- Home

- »

- Plastics, Polymers & Resins

- »

-

Mailer Packaging Market Size, Share, Industry Report, 2033GVR Report cover

![Mailer Packaging Market Size, Share & Trends Report]()

Mailer Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Foil), By Product (Cushioned, Non-cushioned), By Insulation, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-992-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mailer Packaging Market Summary

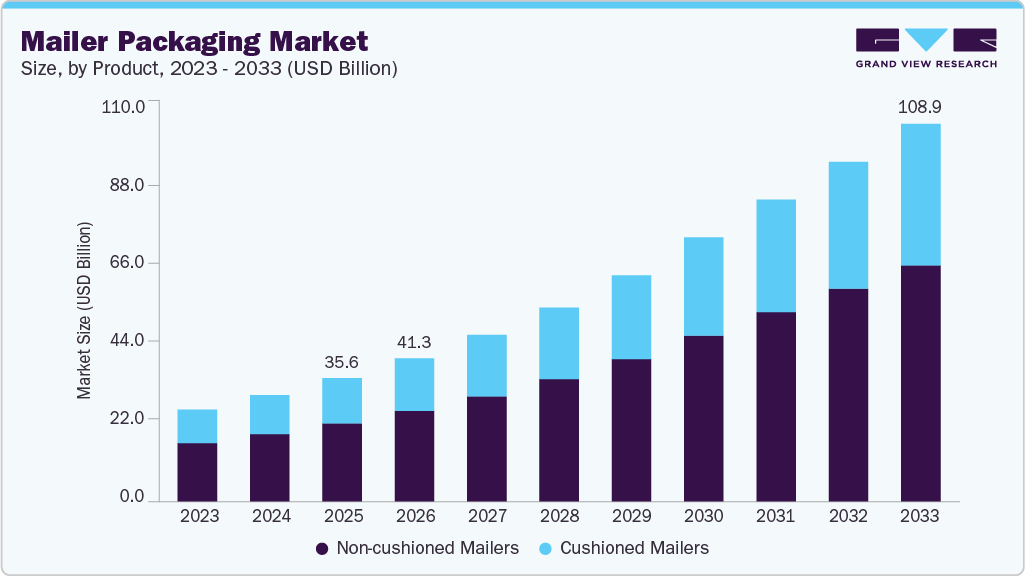

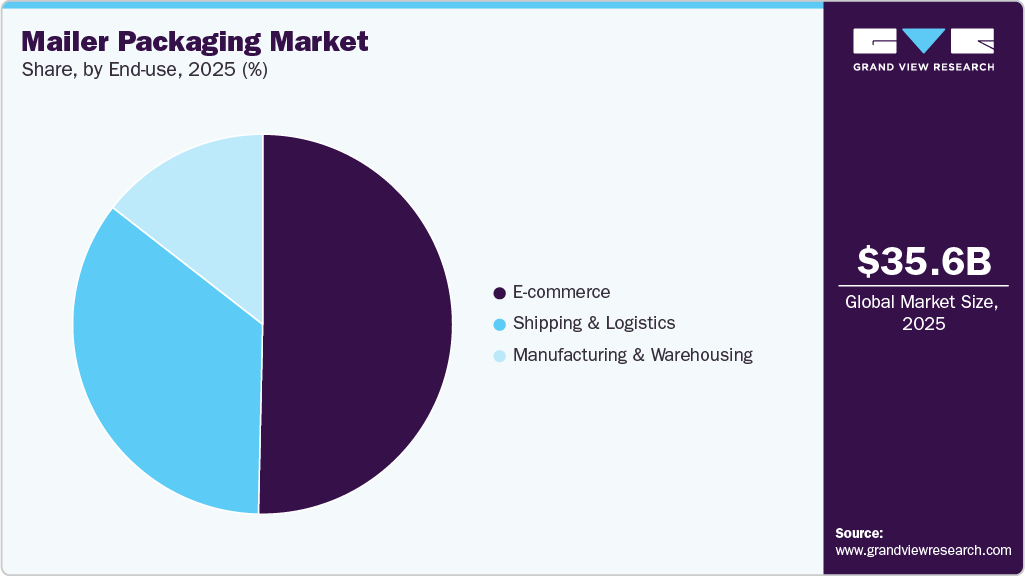

The global mailer packaging market size was estimated at USD 35.56 billion in 2025 and is projected to reach USD 108.99 billion by 2033, growing at a CAGR of 14.9% from 2026 to 2033. Rising e-commerce penetration and accelerated online order volumes are driving strong demand for protective, lightweight, and cost-efficient mailer packaging.

Key Market Trends & Insights

- Asia Pacific dominated the mailer packaging market with the largest revenue share of 41.0% in 2025.

- The mailer packaging market in India is expected to grow at the fastest CAGR of 15.9% from 2026 to 2033.

- By product, the cushioned segment is expected to grow at the fastest CAGR from 2026 to 2033 in terms of revenue.

- By insulation, the insulated segment is expected to grow at the fastest CAGR of 15.2% from 2026 to 2033 in terms of revenue.

- By material type, the paper segment accounted for a revenue share of over 53.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 35.56 billion

- 2033 Projected Market Size: USD 108.99 billion

- CAGR (2026 - 2033): 14.9%

- Asia Pacific: Largest market in 2025

Brands’ growing focus on sustainable, recyclable mailers to meet regulatory and consumer expectations further strengthens market growth.The industry is driven primarily by the rapid expansion of e-commerce, which continues to boost demand for protective, lightweight and logistics-efficient packaging formats. As online retail volumes grow across apparel, electronics, beauty, and small consumer goods, brands and fulfillment centers increasingly rely on mailers for cost-effective last-mile delivery. Their ease of handling, lower dimensional weight charges, and compatibility with automated packing systems position mailers as a preferred solution for high-velocity shipping operations.

Growing emphasis on sustainable and recyclable packaging is another strong market driver. Consumers, retailers and regulators are pushing for materials that reduce plastic usage and improve recyclability, accelerating the adoption of paper mailers, padded paper mailers and compostable variants. Global brands are redesigning packaging portfolios to meet ESG commitments and extended producer responsibility (EPR) mandates, thereby increasing demand for eco-friendly mailer alternatives to traditional polybags.

Advancements in protective packaging technology are also supporting market growth. Manufacturers are innovating with lightweight cushioning, self-seal adhesives, tamper-evident closures and moisture-resistant materials that enhance product protection without increasing shipping costs. These innovations enable mailers to replace bulky boxes in several applications, particularly for small, fragile or high-value products, strengthening their position in omnichannel retail and subscription commerce.

The rise of direct-to-consumer (D2C) brands and global logistics networks further accelerates mailer demand. D2C startups prioritize branded, compact, and customer-friendly packaging that delivers a positive unboxing experience while controlling fulfillment costs. Meanwhile, growth in cross-border e-commerce and improvements in courier, express and parcel (CEP) services expand the usage of mailers across regions. Together, these dynamics ensure sustained demand for versatile, efficient and brandable mailer packaging solutions worldwide.

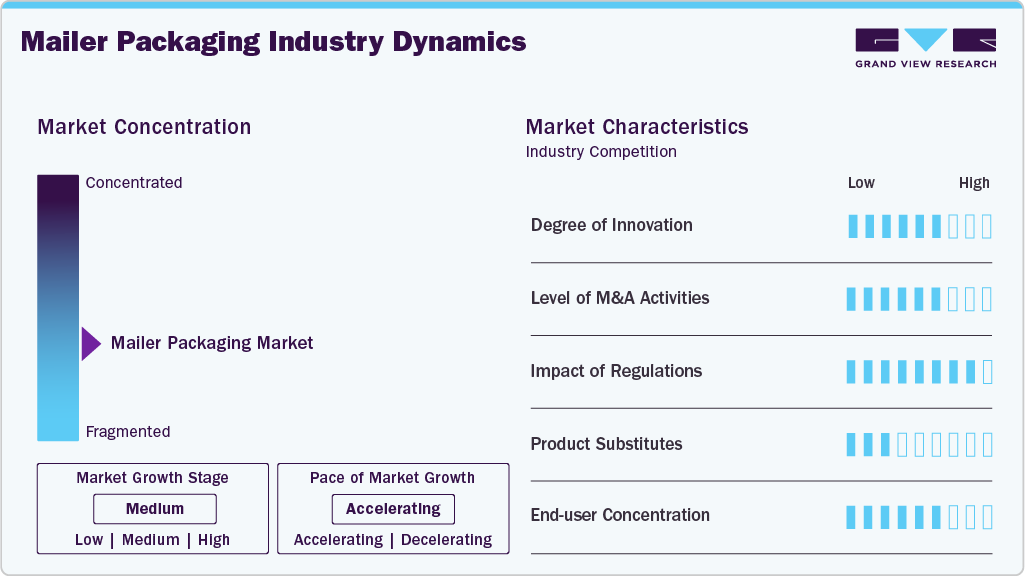

Market Concentration & Characteristics

The mailer packaging industry is characterized by high-volume, cost-sensitive production, driven largely by e-commerce and parcel shipping activities. Manufacturers operate in a competitive environment where material efficiency, lightweight design, and automation capability are critical to meeting large-scale fulfillment needs and maintaining profitability.

It is a material-diverse industry, encompassing paper, plastic, padded, bubble-lined, and compostable mailers. This diversity allows suppliers to target multiple end-use sectors while responding to rising sustainability requirements. Innovation in recyclable and fiber-based mailers is reshaping product portfolios as brands adopt greener packaging solutions.

The industry is also marked by rapid product innovation, with companies developing advanced sealing systems, tamper-evident features, water-resistant coatings, and custom-printed designs to enhance protection and branding. This focus on product performance and differentiation is essential to serving omnichannel retail and high-growth D2C brands.

Product Insights

The non-cushioned mailers segment dominated the market with a revenue share of over 63.0% in 2025. The high share of this segment can be attributed to the large-scale adoption of non-cushioned mailers for shipping products that do not require additional padding or protection during transit. They are commonly employed for clothing, documents, or lightweight products. Their popularity stems from their lightweight, cost-effectiveness, and versatility.

The cushioned mailer segment is expected to progress at the highest CAGR over the forecast period. Cushioned mailers are compact, easy to handle, and take up less space compared to traditional packaging materials like boxes with additional padding. This can be beneficial for both manufacturers and retailers in terms of logistics and storage efficiency. Sales of consumer electronics, such as smartphones, tablets, and accessories, have been on the rise. These products often require careful handling and protection during transit, driving the demand for cushioned mailers.

Insulation Insights

The non-insulated mailer packaging segment dominated the overall market in 2025 with a revenue share of over 89.0%. Non-insulated mailers are often more cost-effective than their insulated counterparts. For businesses looking to minimize packaging costs while maintaining product protection, non-insulated mailers can be an economical choice, which contributes to their high market share.

The insulated mailer segment is expected to witness the fastest CAGR of 15.2% over the forecast period. The pharmaceutical industry often requires temperature-controlled packaging for the shipment of medications that are sensitive to temperature variations. Insulated mailers provide a solution for maintaining the required temperature range during transit.

Material Type Insights

The paper segment accounted for a revenue share of over 53.0% in 2025 and is expected to progress at a significant CAGR over the forecast period. The paper segment of the mailer packaging market is expanding rapidly due to rising demand for recyclable, fiber-based alternatives that help brands meet sustainability goals and regulatory requirements. Paper mailers, including kraft mailers and padded paper formats, offer strong protection, lightweight performance, and curbside recyclability, making them an attractive replacement for traditional poly mailers. Their improved strength, printability, and compatibility with automated fulfillment systems enhance both branding and operational efficiency.

The plastic segment of the mailer packaging market is driven by its durability, moisture resistance, and cost-efficiency, making it a preferred choice for shipping apparel, soft goods, and lightweight e-commerce items. Poly mailers offer strong tear resistance, secure sealing, and lower dimensional weight, which helps reduce logistics costs for high-volume shippers. Their compatibility with automated packing systems and availability in custom-printed formats further enhances brand visibility and operational efficiency. Although sustainability concerns are prompting shifts toward recyclable and bio-based plastics, plastic mailers remain widely used due to their performance reliability and favorable economics.

End Use Insights

E-commerce dominated the end-use segment in 2025 with a revenue share of over 50.0% and is expected to grow at a CAGR of 15.2% from 2026 to 2033. The lightweight design of mailer packaging contributes to cost savings in shipping, which is often based on weight. E-commerce businesses can benefit from reduced shipping costs while ensuring safe delivery of products. In addition, mailer packaging can be customized according to different types of products, including clothing, accessories, books, electronics, and more, which contributes to its adoption in the e-commerce industry.

The shipping & logistics end-use segment plays a critical role in driving demand for mailer packaging as parcel carriers, courier companies, and fulfillment centers increasingly prioritize lightweight, durable, and cost-efficient packaging solutions. Mailers help reduce dimensional weight charges, speed up packing operations, and improve last-mile delivery efficiency, making them ideal for high-volume parcel networks. Their protective features, such as tear resistance, secure sealing, and moisture protection, ensure safe transit across long and complex supply chains. As global parcel volumes surge due to e-commerce growth, reverse logistics, and cross-border shipping, logistics providers continue to adopt mailers to enhance operational performance and reduce overall shipping costs.

Regional Insights

North America mailer packaging market has several manufacturers, such as ProAmpac, Mondi, American Polypak Packaging, and PAC. These players constantly develop customized mailer options for various end-use industries to strengthen their market presence, which can increase the penetration of custom packaging solutions in North America.

U.S. Mailer Packaging Market Trends

The mailer packaging market in the U.S.is growing due to the adoption of sustainable options. Policies developed by State Governments to limit the use of plastics in packaging and promote sustainable materials are leading end-users to shift from plastic mailers to paper-based mailers. For instance, in July 2023, Amazon Inc. announced its shift from plastic-padded mailers to paper-based mailers.

Canada mailer packaging marketis expected to progress at a significant CAGR over the forecast period. According to the International Trade Administration, e-commerce infrastructure in Canada is highly advanced and closely integrated with the U.S. Broadband internet connectivity is provided using technology similar to that of the U.S.

Asia Pacific Mailer Packaging Market Trends

The mailer packaging market in Asia Pacific dominated the global market, accounting for the largest revenue share of 41.0% in 2025. Asia Pacific drives the mailer packaging market due to its massive e-commerce ecosystem, rapid digital adoption, and strong manufacturing base. Countries like China, India, and Southeast Asian nations are experiencing explosive growth in online retail, which directly increases demand for lightweight, cost-efficient mailers. The region also houses large-scale converters and raw material suppliers, enabling competitive pricing and fast production cycles for both paper and plastic mailers. High population density and rising middle-class consumption continue to accelerate parcel volumes, reinforcing mailers as a primary packaging format.

Europe Mailer Packaging Market Trends

The mailer packaging market in Europeheld a significant revenue share in 2025, owing to flexible packaging developments. The growth of digital health platforms and telemedicine services has created an ecosystem for patients to receive virtual consultations and prescriptions with the option of home delivery. Flexible packaging is used for packaging pharmaceuticals, personal care items, and medical supplies. Therefore, the growing online delivery of pharmaceuticals is expected to drive the market growth.

Germany mailer packaging marketaccounted for a considerable share of the market. According to the International Trade Administration (ITA), Germany has one of the largest e-commerce markets in Europe. The country’s internet penetration, number of e-commerce consumers, and the average amount spent on online purchasing are higher than the European region's average, presenting a positive market outlook.

Latin America Mailer Packaging Market Trends

The mailer packaging market in Latin Americais expected to progress at a CAGR of 15.1% from 2026 to 2033. Several strategic initiatives undertaken by regional mailer packaging manufacturers further contribute to the growth of the market in Latin America.

Brazil mailer packaging market is expected to witness growth in demand for various packaging solutions. Brazil, like many other countries, has seen a significant increase in e-commerce activities. The growth of online retail contributes to the demand for packaging solutions like mailer packaging, which is often used for shipping smaller items. The efficiency of Brazil's logistics and distribution networks plays a crucial role in determining the demand for packaging materials.

Middle East & Africa Mailer Packaging Market Trends

The mailer packaging market in the Middle East & Africawill register growth as online retail gains momentum. Businesses are increasingly investing in advanced mailer packaging options to enhance product protection and streamline shipping processes. This surge in demand has led to innovation in packaging materials and design, with an emphasis on sustainability to align with global environmental goals. Furthermore, the MEA mailer packaging market exhibits a diverse landscape shaped by unique regional factors. Countries in the Gulf Cooperation Council (GCC) are witnessing rapid growth in e-commerce, which is fueling the demand for customized and technologically advanced mailer solutions.

The GCC mailer packaging market is expected to grow as the GCC countries focus on the development of non-oil economy sectors such as automotive, renewable energy, and pharmaceutical. The automobile sector in GCC countries comprises top international automotive brands, with major international automotive manufacturers operating in the region. With the rise in electric vehicles, automotive manufacturers are expected to set up manufacturing facilities in GCC countries.

Key Mailer Packaging Companies Insights

Key players operating in the mailer packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Mailer Packaging Companies:

The following are the leading companies in the mailer packaging market. These companies collectively hold the largest Market share and dictate industry trends.

- Pregis LLC

- 3M

- Novolex

- Sealed Air

- ProAmpac

- Georgia-Pacific LLC

- Intertape Polymer Group (IPG)

- DS Smith

- Mondi

- Stora Enso

- Smurfit Westrock

- Abriso Jiffy

- Henkel Corporation

- Storopack Hans Reichenecker GmbH

- VP Group

- Manufacturas Polisac S.A.

Recent Developments

-

In May 2025, Mondi expanded the production capacity of its recyclable MailerBAG by adding a new production line at its Krapkowice plant in Poland. This expansion is in response to the growing demand for sustainable e-commerce packaging solutions. It aligns with Mondi’s MAP2030 sustainability commitments and its focus on circular packaging solutions, reinforcing the company’s leadership in delivering innovative, sustainable alternatives to plastic mailers in the rapidly growing online retail market.

-

In January 2025, International Paper completed its USD 7.2 billion acquisition of DS Smith, creating a global leader in sustainable packaging solutions with a strong presence in North America and Europe. The combined company aims to accelerate growth, improve profitability, and enhance customer offerings with an expected synergy.

Mailer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 41.30 billion

Revenue forecast in 2033

USD 108.99 billion

Growth rate

CAGR of 14.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, insulation, material type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada. Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Pregis LLC; 3M; Novolex; Sealed Air; ProAmpac; Georgia-Pacific LLC; Intertape Polymer Group (IPG); DS Smith; Mondi; Stora Enso; Smurfit Westrock; Abriso Jiffy; Henkel Corporation; Storopack Hans Reichenecker GmbH; VP Group; Manufacturas Polisac S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mailer Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mailer packaging market report on the basis of product, insulation, material type, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Paper

-

Foil

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cushioned Mailers

-

Non-cushioned Mailers

-

-

Insulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Insulated

-

Non-Insulated

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

E-commerce

-

Shipping & Logistics

-

Manufacturing & Warehousing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mailer packaging market size was estimated at USD 35.56 billion in 2025 and is expected to reach USD 41.30 billion in 2026.

b. The global mailer packaging market is expected to grow at a compound annual growth rate of 14.9% from 2026 to 2033 to reach USD 108.99 billion by 2033.

b. The paper segment by material dominated the market with a revenue share of nearly 53.2% in 2025 owing to its eco-friendly nature.

b. Some of the key players operating in the global mailer packaging market include Pregis LLC, 3M Company, Sealed Air Corporation, ProAmpac LLC, Georgia-Pacific LLC, Intertape Polymer Group Inc, Crown Packaging Corp., Mondi, Abriso Jiffy, and Henkel Corporation.

b. The key factors that are driving the global mailer packaging market include an increasing number of e-shoppers, increased demand for sustainable packaging solutions, and increasing expansion of e-commerce giants in the global market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.