- Home

- »

- Consumer F&B

- »

-

Malted Milk Market Size, Share, Global Industry Analysis Report, 2025GVR Report cover

![Malted Milk Market Size, Share & Trends Report]()

Malted Milk Market Size, Share & Trends Analysis Report By Source (Wheat, Barley), By Type (Liquid, Powder), By Region (Central & South America, MEA, APAC, Europe, North America), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-480-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

Industry Insights

The global malted milk market size was estimated at USD 5.58 billion in 2018 and will expand further at a CAGR of 5.5% over the forecast period. Malted milk is prepared by combining whole milk powder, malted grain flour, and other ingredients, which are used as fortification and flavoring agents in food and beverages. It provides sweetness and a creamy mouthfeel to the food products. It is widely used as a coating ingredient.

Rising awareness about following a healthy lifestyle is the major factor responsible for increasing product demand. In addition, manufacturers are focusing on usage of natural ingredients, which is driving product sales. Increasing awareness about the various benefits of malted foods and drinks and high product consumption as a nutrition supplement will augment the market growth further.

Changing food preferences, such as high demand for bite-sized snacks, due to hectic lifestyle along with rapid urbanization and industrialization will also have a positive impact on market growth. Moreover, innovations in bite-sized snacks, such as malted milk powder cookies and other baked products, are projected to boost the demand. In addition, rising demand for flavored milk is likely to contribute to industry growth.

Asia Pacific is estimated to be the dominant, as well as, the fastest-growing regional market over the forecast period on account of high product demand. In addition, the growing population in countries, such as India, Japan, and China, along with the increasing health awareness is expected to spur the growth of the regional market.

Source Insights

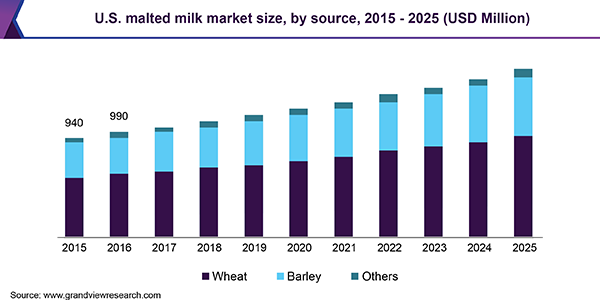

Based on source, the market is classified into wheat, barley, and others. Wheat segment led the global market in 2018 and accounted for a share of more than 64%. The segment is projected to remain dominant throughout the forecast years, as wheat is an easily and abundantly available source. Moreover, wheat is cheaper than other sources and provides a better base making it a premium ingredient. All these factors are estimated to drive the segment growth over the forecast period.

Barley is another ingredient, which is a highly nutritious substance and thus has high demand in the malted milk market. The aqueous extracts of barley are called ‘wort’, which consists of vitamin B constituents, such as folic acid, Vitamin B6 (pyridoxine), thiamine, riboflavin, and biotin. It also contains essential minerals, such as potassium, zinc, calcium, and magnesium, as well as proteins, amino acids, and soluble fiber.

Type Insights

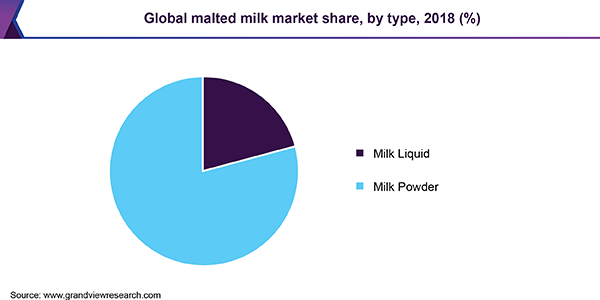

Based on type, the market has been bifurcated into liquid and powder. The liquid segment is anticipated to hold the largest share in the market by 2025. Rising demand for sports drinks is likely to fuel the segment growth over the forecast years. The powder segment is estimated to register the fastest CAGR from 2019 to 2025.

Extensive usage of malted milk powders in biscuits, cookies, and other foods, due to growing demand for healthy snacks, will drive the segment. On the other hand, rising concerns about the added preservatives in milk powders may have a negative impact on the growth of this segment.

Regional Insights

Asia Pacific is expected to be the largest, as well as the fastest-growing, regional market from 2019 to 2025. This growth can be attributed to the rising target population in countries, such as India, Japan, and China, and growing awareness about following a healthy lifestyle. In addition, product portfolio extension by key companies through innovations will have a positive impact on the regional market growth. For instance, GlaxoSmithKline has extended its Horlicks family brand through Horlicks for Women, Horlicks Lite for diabetes patients, and Junior Horlicks for children aged between 1 and 3 years.

Malted Milk Market Share Insights

Manufacturers in the market have undertaken several marketing strategies, such as product innovation, M&A, and regional expansions, to gain a higher market share. For instance, Horlicks re-launched Mother’s Horlicks for nursing and pregnant women and was widely marketed through TV commercials and in-store promotions. It had gained 10% off-trade sales for Horlicks in India.

Manufactures are also focusing on product packaging to attract more consumers. For instance, in January 2019, Full Sail Brewing launched Malted Milkshake-Style IPA in an attractive packaging of 6 bottles, each of 12 ounces. Some of the key companies in the market are Nestle S.A., Horlicks, GlaxoSmithKline PLC, Briess Malt & Ingredients, Imperial Malts Ltd., SSP Pvt Ltd., Family Cereal Sdn. Bhd., Muntons PLC, Food & Biotech Engineers India Pvt. Ltd., and Insta Foods.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Billion and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central and South America, and Middle East and Africa

Country scope

U.S., U.K., Germany, India, Japan, Brazil, and South Africa

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global malted milk market report on the basis of source, type, and region:

-

Source Outlook (Revenue, USD Billion, 2015 - 2025)

-

Wheat

-

Barley

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

Milk Liquid

-

Milk Powder

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."