to focus on mobile and eCommerce development services to meet the needs of a major client in Los Angeles and enhance service delivery by utilizing local talent.

-

In December 2023, ProScan Imaging acquired OpenSided MRI in Jeffersonville, Indiana, adding a state-of-the-art imaging center with advanced technology, including a High-Field Fuji Oasis 1.2T Open MRI and Fuji Supria Plus CT scanner. This expansion marked the company's second location in the Kentuckiana area, complementing its existing center in Louisville.

Medical Imaging Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.96 billion

Revenue forecast in 2030

USD 25.23 billion

Growth rate

CAGR of 12.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type,application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U;S;, Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait;

Key companies profiled

Alliance Medical Limited; Flatworld Solutions Inc; MetaMed; North American Science Associates, LLC; Shields MRI; ProScan Imaging, LLC; RadNet Inc; TOSHIBA CORPORATION; Hitachi High-Tech Corporation; CANON MEDICAL SYSTEMS CORPORATION.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Imaging Outsourcing Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global medical imaging outsourcing market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computed Tomography (CT)

-

Magnetic Resonance Imaging (MRI)

-

Ultrasound

-

X-ray

-

Nuclear Medicine

-

Other Modality

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Imaging

-

Interventional Imaging

-

Teleradiology

-

Research and Clinical Trials

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Interventional Imaging Centers

-

Other End Use

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.