- Home

- »

- Consumer F&B

- »

-

Mafaldine Pasta Market Size, Share & Trends Report, 2030GVR Report cover

![Mafaldine Pasta Market Size, Share & Trends Report]()

Mafaldine Pasta Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Gluten-free), By Distribution Channel (Food Service, Retail), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-394-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mafaldine Pasta Market Size & Trends

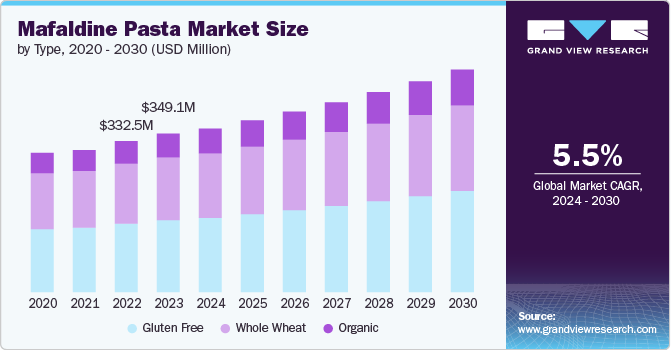

The global mafaldine pasta market size was estimated at USD 349.1 million in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The market is growing owing to the culinary exploration and the desire for variety encouraging consumers to try unique pasta shapes, adding new textures and flavors to their meals.The growing trend towards gourmet and artisanal foods has also led to an appreciation for high-quality, specialty pasta including Mafaldine, which is often produced by artisanal brands.

The market for Mafaldine (or Reginette) pasta is growing due to a combination of culinary exploration, media influence, and the appeal of unique food experiences. Consumers are increasingly adventurous with their culinary choices, seeking out new pasta shapes like Mafaldine for their distinct texture and aesthetic appeal. The rise of cooking shows, food blogs, and social media platforms has introduced home cooks and food enthusiasts to a wider variety of pasta shapes, sparking interest in Mafaldine.

Also. the appeal of traditional and authentic Italian cooking also boosts Mafaldine's popularity. There is a growing interest in exploring traditional Italian recipes and cooking methods, and Mafaldine, with its Italian heritage, fits perfectly into this trend. Consumers seeking authentic culinary experiences are drawn to this pasta shape for its connection to Italian culinary traditions.

Additionally, the trend towards artisanal and gourmet foods has led to a greater appreciation for specialty pasta types, with Mafaldine being valued for its ability to hold sauces well and its versatility in recipes. Improved availability through physical and online retailers, coupled with a growing interest in traditional and authentic Italian cooking, further drives the demand for this unique pasta shape.

Moreover, the growth of e-commerce is significantly contributing to the increasing popularity of Mafaldine pasta as consumers are more inclined to explore new and unique pasta shapes. Online platforms offer a vast selection of specialty food products that may not be readily available in physical stores, making it easier for consumers to discover and purchase Mafaldine pasta. The convenience of e-commerce, combined with detailed product descriptions, reviews, and cooking tips, encourages consumers to experiment with new varieties like Mafaldine. This accessibility and exposure through online shopping channels are driving the demand and fostering culinary exploration among home cooks and food enthusiasts.

Type Insights

Gluten-free mafaldine pasta accounted for a market share of over 45% of global revenues in 2023. Gluten-free pasta is often made from a variety of grains and legumes such as rice, corn, quinoa, and lentils. This variety can provide different nutritional benefits, such as higher protein content, more fiber, and a wider range of vitamins and minerals. For individuals with celiac disease or gluten intolerance, consuming gluten-free pasta is essential. It helps them avoid adverse reactions such as digestive issues, fatigue, and other health problems associated with gluten consumption.

The organic mafaldine pasta market is expected to grow at a significant CAGR from 2024 to 2030. Organic pasta is made from organically grown wheat, which means it is free from synthetic pesticides, herbicides, and fertilizers. This reduces the intake of potentially harmful chemicals and supports overall health. Additionally, some people believe that organic pasta has a better taste and texture compared to conventional pasta. The absence of synthetic additives and the use of traditional farming methods are thought to contribute to a more authentic and superior culinary experience.

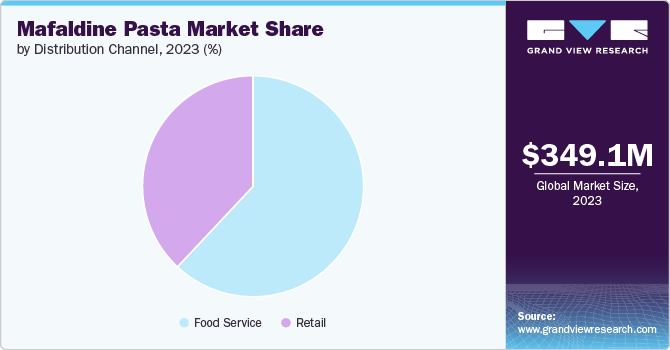

Distribution Channel Insights

Sales of mafaldine pasta through food service accounted for a share of 62.3% of the global revenues in 2023. Mafaldine pasta has gained popularity in restaurants and food service settings due to its unique shape and texture. This demand creates a steady market for manufacturers who produce and supply mafaldine pasta in bulk. Established manufacturers of mafaldine pasta can provide a consistent product in terms of quality, texture, and cooking characteristics. Food service operators rely on this consistency to maintain the standard of their dishes and meet customer expectations.

The retail channel segment is expected to grow at a significant CAGR from 2024 to 2030. Retail channels offer convenience as consumers can easily purchase mafaldine pasta along with other groceries during their regular shopping trips. Supermarkets and convenience stores are often located conveniently for shoppers. Consumers often recognize and trust brands they are familiar with, which are commonly stocked in retail channels. Familiarity with specific mafaldine pasta brands can influence purchasing decisions in supermarkets and convenience stores.

Regional Insights

The market in North America accounted for a market share of 27.9% in 2023. North American consumers appreciate culinary diversity and enjoy exploring different types of pasta beyond traditional shapes like spaghetti or penne. Mafaldine pasta's unique ribbon-like shape and ruffled edges offer a novel eating experience that appeals to those seeking variety in their meals.Culinary trends, driven by social media and celebrity chefs, often showcase unique pasta shapes like Mafaldine, sparking interest and curiosity among consumers in North America. These platforms promote new food experiences and encourage experimentation with different pasta varieties.

U.S. Mafaldine Pasta Market Trends

The influence of Italian cuisine in the U.S. has grown significantly, with many restaurants featuring authentic Italian dishes. Mafaldine pasta, being a traditional Italian pasta shape, has gained popularity in these establishments, prompting consumers to seek it out for home cooking or dining experiences.

Europe Mafaldine Pasta Market Trends

The market in Europe accounted for a market share of 32.6% in 2023. Mafaldine pasta is deeply rooted in Italian culinary tradition. Mafaldine pasta is often associated with artisanal craftsmanship and gourmet dining experiences. Artisanal pasta makers may produce mafaldine using traditional methods and high-quality ingredients, attracting consumers who appreciate authenticity and premium products.

Asia Pacific Mafaldine Pasta Market Trends

The market in Asia Pacific is expected to grow at a CAGR of 6.4% from 2024 to 2030. Exposure to Western trends and lifestyles, influences consumer preferences in the Asia-Pacific region, leading to a greater acceptance and demand for new pasta shapes including mafaldine.Mafaldine pasta's unique shape and ruffled edges make it versatile in cooking. It can hold various types of sauces, from simple tomato-based sauces to creamy and hearty preparations. This versatility appeals to Asian consumers who enjoy experimenting with different flavors and ingredients in their cooking.

Key Mafaldine Pasta Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the largest mafaldine pasta manufacturers including De Cecco, Barilla, and Great Value have entered into the market. Along with that, in order to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

Key Mafaldine Pasta Companies:

The following are the leading companies in the mafaldine pasta market. These companies collectively hold the largest market share and dictate industry trends.

- De Cecco

- Nando's Italian Kitchen

- Alma Gourmet

- Barilla

- Giovanni Rana

- Great Value

- Rao's Specialty Foods

- Winland Foods, Inc.

- Sfoglini

- BRAMI

Recent Developments

-

In July 2024, Napolina, a prominent U.K.-based Italian food brand, expanded its pasta range with the introduction of two new shapes: Casarecce, a twisted and rolled pasta, and Gigli, a fluted flower-shaped pasta. These additions are part of Napolina's strategy to offer consumers more variety and enhance their pasta-eating experience. The launch of these new pasta shapes reflects Napolina's commitment to innovation and its response to the growing interest in pasta among UK consumers. This move demonstrates the brand's dedication to meeting consumer demands and staying at the forefront of the market in the U.K.

-

In March 2024, Barilla, a leading pasta brand, introduced a new shape to its pasta lineup called Cellentani. This corkscrew-shaped pasta, also known as cavatappi, is designed to hold sauce well and provide a satisfying texture. The Cellentani shape features tight spirals and ridges that capture and hold onto various sauces, making it versatile for a wide range of pasta dishes. Barilla's Cellentani is made from high-quality durum wheat semolina and is suitable for both hot and cold pasta recipes. This addition to Barilla's product line demonstrates the company's commitment to providing diverse pasta shapes to meet consumer preferences and enhance the pasta-eating experience.

-

In January 2023, Sporkful, a food podcast, and Sfoglini, a Hudson Valley-based pasta brand, collaborated to introduce two new pasta shapes: Vesuvio and Quattrotini. Both shapes, along with the original Cascatelli, form a unique collection that achieves Pashman's pasta principles while offering distinct characteristics. This collaboration demonstrates Sporkful and Sfoglini's commitment to innovating and expanding the world of pasta in creative and functional ways.

Mafaldine Pasta Market Report Scope

Report Attribute

Details

Market application value in 2024

USD 366.9 million

Revenue forecast in 2030

USD 505.2 million

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, South Africa

Key companies profiled

De Cecco; Nando's Italian Kitchen; Alma Gourmet.; Barilla; Giovanni Rana; Great Value; Rao's Specialty Foods; Winland Foods, Inc.; Sfoglini.; BRAMI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mafaldine Pasta Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mafaldine pasta market based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Gluten-free

-

Whole Wheat

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mafaldine pasta market size was estimated at USD 349.1 million in 2023 and is expected to reach USD 366.9 million in 2024.

b. The global mafaldine pasta market is expected to grow at a compounded growth rate of 5.5% from 2024 to 2030 to reach USD 505.2 million by 2030.

b. Gluten-free mafaldine pasta accounted for a market share of over 45% of global revenues in 2023. Gluten-free pasta is often made from a variety of grains and legumes such as rice, corn, quinoa, and lentils.

b. Some key players operating in mafaldine pasta market include De Cecco, Nando's Italian Kitchen, Alma Gourmet., Barilla, and others.

b. Key factors that are driving the market growth include rising gourmet and artisanal among consumers and rising globalization of italian cuisine. The growing trend towards gourmet and artisanal foods has also led to an appreciation for high-quality, specialty pasta like Mafaldine, which is often produced by artisanal brands.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.