- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Jewelry Market Size & Share, Industry Report, 2030GVR Report cover

![Luxury Jewelry Market Size, Share & Trends Report]()

Luxury Jewelry Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Diamond, Gold, Platinum), By Product (Necklace, Ring, Earring), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-093-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Jewelry Market Summary

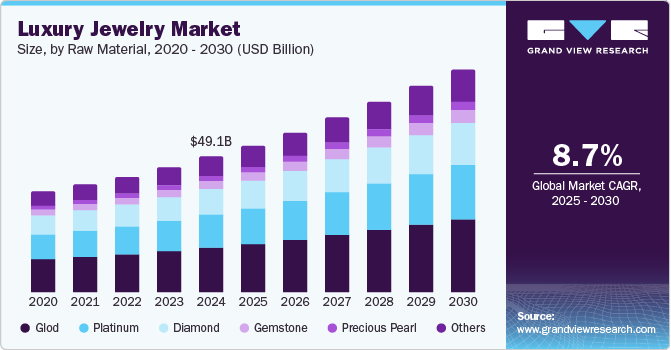

The global luxury jewelry market size was estimated at USD 49.1 billion in 2024 and is projected to reach USD 82.1 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The increasing demand for sustainable and gender-fluid jewelry is driving the growth of the luxury jewelry market.

Key Market Trends & Insights

- Asia Pacific luxury jewelry market dominated the global market, with the largest revenue share of 66.6% in 2024.

- China luxury jewelry market dominated the Asia Pacific region and accounted for the largest revenue share 66.57% in 2024.

- Based on raw material, gold segment dominated the market with the largest revenue share of 33.1% in 2024.

- Based on product, rings segment dominated the market with the largest revenue share in 2024.

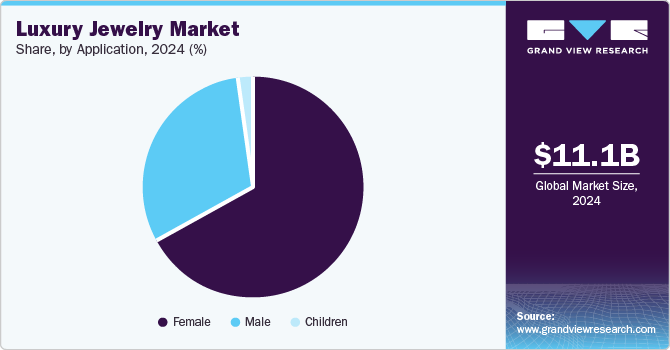

- Based on application, the female segment dominated the market, with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 49.1 Billion

- 2030 Projected Market Size: USD 82.1 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2024

Luxury jewelry has also become a medium for self-expression, with many buyers seeking unique and meaningful pieces. Unconventional designs, shapes, and materials have increasingly become part of jewelry collections. Non-traditional forms, shapes, and materials have made their way into jewelry collections. Asymmetrical cuts, gemstone imperfections, utilitarian designs, and opaque gems have added a unique dimension that resonates with customers' desire for individuality. Pearl jewelry has gained popularity, thanks to glowing endorsements from former US Vice President Kamala Harris, film and music stars, and members of the British Royal Family, who showcased them at prominent public events.

Jewelry trends are evolving as boundaries shift, embracing gender fluidity across various pieces, including watches and wedding rings. Although men's jewelry has always been present, there is a growing presence of unisex designs. For instance, Gucci's jewelry collection caters to all genders, and Bulgari's B.Zero 1 Rock line offers modern, stylish, and gender-neutral designs.

Generation Z is especially resistant to categorization and labeling. This allows marketers to target items to a wide range of people, connections, and events. London-based Shaun Leane is a pioneer in the field of gender-neutral jewelry. The designer, who began his company in 1999 after working as a jeweler for Alexander McQueen, has seen an increase in gay couples seeking unique engagement rings.

Raw Material Insights

Gold dominated the market with the largest revenue share of 33.1% in 2024. Gold is an alluring investment during times of political and economic crisis. Gold’s cultural significance, timeless appeal, and status as a symbol of wealth and prosperity make it a preferred choice for many consumers. Gold's versatility in jewelry design also plays a role, as it can be crafted into a wide range of styles and combined with various gemstones to create exquisite pieces. Gold's intrinsic value and stability as an investment asset also solidify its position in the market. Gold prices have surged by more than 25% over the past year, making the precious metal an increasingly valuable asset and a reliable form of collateral. As gold prices hit record highs, demand of gold in India increased by 5%, reaching 802.8 tonnes in 2024. In terms of value, gold demand rose by 21%, reaching USD 59.7 billion in 2024, according to the World Gold Council.

Platinum is expected to grow at the fastest CAGR of 9.4% over the forecast period owing to its unique properties—platinum is known for its hypoallergenic nature, durability, and rarity, which adds to its exclusivity. Furthermore, the rising demand for customized and unique jewelry pieces drives interest in platinum, as it allows for intricate designs and craftsmanship. As consumers continue seeking high-quality, investment-worthy jewelry, platinum's appeal is anticipated to grow even more. Additionally, platinum's natural white luster makes it an excellent choice for setting diamonds and other precious gemstones, enhancing their brilliance.

Product Insights

Rings dominated the market with the largest revenue share in 2024. Rings hold significant emotional and symbolic value and are commonly used for engagements, weddings, and other meaningful life occasions. The customization options available reflect personal taste and style, contributing to their dominance. Whether an intricate vintage design, a classic solitaire diamond ring, or a bold statement piece, rings offer endless possibilities for self-expression and luxury. Companies' key marketing techniques are branding through social media platforms and celebrity endorsements. Similarly, the messaging strategy used by businesses in their marketing efforts has a significant impact on consumers' purchasing decisions.

Necklace sales are expected to grow at a significant CAGR over the forecast period owing to their versatility and ability to make a bold fashion statement. The market offers a wide range of styles, from extravagant ornament pieces to minimalist designs, supporting the demand for necklaces. Moreover, the trend of layering neckpieces encourages consumers to use multiple necklaces to create fashionable and personalized looks.

Distribution Channel Insights

The offline channel dominated the market, with the largest revenue share in 2024. Several consumers prefer purchasing luxury jewelry from offline stores as opposed to online platforms. According to a survey in 2021, even though consumers browsed or selected products online, only 15-20% of them bought jewelry online, and the remainder preferred to purchase these items from physical stores. The luxury brands Graff and MIKIMOTO have launched flagship stores in Hong Kong in 2020 and New York in 2021, respectively. The stores have been built to provide more personalized experience to customers. The major players are generating maximum revenue from offline sales on account of the benefits they offer to the customers, such as free demonstrations, physically examining the product before purchase, the availability of a large number of options to choose from, and guidance from sales executives in choosing the best product based on one’s specific needs.

The online channel is expected to grow at the fastest CAGR over the forecast period. The online channel offers tools for customization and personalization, catering to individual preferences. The accessibility and convenience of online shopping allow consumers to browse and choose luxury jewelry anywhere. Furthermore, effective digital marketing and social media campaign attracts a boarder audience. Customer ratings and online reviews help potential customers make informed decisions. In addition, innovative technologies, such as virtual reality (VR) and augmented reality (AI), allow customers to visualize luxury jewelry products on themselves before buying.

Application Insights

The female segment dominated the market, with the largest revenue share in 2024. Studies show that wearing jewelry activates the brain's pleasure center, releasing dopamine and enhancing well-being. Jewelry also serves as a cultural symbol, representing social status and identity, and is integral to rituals such as engagements, weddings, and anniversaries. Discounts from major luxury jewelry brands attract women by creating a sense of urgency and value. Women may perceive the discounted price as an opportunity to obtain luxury items at a more affordable rate, leading to an emotional connection with the brand.

The sale of luxury jewelry among males is expected to grow at the fastest CAGR over the forecast period. Previously limited to wedding bands and watches, men's jewelry now offers a broader range of options for self-expression. The expansion of e-commerce platforms has significantly contributed to this growth, allowing consumers to browse and purchase products online, thereby reaching a broader audience.

Regional Insights

Asia Pacific luxury jewelry market dominated the global market, with the largest revenue share of 66.6% in 2024. Jewelry holds deep cultural importance in many APAC countries, often associated with traditions, ceremonies, and celebrations. This cultural affinity drives consistent demand for luxury jewelry items. Luxury brands are increasingly incorporating cultural elements to resonate with APAC consumers.

China Luxury Jewelry Market Trends

China luxury jewelry market dominated the Asia Pacific region and accounted for the largest revenue share 66.57% in 2024. China's expanding affluent class and emerging middle-income segment are driving demand for luxury jewelry. Consumers view these items as status symbols and investments. Brands are collaborating with local designers to fuse global luxury with Chinese craftsmanship, creating collections that resonate with local aesthetics. Bulgari organized exhibitions featuring works by local artists, blending Italian luxury with Chinese cultural elements to engage consumers. Bulgari incorporates Chinese cultural symbols in its designs, such as the snake motif from Chinese mythology and the ginkgo leaf, which mirrors the Divas’ Dream collection. This cultural overlap strengthens collaborations and enhances the brand’s authenticity in diverse markets.

North America Luxury Jewelry Market Trends

North America luxury jewelry market accounted for a substantial market share in 2024. Retailers are progressively creating their own high-margin jewelry brands. Watches of Switzerland secured the distribution rights for Roberto Coin in North and Central America, while other retailers, such as Jared and Birks, have expanded their own in-house jewelry collections. Luxury brands such as Richemont witnessed a 10% increase in sales during Q3, reaching USD 6.64 billion, primarily driven by robust jewelry sales and growth in the U.S. market.

The luxury jewelry market in the U.S. accounted for the largest North America revenue share in 2024. Tiffany & Co. partnered with streetwear brand Supreme to release a collection of eight masculine jewelry pieces, such as thick silver signet rings engraved with "NYC" or "LA." This unexpected collaboration blended luxury with urban street style, attracting a diverse male audience for luxury jewelry.

Key Luxury Jewelry Company Insights

Some of the key luxury jewelry market companies include Guccio Gucci S.p.A.; The Swatch Group Ltd; Compagnie Financière Richemont SA; and T&CO.; among others. They focus on exclusivity, craftsmanship, and innovative designs. They adapt to changing consumer preferences through personalized experiences and digital platforms, enhancing customer engagement. Collaborations with high-profile celebrities and designers also boost their visibility. Additionally, these brands strategically expand into emerging markets, emphasizing sustainability and ethical sourcing, which resonates with modern consumers, ensuring long-term growth and relevance in the competitive luxury sector.

-

Guccio Gucci S.p.A. is a luxury brand recognized for its high-quality jewelry collections. The brand offers an extensive range of products, including bracelets, necklaces, earrings, and rings, crafted with precision using premium materials.

-

The Swatch Group Ltd is a Swiss conglomerate specializing in the design, manufacturing, and distribution of watches and luxury jewelry. The company owns several brands, including Omega, Longines, and Breguet.

Key Luxury Jewelry Companies:

The following are the leading companies in the luxury jewelry market. These companies collectively hold the largest market share and dictate industry trends.

- Guccio Gucci S.p.A.

- The Swatch Group Ltd

- Compagnie Financière Richemont SA

- T&CO.

- GRAFF

- LOUIS VUITTON

- Signet Jewelers.

- Chopard

- MIKIMOTO

- Pandora

Recent Developments

-

In February 2025, Aesop, known for its unconventional fragrances, collaborated with jeweler Patcharavipa Bodiratnangkura to create a limited-edition rhodium-plated ear cuff, inspired by the brand's floral fragrance "Aurner." The cuff’s organic leaf design reflects Aesop's deep connection to the arts.

-

In February 2025, Tanishq debuted at New York Fashion Week, collaborating with fashion designer, Bibhu Mohapatra. The collaboration featured over 40 creations, complementing Bibhu's 2025 Fall collection inspired by Indian heritage. Tanishq’s designs, known for their global appeal, highlighted the essence of India’s craftsmanship, enhancing the collection's bold elements.

Luxury Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.2 billion

Revenue forecast in 2030

USD 82.1 billion

Growth Rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Guccio Gucci S.p.A.; The Swatch Group Ltd; Compagnie Financière Richemont SA; T&CO.; GRAFF; LOUIS VUITTON; Signet Jewelers.; Chopard; MIKIMOTO; Pandora

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Jewelry Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury jewelry market report based on raw material, product, distribution channel, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Gold

-

Platinum

-

Diamond

-

Gemstones

-

Precious Pearls

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Necklace

-

Ring

-

Bracelet

-

Earring

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Children

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.