- Home

- »

- Medical Devices

- »

-

Medical Billing Outsourcing Market, Industry Report, 2033GVR Report cover

![Medical Billing Outsourcing Market Size, Share & Trends Report]()

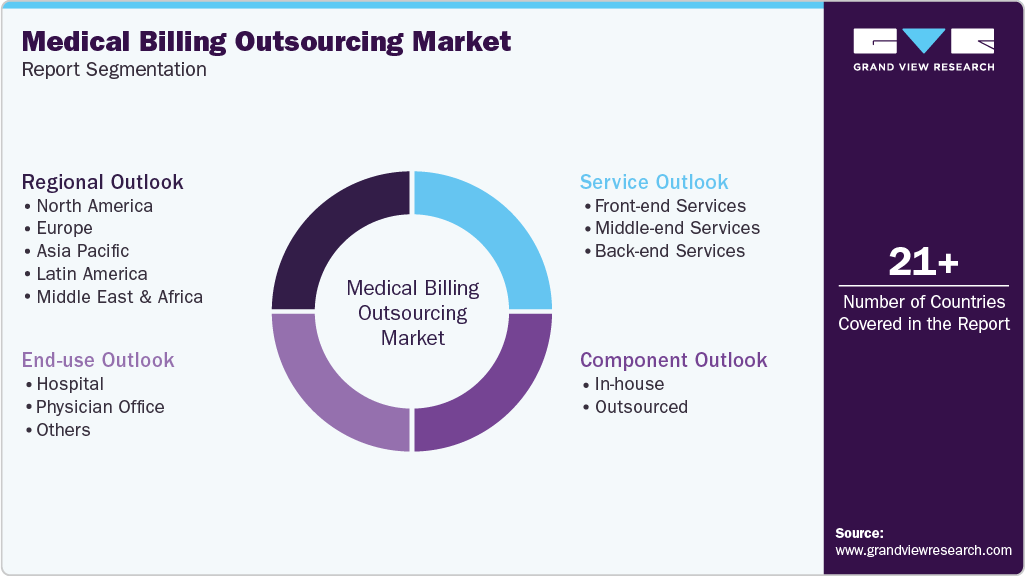

Medical Billing Outsourcing Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (In-house, Outsourced), By Service (Front-end, Middle-end, Back-end), By End-use (Hospital, Physician Office), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-261-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Billing Outsourcing Market Summary

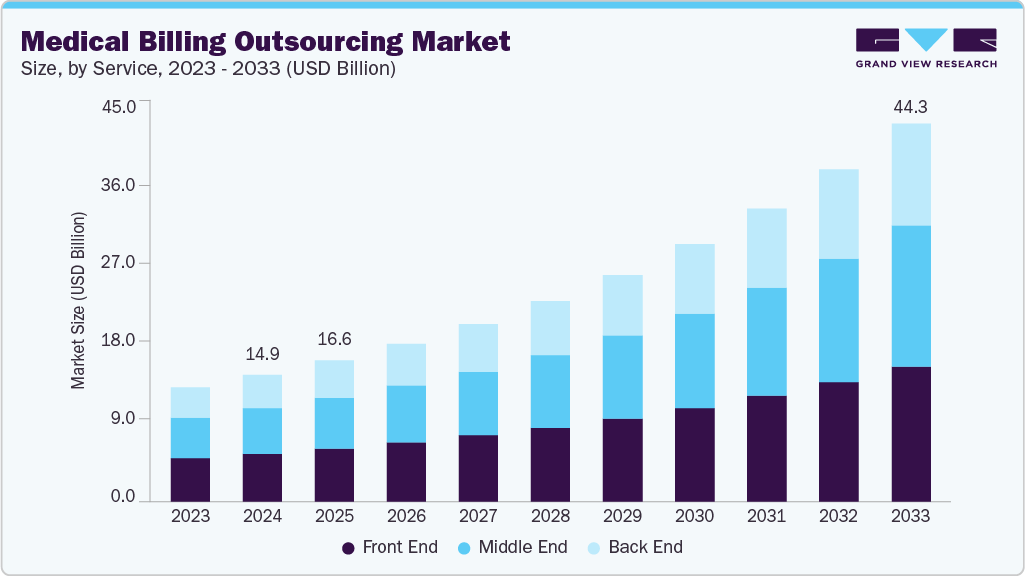

The global medical billing outsourcing market size was estimated at USD 14.90 billion in 2024 and is projected to reach USD 44.30 billion by 2033, growing at a CAGR of 13.06% from 2025 to 2033. Increasing complexity in medical billing, expansion of telehealth services, growing need for revenue cycle management (RCM) optimization, and changing regulatory guidelines are factors contributing to market growth.

Key Market Trends & Insights

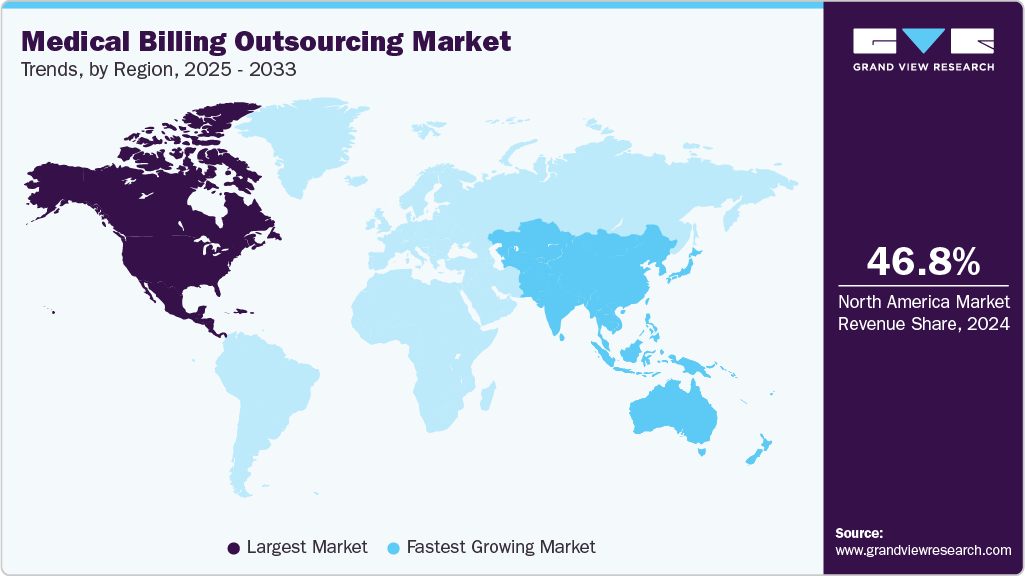

- North America dominated the medical billing outsourcing market with the largest revenue share of 46.78% in 2024.

- The medical billing outsourcing market in the U.S. accounted for the largest market revenue share in 2024.

- By component, the outsourced segment led the market with the largest revenue share of 54.93% in 2024 and is expected to register at the fastest CAGR from 2025 to 2033.

- Based on services, the front-end services segment led the market with the largest revenue share of 37.76% in 2024.

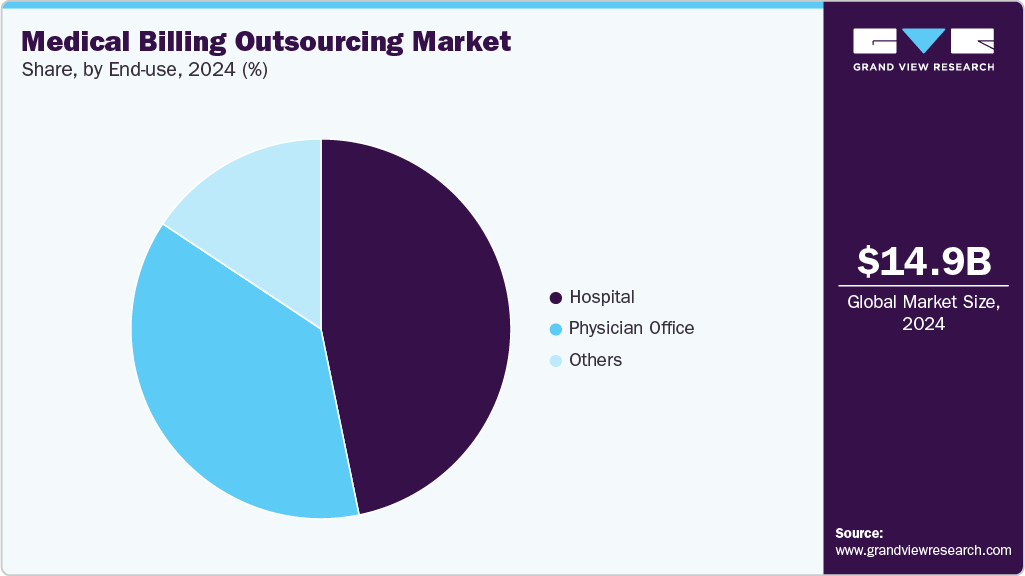

- By end-use, the hospitals segment accounted for the largest market revenue share of 46.78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.90 Billion

- 2033 Projected Market Size: USD 44.30 Billion

- CAGR (2025-2033): 13.06%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Medical billing outsourcing helps lower equipment and software expenses, improving cash flow, and reducing employee size and costs. The increased cost of healthcare, particularly in developed countries, has led to continuous advancements, allowing for the high adoption of modern technology devices and equipment, such as RCM software. The rising patient load and the need to address the increasing records and bills are creating a burden on health practitioners. To counter such a situation, hospitals are outsourcing the clinical billing process, which is expected to drive the market growth.

Owing to the evolving healthcare landscape, healthcare providers increasingly partner with specialized vendors or companies to modernize and optimize their billing operations. For instance, in July 2023, Veradigm secured two multi‑year provider agreements: one with State of Franklin Healthcare Associates across Tennessee and Virginia for expanded RCM services, and another with Total Orthopedics and Sports Medicine in the New York/New Jersey region to enhance billing, scheduling, and digital engagement.

The medical coding classification system is continually evolving, contributing to the market's expansion. Billing for surgical procedures often poses significant challenges for many healthcare professionals and organizations, particularly those lacking access to qualified coding specialists. Thus, healthcare providers, hospitals, clinicians, and physicians increasingly outsource their medical billing and financial management functions to specialized third-party service providers.

The adoption of advanced technologies, coupled with the need for cost, labor, and time efficiency, is driving healthcare providers to prefer outsourcing medical billing services increasingly. Demand for these services is growing as providers seek to minimize errors and reduce internal administrative expenses. Outsourcing enhances organizational revenue by delivering significant savings on infrastructure, payroll, maintenance, procurement, and software updates. In addition, established outsourcing firms provide healthcare organizations with streamlined and transparent processes, ensuring both efficiency and accountability in billing operations.

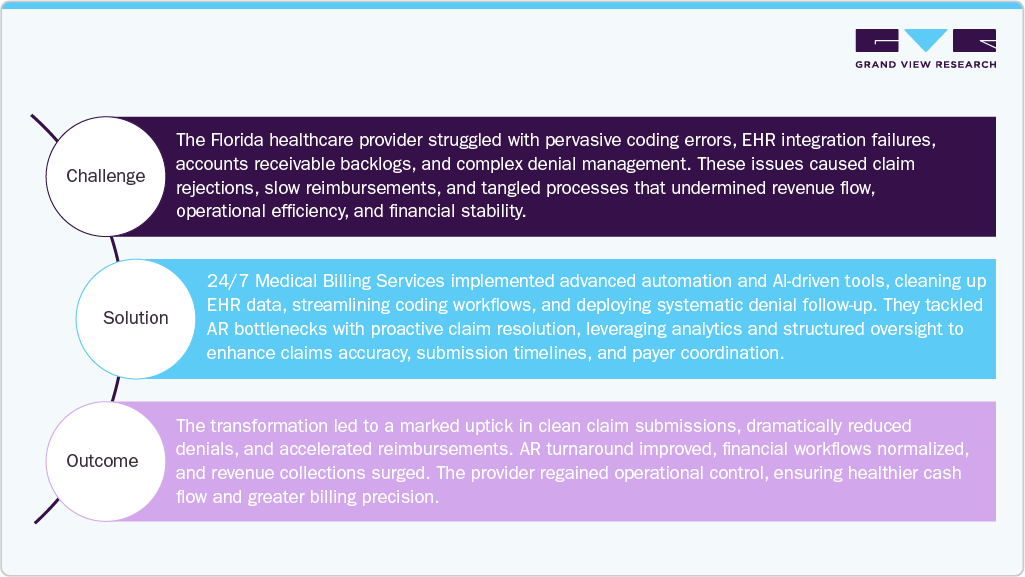

Case Study

The following case study shows how a Florida healthcare provider overcame billing inefficiencies and financial setbacks through expert intervention, driving improved reimbursements and operational performance.

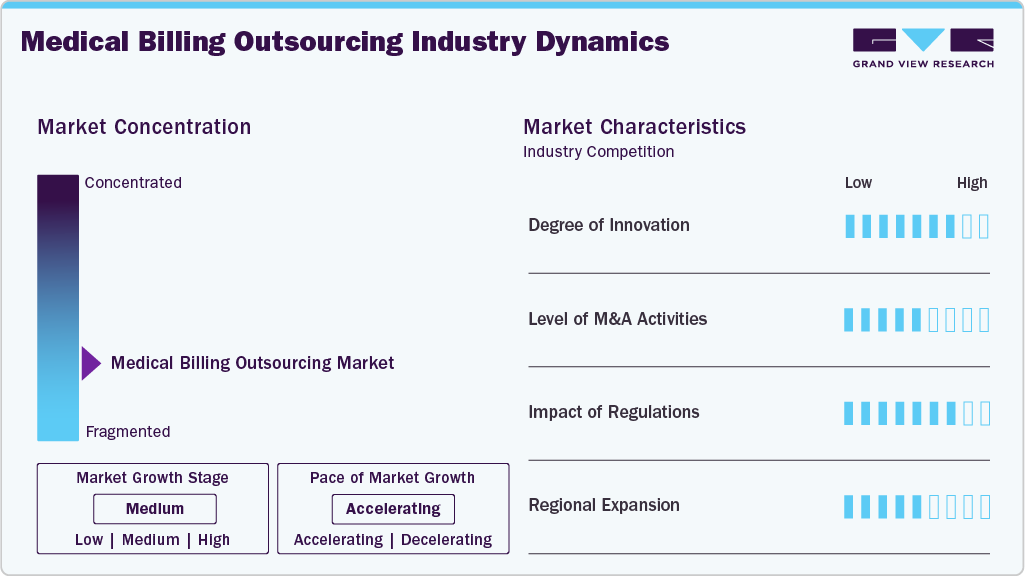

Market Concentration & Characteristics

The degree of innovation in the medical billing outsourcing industry is high, primarily driven by integrating artificial intelligence (AI) and machine learning (ML) into billing and revenue cycle management processes. Companies are developing advanced analytics platforms to predict claim denials, automate coding tasks, and enhance billing accuracy. The shift to cloud-based billing systems and AI-driven dashboards enables real-time financial metrics tracking and improves decision-making.

The level of mergers & acquisitions in the medical billing outsourcing industry is moderate as companies aim to expand their service portfolios, client base, and geographic reach. For instance, in January 2024, Veradigm expanded its Revenue Cycle Services portfolio by acquiring Koha Health, enhancing its ambulatory RCM capabilities with musculoskeletal care expertise, streamlining workflows and EHR integration, and reinforcing its commitment to cost-effective, scalable financial management solutions.

The impact of regulations in the medical billing outsourcing industry is moderate to high, especially in regions such as the U.S., where laws such as the HIPAA, ACA, and MACRA impose strict data privacy and billing compliance requirements. These laws have increased the demand for specialized outsourcing partners who can ensure the secure handling of patient information and maintain regulatory compliance across diverse payer systems.

Regional expansion in the medical billing outsourcing industry is moderate. Companies target emerging regions, owing to their growing healthcare infrastructure, rising patient volumes, and cost-effective labor. In addition, regional players are forming partnerships with local healthcare providers to cater to country-specific billing regulations and language requirements, expanding their global footprint. For instance, in May 2021, R1 expanded and extended its revenue cycle management partnership with Ascension, reinforcing its role in patient experience technologies, including unified scheduling, payments, and access platforms. It also secured a contract extension through 2031 to enhance its nationwide digital engagement strategy.

Component Insights

The outsourced segment led the market with the largest revenue share of 54.93% in 2024 and is expected to register at the fastest CAGR from 2025 to 2033. Outsourcing services have proven highly effective in reducing costs and are particularly well-suited for small and medium-sized healthcare operations. Recent regulations have also added complexity to administrative processes, making outsourcing a beneficial solution for sustaining efficiency and compliance. For instance, according to a survey published by the Medical Group Management Association (MGMA) in May 2023, the average denial rate for medical claims is estimated to be between 5% and 10%. Such factors are anticipated to drive segment growth.

Moreover, many companies are adopting cloud-based medical billing capabilities for enhanced security of patient data. For instance, in July 2024, Odyssey House in Utah implemented Oracle Health’s EHR and behavioural health solutions at its Martindale Clinic. The upgrade automated billing and revenue cycle functions, unified clinical and financial data, streamlined workflows, and enhanced care coordination for patients and providers.

Service Insights

The front-end services segment led the market with the largest revenue share of 37.76% in 2024. Front-end services consist of processes, such as scheduling, preregistration, registration, pre-authorization, and insurance verification. It involves the major functions of medical billing. Managing front-end services helps reduce repetitive work and improve patient experience with quick service. Hence, the demand for outsourcing these services is strong.

The middle-end services segment is expected to experience at the fastest CAGR during the forecast period, driven by the entry of new market participants and increasing awareness among healthcare practitioners. These services have emerged as the most widely outsourced function, mainly due to the sensitive nature of healthcare data and the complexities associated with managing its transfer internally. Outsourcing provides a more efficient and cost-effective solution, enabling providers to address these challenges while ensuring data accuracy, compliance, and operational efficiency.

End-use Insights

The hospital segment led the market with the largest revenue share of 46.78% in 2024. The segment is expected to maintain its dominance throughout the forecast period. This is primarily due to the increasing demand for financing services in healthcare facilities. For instance, in January 2022, Day Kimball Healthcare partnered with Ensemble Health Partners to manage its full patient financial journey, from scheduling and registration through billing and collections, leveraging Ensemble’s technology and expertise to boost patient experience and financial performance. In addition, Luminis Health, a Maryland-based nonprofit, partnered in December 2022 with VisiQuate to deploy its Denials Management and Revenue Management, integrated with Epic, to deliver real-time, unified hospital and physician billing insights that improve financial operations.

The physician office segment is expected to grow at the fastest CAGR over the forecast period, driven by the increasing administrative burden faced by independent practices and small clinics. Physicians are outsourcing billing functions to ensure accuracy and efficiency with declining reimbursement rates and rising regulatory complexities. By leveraging external expertise, practices are anticipated to streamline revenue cycle management, optimize reimbursements, and accelerate payment cycles. Smaller practices benefit significantly, as they often lack the infrastructure or workforce to handle evolving compliance requirements.

Regional Insights

North America dominated the global medical billing outsourcing market with the largest revenue share of 46.78% in 2024. The dominance is due to the widespread adoption of electronic health records (EHR), high healthcare expenditure, and growing demand for revenue cycle management services. The presence of well-established healthcare infrastructure and strict regulatory frameworks, such as HIPAA, drives healthcare providers to seek professional billing services to ensure compliance. The region’s advanced technological landscape further supports the rapid adoption of AI-based and automated billing solutions.

U.S. Medical Billing Outsourcing Market Trends

The medical billing outsourcing market in the U.S.accounted for the largest market revenue share in 2024, owing to its robust healthcare reimbursement system. The growing pressure on hospitals and clinics to reduce operational costs, manage high claim denial rates, and improve patient care has led to a surge in outsourcing billing services. In addition, frequent changes in coding systems and insurance policies further compel healthcare providers to rely on third-party billing experts to ensure timely and accurate reimbursements.

Europe Medical Billing Outsourcing Market Trends

The medical billing outsourcing market in Europe is expected to grow at a significant CAGR over the forecast period, supported by the rising digital transformation of healthcare systems and increasing pressure to improve billing efficiency. European countries are investing in outsourcing to reduce administrative burdens and improve compliance with evolving regulations. The rise of private healthcare providers and the shift toward value-based care drive demand for the market in this region.

The UK medical billing outsourcing market is anticipated to grow at a significant CAGR over the forecast period, as healthcare providers, especially in the private sector, increasingly outsource non-clinical tasks such as billing to streamline operations. Although the National Health Service (NHS) manages a significant portion of healthcare services, private providers are adopting outsourced billing to improve cash flow and operational transparency. The demand is further driven by the need for digital billing platforms and growing interest in artificial intelligence-based claim processing.

Asia Pacific Medical Billing Outsourcing Market Trends

The medical billing outsourcing market in the Asia Pacific is anticipated to witness at the fastest CAGR during the forecast period. Emerging countries such as India and China are anticipated to register high growth owing to increasing patient populations and improving healthcare infrastructure. Increasing awareness about clinical billing software and the rising adoption of the latest technology are expected to boost the market.

The China medical billing outsourcing market is rising significantly due to its rapidly growing healthcare sector, increasing urbanization, and focus on healthcare IT infrastructure. The country's efforts to modernize its medical billing processes and implement advanced digital tools create opportunities for outsourcing companies. In addition, local providers are exploring partnerships with global firms to improve efficiency and reduce administrative burdens in public and private hospitals.

Latin America Medical Billing Outsourcing Market Trends

The medical billing outsourcing market in Latin America is anticipated to grow at a significant CAGR over the forecast period. Economic development, expanding healthcare access, and growing private healthcare providers are key drivers for the region. Outsourcing is seen as a viable option to manage rising operational costs and improve claim processing accuracy. However, concerns around data security and inconsistent IT infrastructure in some countries are expected to limit growth.

The Brazil medical billing outsourcing market is expected to grow at a substantial CAGR over the forecast period due to factors such as its large population and growing private healthcare sector. The complexity of billing regulations and the need for accurate reimbursement management are prompting private hospitals and clinics to adopt outsourced billing services. In addition, the government's focus on healthcare modernization and the rising penetration of digital tools support market development.

Middle East & Africa Medical Billing Outsourcing Market Trends

The medical billing outsourcing market in the Middle East and Africa is anticipated to grow at a significant CAGR over the forecast period, due to improving healthcare infrastructure, increasing investments in hospital digitization, and the rising presence of private healthcare providers. The demand for efficient billing and revenue cycle management is rising, particularly in the Gulf Cooperation Council (GCC) countries.

The Kuwait medical billing outsourcing market is growing as the country is gradually adopting medical billing outsourcing as part of its broader healthcare digitization strategy. Government initiatives to modernize healthcare services, the expansion of private healthcare facilities, and the rising demand for efficient administrative processes are driving interest in outsourcing. The market is expected to benefit from regional collaborations and increased investment in IT infrastructure in the coming years.

Key Medical Billing Outsourcing Company Insights

The key companies in the industry continuously undertake strategies such as partnerships, technological advancements, mergers, and acquisitions to strengthen their market position. For instance, in March 2022, Omega Healthcare acquired Reventics, an RCM solution developer that provides solutions for provider engagement to improve compliance and physician reimbursement. Furthermore, in May 2023, Aspirion, a leading RCM provider, announced the acquisition of FIRM Revenue Cycle Management Services, Inc.

Key Medical Billing Outsourcing Companies:

The following are the leading companies in the medical billing outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- R1RCM Inc.

- Veradigm, LLC

- eClinicalWorks

- Oracle

- Kareo, Inc.

- Quest Diagnostics Incorporated

- AdvancedMD, Inc.

- Promantra Inc.

- McKesson Corporation

Recent Developments

-

In May 2025, U.S.-based R1 announced an investment from Khosla Ventures to accelerate its AI-driven healthcare transformation initiatives, aiming to enhance operational efficiency and innovation across the healthcare revenue cycle through advanced artificial intelligence solutions.

“AI is transforming every corner of the economy, with healthcare being one of the largest sectors of impact. R1 is pioneering the use of AI in healthcare revenue management, and we are excited to partner with them as they leverage AI to simplify the healthcare experience for patients and help providers operate more efficiently.”

-Vinod Khosla, founder of Khosla Ventures.

-

In May 2025, U.S.-based Hendry Regional Medical Center in Florida leveraged eClinicalWorks’ AI medical scribe, Sunoh.ai, to automate clinical documentation. This deployment reduced end-of-day charting lag by over two hours per provider and accelerated billing workflows.

“Sunoh.ai streamlines documentation methods for our providers; they can easily access the AI scribe and document on any device, such as a phone, tablet, or laptop. Moreover, the medical transcription software generates the HPI details and inserts them into the appropriate sections of the patient’s progress notes, saving providers substantial time and effort. Sunoh.ai saves our providers more than two hours daily. The AI medical scribe allows providers to lock the progress notes promptly, enabling the billing staff to manage their workflows efficiently. The detailed transcripts also assist billers and coders in identifying missing CPT and ICD codes, ensuring no revenue is lost and improving overall practice workflows.”

-Esteban Gentle, Analyst at Hendry Regional Medical Center.

-

In March 2025, R1 and Palantir launched R37, an advanced AI lab in the U.S., designed to revolutionize healthcare financial performance by automating coding, billing, and denial management processes to boost efficiency, accuracy, and cash flow for health systems.

“R1 is thrilled to partner with Palantir to bring the transformational power of agentic AI to the revenue cycle through R37. With our leading experts in reimbursement and history of automation, this lab will further accelerate investments on behalf of providers and create a new revenue cycle that delivers a faster, frictionless, and more transparent financial experience for both providers and patients.”

-Joe Flanagan, CEO of R1

-

In October 2024, eClinicalWorks unveiled breakthrough AI-powered solutions at its National Conference in Westborough, Massachusetts. The enhancements include RCM automation and patient experience tools, aimed at optimizing practice efficiency.

“After 25 years, our mission remains true and simple: improve healthcare together. We are committed to transforming the healthcare industry with cutting-edge AI-driven technology with a patient-centric approach. We believe that by working together and leveraging these groundbreaking AI enhancements, we can improve patient outcomes, reduce physician burnout, and transform the patient experience.”

-Girish Navani, CEO and cofounder of eClinicalWorks.

-

In October 2024, Oracle introduced Oracle Health Payments, an embedded, PCI-compliant payments platform built on Oracle Cloud Infrastructure. It enabled clinics and hospitals across the U.S. to streamline patient transactions, supporting card and mobile tap payments while reducing fees and automating reconciliation.

“Healthcare providers are looking to minimize unnecessary expenses and enhance security and efficiency in all aspects of their business.”

Seema Verma, Executive Vice President, Oracle.

Medical Billing Outsourcing Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 16.59 billion

The revenue forecast in 2033

USD 44.30 billion

Growth rate

CAGR of 13.06% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, service, end-use, region

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

R1RCM Inc.; Veradigm, LLC; eClinicalWorks; Oracle; Kareo, Inc.; Quest Diagnostics Incorporated; AdvancedMD, Inc.; Promantra Inc.; McKesson Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Billing Outsourcing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical billing outsourcing market report based on component, service, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

In-house

-

Outsourced

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Front-end Services

-

Middle-end Services

-

Back-end Services

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital

-

Physician Office

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical billing outsourcing market size was estimated at USD 14.90 billion in 2024 and is expected to reach USD 16.59 billion in 2025.

b. The global medical billing outsourcing market is expected to grow at a compound annual growth rate of 13.06% from 2025 to 2033 to reach USD 44.30 billion by 2033.

b. North America held the largest revenue share of 46.78% in the medical billing outsourcing market in 2024. The dominance is due to the widespread adoption of electronic health records (EHR), high healthcare expenditure, and growing demand for revenue cycle management services. The presence of well-established healthcare infrastructure and strict regulatory frameworks such as HIPAA drives healthcare providers to seek professional billing services to ensure compliance.

b. Some key players operating in the medical billing outsourcing market include R1RCM Inc.; Veradigm, LLC; eClinicalWorks; Oracle; Kareo, Inc.; Quest Diagnostics Incorporated; AdvancedMD, Inc.; Promantra Inc.; and McKesson Corporation

b. Key factors that are driving the medical billing outsourcing market growth include increasing complexity in medical billing, expansion of telehealth services, growing need for revenue cycle management (RCM) optimization, and changing regulatory guidelines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.