- Home

- »

- Consumer F&B

- »

-

Meat Stabilizers Blends Market Size, Industry Report, 2030GVR Report cover

![Meat Stabilizers Blends Market Size, Share & Trends Report]()

Meat Stabilizers Blends Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Plant, Seaweed, Animal), By Application (Meat Processing, HoReCa, Pet Food), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-171-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Stabilizers Blends Market Trends

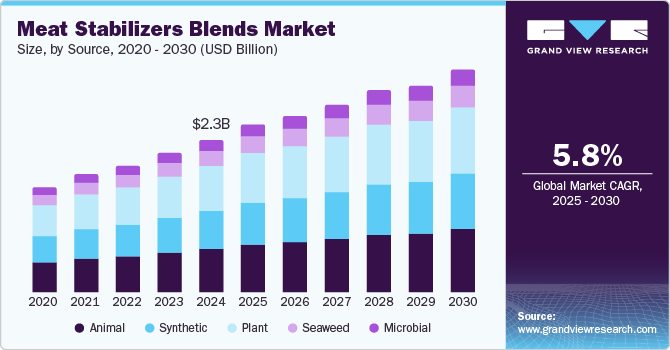

The global meat stabilizers blends market size was valued at USD 2.27 billion in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2030. The rising demand for processed meat products, particularly in developing regions such as China and India, is driving the market growth. Consumers' increasing preference for convenience foods and the growing importance of stabilizing agents for improving texture and smoothness in meat products also contribute to market growth. Additionally, the focus on food safety and the rising health consciousness among consumers drives the demand for natural and organic meat stabilizers. The expanding applications of meat stabilizers in the pharmaceutical and pet food industries further support market expansion.

The globalization of meat processing and the increasing focus on food safety are significant drivers for this market. Furthermore, consumers' growing preference for natural and organic products drives demand for stabilizers derived from plant, microbial, and seaweed sources.

The increasing demand for organic foods in developed countries, including the U.S., Germany, France, and the U.K., is expected to expand the scope of application for organic stabilizing agents in the industry. Manufacturers focus on R&D of organic products to meet consumer demand. A growing number of organic meat producers on a global scale is expected to expand the utility of various stabilizing additives in the near future.

The incorporation of stabilized blends results in improved product quality and taste of the finished goods. Producers add additives to maintain the taste of the product and reduce the fat content of the meat based on consumer preference. This trend is expected to expand the scope of stabilizers in the food processing market.

Source Insights

The animal segment dominated the market with the largest revenue share of 32.0% in 2024. This dominance is driven by several factors, including the increasing demand for processed meat products, which require effective stabilizers to maintain quality and shelf life. Additionally, advancements in meat processing technologies and the growing trend of convenience foods have heightened the need for reliable stabilizers. The emphasis on texture and smoothness in meat products also contributes to the segment's strong performance.

The plant segment is expected to grow at the fastest CAGR of 7.1% over the forecast period due to the growing demand for natural food stabilizer agents. In addition, continuous R&D is expected to expand the scope of plant-based food additives. The food processing industry has been rapidly adopting this trend due to the increasing demand for natural ingredients in countries including the U.S., U.K., and Germany.

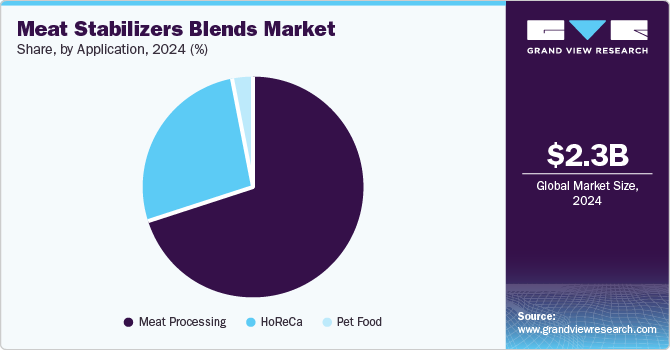

Application Insights

The meat processing segment dominated the market with the largest revenue share in 2024. Over the past few years, the meat processing industry has witnessed significant expansion across the world. The expansion of the broiler meat industry in developing countries, including Brazil, China, and India, due to reduced production costs and increased spending on advanced technology, is projected to remain a favorable factor for growth. Furthermore, the significant rise in demand for frozen meat in developed economies, including the U.S. and Germany, as a result of the increasing consumption of products among millennials, is projected to open new avenues.

The HoReCa (Hotel, Restaurant, and Catering) segment is expected to grow at the fastest CAGR over the forecast period. This robust growth is driven by the increasing demand for high-quality, consistent meat products in the hospitality sector. Hotels, restaurants, and catering services prioritize using reliable stabilizers to ensure their meat offerings' texture, flavor, and shelf life. The rising trend of dining out and the expansion of the food service industry further fuel this demand.

The rising trend of dining out is the major driving factor for this growth. A study has found that 18% of European consumers eat all of their meals away from home. The number of drinking places, restaurants, and cafés has been increasing significantly across the world. The fast-growing food chains in developing nations, including China, India, and Brazil, are anticipated to accelerate the growth of the market in the upcoming years. In addition, the rapid penetration of online food services has fueled market growth. Over the past few years, online food services have gained huge popularity among millennials & Gen Z and working professionals.

Regional Insights

Asia Pacific meat stabilizers blends market dominated the global market with the largest revenue share of 44.6% in 2024. This dominance is driven by several factors, including the region's expanding meat processing industry and the increasing demand for processed meat products. Rising disposable incomes and the growing middle-class population are also contributing to higher consumption rates.

China Meat Stabilizers Blends Market Trends

China meat stabilizers blends market dominated the Asia Pacific market with the largest revenue share in 2024 owing to the country's vast and growing meat processing industry, which requires stabilizers to maintain product quality and extend shelf life. The rising consumer demand for processed meat products and the increasing focus on food safety and quality further support this market's growth. Additionally, China's expanding middle-class population and their higher disposable incomes contribute to the increased consumption of meat products. According to a recent report by the USDA Foreign Agricultural Service, China's meat consumption is projected to increase significantly. By 2024, meat consumption in China is expected to reach 101 million tons, and this figure is anticipated to rise further to 102 million tons by 2028.

North America Meat Stabilizers Blends Market Trends

The North American meat stabilizer blends market was identified as a lucrative region in 2024. This growth is attributed to several factors, including the increasing demand for processed meat products, which require stabilizers to maintain quality and extend shelf life. The rising consumer preference for convenience foods and the growing emphasis on food safety and quality are also significant drivers. Additionally, the presence of key market players and the availability of advanced meat stabilizer blends further bolster the market's performance.

U.S. Meat Stabilizers Blends Market Trends

The U.S. meat stabilizer blends market is anticipated to experience significant growth during the forecast period. Factors such as busy lifestyles and a high demand for better-quality meat products are expected to drive this growth. Additionally, the presence of several key players in the region and an increase in disposable income are projected to enhance market expansion further.

Europe Meat Stabilizers Blends Market Trends

The European meat stabilizer blends market is expected to grow significantly over the forecast period. The growing meat population across Europe and demand for high-quality meat products are anticipated to fuel market growth. In addition, the rapid expansion of the region's food industry, high demand for food safety and quality, and advancements in meat processing technologies further support the market's growth.

Key Meat Stabilizers Blends Company Insights

Some key companies in the meat stabilizers blends market include DuPont, Cargill, Incorporated, Tate & Lyle, Palsgaard, ADM, and others. Companies are focusing on new product innovation to increase customer base. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

DuPont provides a variety of meat stabilizer blends, including gelatin blends, carrageenan blends, modified starch blends, and pectin blends. These products are used in various applications, such as processed meat products, fresh meat, ready-to-eat meals, sausages, and hotdogs.

-

Cargill offers a comprehensive range of functional systems and stabilizer blends. Its products include refined carrageenans such as Satiagel, which provides drip loss control in enhanced meats and increases gel strength in fully cooked items.

Key Meat Stabilizers Blends Companies:

The following are the leading companies in the meat stabilizers blends market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Cargill, Incorporated

- Tate & Lyle

- Palsgaard

- ADM

- Ashland

- Cp Kelco

Meat Stabilizers Blends Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.48 billion

Revenue forecast in 2030

USD 3.29 billion

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

DuPont; Cargill, Incorporated; Tate & Lyle; Palsgaard; ADM; Ashland; Cp Kelco; Kerry Group plc.; Ingredion ; Nexira; Hydrosol GmbH & Co. Kg; BASF

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Stabilizers Blends Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global meat stabilizers blends market report based on source, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant

-

Seaweed

-

Animal

-

Microbial

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat Processing

-

HoReCa

-

Pet Food

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.