MEA Healthcare CRM Market Size, Share & Trends Analysis Report By Functionality, By Deployment Mode (On-premise, Cloud/Web-based), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-323-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

MEA Healthcare CRM Market Size & Trends

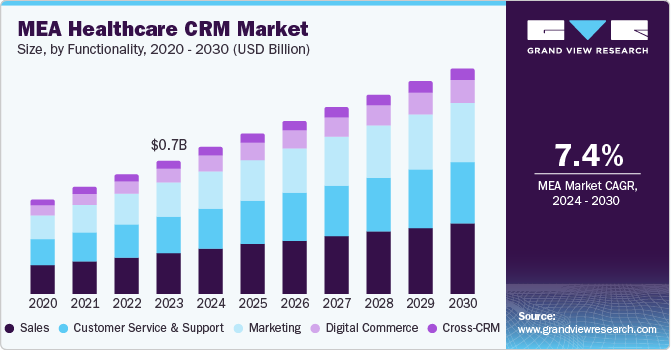

The MEA healthcare CRM market size was estimated at USD 0.66 billion in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030. The rising adoption of digital health technologies, including electronic health records (EHRs), telemedicine, mobile, and the integration of artificial intelligence (AI) and machine learning (ML) in the healthcare sector to enhance operational efficiency and patient care is driving the market growth. In addition, the rising burden of chronic diseases in the region and the demand for structured data and automation in healthcare organizations is expected to fuel the market growth.

The market is anticipated to grow due to a rising need for organized data and automation within healthcare organizations. According to the African Union August 2023 insights, despite having 24% of the global disease burden in Africa, health spending by governments in Africa constitutes only about 1% of the region's total health expenditures. This disparity is largely attributed to the lack of precise data, fragmented manual data gathering, and the absence of a central electronic database.

The absence of database results in significant gaps in data collection and capture, potentially leading to underrepresentation of key population segments and biased digital health technologies. Consequently, data-driven interventions might be detrimental and skewed for specific populations. Addressing these challenges through the implementation of advanced CRM systems can facilitate more accurate and comprehensive data management, ultimately supporting equitable healthcare delivery and improving patient outcomes across the region.

The intensity of globalization, along with increasing competition and advancements in ICT, has compelled companies in developing countries to focus on CRM to maximize revenues. SMEs play a crucial role in this context and should be supported as agents of structural change, helping to reduce marginalization and achieve equitable income distribution. The rise in ICT usage and development has integrated Middle Eastern economies into the global competitive landscape.

According to a study Journal published in March 2021, client relation management spending in this region has reached to 10.7%, reflecting its importance as a customer-focused business strategy that seamlessly integrates sales, marketing, and customer care services to create and add value for both the company and its customers. The significance of CRM is evident in its ability to increase customer retention, predict future customer transactions, and provide a comprehensive overview of customer needs and requirements.

Furthermore, CRM has become a vital strategy for small companies in the Middle East, highlighting the necessity for more SMEs to implement CRM for effective business operations. CRM not only fosters high-performance strategies but also facilitates value-added, technical, and innovative mechanisms to gain a competitive edge.

The region's growing healthcare expenditure and the population's demand for improved medical services are accelerating the adoption of new technologies. CRM systems, in particular, are becoming essential for managing patient data, facilitating personalized care, and improving overall healthcare delivery efficiency. These systems support providers in delivering better patient outcomes and operational effectiveness, making them integral to the region's evolving healthcare landscape.

Market Concentration & Characteristics

The MEA healthcare CRM market is expected to grow at a moderate pace over the forecast period, driven by a dynamic and competitive environment where companies are offering specialized solutions to cater to different segments of the healthcare industry. This diversity among market players reflects the trend of innovation and customization aimed at meeting the specific needs of healthcare providers in the MEA region. For example, in September 2021, Salesforce introduced Health Cloud 2.0, an integrated platform designed to enhance the safety and health of customers, communities, and employees. Such innovations underscore the importance of tailored CRM solutions that address unique healthcare challenges, support efficient patient management, and improve overall service delivery in the region.

In terms of innovation, the industry is experiencing a moderate to high degree of innovation. Innovations such as advanced analytics, AI-driven solutions, and mobile health applications are driving industry growth by enhancing patient engagement, improving operational efficiency, and facilitating personalized care delivery. These innovations are crucial in meeting the evolving demands of healthcare organizations in the region and are key drivers of industry expansion. In November 2022, Salesforce launched Patient 360 for Health Innovations, which aims to lower costs and provide more efficient care for patient success. These include advanced therapy management, behavioral health, care coordination, and salesforce genie for health, all on a single platform.

Mergers & acquisitions activities are relatively moderate in the market, reflecting a dynamic landscape where companies pursue strategic partnerships to enhance their market presence and offerings. For instance, in May 2023, Veeva Systems introduced Vault CRM, featuring advanced capabilities like the CRM Bot and Service Center. This next-generation model, built on the Veeva Vault Platform, is highly pertinent to the MEA (Middle East and Africa) healthcare CRM industry.

The introduction of stringent data protection regulations, like South Africa's Protection of Personal Information Act (POPIA) and the Saudi Health Information Exchange Policy (SeHE) outlines standards for data privacy and security in healthcare CRM systems. Compliance norms ensure that patient information is handled confidentially and securely, fostering trust between patients and healthcare professionals.

Companies in the market are actively expanding both regionally and globally to seize new opportunities and broaden their industry presence. For example, in March 2021, Zoho Corporation announced its plan to implement transnational localism in the MEA region and expand its product portfolio. This strategic initiative aims to strengthen Zoho's presence in the global industry by offering tailored solutions and services that cater to the specific needs and demands of the healthcare sector in the Middle East and Africa.

Case Studies And Related Insights

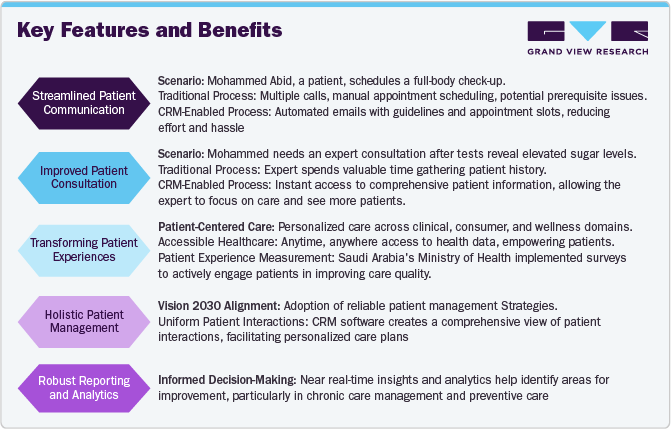

Case Study: Transforming Patient Experience and Outcomes with Healthcare CRM in the Middle East

Background

As the Middle East's healthcare sector undergoes significant digital transformation, healthcare organizations recognize the importance of building long-term customer relationships to create a patient-centered experience. This shift is fueled by patients becoming more proactive and self-reliant in their healthcare journeys, changing the dynamics of care delivery.

Challenge

A major healthcare organization in Abu Dhabi faced challenges in improving patient engagement, streamlining workflows, and optimizing patient outcomes. Traditional methods of patient communication and data management were inefficient, leading to delays, increased administrative burdens, and suboptimal patient experiences.

Solution: Implementing Healthcare CRM

Therefore, organizations implemented specialized healthcare CRM systems to address these challenges. This technology facilitated the storage and organization of patient information, improved patient engagement, and enhanced overall satisfaction.

“Analyst Insights: By leveraging healthcare CRM systems, the healthcare organization significantly improved patient experiences, engagement, and outcomes. The integration of advanced CRM tools streamlined operations, enhanced inter-departmental collaboration, and provided actionable insights, driving continuous improvement and positioning the organization as a leader in patient-centered care in the Middle East.”

AI-Powered Healthcare CRM Insights in MEA region

In the healthcare industry, integrating AI and ML into CRM systems utilizes extensive data sets from various sources to generate actionable insights and recommendations to enhance customer relationships and outcomes. For instance, AI and ML applications within healthcare CRMs can predict customer behavior, preferences, and needs, facilitating personalized communication and services.

One application of AI-powered CRM is predictive analytics, which can help manage healthcare resources more efficiently in areas with limited resources. It can monitor chronic diseases like diabetes and cardiovascular conditions, enabling timely interventions and better disease management. In remote areas, AI-powered CRMs enhance telemedicine services, facilitating remote diagnostics, patient follow-ups, and virtual consultations, making healthcare more accessible to underserved populations. This technology is particularly beneficial in regions with a high prevalence of chronic diseases.

AI-powered CRMs can improve patient experience by offering personalized care plans, coordinating treatment schedules, and managing follow-up care. Mobile health applications, particularly in the MEA region, can deliver personalized health advice, medication reminders, and wellness tips, boosting patient engagement. They can also analyze geographical and demographic data to identify healthcare access gaps, aiding providers and governments in improving delivery in remote and underserved areas.

Functionality Insights

Sales segment dominated the market and held the largest revenue share of 31.3% in 2023 and is expected to grow at the fastest CAGR during the forecast period, due to the increasing focus on enhancing sales processes and customer interactions in healthcare organizations. This emphasis on sales functionality within CRM systems allows the providers to streamline their sales operations, improve customer engagement, and ultimately drive revenue growth. By utilizing these tools tailored for sales, healthcare institutions can effectively manage leads, track interactions, and optimize their sales strategies, leading to increased efficiency and profitability within the healthcare sector. In April 2024, Aesthetix CRM partnered with Keragon to offer seamless EMR integrations for aesthetic practices. This partnership allows aesthetic practices to integrate Aesthetix CRM with various EMR systems, including DrChrono, Athenahealth, ModMed, Healthie, and Charm EMR.

Marketing segment is expected to grow with a significant CAGR during the forecast period. Marketing plays a crucial role in promoting healthcare services, enhancing patient engagement, and improving overall customer experience. With the increasing focus on personalized health services and the adoption of digital marketing strategies, the marketing functionality within healthcare CRM systems is expected to witness significant growth, driving the overall market expansion.

Deployment Mode Insights

Cloud/Web-based segment dominated the market and accounted for the largest share in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is driven by the increasing adoption of cloud technologies, the digitalization of healthcare, and initiatives by leading companies. Key providers of cloud-based CRM solutions include IBM, SAP, Accenture, Cerner, Salesforce, among others. In October 2023, Salesforce launched Life Sciences Cloud, a secure cloud platform designed for MedTech and pharmaceutical organizations to retain patients, expedite drug development, and utilize AI for personalized customer experiences.

On-premise segment is projected to grow at a nominal CAGR during the forecast period. This segment encompasses server hardware, software licenses, integration capabilities, and internal IT staff managed within a company's premises. Noteworthy features of on-premise solutions include sales acceleration, pipeline management, case management, campaign and lead management, reporting & dashboards, and process automation. Despite its current presence, the forecast indicates a decreasing trend for on-premise solutions, reflecting a shift towards cloud-based alternatives for enhanced efficiency and scalability in organizational operations.

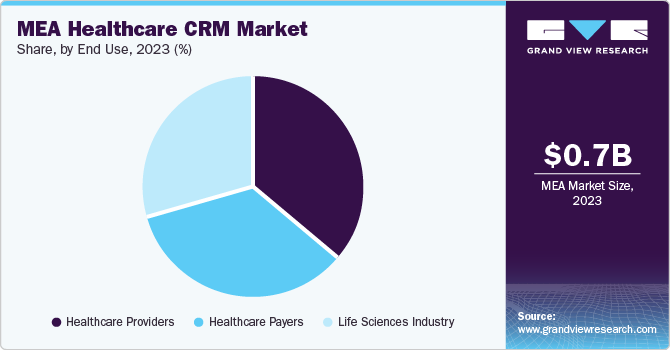

End Use Insights

Healthcare providers dominated the market and held the largest share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Healthcare providers are increasingly adopting CRM systems to enhance patient engagement, improve communication, streamline workflows, and optimize patient outcomes.

The healthcare payer segment is projected to achieve the significant CAGR from 2024 to 2030. Healthcare CRM systems streamline billing and claims processes by automating tracking claims status, workflows, and resolving payment issues. This enables payers to improve operational efficiency, reduce administrative costs, and optimize revenue cycle management through CRM-enabled claims processing. In addition, these systems offer analytics and reporting tools, empowering payers with insights into member behavior, cost drivers, and utilization patterns. By leveraging data analytics, payers can identify opportunities for cost savings, improve care, and make strategic decisions.

Regional Insights

The MEA healthcare CRM market is witnessing significant growth due to several key factors, including rising investments in healthcare infrastructure, increasing demand for better healthcare services, and the adoption of advanced technologies to enhance patient care. In addition, the region's focus on improving access and quality, along with the growing population's healthcare needs, contributes to the expansion of the CRM market in MEA.

South Africa in MEA Healthcare CRM Market Trends

South Africa dominated the healthcare CRM market with the largest revenue share in 2023. The country's strong market position can be attributed to its well-established healthcare infrastructure and a growing emphasis on improving patient care and operational efficiency. In addition, a proactive approach towards healthcare innovation and digital transformation has positioned it as a leader in the adoption of healthcare CRM solutions, driving its dominance in the market.

Saudi Arabia in MEA Healthcare CRM Market Trends

MEA healthcare CRM market in Saudi Arabia is anticipated to grow at the fastest CAGR during the forecast period, primarily due to initiatives like Saudi Vision 2030. This ambitious vision aims to transform the country's healthcare sector by promoting digitalization, enhancing healthcare services, and improving patient outcomes. The emphasis on technological advancements, coupled with the government's support for healthcare innovation, is expected to drive the adoption of healthcare CRM solutions in Saudi Arabia.

UAE in MEA Healthcare CRM Market Trends

The MEA Healthcare CRM market in UAE is expected to grow significantly over the forecast period. This can be attributed to increasing strategic investments in healthcare infrastructure and government initiatives aimed at enhancing patient care efficiency. These efforts are bolstering the UAE’s position as a regional healthcare hub. The government's focus on integrating dynamic technological solutions into healthcare is further fostering an environment conducive to market expansion.

Kuwait in MEA Healthcare CRM Market Trends

MEA Healthcare CRM market in Kuwait is expected to witness stable growth in the coming years. Kuwait's commitment to improving healthcare accessibility, efficiency, and patient outcomes, along with a supportive regulatory environment, positions it for significant expansion in the healthcare CRM market during the forecast period.

Key MEA Healthcare CRM Company Insights

Key companies in the market are implementing strategic initiatives such as expanding their portfolios, launching & upgrading products, forming partnerships, broadening their regional presence, and engaging in mergers and acquisitions to gain the market share. For instance, in 2023, Zoho launched seven innovative solutions, including CRM tools. These solutions have the potential to augment user experience, increase operational efficiency, and offer advanced tools for healthcare providers in the region, thereby possibly enhancing productivity and the quality of patient care. Major industry participants such as IBM, Microsoft, and SAP are increasingly concentrating on cognitive technology and artificial intelligence to improve patient experience and secure a larger market share.

Key MEA Healthcare CRM Companies:

- Microsoft

- Cerner Corporation (Oracle)

- IBM

- SAP

- Accenture

- Zoho Corporation

- hc1

- LeadSquared

- Salesforce

- Veeva Systems

- Talisma

- Verint Systems Inc.

- Creatio

Recent Developments

-

In March 2024, Salesforce introduced AI and data innovations designed to enhance healthcare operations within its CRM platform. A key feature of these enhancements is Einstein Copilot, a conversational AI assistant integrated into Salesforce's Einstein 1 Platform. This AI assistant leverages the metadata from healthcare organizations stored in Salesforce's Data Cloud. By doing so, it can effectively capture and analyze patient and member details. This capability not only improves the accuracy and depth of data insights but also automates a range of manual processes, streamlining operations and improving efficiency for healthcare providers.

-

“These new data, AI, and CRM features help reduce the administrative and operational burden for healthcare providers and care teams, leading to better outcomes for their patients. And with Salesforce’s trusted AI, healthcare organizations excited about generative AI - but nervous about clinical and security concerns - can confidently use these innovations in their everyday workflows.” Amit Khanna, SVP & GM for Health

-

In November 2023, Accenture and Salesforce collaborated to assist companies in the life sciences sector in achieving sustainable growth and value. Their investment is directed towards the enhancement of Salesforce Life Sciences Cloud, which includes the introduction of new innovations, resources, and accelerators, all of which are driven by data and artificial intelligence (AI).

-

“The rapid pace of science and technology advancements is making treatment decisions more complex,

-

“Data and AI will drive differentiation around how life sciences organizations engage with their customers. Together with Salesforce, we can help organizations establish a digital foundation to support omni-channel experiences across sales, service and marketing with data and intelligence at the core.” Emma McGuigan, Senior Managing Director and Enterprise & Industry Technologies Lead At Accenture

MEA Healthcare CRM Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 0.72 billion |

|

Revenue forecast in 2030 |

USD 1.10 billion |

|

Growth rate |

CAGR of 7.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Market representation |

Revenue in USD million & CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, trends |

|

Segments covered |

Functionality, deployment mode, end use, region |

|

Regional scope |

MEA |

|

Country scope |

South Africa; Saudi Arabia; UAE; Kuwait, Rest of MEA |

|

Key companies profiled |

Microsoft; Cerner Corporation (Oracle); IBM; SAP; Accenture; Zoho Corporation; hc1; LeadSquared; Salesforce; Veeva Systems; Talisma; Verint Systems Inc.; Creatio |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

MEA Healthcare CRM Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MEA healthcare CRM market report based on functionality, deployment mode, end use, and region:

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Customer Service and Support

-

Digital Commerce

-

Marketing

-

Sales

-

Cross -CRM

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise Model

-

Cloud/Web-based Model

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Life Sciences Industry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The MEA healthcare CRM market size was estimated at USD 0.66 billion in 2023 and is expected to reach USD 0.72 billion in 2024.

b. The MEA healthcare CRM market is expected to grow at a compound annual growth rate of 7.37% from 2024 to 2030 to reach USD 1.10 billion by 2030.

b. South Africa dominated the MEA healthcare CRM market with a share of 45.9% in 2023. This is attributable to the adoption of advanced technologies in healthcare settings, growing emphasis on improving patient care and operational efficiency, and significant digital transformation in healthcare organizations.

b. Some key players operating in the MEA healthcare CRM market include Microsoft, Cerner (Oracle), IBM, SAP, Accenture, Zoho Corporation, hc1, LeadSquared, Salesforce, Inc., Veeva Systems, Talisma, Verint Systems Inc., and Creatio.

b. Key factors driving the market growth include the increasing adoption of digital health technologies and growing challenges to improve patient engagement and streamline workflows. Moreover, advancing advanced technologies, such as integrating artificial intelligence (AI) and machine learning (ML) in the healthcare sector to enhance operational efficiency and patient care, is driving the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."