- Home

- »

- Healthcare IT

- »

-

MEA Clinical Trials Management System Market, Report 2030GVR Report cover

![MEA Clinical Trials Management System Market Size, Share & Trends Report]()

MEA Clinical Trials Management System Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution Types, By Delivery Mode (Web & Cloud-based, On-premise), By Component, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-319-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

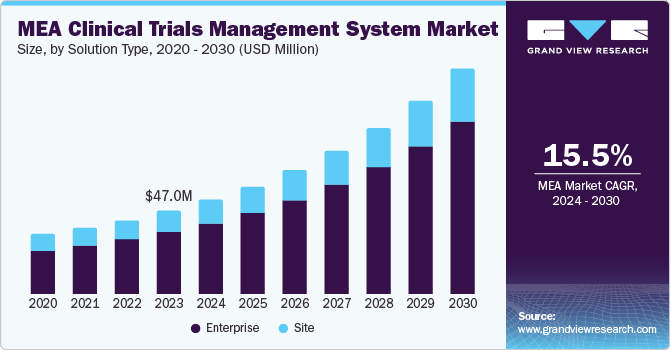

The MEA clinical trials management system market size was estimated at USD 47.02 million in 2023 and is expected to grow at a CAGR of 15.54% from 2024 to 2030. The increasing number of clinical trials, significant development of healthcare IT, and government support for clinical research are driving the market growth. According to the Department of Health, Abu Dhabi, the capital of the UAE, is a leading healthcare destination in the MENA region, offering numerous opportunities for collaboration in life sciences and healthcare and has seen a 484% increase in clinical trials in 2022 alone.

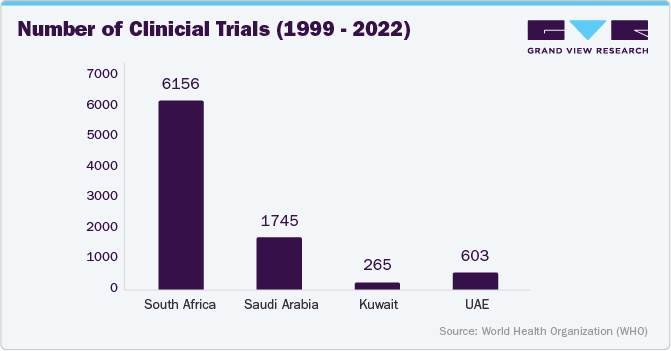

The Middle East and Africa region is seeing a rise in the number of clinical trials being conducted. This is due to the growing healthcare needs and the pursuit of innovative medical treatments and drugs. The diverse patient populations and relatively lower costs make these regions attractive for conducting extensive clinical research. As more trials are initiated, the demand for efficient management systems such as clinical trials management system (CTMS) increases to handle the complex logistics and data involved.

Government in the MEA countries are establishing regulatory frameworks to support clinical research, making it easier to conduct trials. The increasing establishment of regulatory frameworks and support systems for clinical trials in the Middle East and Africa (MEA) regions signals a growing demand for efficient and effective clinical trial management systems (CTMS). Here are the key points that drive this demand:

Faster Approval Processes and Clear Guidelines: MEA Governments are creating streamlined approval processes and clear guidelines for clinical trials. This implies a higher volume of trials being initiated, necessitating robust systems to manage these processes efficiently.

Role of AVAREF and PACTR: The African Vaccine Regulatory Forum (AVAREF) supports the Pan African Clinical Trial Registry (PACTR), indicating a centralized system for trial registration and oversight. A CTMS can integrate with such registries to ensure compliance and smooth data flow. The proposed legislation by AVAREF members for mandatory registration in PACTR suggests a need for systems that can handle increased regulatory requirements and ensure that all trials are properly registered and tracked.

Integration of Ethical Review, Regulation, and Registration: The concept paper from AVAREF emphasizes integrating ethical review, regulation, and registration. A CTMS can provide a unified platform to manage these aspects, ensuring that all regulatory and ethical standards are met throughout the trial lifecycle. With 19 countries involved, there is a significant scope for cross-border clinical trials. A CTMS can facilitate collaboration and coordination among different stakeholders across these countries, ensuring consistency and efficiency in trial management.

Increased Volume of Clinical Trials: As the regulatory environment becomes more supportive, the volume of clinical trials is likely to increase. A CTMS is essential to handle the complexities associated with managing multiple trials simultaneously, including patient recruitment, data management, compliance tracking, and reporting.

Need for Transparency and Efficiency: Enhancing transparency and efficiency in clinical trials is a primary goal. A CTMS can provide real-time insights, automate workflows, and ensure data integrity, contributing to more transparent and efficient trial processes.

The expansion of clinical trials is also supported by improvements in the healthcare infrastructure across these regions. Enhanced facilities and better-equipped research centers provide a conducive environment for conducting high-quality clinical trials. According to the International Trade Administration March 2024 insights, the Saudi Arabian Government plans to fund over USD 65 billion under Vision 2030 to expand the country's healthcare infrastructure, launch 21 health clusters, privatize health services and insurance, and expand e-health services.

As per same insights, in 2023, Saudi Arabian government announced USD 50.4 billion spending budget on healthcare and social development by prioritizing local production, clinical trials, technology transfer, and training for the Saudi labor force. Such investments and efforts to increasing the number of clinical trials and the significant development in Healthcare IT open profitable opportunities in the CTMS market for providers, as these systems are essential for managing the complex logistics, data, and regulatory requirements associated with clinical research.

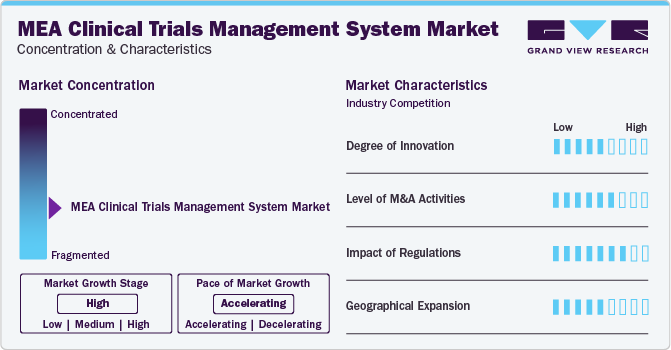

Market Characteristics & Concentration

The industry growth stage is high, and pace of the growth depicts an accelerating trend. The MEA clinical trials management system industry is fragmented, which is marked by the presence of large number of companies competing for the market share.

The CTMS market is undergoing a transformation with the integration of advanced technologies such as AI and ML, enhancing data analysis, patient recruitment, and trial monitoring. Cloud-based solutions offer flexibility, scalability, and cost-effectiveness, especially in geographically diverse regions such as the Middle East and Africa. Mobile technology and remote monitoring tools enable real-time data collection and patient engagement, particularly in regions with geographical and infrastructural challenges.

The MEA clinical trials management system industry is characterized by a moderate level of M&A and partnership activities undertaken by key manufacturers. Numerous players in the country are partnering with other relevant companies to strengthen their portfolio and expand their reach. For instance, in August 2023, Novo Nordisk announced its plan to acquire Inversago Pharma. This acquisition was part of Novo Nordisk's strategic efforts to develop new therapies and clinical trials targeting individuals with obesity, diabetes, and other significant metabolic diseases.

The Clinical Trial Management System (CTMS) market in the Middle East and Africa is influenced by various regulations, including international standards like International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) and Google Cloud Platform (GCP), which ensure ethical and safe clinical trials. Local regulations demand adaptations to meet trial registration, ethical approvals, patient consent, and data privacy.

Solution Type Insights

The enterprise segment held the largest market share at 74.1% in 2023. The segment is also projected to exhibit significant growth rate over the forecast period. Enterprise software solutions integrate multiple application packages that support the organization to manage critical tasks. For instance, Real Time’s Enterprise CTMS offers comprehensive solutions to perform different tasks including centralized recruitment, accounting, regulatory, and aggregate reporting across universities & other large site networks.

These solutions are typically cloud-based, enabling large-scale companies to allocate specific cloud-computing resources as per the precise requirements. The enterprise segment is expected to dominate the market owing to its exceptional benefits including robust reporting, offering end-to-end insights into deviations & accruals, tracking & managing regulatory processes, scalability of solutions, and enhanced billing compliance.

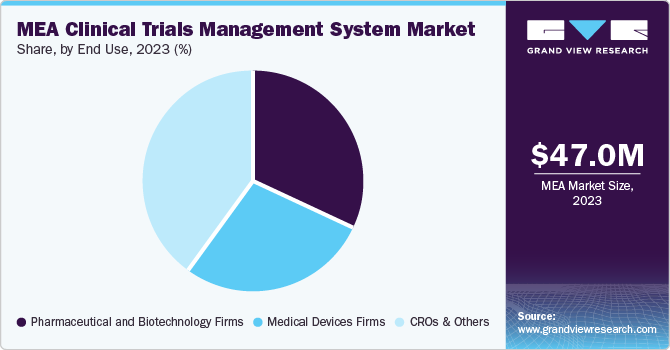

End Use Insights

CROs & others segment accounted for the largest share in 2023. The segment is also expected to grow at a significant pace over the forecast period. The segment includes contract research organizations, academic research institutes, and others. The market growth is attributed to surging rate of clinical trial outsourcing to contract research organizations and increasing number of decentralized trial counts.

Clario, one of the key companies in the market, offers solutions for all trial models, including site-based, decentralized, and hybrid trials. With its 30 facilities present across the world, the company’s solutions generate reliable, diverse, and rich evidence. Furthermore, the presence of various academic research groups that are involved in the study of clinical data generated in laboratory experiments and clinical trials is expected to broaden the segment scope.

Delivery Mode Insights

Web & cloud-based segment held the largest market share of 70.7% in 2023. The segment is also expected to grow at the fastest CAGR during the forecast period. Web & cloud-based solutions help manage clinical trial data with the help of third-party providers who host on an as-needed basis with options to scale up or down. This segment is expected to witness the fastest growth over the forecast period owing to its widespread adoption among end users.

Furthermore, the increasing adoption of artificial intelligence, machine learning algorithms, and analytics has enabled advanced automation in the CTMS platform. Another advantage of cloud-based technologies is easy data access from any device such as laptops, mobiles, workstations, and tablets with the help of CTMS software.

Component Insights

Software segment held the largest market share in 2023. CTMS software is an easy-to-use tool that aids in managing clinical trials and performing critical functions. These functions include trial planning, management of regulatory procedures, site & country progress, activity monitoring, finance, and supplies. The software is deployed at both site and enterprise levels and is based majorly on subscriptions. CTMS software also helps in streamlining the clinical document management processes, ensuring data security & quality.

The services segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the increasing demand for training & assistance required for installation, upgrade, and maintenance of the system. Furthermore, the efficient running of CTMS relies heavily on services. CTMS service providers have cost-effective offerings to maintain or build the technology foundation for efficient trial management. In addition, CTMS service organizations manage outsourced clinical trials on behalf of manufacturers for better efficiency.

Region & Country Level Insights

The regional market is expected to grow over the forecast period, which can be attributed to the increasing need for integration of healthcare systems, the growing focus on high return on investments, and the rising need for high-quality care. The GCC countries are relatively new to clinical research, however, with technological advancements and rapid digitization, the countries are overcoming the challenges faced on the technological front & are witnessing significant growth.

South Africa in MEA Clinical Trials Management System Market Trends

MEA clinical trials management system market in South Africa held the largest market share of over 29.0% in 2023. This can be attributed to the increasing focus on scaling up digital technologies to improve access to healthcare and clinical systems. In addition, the rising cost of overall drug development techniques for pharmaceutical firms has led to the adoption of electronic clinical data management over paper-based documentation, which is expected to drive market growth over the forecast period. Although African countries have historically been lagging in terms of clinical trials, South Africa is starting to see growth in this space.

Saudi Arabia in MEA Clinical Trials Management System Market Trends

MEA clinical trials management system market in Saudi Arabia is expected to grow significantly over the forecast period. This can be attributed to the largest number of hospitals, growing incidences of oncology & infectious diseases, and the presence of primary health centers. Furthermore, growing trial awareness is expected to further boost the demand for recruitment and retention services in Saudi Arabia.

As per the Saudi Vision 2030, healthcare system in Saudi Arabia is revolutionizing significantly to address the health needs of every member of society. With the strategic priority of developing clinical research talents, attract international expertise, the Saudi Vision 2030 focuses on diversifying the Kingdom’s economy through a superior focus on research and development. It showcases that clinical trials are the pathway for enhanced healthcare, developing treatment as per the specific needs of the population.

As a result, clinical trials are gaining importance in Saudi Arabia for innovating medication and devices for the treatment of various disorders. Moreover, major upcoming projects aim at developing hospitals such as King Khaled Medical City, King Faisel Medical City, and King Abdullah Medical City, which are expected to give research facilities. This expansion is expected to open new avenues for market players in the country.

UAE in MEA Clinical Trials Management System Market Trends

MEA clinical trials management system market in UAE is expected to grow at fastest CAGR over the forecast period. Key factors such as robust regulatory management, diverse population pool, growing academic research workforce, and rising digitalization in the healthcare system are contributing opportunities for market growth. Historically, conducting phase 3 trials was a challenge in the country owing to the requirement of a diverse & large volunteering population. However, the government is growing confident in conducting multiple trials with over 200 nationalities spread across the geographical location. As of 2022, the country had over 400 clinical trials registered under the Ministry of Abu Dhabi. Therefore, rising clinical trials are expected to increase the usage of CTMS solutions to accelerate new medical drug discoveries.

Kuwait in MEA Clinical Trials Management System Market Trends

MEA Clinical Trials Management System market MEA in Kuwait is expected to grow significantly over the forecast period. The market growth is driven by the presence of local pharmaceutical manufacturing companies and increasing requirements for critical medications and generic drugs. As a result, clinical trials are becoming more important among big pharmaceutical & biopharmaceutical companies for commercial expansion to treat various diseases. Such factors are anticipated to drive the market over the forecast period.

Key MEA Clinical Trials Management System Company Insights

Key players in the MEA clinical trials management system (CTMS) market include Oracle, IQVIA Inc., and Medidata (Dassault Systèmes), among others. These companies are actively expanding their global presence through collaborations, partnerships, and acquisitions to enter new markets and regions. Collaborations with healthcare providers, research institutions, and academic medical centers are particularly strategic, enabling access to specialized expertise and opportunities to evaluate their technologies in real-world clinical environments.

Key MEA Clinical Trials Management System Companies:

- IQVIA Inc.

- Medidata (Dassault Systèmes)

- Oracle

- DATATRAK International, Inc.

- Clario

- SimpleTrials

- Calyx

- RealTime Software Solutions, LLC

- Laboratory Corporation of America Holdings

- Veeva Systems

- Wipro

- PHARMASEAL International Ltd.

Recent Developments

-

In July 2023, RealTime Software Solutions acquired Devana Solutions, a SaaS provider specializing in analytics solutions and clinical trial workflow. The acquisition will provide an end-to-end site platform for clinical research organizations, integrating solutions from Devana into RealTime's SOMS. RealTime's integrated suite of products, including CTMS, eConsent, eRegulatory solutions, Texting solutions, eSource, Payments, and the MyStudyManager Participant Portal, will be seamlessly connected.

-

In April 2022, Bristol Myers Squibb globally adopted Veeva Systems' Clinical Trial Management System (CTMS) to enhance their trial management capabilities. This implementation allowed the company to create agile, unified, and streamlined trial processes, significantly improving the speed and efficiency of their clinical trials.

MEA Clinical Trials Management System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 53.26 million

Revenue forecast in 2030

USD 126.73 million

Growth rate

CAGR of 15.54% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Solution type, delivery mode, component, end-use, country

Country Scope

Saudi Arabia; South Africa; UAE; Kuwait; Rest of MEA

Key companies profiled

IQVIA Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Clario; SimpleTrials; Calyx; RealTime Software Solutions, LLC; Laboratory Corporation of America Holdings; Veeva Systems; Wipro Limited; PHARMASEAL International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Clinical Trials Management System Market Segmentation

This report forecasts revenue growth in the MEA market and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MEA clinical trials management system market based on solution type, delivery mode, component, end use, and country:

-

Solution Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Enterprise

-

Site

-

-

Delivery Mode Outlook (Revenue in USD Million, 2018 - 2030)

-

Web & Cloud-based

-

On-premise

-

-

Component Outlook (Revenue in USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End Use Outlook (Revenue in USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Firms

-

Medical Devices Firms

-

Academic and Government Research Institutes

-

CROs & Others

-

-

Country (Revenue in USD Million, 2018 - 2030)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

Rest of MEA

-

Frequently Asked Questions About This Report

b. The MEA clinical trials management system market size was estimated at USD 47.02 million in 2023 and is expected to reach USD 53.26 million in 2024.

b. The MEA clinical trials management system market is expected to grow at a compound annual growth rate of 15.54% from 2024 to 2030 to reach USD 126.73 million by 2030.

b. Software segment held the largest market share in 2023. CTMS software is an easy-to-use tool that aids in managing clinical trials and performing critical functions. These functions include trial planning, management of regulatory procedures, site & country progress, activity monitoring, finance, and supplies.

b. Some key players operating in the MEA CTMS market include IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Clario; SimpleTrials; Calyx (formerly Parexel Informatics); RealTime Software Solutions, LLC; Laboratory Corporation of America Holdings; Veeva Systems; Wipro; PHARMASEAL International Ltd.

b. Key factors that are driving the CTMS market growth include rapid growth of healthcare IT, preference for decentralized clinical trials, initiatives by key companies, and increasing number of clinical studies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.