- Home

- »

- Clinical Diagnostics

- »

-

Lyme Disease Testing Market Size & Share Report, 2030GVR Report cover

![Lyme Disease Testing Market Size, Share & Trends Report]()

Lyme Disease Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (IGRA Testing), By Testing (Serological Test, Nucleic Acid Test), By Sample (Blood, Urine), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-419-8

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lyme Disease Testing Market Summary

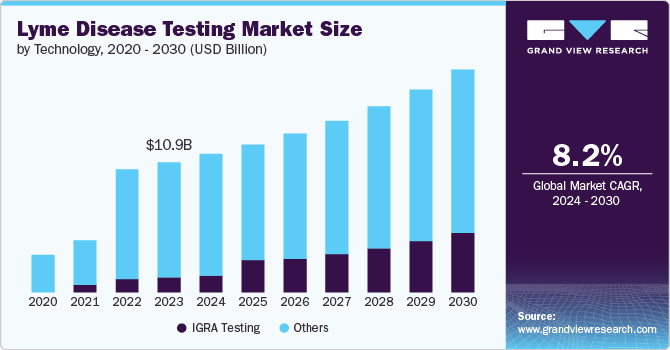

The global lyme disease testing market size was estimated at USD 10.85 billion in 2023 and is projected to reach USD 18.57 billion by 2030, growing at a CAGR of 8.2% from 2024 to 2030. The market is expanding, driven by several key factors.

Key Market Trends & Insights

- Europe dominated the lyme disease testing market with the revenue share of 48.22% in 2023.

- The France lyme disease testing market is expected to grow at the fastest CAGR during the forecast period.

- Based on technology, the other segment led the market with the largest revenue share of 88.6% in 2023.

- Based on testing, the serological test segment led the market with the largest revenue share of 53.1% in 2023.

- Based on sample, the blood segment led the market with the largest revenue share of 62.4% in 2023 .

Market Size & Forecast

- 2023 Market Size: USD 10.85 Billion

- 2030 Projected Market Size: USD 18.57 Billion

- CAGR (2024-2030): 8.2%

- Europe: Largest market in 2023

The primary factor is the rising incidence of Lyme disease, particularly in North America and Europe, which increased demand for accurate diagnostic tools. Growing awareness and education about the disease among the public and healthcare professionals have further driven this demand. For instance, in June 2024, Valneva SE announced the publication of Phase 2 trials for its Lyme disease vaccine candidate, VLA15, in The Lancet Infectious Diseases. These trials showed that VLA15, targeting six Borrelia serotypes, was highly immunogenic with a favorable safety profile.

In addition, shifts in climate conditions are broadening the habitats of ticks, facilitating the spread to new areas. Increased public awareness about Lyme disease and its potential long-term complications also played a vital role in driving the testing market. The increasing incidence of particularly in North America and Europe, is a primary driver of the disease testing market. The growing prevalence of Lyme disease prompted significant initiatives for improved diagnostics, with approximately 476,000 Americans diagnosed annually, according to the CDC. This led to advancements in testing technologies, such as multiplex PCR assays and enhanced immunoassays, which are crucial for early and accurate detection. The World Health Organization (WHO) noted that Lyme disease is endemic in over 80 countries, underscoring its global impact. The rising number of cases creates a pressing need for reliable diagnostic tests to ensure early detection and treatment, fueling demand in the testing market.

Technological advancements in diagnostic methods are another crucial driver for the market growth. Innovations such as multiplex PCR assays and enhanced immunoassays have significantly improved the accuracy and speed of Lyme disease detection. For instance, in February 2023, the LymeX Diagnostics Prize entered Phase 2, which includes a virtual accelerator program designed to help refine concepts for detecting active Lyme disease infections. Introducing these advanced diagnostic techniques enhances testing efficiency and addresses the challenges associated with early-stage diagnosis, thereby boosting market growth.

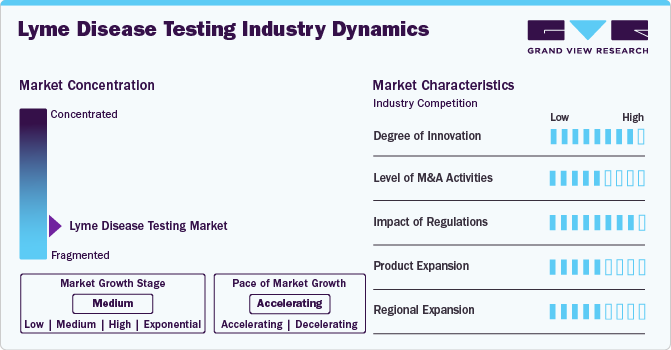

Market Concentration & Characteristics

The degree of innovation in the global market is high, driven by advancements in molecular diagnostics and serological testing methods. Recent innovations include developing empathetic and specific polymerase chain reaction (PCR) tests that can detect Lyme disease at earlier stages than traditional serological tests. For instance, a study published in 2022 highlighted a new PCR-based assay that significantly improved detection rates in patients with early Lyme disease, showcasing the potential for rapid diagnosis and treatment. In addition, companies are exploring integrating artificial intelligence (AI) to enhance diagnostic accuracy and streamline laboratory processes, indicating a robust trend toward innovative solutions.

The level of merger and acquisition activities within the global market is considered medium. Strategic partnerships, collaborations, and acquisitions among critical players aimed at enhancing competitiveness, expanding product portfolios, and strengthening market positions. For instance, diagnostic companies are involved in mergers, acquisitions, and partnerships to develop innovative testing solutions and gain a larger share of the growing Lyme disease diagnostics market. These M&A activities contributed to the overall growth and consolidation of the market as companies seek to capitalize on the rising demand for effective Lyme disease testing driven by increasing disease prevalence and advancements in diagnostic technologies.

The impact of regulations on the global market is assessed as high, as regulatory bodies like the FDA impose stringent test approval and quality assurance requirements. The regulatory landscape has become increasingly complex, especially with the introduction of new technologies such as point-of-care testing devices. For instance, in July 2024, Pfizer and Valneva are nearing FDA approval for their first Lyme disease vaccine, VLA15, following the completion of participant recruitment for their Phase 3 trial. This vaccine aims to protect against Lyme disease, addressing a significant health need as cases continue to rise.

The global market saw moderate product expansion, with the introduction of innovative diagnostic technologies and the launch of new products. For instance, in April 2022, the FDA authorized Boston Scientific Corporation’s Embold Fibered Detachable Coil, a medical device intended to block or diminish blood flow within the peripheral vascular system. These developments indicate a medium level of product expansion in the market, as companies focus on enhancing diagnostic capabilities and exploring preventive measures to address the growing incidence worldwide.

The market is experiencing moderate regional expansion, particularly in North America and Asia-Pacific. In Asia-Pacific, growth is driven by expanding healthcare infrastructure and rising awareness of Lyme disease, supported by government initiatives promoting screening programs. For instance, T2 Biosystems launched its T2Lyme Panel Diagnostic technology in 2022, further enhancing diagnostic capabilities in the region. Overall, the regional expansion of the market is moderate, reflecting ongoing efforts to improve diagnostics and increase accessibility in response to rising disease incidence.

Technology Insights

Based on technology, the other segment led the market with the largest revenue share of 88.6% in 2023. The widespread use of ELISA and Western blot test significantly contributed to the growth. On the other hand, the IGRA segment is expected to witness lucrative growth over the forecast period. One primary driver is the continuous advancement in diagnostic technologies, which have significantly enhanced the accuracy of tests. Government initiatives also play a crucial role in advancing diagnostics. For instance, the Centers for Disease Control and Prevention (CDC) advocates a two-step serological testing approach utilizing assays that have received clearance from the Food and Drug Administration (FDA). It is important to note that these serological tests may yield false-negative results within the first 4 to 6 weeks following infection. Furthermore, before the CDC endorses any new diagnostic tests, the FDA must approve them.

The Interferon-Gamma Release Assays (IGRA) testing technology segment is experiencing substantial growth due to several factors. The rising prevalence of Lyme disease, particularly in regions such as North America & Europe, has increased the demand for accurate and timely diagnostic tools, including IGRA tests. Growing incidence has led to greater awareness and the necessity for reliable diagnostics. Furthermore, technological advancements in diagnostic methods have also played a crucial role. Continuous improvements have made IGRA tests more sensitive and specific, enhancing the reliability of the results and boosting market growth.

Testing Insights

Based on testing, the serological test segment led the market with the largest revenue share of 53.1% in 2023, due to its widespread availability, cost-effectiveness, and proven reliability in detecting antibodies against Borrelia burgdorferi. These factors make serological tests a trusted and accessible choice for both healthcare providers and patients. Recent trends in the serological test segment include technological advancements that enhance the sensitivity & specificity of ELISA and Western Blot tests. For instance, Adaptive Biotechnologies launched the T-Detect Lyme test in June 2022, identifying T cells activated by Borrelia burgdorferi, offering a novel approach to early diagnosis. There is also a shift toward automation and multiplex assays that can detect multiple pathogens simultaneously, improving efficiency and reducing diagnosis time. Furthermore, companies like Bio-Rad Laboratories have introduced resources to enhance the accuracy and efficiency of Western blot testing, demonstrating ongoing innovation in this segment.

The Nucleic Acid Test (NAT) segment is experiencing significant growth, driven by its high sensitivity and specificity in detecting Borrelia burgdorferi's genetic material. Technological advancements have significantly improved the NAT segment.Innovations in Polymerase Chain Reaction (PCR) techniques and other amplification methods have enhanced the detection capabilities of these tests. Furthermore, recent strategic initiatives highlight the potential of NATs in the market. For instance, in July 2022, T2 Biosystems received FDA Breakthrough Device Designation for their T2Lyme Panel, a NAT designed to detect Lyme disease directly from a patient's blood with high accuracy. This approval marks a significant step forward in providing advanced diagnostic tools for Lyme disease.

Sample Insights

Based on sample, the blood segment led the market with the largest revenue share of 62.4% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This is because blood tests, such as ELISA and Western blot, can effectively detect antibodies against Borrelia burgdorferi, the bacteria causing Lyme disease. Blood samples are also easy to obtain and handle, making them a practical choice for widespread diagnostic use. Blood samples are integral to testing, primarily through serological tests that detect antibodies against Borrelia burgdorferi. This method is widely used in diagnostic laboratories, driving market growth due to increasing Lyme disease incidence and advancements in testing technology. Blood samples are preferred for testing due to their higher sensitivity and specificity in detecting antibodies against Borrelia burgdorferi. Blood tests, such as ELISA and Western blot, offer reliable results, and blood samples are more accessible to collect than Cerebrospinal Fluid (CSF), which requires invasive lumbar punctures. Clinical guidelines endorse blood testing as the most effective Lyme disease diagnosis, reinforcing its superiority over urine and CSF options.

The CSF samples segment is expected to grow at a significant CAGR over the forecast period. CSF samples diagnose neurological involvement by detecting bacterial DNA or antibodies. Still, they are less common due to their specialized collection process and specific application in advanced cases. CSF samples are used in Lyme disease testing to confirm neurological involvement and diagnose Central Nervous System Lyme Disease (CNSLD). The preferred test is the antibody index assay, which measures intrathecal production of anti-Borrelia burgdorferi antibodies in the CSF and corrects for passive diffusion from serum. CSF testing is essential for accurately diagnosing neurological Lyme disease, as positive serology alone does not establish intrathecal antibody production. A CSF test may be required if symptoms suggest Lyme disease affects the nervous system, such as a stiff neck or numbness in hands or feet, or if blood test results are uncertain. The procedure involves a lumbar puncture, where the patient lies on their side or sits while a provider performs it. This process includes cleaning the back, injecting an anesthetic, and inserting a needle between vertebrae in the lower spine to collect the CSF. The procedure takes about 5 minutes, and patients may need to lie on their back for an hour or two afterward to prevent headaches. No special preparations are required for a blood test; however, patients may be asked to empty their bladder and bowels before the lumbar puncture.

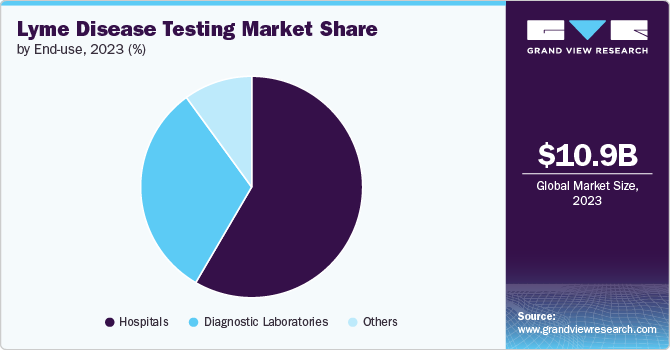

End-use Insights

Based on end use, the hospital segment led the market with the largest revenue share of 58.4% in 2023, due to its access to advanced technology and diagnostic tools, which enabled accurate and timely Lyme disease testing. In addition, hospitals employ skilled healthcare professionals who are experienced in conducting and interpreting diagnostic tests, ensuring accuracy and reliability. Hospitals are a critical end use segment in the global market, utilizing diagnostic tests to manage and treat patients presenting with symptoms. These facilities use a range of diagnostic tools, including serologic tests and PCR assays, to accurately diagnose Lyme disease and its complications, such as Lyme arthritis and neuroborreliosis. Furthermore, hospitals are equipped to perform comprehensive diagnostic procedures and manage complex cases that require advanced treatment strategies, including intravenous antibiotics and long-term management of persistent symptoms.

The diagnostic laboratories segment play a vital role in the global market. They are primarily responsible for analyzing and interpreting test samples collected from patients suspected of having Lyme disease. The primary uses of testing in diagnostic laboratories include performing confirmatory tests to verify initial diagnoses of the disease, typically using techniques like ELISA and Western blot assays. Furthermore, there is a growing demand for Lyme disease testing in diagnostic laboratories due to the rising incidence of Lyme disease, driven by climate change, which expands the habitat of ticks that carry the bacterium Borrelia burgdorferi. This increased incidence has led to heightened awareness and more frequent testing. According to the European Commission's response to Petition No 0986/2023 in March 2024, the crucial role of diagnostic laboratories in Lyme disease testing is emphasized. These labs use various methods, including ELISA for initial screening and immunoblotting for confirmation, to address the challenges of accurately diagnosing Borrelia infections. CE-marked tests, required for medical purposes, ensure safety and efficacy.

Regional Insights

The lyme disease testing market in North America is anticipated to grow at a steady CAGR during the forecast period, driven by increasing awareness, advancements in diagnostic technologies, such as serological tests and PCR assays, and the rising incidence of Lyme disease in endemic regions. Increasing awareness initiatives, such as those led by the New York State Department of Health in May 2024, is pivotal in driving market growth. These efforts educate the public and promote early detection and treatment, thereby increasing the demand for Lyme disease testing. In May 2024, the New York State Department of Health and other state agencies promoted Lyme Disease Awareness Month by highlighting the importance of preventing tick bites, particularly from the black-legged tick, which is responsible for transmitting Lyme disease and other related illnesses.

U.S. Lyme Disease Testing Market Trends

The lyme disease testing market in the U.S. is experiencing significant growth driven by increased incidence, heightened public awareness, and advancements in diagnostic technologies. The prevalence of Lyme disease has surged, particularly in regions with high tick populations, prompting a greater demand for accurate and efficient diagnostic tools. Innovative testing methods such as nucleic acid amplification tests (NAATs), enzyme immunoassays (EIAs), and multiplex assays enhance the sensitivity and specificity of diagnoses. In addition, serological tests, particularly ELISA, continue to dominate due to their affordability and widespread availability.

Europe Lyme Disease Testing Market Trends

Europe dominated the lyme disease testing market with the revenue share of 48.22% in 2023, driven by advancements in diagnostic technologies, increased research funding, and heightened awareness of Lyme disease. Chen Even and Fernando Beils highlighted that FDA approval would enhance their diagnostic offerings and strengthen collaboration. Using advanced chemiluminescent immunoassays, this innovative test may set new standards for early detection and precision, potentially driving higher demand for advanced diagnostic solutions. Its success in the U.S. is expected to lead to similar innovations and investments in Europe, increase awareness, and prompt regulatory bodies to expedite approvals for new tests. Overall, it is anticipated to drive market growth by enhancing diagnostic accuracy and encouraging technological advancements in Lyme disease testing.

The lyme disease testing market in UK exhibits growth potential driven by increased research funding and initiatives such as the HPRU-EZI's Lyme-UK Study and the development of specialist clinics by Lyme Disease Action. These efforts aim to improve diagnostics and treatment outcomes, boosting the demand for advanced testing technologies & enhancing patient care. Focused on Lyme disease caused by Borrelia burgdorferi, the study aims to enhance understanding of symptoms, diagnosis, and treatment outcomes in primary care settings across the UK. It includes a GP survey and a patient cohort study in Inverness, aiming for 12-month follow-ups post-diagnosis. Bio banked samples and data from this research promise valuable insights for future Lyme disease diagnostics and research efforts.

The France lyme disease testing market is expected to grow at the fastest CAGR during the forecast period, driven by recent vaccine research and development advancements. Researchers from INRAE, ANSES, and the National Veterinary School of Alfort have developed an innovative vaccine targeting tick microbiota to combat Lyme disease. Published in July 2023 in Microbiome, the study demonstrates that this vaccine, using a benign E. coli strain, induces antibodies in mice that disrupt the tick's microbiota. This disruption reduces Borrelia colonization in ticks and potentially protects mice from Lyme disease. This novel approach highlights the role of tick microbiota in Borrelia infection and paves the way for new vaccine strategies against vector-borne diseases.

Asia Pacific Lyme Disease Testing Market Trends

The lyme disease testing market in Asia Pacific is evolving due to diverse regional dynamics. In areas with historically low incidence, the market remains modest, with major international firms setting the standard in advanced diagnostics. However, increasing seroprevalence in certain regions drives demand for improved testing solutions. Research indicating significant Lyme disease prevalence in high-risk environments indicates a growing market opportunity. Rising awareness and potential misdiagnoses could further boost demand in regions with smaller, more niche markets. Moreover, detecting emerging tick-borne pathogens highlights an urgent need for enhanced diagnostic capabilities.

The Japan lyme disease testing market is witnessing significant trends driven by a combination of innovation, increased awareness, and demographic factors. One notable trend is the introduction of advanced diagnostic technologies, such as polymerase chain reaction (PCR) tests and serological assays that enhance the accuracy and speed of detection. In addition, there was a rise in product launches to improve testing accessibility and convenience for patients, particularly in rural areas where tick exposure is more prevalent. The senior population, which is increasingly vulnerable to tick-borne diseases due to age-related health decline, also influences market dynamics; studies indicate that older adults are more likely to experience severe symptoms from Lyme disease, prompting healthcare providers to prioritize early testing and intervention strategies.

The lyme disease testing market in India is on the brink of significant growth as emerging research highlights the rising prevalence of Lyme disease in various regions, including forest areas with high tick exposure. Increasing awareness and the growing need for accurate diagnostics, especially following recent findings of substantial seroprevalence, contribute to market growth. According to an NCBI study on Nagarahole and Bandipur forest areas of South India, a high seroprevalence of Lyme disease was observed. Among 472 forest workers screened, 19.9% tested positive for Borrelia burgdorferi using ELISA, with 15.6% of these cases confirmed by Western blot. The study found a significant correlation between seropositivity and tick bites, highlighting a notable risk among field workers. This elevated prevalence indicates that Lyme disease is an important health concern in these regions.

Latin America Lyme Disease Testing Market Trends

The lyme disease testing market in Latin America is witnessing significant trends driven by increased awareness of tick-borne diseases, innovations in diagnostic technologies, and a growing senior population more susceptible to such infections. Recent studies indicate that the incidence of Lyme disease is rising, with reports suggesting a 20% increase in cases over the past five years across various regions. This surge prompted healthcare providers to seek advanced testing solutions, leading to the introduction of rapid diagnostic tests and molecular assays that offer quicker results and higher accuracy. Product launches focusing on point-of-care testing are becoming more prevalent, catering to remote areas where access to traditional laboratory facilities may be limited.

The Brazil lyme disease testing market faces constraints due to its moderate disease incidence, which is unevenly distributed across specific geographic regions. The diversity of tick species and varying prevalence rates among different states complicate disease management and diagnostic protocols. Despite these complexities, the rising awareness among healthcare professionals and the public and advancements in diagnostic technologies bolster initiatives to control the disease effectively. Ensuring precise testing procedures is pivotal in managing the disease within Brazil’s diverse ecological contexts.

Middle East & Africa Lyme Disease Testing Market Trends

The lyme disease testing market in MEA demonstrates a diverse landscape influenced by varying levels of disease prevalence and healthcare infrastructure. In regions where Lyme disease is not endemic, market growth is driven by collaborations between international diagnostic firms and local healthcare providers. These partnerships aim to enhance diagnostic capabilities and expand market penetration. Global players contribute significantly to the competitive environment by offering advanced serological tests and diagnostic technologies. This supports the overall market growth despite the relatively low incidence of Lyme disease in certain areas. The presence of established healthcare infrastructure facilitates the adoption of sophisticated diagnostic tools, driving the demand and improving healthcare outcomes.

The Saudi Arabia lyme disease testing market is anticipated to grow at the fastest CAGR during the forecast period. The country has seen an increase in the adoption of innovative diagnostic technologies, such as serological tests, nucleic acid tests, and Immunofluorescent staining, which offer improved accuracy and faster results. Introducing new products, like the Hemanext ONE system for red blood cell processing and storage, has also contributed to the market's growth. The rising prevalence of tick-borne illnesses, particularly Lyme disease, has heightened awareness and drive the demand for effective testing solutions.

Key Lyme Disease Testing Company Insights

The market is characterized by a competitive landscape with several key players holding significant market shares. These companies primarily develop and commercialize advanced diagnostic tests, including serological assays, polymerase chain reaction (PCR) tests, and other innovative methodologies to improve accuracy and speed in diagnosing Lyme disease. The market is witnessing a trend towards integrating molecular diagnostics, which enhances sensitivity and specificity compared to traditional serological methods.

Key Lyme Disease Testing Companies:

The following are the leading companies in the lyme disease testing market. These companies collectively hold the largest market share and dictate industry trends.

- DiaSorin S.p.A

- BIOMÉRIEUX

- Oxford Immunotec

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- T2 Biosystems

- IGeneX

- Gold Standard Diagnostics

- ZEUS Scientific

- Trinity Biotech

Recent Developments

-

In January 2024, DiaSorin announced that it submitted the LIAISON LymeDetect test to the U.S. FDA in December 2023. Developed in partnership with QIAGEN, this test detects IgG, IgM, and T-cell mediated responses using QIAGEN’s proprietary QuantiFERON technology, an Interferon-Gamma Release Assay (IGRA). This novel solution will enhance DiaSorin's LIAISON immunodiagnostic offerings in the U.S. market, representing a significant milestone in its collaboration with QIAGEN

-

In May 2024, T2 Biosystems, Inc. announced a nonbinding Letter of Intent (LOI) to form a strategic partnership with ECO Laboratory. The collaboration aims to introduce the T2Lyme Panel as an LDT for early Lyme disease detection and to establish a leading Lyme testing laboratory in the U.S.

Lyme Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.54 billion

Revenue forecast in 2030

USD 18.57 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, testing, sample, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

DiaSorin S.p.A; BIOMÉRIEUX; Oxford Immunotec; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; T2 Biosystems; IGeneX; Gold Standard Diagnostics; ZEUS Scientific; Trinity Biotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lyme Disease Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lyme disease testing market report based on technology, testing, sample, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

IGRA Testing

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Serological Test

-

ELISA

-

Western Blot

-

-

Lymphocytic Transformation Test

-

Urine Antigen Testing

-

Immunofluorescent Staining

-

Nucleic Acid Test

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Urine

-

CSF

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lyme disease testing market size was estimated at USD 10.85 million in 2023 and is expected to reach USD 11.53 million in 2024.

b. The global lyme disease testing market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 18.56 million by 2030.

b. Europe dominated the lyme disease testing market with a share of 48.2% in 2023. This is attributable to the large number of cases and the number of tests approved within the region

b. Some key players operating in the Lyme disease testing market include DiaSorin S.p.A; BIOMÉRIEUX; Oxford Immunotec; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; T2 Biosystems; IGeneX; Gold Standard Diagnostics; ZEUS Scientific; Trinity Biotech

b. Key factors that are driving the market growth include a rise in the prevalence of Lyme disease, an increasing number of research programs for Lyme disease diagnosis, and new product launches for testing of lyme disease

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.