- Home

- »

- Medical Devices

- »

-

Maggot Debridement Market Size, Industry Report, 2030GVR Report cover

![Maggot Debridement Market Size, Share & Trends Report]()

Maggot Debridement Market (2025 - 2030) Size, Share & Trends Analysis Report By Administration (Loose Larva, Biobags), By Application (Acute Wounds, Chronic Wounds), By End-use (Hospital, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-965-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Maggot Debridement Market Size & Trends

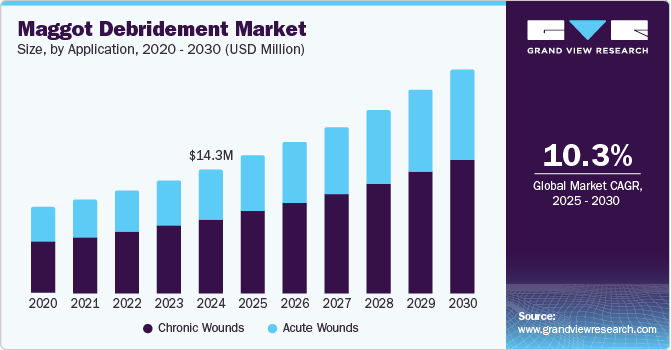

The global maggot debridement market size was valued at USD 14.3 million in 2024 and is anticipated to grow at a CAGR of 10.3% from 2025 to 2030. The demand for Maggot Debridement Therapy (MDT), which involves using disinfected maggots to remove dead tissue and bacteria from wounds, is rising. The increasing prevalence of chronic wounds, a rising geriatric population, and the growing acceptance of bio-based therapies in clinical applications drive market growth. The increasing prevalence of diabetes and obesity is responsible for growing incidences of chronic wounds such as diabetic foot ulcers, venous ulcers, and pressure ulcers, which pose significant challenges to patients worldwide.

Maggot debridement therapy promotes healing and has proven to be a safe and effective alternative to traditional surgical removal techniques from surgery. An additional driving force for market growth is the aging population, prone to chronic wounds due to age-related physiological changes and co-morbidities. MDT offers a less invasive approach as it is particularly useful for elderly patients who find invasive procedures difficult. This demographic shift is expected to significantly impact the market as healthcare providers search for effective treatments that meet the specific needs of geriatric patients.

In addition, the adoption of biotherapies has increased in recent years. As awareness of its therapeutic benefits increases, more healthcare providers are implementing MDT in their practices. Clinical studies demonstrating the efficacy of MDT in improving wound healing outcomes and reducing complications have increased its credibility. Furthermore, sustainable and increasingly environmentally friendly treatments align well with the principles of MDT, leading to its adoption in clinical settings.

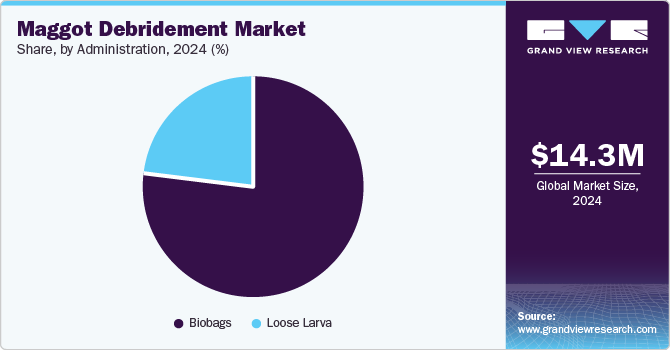

Administration Insights

The biobags segment dominated the market with the largest revenue share of 76.5% in 2024 owing to its ease of use, which has proven effective in promoting wound healing. The popularity of biobags can be attributed to their standardized, controlled environment, which ensures stability and safety in clinical applications. Biobags have become mainstream with the rise in demand for minimally invasive biotherapies. In addition, their pre-packaged design allows for simplified storage and handling, reducing the need for extensive training and minimizing the risk of contamination.

The loose larva segment is expected to grow at a CAGR of 10.4% over the forecast period, driven by increasing demand for personalized wound care treatments. Loose larvae offer high flexibility; they can be used directly on wounds and enable healthcare professionals to make precise treatment-based adjustments based on wound size, depth, and severity when treating complex or irregular wounds. The combination of low cost and flexibility increases the appeal of loose larvae in clinical and home care settings. Furthermore, advances in the breeding and sterilization processes of maggots have improved the safety, availability, and vulnerability of loose larvae, further increasing their growing demand and supporting their growth.

Application Insights

The chronic wounds segment dominated the market and accounted for the largest revenue share of 59.9% in 2024, largely due to a rise in chronic wounds, such as diabetic foot ulcers, arthritis, and pressure ulcers, which are more common in older people and individuals with comorbidities such as diabetes and peripheral vascular diseases. Maggot debridement therapy helps to remove dead tissue, reduce infection, and promote tissue regeneration. The therapy’s ability of the treatment to accelerate healing and reduce the need for surgery has made it desirable in managing chronic wounds, which often require long-term, specialized care.

The wounds segment is expected to grow at a CAGR of 10.4% over the forecast period from 2024 to 2030, driven by the increasing incidence of traumatic injuries and surgical wounds and the growing adoption of advanced wound care technologies. Traumatic wounds, such as accidents or burns, extensive tissue damage where maggots selectively strip necrotic tissue, leaving healthy tissue intact, thus accelerating the healing process. In addition, MDT is used to treat common surgeries in elective and emergency procedures, largely due to its ability to prevent infection and promote excellent tissue regeneration. Maggot debridement therapy is becoming preferred as healthcare professionals search for alternative antibiotics and persistent surgical interventions.

End-use Insights

Hospitals dominated the market and accounted for the largest revenue share of 45.4% in 2024, driven by their critical role in providing comprehensive wound care for patients with chronic, non-healing wounds and severe tissue damage. Maggot debridement therapy has gained traction in these cases due to its ability to effectively patch up wounds, accelerate healing, and reduce the risk of infection. MDT can debride dead tissue while preserving healthy tissue, making it an essential option for hospital-based wound care, especially in intensive care units (ICUs) and specialized burn units.

Wound care centers are expected to grow at the highest CAGR of 11.0% over the forecast period, largely due to the increasing prevalence of chronic and complex wounds. These centers specialize in treating non-healing wounds, often requiring advanced therapy for successful management. The specialized focus on comprehensive, personalized treatment programs makes them ideal centers for MDT, leading to increased acceptance of this treatment and the expansion of wound centers with the growing acceptance of conventional biologically based therapies as a more sustainable and less invasive alternative to traditional methods.

Regional Insights

North American maggot debridement marketdominated the global market. It accounted for the largest revenue share of 47.4% in 2024, driven by the region's advanced healthcare infrastructure and increasing prevalence of chronic diseases. The regulatory environment in North America is favorable for the recognition of MDTs. Moreover, North American healthcare providers recognize MDT's benefits, such as reduced infection and its ability to accelerate wound healing, contributing to faster recovery and lower overall healthcare costs.

U.S. Maggot Debridement Market Trends

The maggot debridement market in the U.S. dominated North America, accounting for the largest revenue share in 2024, as the U.S. has one of the largest patient populations seeking specialized wound care and requiring advanced treatments such as maggot debridement. Furthermore, the improved health care system, including hospitals, wound care centers, and the inclusion of outpatient clinics, has facilitated the widespread acceptance of MDT as a reliable solution for non-healing and complex wounds.

Asia Pacific Maggot Debridement Market Trends

The Asia Pacific maggot debridement marketis expected to grow at a CAGR of 11.1% over the forecast period, driven by increasing adoption of healthcare, high diabetic prevalence, and increasing awareness of innovative wound treatments, especially in countries including India and China, where China alone is expected to have more than 140 million diabetics by 2045. Furthermore, regulatory support for MDT, such as the Japanese Ministry of Health, Labor and Welfare, agreed on medical-grade maggots to facilitate its integration into standardized wound care practices. This regulatory approach and the region's growing biologic-based therapies expand healthcare infrastructure.

The maggot debridement market in China is expected to grow significantly due to the country’s rapid growth and rising incidence of chronic diseases, especially diabetes. According to the international diabetes federation, China has the highest number of adults with diabetes, with an estimated 116 million people affected by the condition by 2021. As a result, there is a growing demand for alternative wound care products such as maggot debridement therapy (MDT). Under increasing pressure from China’s patient population and healthcare system, MDT is increasingly seen as a cost-effective and effective alternative to more invasive procedures, driving its adoption.

Europe Maggot Debridement Market Trends

The growth of the maggot debridement market in Europe is primarily driven by the high burden of chronic wounds, especially among the elderly and diabetic population. According to the European Diabetes Association, more than 60 million people have diabetes in Europe. The European Medicines Agency (EMA) granted regulatory approval for using medical-grade maggots in wound care, ensuring the treatment is safe and effective. Clinical studies in Europe have demonstrated the effectiveness of MDT, especially in reducing wound size and promoting faster healing in diabetic ulcers and pressure sores.

Key Maggot Debridement Company Insights

Some key players in the market are BioMonde, Monarch Labs, Mega Pharma (Pvt) Ltd., Smith & Nephew, Coloplast, B. Braun Melsungen AG, Mölnlycke Healthcare, Lohmann & Rauscher, Arobella Medical and others. These companies focus on continuous innovation and product development, introducing new and improved products that meet the needs of different patients.

They aim to improve patient outcomes by increasing safety, efficacy, and ease of use. In addition, many players are increasing investments in research and development, collaborating with healthcare organizations and clinical experts to conduct studies demonstrating efficacy. This focus on clinical evidence and outcomes-based solutions is critical for building trust among healthcare professionals and ensuring widespread adoption.

-

Smith+Nephew offers advanced wound care technologies and is recognized for its chronic wound and infection management and solutions. The company provides effective treatment options for diabetic foot ulcers and pressure sores.

-

BioMonde is a Europe-based company that offers larval therapy products for wound care. The company has production facilities in the UK and Germany.

Key Maggot Debridement Companies:

The following are the leading companies in the maggot debridement market. These companies collectively hold the largest market share and dictate industry trends.

- BioMonde

- Monarch Labs

- Mega Pharma (Pvt) Ltd.

- Smith & Nephew

- Coloplast

- B. Braun Melsungen AG

- Mölnlycke Healthcare

- Lohmann & Rauscher

- Arobella Medical

Recent Developments

-

In July 2024, Cuprina launched MEDIFLY, a bio-dressing that employs maggot debridement therapy for chronic wound treatment. This innovative dressing combines physical debridement from live larvae and chemical action from enzymes to effectively remove necrotic tissue while preserving healthy tissue. Since its introduction, MEDIFLY has gained traction in the Hong Kong market, with several major hospitals adopting the product.

Maggot Debridement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.7 million

Revenue forecast in 2030

USD 25.7 million

Growth Rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Administration, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BioMonde; Monarch Labs; Mega Pharma (Pvt) Ltd.; Smith & Nephew; Coloplast; B. Braun Melsungen AG; Mölnlycke Healthcare; Lohmann & Rauscher; Arobella Medical

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maggot Debridement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global maggot debridement market report based on administration, application, end-use, and region:

-

Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Loose Larva

-

Biobags

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics

-

Wound Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.