- Home

- »

- Advanced Interior Materials

- »

-

Marine Vinyl Market Size, Share And Growth Report, 2030GVR Report cover

![Marine Vinyl Market Size, Share & Trends Report]()

Marine Vinyl Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Yachts, Cruise Ships, Sport Boats), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-334-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Vinyl Market Summary

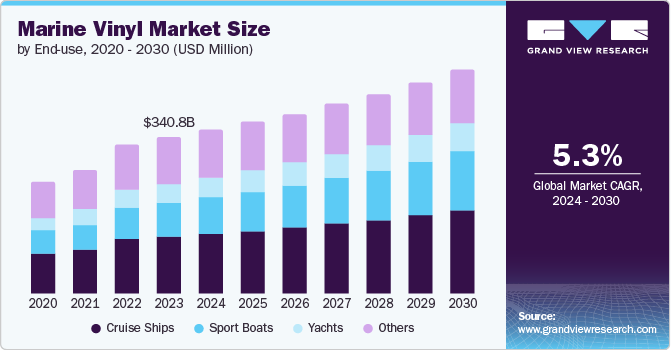

The global marine vinyl market size was estimated at USD 340.80 million in 2023 and is projected to reach USD 488.02 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Marine vinyl has its application in a variety of outdoor settings beyond just marine environments.

Key Market Trends & Insights

- North America dominated the marine vinyl market in 2023 with a revenue share of 48.83%.

- The marine vinyl market in the U.S. dominated the North America market in 2023.

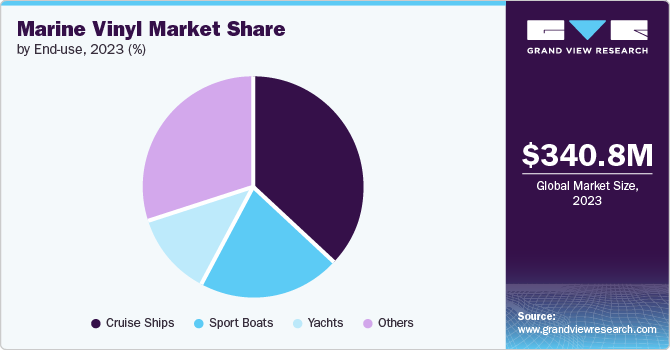

- Based on end use, cruise ships segment dominated the market in 2023, accounting for a revenue share of 36.86%.

Market Size & Forecast

- 2023 Market Size: USD 340.80 Million

- 2030 Projected Market Size: USD 488.02 Million

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

It is used to develop patio furniture, outdoor cushions, awnings, covers, and other sporting goods. The adaptability of the product to different outdoor applications drives its demand across various industries.

Marine vinyl is specifically engineered to withstand harsh marine environments, which makes it exceptionally durable. It is highly resistant to tearing, puncturing, and abrasions, thereby making this product ideal for outdoor use where it has to encounter rough handling and potential damage. Unlike marine vinyl, conventional fabrics, while sometimes durable, often lack inherent strength. They can tear, fray, or wear down quickly, especially during heavy use or exposure to rough conditions.

Another primary attribute of this product is its water resistance. Unlike other materials that may absorb water and degrade over time, marine vinyl remains impervious to water. As such, it maintains its structural integrity and appearance even when exposed to rain and humidity or has direct water contact. On the other hand, conventional fabrics can degrade quickly due to exposure to natural elements such as moisture and sunlight, thereby requiring highly frequent replacements and repairs. This makes the maintenance process of conventional fabrics costly and time-consuming.

Moreover, it is treated to resist ultraviolet (UV) rays and mildew. This makes it particularly suitable for outdoor environments wherein exposure to sunlight can cause other materials to fade, crack, or degrade. The UV resistance helps maintain its color and strengthens it, while the mildew resistance prevents mold and mildew growth, which is crucial in humid or wet conditions. Contradictory sunlight can cause conventional fabrics to fade, weaken, and degrade. Although different types of treatment for developing UV resistance are available for conventional fabrics, they can be less effective and wear off, thereby requiring their reapplication.

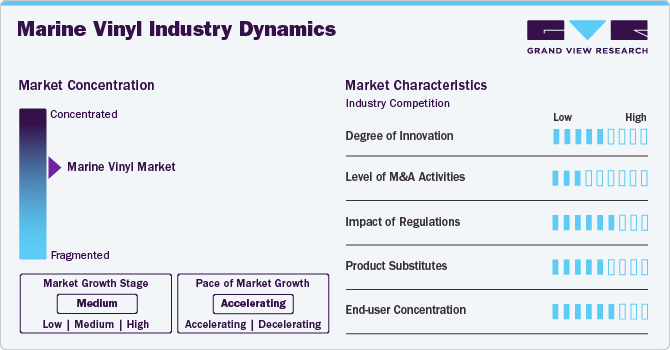

Industry Dynamics

The market is moderately competitive owing to the presence of both regional and multinational players. The key players in this market are investing in improving the quality of their products and enhancing their manufacturing capacities. They are also increasingly focused on improving the quality of their products and providing customization options in terms of color, texture, and size for use in specific applications.

The threat of substitution in the industry is moderately high and is affected further by the availability of alternatives, technological advancement, and cost considerations. For instance, a marine-grade canvas is a primary substitute for marine vinyl. This material is often used in similar applications, such as boat upholstery and covers, due to its durability, water resistance, and breathability. Canvas can be perceived as more eco-friendly compared to vinyl, which is a petroleum-based product. In addition, advancements in fabric technology have led to the development of high-performance textiles that mimic the properties of marine vinyl while offering benefits like better UV resistance and less environmental impact.

Marine vinyl is mainly used for upholstery and flooring applications in yachts and cruise ships. Hence, consumers often prioritize high-quality marine vinyl that offers durability, UV resistance, mildew resistance, and ease of maintenance. Given the marine environment, this type of vinyl is expected to withstand exposure to saltwater, sun, and high foot traffic, which is a major factor affecting consumers' buying decisions.

Increasing focus on sustainability and environmental regulations may hamper the growth of marine vinyl. Several regulations have been imposed on phthalates, often used as plasticizers in vinyl products. REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulates the use of phthalates in vinyl in Europe.

Established brands with higher goodwill and a reputation for producing reliable and high-quality marine vinyl products tend to attract more consumers. Brand loyalty is an important factor affecting the buying decisions in the market, where consumers rely on trusted brands to ensure the safety and longevity of their marine upholstery.

This industry is experiencing several technological trends to enhance the sustainability, performance, and aesthetic appeal of marine vinyl upholstery, flooring, and covers. Advances in UV inhibitors and coatings are improving the longevity of marine vinyl by preventing fading and degradation of upholstery from prolonged sun exposure.

The raw materials used in the production of marine vinyl are polyvinyl chloride (PVC), plasticizers, stabilizers, and other additives that enhance its durability, flexibility, and versatility. There is a growing use of bio-based PVC as an alternative to standard PVC. Manufacturers increasingly incorporate recycled materials into their products to reduce their environmental impact.

End Use Insights

Based on end use, cruise ships dominated the market in 2023, accounting for a revenue share of 36.86%. According to the Cruise Lines International Association, global cruise capacity was likely to grow by 19% from 2022 to 2028. Marine vinyl is preferred for seating and upholstery on cruise ships, including lounges, dining areas, and outdoor deck furniture. It is resistant to UV rays, saltwater, and mildew, making it ideal for indoor and outdoor applications. It can also endure heavy use while maintaining its aesthetic appeal, which is crucial for high-traffic areas on cruise ships. Flooring is another application of this product in areas exposed to moisture, such as bathrooms, kitchens, and outdoor decks. Vinyl flooring offers slip resistance, durability, and ease of maintenance, making it suitable for the safety and comfort of passengers and crew. In spa and pool areas, marine vinyl is used for lounge chairs, cushions, and other seating. Its resistance to chlorine and saltwater, combined with its comfort and aesthetic versatility, is expected to propel its demand.

On the basis of end use, the sport boat segment is expected to grow at the fastest revenue CAGR of 8.4% from 2024 to 2030. Marine vinyl is primarily used for seating and upholstery in sport boats. According to the National Marine Manufacturers Association (NMMA), new motorboat sales have declined by 1% to 3% in the U.S.. However, personal watercraft sales rose by 20% to 25%. This is attributed to the rising inflation and interest rates in 2023, as price-sensitive customers are restricting their purchase of personal watercraft rather than spending on buying a new boat. According to the Boating Industry Association (BIA), in Australia, there are more than 95,000 personal watercraft registered in the country. The growth of registered personal watercraft is expected to further boost the demand for these products over the coming years.

Regional Insights

North America dominated the marine vinyl market in 2023 with a revenue share of 48.83%. North America is one of the popular destinations for marine tourism, encompassing a wide range of activities such as snorkeling, diving, sailing, and boating. The Pacific Coast, Atlantic Coast, Caribbean, and Gulf of Mexico are a few of the major tourist attractions of the region, offering coastal cruising, sailing, and kayaking experiences. Marine tourism significantly contributes to the market growth in the U.S., Canada, and Mexico, owing to the rising demand for yachts, sport boats, and cruise ships in these regions. According to a report published by the Cruise Lines International Association (CLIA), the marine tourism industry in North America has been recovering from the effects of COVID-19 for the past two years. The report also stated the passenger volume for the year 2022 to be 12.5 million, a 467.6% increase from 2.2 million in 2021. Therefore, the growing number of passengers for marine tourism in the region is expected to drive the demand for recreational boats, thereby boosting the market demand.

U.S. Marine Vinyl Market Trends

The marine vinyl market in the U.S. dominated the North America market in 2023, as its coasts are a hub for travel, tourism, and recreation. According to the NMMA, in 2022, the annual sales of boats, marine products, and services were estimated to be USD 59.30 Million. This trend is expected to continue over the forecast period, supporting the demand for marine vinyl in the U.S.

Europe Marine Vinyl Market Trends

The marine vinyl market in Europe is expected to grow significantly over the forecast period. Europe comprises many developed economies, such as Germany, the UK, Spain, and France, with a well-established marine tourism sector driving the demand for marine vinyl in the region. Europe’s coastal region is among the most popular tourist destinations for domestic and international visitors. This makes coastal and maritime tourism one of the largest and fastest-growing sectors of Europe’s Blue Economy, in terms of Gross Value Added (GVA), which is further expected to boost the demand for marine vinyl in the coming years.

France marine vinyl market accounted for the largest revenue share of 14.92% in 2023 in Europe. Around 60% of the boats manufactured in France are livable sailboats, and 33% are livable motorboats. Such boats require high-quality materials, such as marine vinyl, for upholstery and flooring applications, which is expected to boost the demand for marine vinyl in the country.

Asia Pacific Marine Vinyl Market Trends

The marine vinyl market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to several key factors, including economic development, the increasing popularity of recreational boating, and the expansion of marine tourism. Moreover, rapid economic development in countries like China, Japan, India, and Singapore has led to rising disposable incomes, enabling more people to afford recreational activities, including boating.

Japan marine vinyl market dominated the Asia Pacific market with the highest revenue market share in 2023. Japan has a strong culture of recreational boating, with many coastal regions and a significant number of boat owners. According to the International Trade Administration, in 2022, the total Japan’s pleasure boat industry which includes personal watercraft, recreational boat, outboard engine, and yachts, was valued at around USD 204 million. This has led to the demand for high-quality, durable, and aesthetically pleasing materials for boat interiors and exteriors, which is expected to drive the growth of the marine vinyl market.

Central & South America Marine Vinyl Market Trends

The marine vinyl market in CSA is expected to grow lucratively over the forecast period. Countries like Brazil, Argentina, Costa Rica, and the Caribbean nations are experiencing increased tourist influx owing to the popular beaches and marine recreational activities. Moreover, the cruise industry is expanding in the Caribbean as well as along the coastlines of Central and South America.

Brazil marine vinyl market dominated the CSA market in 2023 and is expected to grow significantly during the forecast period. Brazil has one of the longest coastlines in the world, stretching over 7,400 kilometers. This extensive coastline supports a wide range of marine activities, from fishing to recreational boating, which in turn drives demand for the marine vinyl market. Furthermore, the popularity of boating as a leisure activity is increasing among Brazilians, particularly in affluent areas like Rio de Janeiro and São Paulo. The rise in recreational boating fosters demand for high-quality marine vinyl for upholstery, flooring, and protective covers.

Middle East & Africa Marine Vinyl Market Trends

The marine vinyl market in MEA is expected to grow significantly over the forecast period. Countries in this region, such as the U.A.E., are investing heavily in marine tourism, including luxury yacht charters, cruise tourism, and waterfront developments. Moreover, countries like Saudi Arabia are developing extensive tourism projects along the Red Sea, including luxury resorts and marine parks, which require durable and aesthetically pleasing marine vinyl for various applications.

Saudi Arabia marine vinyl market is expected to account for a significant share of the Middle East & Africa over the forecast period owing to continued investments by its government in waterfront development projects. Moreover, marine tourism in Saudi Arabia is growing due to the rising per capita income of the working population. The Saudi government has been implementing policies and initiatives to promote recreational boating to support the ongoing marine tourism development in the country.

Key Marine Vinyl Company Insights

Some of the key players operating in the market include Sunbrella, OMNOVA North America Inc., and Uniroyal Engineered Products, LLC.

-

Sunbrella is involved in the production of fabrics for several applications including residential upholstery, shade, marine, commercial, and contract applications.

-

OMNOVA North America Inc. caters to several industries, including agricultural & landscape, building & architecture, electronics & appliances, food service, industrial, manufactured housing, recreational vehicles, sports surfaces, automotive, flooring, furniture, healthcare, hospitality & entertainment, marine, retail, and transportation.

-

Uniroyal Engineered Products, LLC produces cast-coated vinyl fabrics for various application industries, such as residential, hospitality, healthcare, marine, fitness, recreational vehicles, transportation, and automotive.

Morbern Europe BV, and Herculite are some of the emerging market participants in market.

-

Morbern Europe BV produces and innovates decorative vinyl upholstery fabrics for various applications in corporate, healthcare, hospitality, marine, and transportation.

-

Herculite is involved in the production of high-performance laminated & coated fabrics and flexible composite textiles for several applications including healthcare & medical equipment, awnings & pool covers, digital media, banners, billboards & graphics, and marine & boating.

Key Marine Vinyl Companies:

The following are the leading companies in the marine vinyl market. These companies collectively hold the largest market share and dictate industry trends.

- Sunbrella

- The Swavelle Group

- Charlotte Fabrics

- Richloom

- Morbern Europe BV

- OMNOVA North America Inc.

- Herculite

- Reliatex Inc.

- Uniroyal Engineered Products, LLC.

- BZ Leather

- SPRADLING GROUP

- Nassimi LLC

- Ultra Fabrics

Recent Developments

-

In May 2020, OMNOVA Solutions, a Synthomer company, announced a new strategic business partnership with Syntec Industries. Under this agreement, OMNOVA would continue to develop, produce, and supply innovative marine upholstery products, and Syntec would oversee the sales function for these products. This will help the companies improve their customer service and client relationships and strengthen their position in the market.

Marine Vinyl Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 357.06 million

Revenue forecast in 2030

USD 488.02 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand square meters, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; China; Japan; Singapore; Brazil; UAE; Saudi Arabia

Key companies profiled

Sunbrella; The Swavelle Group; Charlotte Fabrics; Richloom; Morbern Europe BV; OMNOVA North America Inc.; Herculite; Reliatex Inc.; Uniroyal Engineered Products, LLC.; BZ Leather; SPRADLING GROUP; Nassimi LLC; Ultra Fabrics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Vinyl Markert Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine vinyl market report based on end use, and region:

-

End Use Outlook (Volume, Thousand Square Meters; Revenue, USD Million; 2018 - 2030)

-

Yachts

-

Cruise Ships

-

Sport Boats

-

Others

-

-

Regional Outlook (Volume, Thousand Square Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Singapore

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global marine vinyl market size was estimated at USD 340.8 million in 2023 and is expected to reach USD 357.06 million in 2024.

b. The global marine vinyl market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 488.02 million by 2030.

b. Cruise Ships end use accounted for the largest revenue share of 35.6% in 2023 and is expected to dominate the market over the forecast period, owing to the increasing inclination towards marine tourism across the globe.

b. The key players operating in the global marine vinyl market include Sunbrella, The Swavelle Group, Charlotte Fabrics, Richloom, Morbern Europe BV, OMNOVA North America Inc., Herculite, Reliatex Inc., Uniroyal Engineered Products, LLC., BZ Leather, SPRADLING GROUP, Nassimi LLC, and Ultra Fabrics

b. The marine vinyl market is anticipated to be driven by its application in a variety of outdoor settings beyond just marine environments. It is used for developing patio furniture, outdoor cushions, awnings, and covers, as well as some outdoor sporting goods. The adaptability of marine vinyl to different outdoor applications drives its demand across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.