- Home

- »

- Advanced Interior Materials

- »

-

Magnesium Alloys Market Size, Industry Report, 2020-2027GVR Report cover

![Magnesium Alloys Market Size, Share & Trends Report]()

Magnesium Alloys Market (2020 - 2027) Size, Share & Trends Analysis Report By Application (Automotive & Transportation, Aerospace & Defense, Electronics), By Region (MEA, North America, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-516-8

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

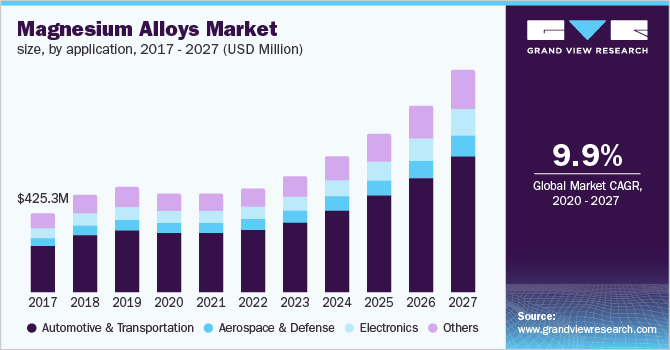

The global magnesium alloys market size to be valued at USD 6.62 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% during the forecast period. Magnesium alloys find applications in jet engine fan frames, transmission castings, spacecraft, and missiles. Thus, increasing spending on the defense sector and demand for new commercial aircraft are anticipated to remain key growth-driving factors for the market.

The U.S. is the leading country with the highest spending on the defense sector. In 2019, the U.S. government proposed a budget of USD 686 billion for the Department of Defense. The key investments of the budget in aircraft included 77 F-35 Joint Strike Fighters, 10 P-8A Aircraft, and 15 KC-46 Tanker Replacements.

As per a recent study published by Boing, North America is likely to have 9,130 new airplane deliveries by 2038, second-highest after Asia Pacific. Moreover, preference for fuel-efficient vehicles is projected to boost the usage of such lightweight materials, thereby augmenting the product demand.

The U.S. automotive market is one of the largest in the world and witnessed sales of 17.2 million units in 2018. It also received Foreign Direct Investment (FDI) of USD 114.6 billion in 2018 for the automotive sector. These factors are also likely to have a positive impact on market growth as magnesium alloys are widely used in vehicle interior, exterior, chassis, and powertrain applications.

On the other hand, challenges, such as concerns about general and galvanic corrosion, and growing cost of high-pressure die casting process, may hamper the industry growth to some extent.

Magnesium Alloys Market Trends

The growing use of alloys in the automotive industry is a key cause driving the market further. Additionally, the rising popularity of magnesium alloy in artificial human implants, and increasing applications of the material in medical aerospace and defense industries are likely to propel the industry growth.

The market is being driven by the increasing manufacturing of engineering components for weight reduction without compromising overall strength along with the growing demand for vibration damping capacity. Moreover, magnesium alloys offer strength, light weight, durability, thermal conductivity, high-temperature creep, and corrosion resistance. As a result, the demand for magnesium alloys is expected to grow substantially owing to these characteristics.

Aluminum alloys are currently utilized for a wide range of structural applications due to their properties like lightweight and high strength. However, magnesium alloys are one-third the weight of aluminum alloys. In addition, the lighter weight magnesium offers more advantages like better machinability, higher dent resistance, and the ability to withstand electromagnetic radiation. All these factors are expected to offer enormous opportunities for the industry.

However, fluctuating magnesium prices, as well as issues associated with corrosion and welding of magnesium alloys, are expected to limit market expansion to some extent. Furthermore, the availability of alternative materials for magnesium alloys at a lower cost is expected to limit the market growth.

Application Insights

Based on the application, the market is categorized into automotive & transportation, aerospace & defense, electronics, and others. In terms of revenue, automotive & transportation is likely to attain the highest CAGR of 10.5% from 2020 to 2027. Incessant production of electric and lightweight vehicles is projected to drive the segment growth over the long term.

Magnesium-alloy based products have the lowest density than most of the engineering materials. The penetration of these products is projected to increase despite volatility in costs and supply. Common automotive applications of these products include valve covers, steering wheels, and instrument panel beams. Recyclability is another key characteristic of magnesium, wherein it is possible to recycle nearly 99% of magnesium parts, which is projected to reduce the costs in automotive & transportation applications.

Magnesium alloys are also used in electronics application as a replacement of plastics, where thermal conductivity, weight, strength, and durability are key aspects. The applications include cell phones, hard drive arms, electronic packaging, and media housings.

Regional Insights

North America was valued at USD 684.1 million in 2019 and projected to attain a lucrative growth over the coming years. The growth of this region is attributed to increasing magnesium content per vehicle, incessant automotive production, and increasing defense budget.

Asia Pacific was the largest regional market in 2019. The region is likely to maintain its position during the forecast period. Investments in new automotive projects and rising FDIs are anticipated to remain key growth-driving factors for the market over the coming years. For instance, in November 2019, Hyundai Motor announced an investment of USD 1.55 billion in its new Indonesia Car Plant. The production is projected to start in late 2021.

Europe holds a prominent position in the global market and is likely to register a significant CAGR of 8.5% from 2020 to 2027, in terms of volume. Owing to the stricter emission control laws, automakers are focusing on developing lightweight vehicles, which is projected to boost the demand of aluminum and magnesium. Moreover, the increasing popularity of electric and hybrid vehicles is anticipated to contribute to market growth.

Key Companies & Market Share Insights

Major companies have undertaken various strategies, such as capacity expansion, partnerships, and joint ventures to maintain their market share. For instance, recently, ALLITE Inc. announced its partnership with Xi’an Jiaotong University.

Recent Developments

-

In April, 2022, Yulin Energy Group and Ka Shui Group collaborated to promote the execution of Yulin magnesium and aluminum industry plan in order to proactively respond to China's development strategies of "One Belt, One Road" and "Intelligent Manufacturing”. Yulin Energy Group and Ka Shui Group announced a strategic partnership framework agreement

-

In Jan, 2020, ALLITE Inc. and Xi'an Jiaotong University collaborated to make significant breakthroughs in magnesium alloy research. ALLITE Inc. extended support of 5-year, multi-million-dollar cooperation with top material science academics at Xi'an Jiaotong University to continue to improve its core offering and capabilities, with an emphasis on furthering the patented ALLITE Super Magnesium alloys.

Some of the prominent players in the magnesium alloys market include:

-

Nanjing Yunhai Special Metals Co.

-

Magontec Ltd.

-

Globe Specialty Metals

-

Fugu Jinwantong Magnesium Industry Co.

-

Weijie Magnesium Industry Co.

Magnesium Alloys Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.93 billion

Revenue forecast in 2027

USD 6.62 billion

Growth Rate

CAGR of 9.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; China; India; Japan; Brazil; South Africa; Saudi Arabia

Key companies profiled

Nanjing Yunhai Special Metals Co.; Magontec Ltd.; Globe Specialty Metals; Fugu Jinwantong Magnesium Industry Co.; and Weijie Magnesium Industry Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Magnesium Alloys Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global magnesium alloys market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Automotive & Transportation

-

Aerospace & Defense

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global magnesium alloys market size was estimated at USD 3.1 billion in 2019 and is expected to reach USD 2.9 billion in 2020.

b. The global magnesium alloys market is expected to grow at a compound annual growth rate of 9.9% from 2019 to 2027 to reach USD 6.6 billion by 2027.

b. Automotive & transportation dominated the magnesium alloys market with a share of 58.1% in 2019. This is attributable to incessant production of electric and lightweight vehicles along with increasing applications including valve covers, steering wheels, and instrument panel beams.

b. Some key players operating in the magnesium alloys market include ALLITE Inc, Nanjing Yunhai Special Metals Co., Magontec Ltd., Globe Specialty Metals, Fugu Jinwantong Magnesium Industry Co., and Weijie Magnesium Industry Co.

b. Key factors that are driving the market growth include increasing applications in jet engine fan frames, transmission castings, spacecraft and missiles along with increasing defense spending and demand for new commercial aircraft.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.