- Home

- »

- Next Generation Technologies

- »

-

Marine Fuel Injection System Market, Industry Report, 2030GVR Report cover

![Marine Fuel Injection System Market Size, Share & Trends Report]()

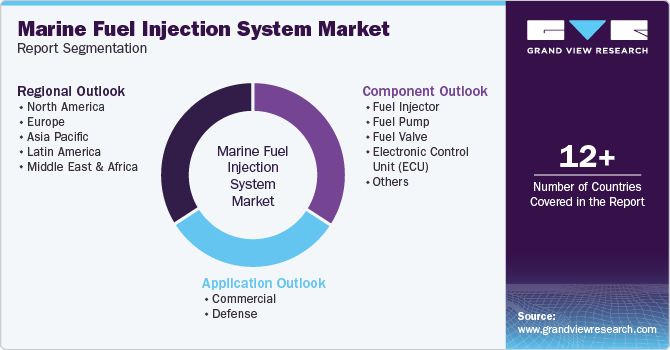

Marine Fuel Injection System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Fuel Injector, Fuel Pump, Fuel Valve, Electronic Control Unit (ECU), Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-222-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

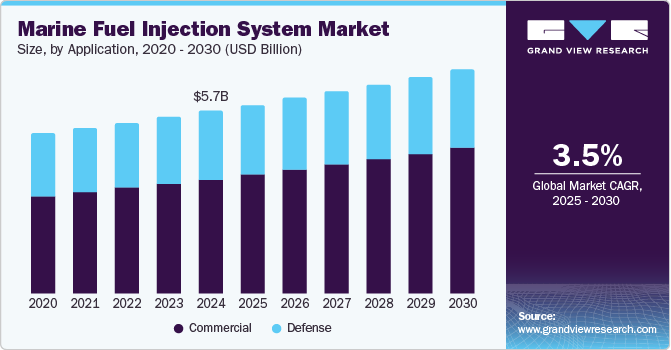

The global marine fuel injection system market size was valued at USD 5.71 billion in 2024 and is projected to grow at a CAGR of 3.5% from 2025 to 2030. Strict regulations regarding the environmental impact of marine transportation, increasing demand for technology that enables fuel efficiency, and the rise in global trade via marine vessels are some of the key growth driving factors for this market. Fleet owners' focus on cost reductions through performance improvement of vessels by adopting advanced technology solutions is primarily influencing the growth in demand.

The growth of this market is mainly driven by the increasing installations of marine fuel injection systems in commercial marine vessels that carry international cargo loads across countries. The growth in global trade has developed a demand for effective international marine transportation solutions. 2023 global maritime trade increased by 2.4%, showing a slight recovery from contractions in 2022. Multiple global industries such as food, energy, consumer electronics, chemicals, and others heavily rely on marine transport for international trade. According to the International Chamber of Shipping, more than 50,000 merchant ships carry international cargo trades with the involvement of nearly one million seafarers from various regions and countries

However, multiple factors have stimulated an increasing focus on cost reductions and performance improvements in recent years. These include headwinds driven by the geopolitical vulnerability of prominent locations in the Suez and Panama Canals, the growing impact of climate change, conflicts among nations, and more. The growing emphasis on reducing environmental footprint through fuel efficiency and cost reduction measures has generated growth in demand for solutions such as marine fuel injection systems.

Common rail fuel injection systems, which store fuel at comparatively higher pressure and efficiently distribute it to injectors, assist in precise control over fuel pressure, enhancing engine performance and reducing emissions. NOx emissions, considered one of the major elements in photochemical smog, are also reduced by this system with the help of pilot injections. The pilot injections reduce the premixed combustion friction to ensure reduced NOx formation.

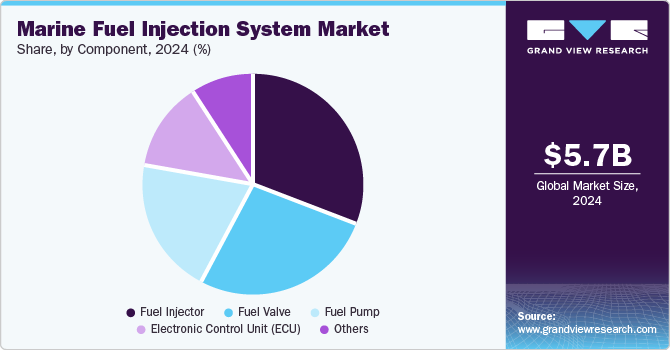

Components Insights

The fuel injector segment dominated the global marine fuel injection system market with a revenue share of 30.7% in 2024. Increasing demand for fuel injectors driven by damages and replacements has contributed to the dominance of this segment. The growing trend of retrofitting newly developed fuel injectors in old vessels for performance improvements and the rising dependence of global trade on maritime transportation is likely to generate growth for this segment in the approaching years. The introduction of strict regulations regarding the environmental impact of marine transportation has resulted in a growing demand for efficient injection systems and their components.

The fuel valve segment is projected to experience significant growth from 2025 to 2030. The fuel valve ensures the right amount of fuel is delivered to the engine and minimizes condensation losses. This component plays a vital role in the seamless operation of marine fuel injection systems. Refurbishment, growing utilization of large ships for international cargo transport, and fleet owners' focus on high-level maintenance of systems to ensure optimized vessel performance are anticipated to develop growth for this segment.

Application Insights

Commercial applications segment held the largest revenue share of the global marine fuel injection systems industry in 2024. This is attributed to factors such as the large number of existing merchant ships operating in global trade fleets and the increasing use of marine vessels for the transportation of goods, including food products, raw materials, machine components, fresh produce, heavy machinery, construction materials, chemicals, and more. In 2023, exports out of the U.S. and imports into the U.S. accounted for goods worth nearly USD 5,100 billion. The growing focus of commercial ship owners on performance improvements and cost reduction is expected to add substantial growth opportunities for this market.

Defense applications are expected to experience moderate growth during the forecast period. Defense vessels, primarily owned and operated by the country's naval forces, highly rely on optimized engine conditions and efficient systems. Continuous demand for the upkeep of existing vessels and growth in the development of new naval ships for capacity improvements by multiple governments are expected to drive the growth of this segment.

Regional Insights

Asia Pacific dominated the marine fuel injection systems with a revenue share of 32.8% in 2024. This is attributed to a large number of commercial vessels owned by the freight transport businesses operating in the country. For instance, in 2023, the total number of commercial vessels owned by Indonesia was 11,422. China and Japan owned 8,314 and 5,229 commercial vessels, respectively. Additionally, commercial ships owned by countries such as Singapore, India, Malaysia, and South Korea also accounted for a large share of the total number of commercial vessels worldwide. Large number of marine freight transportation businesses operating in the region, availability of products and technology, and rising investments in refurbishments are expected to drive the growth of this market from 2025 to 2030.

China marine fuel injection system industry held the largest revenue share of the regional market in 2024. China is home to large enterprises operating in the building sector. The robust shipbuilding industry, multiple organizations that manufacture components of ship engines, and a large share in global trade via marine transportation are some of the key growth driving factors for this market.

North America Marine Fuel Injection System Market Trends

North America was identified as one of the key regions on global marine fuel injection system industry in 2024. This market is mainly driven by the aspects such as presence of numerous freight transport and management companies in the region, major participation of countries in the global trade and increase in transportation through Transatlantic and Transpacific routes.

U.S. Marine Fuel Injection System Market Trends

The U.S. dominated the regional market for marine fuel injection system industry in 2024. The U.S. is one of largest importers and exporter of various goods. Significant participation of the U.S. based companies and fleet owners’ global trade and increasing focus on sustainability through fuel efficiency and reduced emissions are expected to drive growth of this market over forecast period.

Europe Marine Fuel Injection System Market Trends

Europe marine fuel injection system market is projected to experience fastest growth from 2025 to 2030. This is attributed to factors such as the focus of multiple governments on implementing strict regulations and compliance standards regarding the energy efficiency of marine transportation and the presence of many companies that rely on marine transport for business operations. This is anticipated to result in growth in ship refurbishment and continuous demand for ship maintenance solutions.

Germany held the largest revenue share of the regional industry in 2024. This market is mainly driven by the presence of a robust manufacturing industry in the country. Germany is one of the leading nations in cruise ship construction. It is home to nearly 130 shipyards associated with various functions such as commercial ships, inland transport, recreational craft, naval shipbuilding, general repairs, and more.

Key Marine Fuel Injection System Company Insights

Some of the key companies operating in the marine fuel injection system industry are Caterpillar, Rolls-Royce Plc, YANMAR HOLDINGS CO., LTD., Woodward, LIEBHERR, and others. To address growing demand and competition, major market participants embrace strategies such as innovation, increasing focus on research and development, use of advanced materials, geographical expansion, new product launches, and more.

-

Caterpillar manufactures diesel and gas engines, construction and heavy machinery, industrial turbines, mining equipment, and more. Its portfolio features the high-pressure common rail fuel system. The company also offers marine diesel engines and generator sets.

-

YANMAR HOLDINGS CO., LTD. is a Japanese manufacturing company that offers a range of products and services. These include diesel engines, marine equipment, agriculture machinery, and more. YANMAR develops small—to medium-sized diesel engines and other equipment associated with marine industry operations.

Key Marine Fuel Injection System Companies:

The following are the leading companies in the marine fuel injection system market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Rolls-Royce Plc

- YANMAR HOLDINGS CO., LTD.

- Woodward

- LIEBHERR

- Marelli Holdings Co., Ltd.

- Cummins Inc.

- DENSO CORPORATION

- NOVA WERKE AG

Recent Developments

- In September 2024, MAN Energy Solutions, one of the market participants in engine manufacturing, thermal power solutions, energy solutions, and more, introduced a new generation of common-rail fuel injection systems. The significant launch, following reduced dependency on suppliers and complete in-house production implementations, strengthened the company’s positioning in the manufacturing market.

Marine Fuel Injection System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.91 billion

Revenue forecast in 2030

USD 7.01 billion

Growth Rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

Caterpillar; Rolls-Royce Plc; YANMAR HOLDINGS CO., LTD.; Woodward; LIEBHERR; Marelli Holdings Co., Ltd.; Heinzmann GmbH & Co. KG.; Cummins Inc.; DENSO CORPORATION; NOVA WERKE AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Fuel Injection System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine fuel injection system market report based on component, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel Injector

-

Fuel Pump

-

Fuel Valve

-

Electronic Control Unit (ECU)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Passenger Cruise

-

Bulk Carrier & Container ships

-

Tankers

-

Others

-

-

Defense

-

Submarines

-

Aircraft Carriers

-

Destroyers

-

Frigates

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.