- Home

- »

- Consumer F&B

- »

-

Low Sugar Fruit Snacks Market Size, Industry Report, 2030GVR Report cover

![Low Sugar Fruit Snacks Market Size, Share & Trends Report]()

Low Sugar Fruit Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fruit Bars, Fruit Roll-ups), By Distribution Channel (Hypermarkets & Supermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-576-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Sugar Fruit Snacks Market Summary

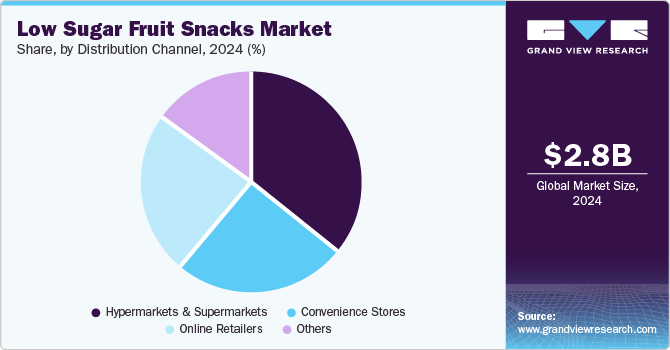

The global low sugar fruit snacks market size was estimated at USD 2.84 billion in 2024 and is projected to reach USD 4.82 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. Rising global awareness regarding the impact of excess sugar consumption on health, coupled with government policies aimed at reducing sugar intake in people’s diets, have positively influenced the growth of the low sugar fruit snacks industry.

Key Market Trends & Insights

- The North America low sugar fruit snacks market accounted for the largest revenue share of 32.7% globally in 2024.

- The U.S. low sugar fruit snacks market accounted for a dominant revenue share in the regional market in 2024.

- In terms of product, The fruit bars segment accounted for the largest revenue share of 39.8% in 2024

- In terms of distribution channel, the supermarkets & hypermarkets segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.84 Billion

- 2030 Projected Market Size: USD 4.82 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

Consumers, on their part, are increasingly looking for products that contain simple and nutritional ingredients, avoiding products with artificial additives or preservatives. Low sugar fruit snacks are generally perceived as more natural and healthier options because they tend to have fewer added ingredients and use natural sweeteners or whole fruits, appealing to consumers who prioritize clean labels.

The increasing prevalence of lifestyle disorders such as obesity, hypertension, and diabetes among the global population has highlighted the need to lower the consumption of unhealthy processed food items. According to the World Health Organization (WHO), in 2022, around 13% of the global population was living with obesity, with adult obesity rates having increased by more than two times since 1990. Furthermore, adolescent obesity rates have quadrupled during this period, with sugary beverages and processed snacks considered to be major contributors to this sharp growth. As a result, governments and health organizations are increasingly initiating public health campaigns to educate adolescents and their families about the dangers of excessive sugar consumption and its link to obesity. These campaigns often focus on promoting healthy eating habits, increasing physical activity, and reducing sugary beverage intake.

The increasingly busy lifestyles of consumers due to urbanization and industrialization have led them to seek convenient snacking options that are both healthy and easy to consume. Low sugar fruit snacks offer a healthy and viable snacking solution that can fit into the hectic routines of consumers. Brands are increasingly developing new and innovative formats for low sugar fruit snacks, such as fruit chips, dried fruit with no added sugar, fruit-based gummies, and fruit bars. These innovations cater to diverse consumer preferences and make low sugar fruit snacks more appealing to a broader audience. Furthermore, to appeal to a wide range of taste preferences, manufacturers are offering various flavors and textures of low sugar fruit snacks, from sweet and tangy fruit chips to chewy fruit bars. These innovations have helped expand the consumer base and substantially increased the demand for low sugar fruit snacks.

Products that are portable, require minimal to no preparation efforts and can be consumed on the go are in high demand among busy professionals, students, and working parents. Companies are additionally focusing on the packaging aspect to appeal to prospective buyers and ensure strong product sales. For instance, in January 2023, Wallaroo Foods, a UK-based producer of organic tropical fruit snacks, announced its partnership with Sappi to develop sustainable packaging using the latter’s Guard Gloss 4-OHG high-barrier paper. This collaboration aims to meet Wallaroo's commitment to sustainability by providing recyclable, paper-based packaging that avoids the use of synthetic materials.

Product Insights

The fruit bars segment accounted for the largest revenue share of 39.8% in 2024 in the low sugar fruit snacks industry. Increasing sales of nutritional snack bars and growing health and wellness trends among modern consumers have enabled strong sales of these products. The high concentration of nutrients in fruit bars and growing availability of diverse flavors such as orange, mango, and strawberry further drive segment expansion. Buyers prefer fruit bars that are flavorful and offer suitable textures, which can be achieved by balancing various components, controlling the ultimate moisture level of the product, and following optimal manufacturing processes. Brands that focus on sustainability in their sourcing, packaging, and production practices are witnessing an increased demand. Low sugar fruit bars, particularly those made with organic or sustainably sourced ingredients, cater to this growing trend.

Meanwhile, the dried tropical fruit segment is anticipated to advance at the fastest CAGR during the forecast period. These products are free from molds, insects, blemishes, and damage without requiring any added preservatives or sugars. Tropical fruits offer a unique and exotic flavor profile that sets them apart from other dried fruits, such as apples or raisins. Fruits such as mango, pineapple, coconut, and dragon fruit are becoming highly popular for their distinctive tastes and vibrant colors. As demand for dried tropical fruit snacks expands, retailers are increasingly adding these products to their shelves. Dried tropical fruit snacks are becoming more widely available in a range of stores, from large grocery chains to health food stores and convenience stores.

Distribution Channel Insights

The supermarkets & hypermarkets segment accounted for the largest revenue share in 2024. The extensive presence of major retail chains such as Walmart, Target, and ASDA have enabled manufacturers of fruit snacks to ensure better visibility for their products while also offering a wider variety of options. The high customer traffic witnessed in such outlets creates a better opportunity for brands to promote the nutritional value of their offerings, which can drive potential sales. Supermarkets and hypermarkets extensively leverage pricing strategies, such as discounts, bundled offers, and loyalty programs, to encourage customers to purchase low-sugar fruit snacks. These promotions help increase sales and make healthier options more accessible to a broader range of consumers.

The online retailers’ segment is expected to witness the fastest CAGR from 2025 to 2030. Online platforms present a major opportunity for both emerging and well-known brands to boost awareness regarding their products among buyers and keep them updated about new launches. The shift towards health-conscious lifestyles among consumers, combined with the convenience offered by online shopping, has created promising growth opportunities for market players in this segment. The ease of product comparison, bulk buying options, availability of product variety, and the ability to access healthy snacks that meet specific dietary needs further aid the expansion of the low sugar fruit snacks industry.

Regional Insights

The North America low sugar fruit snacks market accounted for the largest revenue share of 32.7% globally in 2024. The regional demand is driven by several factors, such as growing health consciousness, the rise of health and wellness trends, and a shift toward more nutritious snack options. Consumers in the U.S. and Canada have become increasingly aware of the negative health impacts of high sugar consumption, such as obesity, diabetes, and heart disease. For instance, in Canada, as per government data, around 3.7 million people, or around 9.4% of the population, were living with diagnosed diabetes in 2020-21. As a result, the rising demographic of diabetes-affected individuals is expected to offer a major growth avenue for manufacturers of low sugar fruit snacks, which are considered healthier snacking options.

U.S. Low Sugar Fruit Snacks Market Trends

The U.S. low sugar fruit snacks market accounted for a dominant revenue share in the regional market in 2024 on account of a combination of factors, including health-focused consumer behavior, improving dietary trends, and an increasing preference for more natural and clean-label foods. Consumers are actively seeking healthier snack products that are low in sugar, high in nutrients, and made with natural ingredients. This shift is supported by innovations in product offerings, increased product availability across various retail channels, and the use of marketing strategies that emphasize health benefits. Products are being sold through both online and offline channels in the country, while the localized presence of several major global manufacturers further aids market expansion in the economy.

Europe Low Sugar Fruit Snacks Market Trends

Europe low sugar fruit snacks market accounted for a substantial revenue share in the global market for low sugar fruit snacks in 2024. Consumers in this region have become highly aware of the various health risks posed by consumption of food items with high sugar content as a result of continuous initiatives by health authorities and private health organizations. This has led to the increased sales of products such as fruit bars and fruit roll-ups that have minimal amounts of sugar in them. The emergence of regulations such as Breakfast Directives in the region and various nationalized strategies, such as the sugar tax in the UK, are expected to influence manufacturers of high-sugar food items to launch low-sugar alternatives in the coming years. As a result, the market is well-positioned to show promising expansion in regional economies.

Asia Pacific Low Sugar Fruit Snacks Market Trends

The Asia Pacific region is expected to witness the fastest CAGR during the forecast period in the low sugar fruit snacks market. Growing prevalence of lifestyle disorders such as diabetes and obesity have made consumers in regional economies such as India, China, and Japan highly aware of the drawbacks of consuming food items with high amounts of sugar. Low sugar fruit snacks are viewed as a healthier option for individuals seeking to prevent or manage such conditions, contributing to their rising popularity in the region. Furthermore, in several countries, snacking has become an integral part of the daily lifestyle, particularly with the evolution of work culture and the rising demand for flexible eating habits. Low sugar fruit snacks are considered a healthier alternative to traditional sugary options in this regard.

China low sugar fruit snacks market accounted for the largest revenue share in the Asia Pacific market for low sugar fruit snacks in 2024. The younger generations in the country, particularly the millennial and Generation Z demographics, are increasingly prioritizing health and wellness. These consumers are more likely to choose low sugar, nutritious snacks that align with their desire for a healthier lifestyle. The concept of functional foods has also gained significant traction in China, which is expected to positively shape market growth in the coming years. Low sugar fruit snacks are marketed as functional items that provide fiber, vitamins, antioxidants, and other nutrients that support overall health. The Chinese government is focusing on improving the nutritional quality of food products to address health issues such as obesity and diabetes among citizens. Policies to reduce sugar consumption and improve food labeling standards have indirectly contributed to the demand for low sugar products, including fruit snacks, in the economy.

Key Low Sugar Fruit Snacks Company Insights

Some major companies involved in the global low sugar fruit snacks industry include Welch’s, Chaucer Foods, and WALLAROO, among others.

-

Welch's Fruit Snacks is an American company that specializes in the manufacturing and sales of fruit-based products such as snacks, juices, and jellies & jams. Under the snacks section, the company is known for its Fruit Snacks, Fresh Fruit, Organic Juice Ice Bar, and Sparkling Soda products. The Welch's Fruit Snacks division has a wide range of offerings, including Welch’s Fruit Snacks, Welch’s Fruit ‘n Yogurt Snacks, Welch’s Juicefuls Juicy Fruit Snacks, Welch’s Absolute Fruitfuls Fruit Strips, and Welch’s Fruit Rolls, among others.

-

Chaucer Foods is a UK-based food company specializing in the manufacturing of baked ingredients and freeze-dried products. Its freeze-dried offerings include fruits, vegetables, cheese, powders, and freeze-dried melts. Under the baked products section, Chaucer Foods provides snacking items, platter companions, sprinkles and toppings, soup croutons, and salad companions.

Key Low Sugar Fruit Snacks Companies:

The following are the leading companies in the low sugar fruit snacks market. These companies collectively hold the largest market share and dictate industry trends.

- Calbee Harvest Snaps

- Tyson Foods, Inc.

- Danone

- Welch's

- Kellanova

- Del Monte Foods Corporation II Inc.

- Chaucer Foods Ltd

- Nestlé

- WALLAROO

- BEAR

Recent Developments

-

In July 2024, Welch’s Fruit Snacks announced the launch of Welch's Absolute Fruitfuls Fruit Strips, a product range that makes use of whole fruits and offers high nutritional value. The products launched in Strawberry, Berry Medley, and Mango-Peach varieties, have been designed as an on-the-go snacking option that are also suitable for school lunch and after-school activities. The new offerings are gluten-free, non-GMO, and vegan, and they are rich in Vitamin C. They have been launched across several major U.S. retailers, including Walmart, Albertsons, H-E-B, Publix, and Kroger, among others.

-

In March 2024, Calbee America introduced ‘Harvest Snaps Kids Freeze-Dried Fruit Snacks’ at the Natural Products Expo West event in California. Through this launch, the company entered into the development of kid-focused snacking products, presenting another major sales avenue. The single-serve snacks developed by Calbee utilize only whole-fruit ingredients and are available in four flavors - Grapes, Apples, Bananas, and Strawberries. The products are certified gluten-free, non-GMO, and are free of artificial colors, flavors, added sugar, and preservatives.

Low Sugar Fruit Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.11 billion

Revenue forecast in 2030

USD 4.82 billion

Growth Rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Calbee Harvest Snaps; Tyson Foods, Inc.; Danone; Welch's; Kellanova; Del Monte Foods Corporation II Inc.; Chaucer Foods Ltd; Nestlé; WALLAROO; BEAR

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Sugar Fruit Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low sugar fruit snacks market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Bars

-

Dried Tropical Fruit

-

Fruit Roll-ups

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Online Retailers

-

Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.