- Home

- »

- Healthcare IT

- »

-

Long-term Care Software Market Size & Share Report, 2030GVR Report cover

![Long-term Care Software Market Size, Share, & Trends Report]()

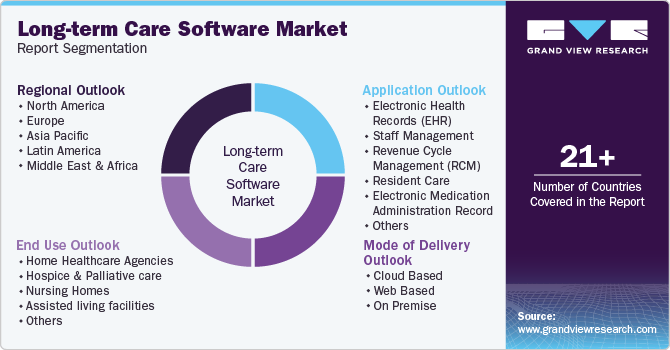

Long-term Care Software Market (2025 - 2030) Size, Share, & Trends Analysis Report By Application, By Mode of Delivery (Cloud Based, Web Based), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Long-term Care Software Market Trends

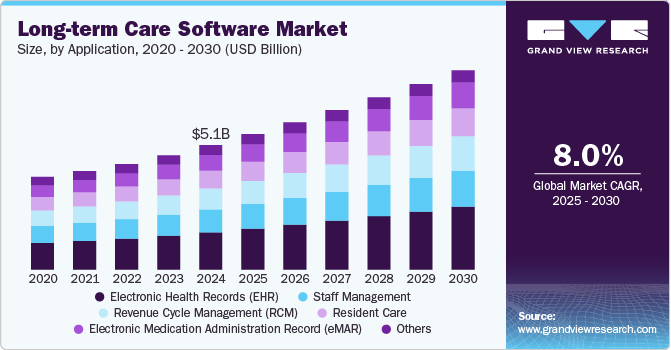

The global long-term care software market size was estimated at USD 5.13 billion in 2024 and is projected to grow at a CAGR of 8.02% from 2025 to 2030. The market is expected to grow significantly due to increasing demand for efficient management in LTC facilities, driven by the aging population and rising chronic health conditions. LTC software improves workflow automation, resident care, and regulatory compliance. It enhances data accuracy, streamlines care coordination, and reduces errors, improving overall quality and operational efficiency. As care centers adopt electronic health records (EHRs) and integrated care platforms, the software’s impact on patient outcomes and administrative processes is expected to drive the market growth.

LTC software provides efficient workflow techniques that save time and money. They include a centralized database, integrated EHRs, and solutions for medication management, payroll management, resident care, revenue cycle management, clinical documentation, & others. This helps provide effective care to patients, improve compliance, and reduce costs. The shortage of nursing staff and increasing burnout among healthcare professionals has enhanced the adoption of healthcare IT solutions.

According to the Canadian press in May 2024, the requirement for nurses and personal support workers in Ontario is expected to be over 33,200 and 50,853 by 2032. Hence, many LTC providers are adopting these suits to efficiently manage their workflow. For instance, in July 2024, Homecare Homebase (HCHB) and SimiTree partnered to integrate HCHB’s EHR technology with SimiTree’s Market Analysis Platform (MAP). This collaboration enhances market visibility for home health providers, helping them identify growth opportunities, analyze referral patterns, and assess competitors. It ultimately drives innovation and improved care quality.

The growing demand for medical services due to the rising elderly population facing long-term diseases is projected to be a significant factor driving the market growth. This software provides effective care management that ensures the efficient use of vital resources, catering to the unique requirements of patients and enhancing healthcare outcomes. Certain conditions, including cancer, Parkinson’s disease, diabetes, heart disease, dementia, multiple sclerosis, Alzheimer’s, mental stress, and cerebral palsy, are becoming more prevalent, especially among the elderly population.

The WHO, in May 2023, published that over 55 million people have dementia across the world, out of which around 60% of people are from low- and middle-income countries. Moreover, the most common form is Alzheimer's disease, which contributes 60% to 70% of cases. This trend is anticipated to increase demand for LTC software to support efficient management and personalized care for Alzheimer's patients.

The COVID-19 pandemic positively impacted the market growth, especially in LTC facilities where the elderly population was severely affected. The rising mortality and prevalence of diseases created an urgent need for strong measures to fight COVID-19 complications. Advanced LTC software & solutions have become crucial tools in the fight against the pandemic, helping track & manage COVID-19 patients in LTC facilities.

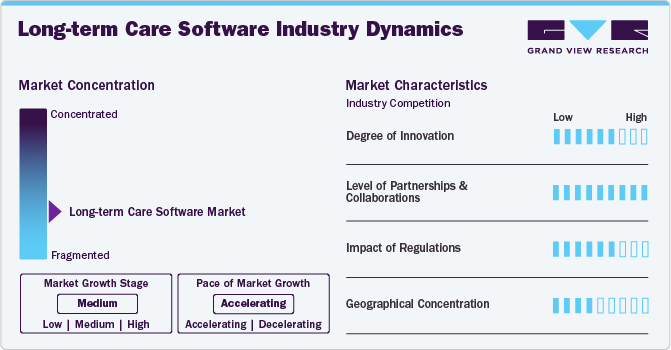

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as the degree of innovation, the impact of regulations, industry competition, service and product expansion, level of partnerships and collaboration activities, and regional expansion. For instance, the industry is fragmented, with many services and end users entering the market. There is a high degree of innovation, a high level of partnerships and collaboration activities, a moderate impact of regulations, and a moderate geographical expansion of industry.

The LTC software industry is experiencing a high degree of innovation. As the focus on delivering better and more efficient care increases, the demand for LTC software is expected to grow significantly, contributing to the overall advancement of the healthcare industry. For instance, in August 2024, the National Guardian Life Insurance Company (NGL) launched ClientConnect, an advanced electronic application platform for its LTC insurance product. ClientConnect, powered by iCover, features an intuitive design, user-friendly layout, and streamlined medical records ordering. This new platform offers a more efficient, seamless, and expedited process for submitting LTC insurance applications with NGL.

Several key players are actively engaging in partnerships and collaborations to foster growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in June 2024, PointClickCare and C3HIE partnered to improve health outcomes across Texas. This partnership involves integrating C3HIE’s Admission, Discharge, & Transfer (ADT) data with PointClickCare’s platform and incorporating SNF data into the C3HIE network. This collaboration would enhance care coordination and provide a seamless, connected healthcare experience for patients throughout their journey.

The regulatory framework for the LTC software industry involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. For instance, in the UK, digital health products (software, apps, and wearables) are classified as medical devices, regulated under Medical Devices Regulations 2002. They should be registered with the Medicines and Healthcare products Regulatory Agency (MHRA) before being launched in the UK market.

Geographical expansion helps companies to increase their presence to maintain or strengthen their market presence. For instance, in May 2024, PointClickCare announced an expansion in California, integrating the state’s largest encounter and clinical data to enhance statewide patient care. Its Care Collaboration Network includes 182 hospitals, 229 clinics, 1,054 skilled nursing facilities, and 17 health plans, serving over 32.7 million Californians. This expansion covers 55% of the state’s acute providers and 78% of SNF providers.

Application Insights

Based on application, the EHR segment led the market with the largest revenue share of 30.02% in 2024 and is anticipated to grow at the fastest CAGR from 2025 to 2030. Electronic Healthcare Records (EHR) play an essential role in the healthcare industry, catering to the rapidly growing population requiring extended care. Technological advancements and data analytics are driving the adoption of EHR systems. Modern EHR solutions offer sophisticated analytics tools to track patient outcomes, identify trends, and support decision-making. This capability enables LTC providers to implement more personalized care plans, monitor performance metrics, and improve overall care quality. As technology evolves, integrating advanced features in EHR systems will likely become more appealing to LTC facilities seeking to enhance their service offerings & operational efficiency.

The revenue cycle management (RCM) segment is expected to grow at a significant CAGR over the forecast period. The growing adoption of integrated software solutions contributes to the expansion of the RCM segment. Integrated RCM systems, which connect financial management with clinical and operational data, offer a comprehensive approach to revenue management. By enhancing data across various functions, these systems provide actionable insights, enhance financial oversight, and improve overall revenue cycle efficiency. This integration supports better decision-making and operational transparency, driving increased demand for advanced RCM solutions in the market. For instance, in March 2024, MatrixCare, a global provider of postacute technology, announced plans to integrate HEALTHCAREfirst’s RCM, coding, and clinical documentation review services with its software suite, offering comprehensive, high-quality solutions to the postacute care market. The addition of RCM services complements MatrixCare’s extensive offerings, enhancing support for home health and hospice providers.

Mode of Delivery Insights

Based on mode of delivery, the cloud-based segment led the market with the largest revenue share of 41.97% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growth of this segment can be attributed to the advantages of cloud-based solutions, which offer cost-effectiveness, lower investment requirements, fewer operational issues, flexible cost & usage options, and a straightforward implementation procedure with advanced security measures.

The demand for cloud-based solutions is rising, leading to the development of new products and the entry of players into the market. For instance, in September 2023, WellSky, a health and community care technology provider, expanded its capabilities in the LTC sector by acquiring Experience Care, a provider of advanced technology solutions for post-acute & LTC services. This acquisition underscored WellSky’s increased investment and commitment to LTC.

The web-based segment is expected to grow at a significant CAGR during the forecast period. The growing demand for accessibility and flexibility in healthcare management is expected to boost the web-based segment. Web-based solutions offer unparalleled access to patient information and care plans from any location, anytime, provided there is internet connectivity. This flexibility is particularly crucial in LTC settings, where care teams often operate across multiple locations and require real-time access to patient records to make swift, informed decisions. In addition, the scalability of web-based platforms allows for the integration of various functionalities as the needs of the facility grow, ensuring that the software can adapt to changing demands without significant overhauls or investments.

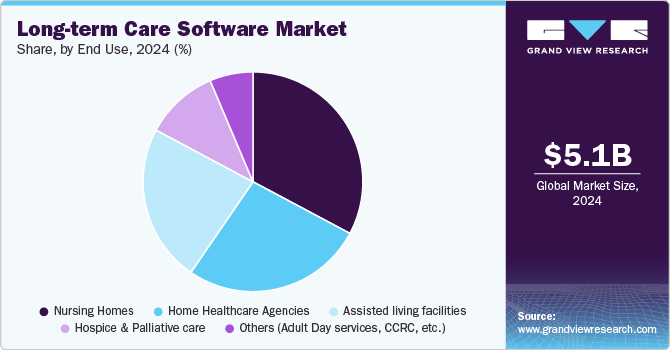

End Use Insights

Based on end use, the nursing homes segment led the market with the largest revenue share of 32.79% in 2024. The growth is attributed to the rising demand for skilled nursing facilities (SNFs) globally. The SNFs offer essential nursing, rehabilitation, and related services, with Medicare covering short-term skilled nursing & rehabilitation for beneficiaries post their stay in acute care hospitals. According to carehome.co.uk in April 2024, carehome.co.uk, the UK has about 16,700 care homes, with approximately 70% being residential settings and 30% classified as nursing homes.

The home healthcare agencies segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by the rising demand for personalized and patient-centric care. As patients and their families increasingly prefer receiving care in the comfort of their own homes rather than in institutional settings, home healthcare agencies are expanding their services to meet these needs. This shift is leading to a heightened demand for advanced software solutions that can efficiently manage patient care, track health outcomes, and ensure compliance with regulatory standards. According to the CMS, in 2022, home healthcare accounted for 3% of the national healthcare expenditure, and spending on services from freestanding home healthcare agencies surged 6.0% to USD 132.9 billion, driven by increased private insurance, out-of-pocket, and Medicaid contributions, despite a slowdown in Medicare spending growth.

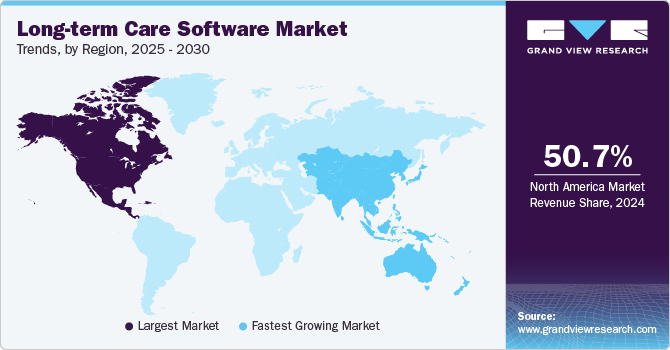

Regional Insights

North America long-term care software market region dominated the with the largest revenue share of 50.66% in 2024. The market growth is driven by an increasing demand for comprehensive healthcare solutions among the rapidly aging population. The growing geriatric population is prompting healthcare facilities to adopt advanced software solutions for better patient care management, efficient operation workflows, and effective handling of administrative tasks. Moreover, the rise in the prevalence of chronic diseases and the need for continuous care & monitoring of patients have necessitated the integration of technologically advanced software systems in LTC facilities. These systems offer functionalities such as EHRs, e-prescribing, patient management, and billing & invoicing, thereby ensuring operational efficiency & improving the quality of care provided.

U.S. Long-term Care Software Market Trends

The U.S. long-term care software market held the largest market share in North America in 2024. The increasing demand for medical services due to the growing elderly population suffering from long-term diseases is projected to be a significant factor driving the market growth in the U.S. The Alzheimer's Association 2023 report reveals that over 33% of people aged 85 and above, followed by around 13% of individuals aged 75 to 84, and over 5% of people aged between 65 and 74 in the U.S. have Alzheimer's dementia. Moreover, between 2000 and 2019, the death rate due to Alzheimer's disease in this age group increased by a staggering 145%. This trend is anticipated to increase the demand for long-term care software to support efficient management & personalized care for Alzheimer's patients.

Europe Long-term Care Software Market Trends

The Europe long-term care software market is anticipated to grow at a significant CAGR over the forecast period, due to the presence of developed economies, such as Germany, the UK, France, Spain, & Italy. The need for integrated health systems is rising due to the rapidly growing geriatric population and, subsequently increasing prevalence of chronic diseases. An increase in the number of initiatives supporting eHealth is expected to drive the regional market over the forecast period. In addition, EU policymakers are promoting various digital health programs, which are expected to boost market growth during the forecast period. For instance, in May 2022, the European Health Data Space Program was launched to support the use of health data for improvements in research, innovative healthcare delivery, and policymaking.

The UK long-term care software market is expected to grow at a significant CAGR over the forecast period. The growth is driven by an ever-increasing need for efficient healthcare services amidst a rising geriatric population and the subsequent rise in chronic health conditions. This increase demands robust and scalable solutions to streamline operations and enhance care delivery in LTC facilities. In addition, the government's initiatives toward digitization of health records and the push for integrated care models are pivotal in steering the adoption of advanced software solutions. For instance, in March 2024, the investment of USD 4.3 million (EUR 4.2 million) by the government in the digitalization of healthcare services is expected to offer lucrative growth opportunities for market players, thereby driving market growth.

The Germany long-term care software market in held a significantshare in Europe in 2024. The growing geriatric population in Germany has led to an increase in the demand for LTC services. As the percentage of the elderly population rises, there is a growing need for efficient management systems in nursing homes, assisted living facilities, and home care settings. Furthermore, the German healthcare system's emphasis on quality care and operational efficiency has increased the adoption of advanced software solutions. These tools enhance patient care management, streamline administrative tasks, and ensure compliance with regulatory standards, fostering a more effective & sustainable long-term care ecosystem.

Asia Pacific Long-term Care Software Market Trends

The long-term care software market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, with a high demand for LTC solutions due to an increase in government spending on healthcare. In addition, the need for LTC software has been growing, as it enables effective management of financial, clinical, and administrative aspects of LTC centers. Various LTC providers in Japan, Malaysia, South Korea, and Australia have adopted these systems for better patient care and satisfaction. Furthermore, several supportive government policies and increasing investments in digital health infrastructure are accelerating market growth. Several governments are implementing initiatives and providing funding to promote the adoption of digital health technologies, including LTC software.

The Japan long-term care software market accounted for a significant revenue share in 2024. Several factors, such as the rapid adoption of new technologies and the growing popularity of at-home care & regular monitoring services are likely to propel the market growth in Japan. For instance, in June 2024, The Ministry of Health, Labour and Welfare (MHLW) and the Ministry of Economy, Trade and Industry (METI) updated the Priority Fields in the Use of Robot Technology for LTC and updated the title to Priority Fields in the Use of Technologies for LTC. The new priority fields aim to enhance care quality, reduce caregiver burden, and support elderly self-reliance with robots, ICT, and other innovations. The increasing number of partnerships among major cross-industry players over recent years is propelling the adoption of newer technologies in Japan’s healthcare sector, such as LTC.

The long-term care software market in Indi is driven by the growing geriatric population, increasing burden of chronic diseases, and government initiatives supporting the country’s eHealth scenario. In addition, efforts to improve healthcare infrastructure are likely to boost the market. The Indian government has undertaken various initiatives to support digital health. Significant investments have been made to develop healthcare IT infrastructure. One such notable initiative is the development of the Integrated Health Information Platform (IHIP). IHIP is being implemented to create standard-compliant EHRs and their integration & interoperability through a centralized platform. This initiative aims to reduce healthcare costs, enable patient involvement in the overall care management process, and optimize information exchange to generate better health outcomes.

Latin America Long-term Care Software Market Trends

The long-term care software market in Latin America is anticipated to grow at a significant CAGR over the forecast period. The healthcare system in Latin America is rapidly evolving. The demand for advanced healthcare is increasing amid a rapidly aging population and rising prevalence of chronic diseases. In certain demographic sectors, rising income fuels the demand for high-quality services, as there is a heightened demand for advanced software that can streamline care delivery, improve operational efficiency, and enhance patient outcomes. Technologies such as EHRs, care coordination platforms, and remote monitoring systems are becoming essential in addressing the complexities of long-term care and managing resource constraints.

The Brazil long-term care software market accounted for the largest market share in Latin America in 2024. Some of the major factors driving this industry are rising per capita income, increasing government medical & healthcare spending, improving access to private healthcare facilities such as LTC centers, and fast-growing healthcare R&D. Brazil is one of the most profitable healthcare markets in Latin America with largest healthcare spending. Strong government backing and high demand for healthcare services drive the country’s healthcare sector. The government has undertaken various efforts and implemented appropriate plans & regulations, which have resulted in the beneficial growth of total healthcare services & facilities.

Middle East and Africa Long-term Care Software Market Trends

The long-term care software market in MEA is anticipated to grow at a significant CAGR during the forecast period. Market growth in this region can be attributed to the steady development of healthcare facilities in emerging economies and an increase in healthcare expenditure. Some of the key countries in the region, such as Saudi Arabia and the UAE, have exhibited significant growth & major changes in healthcare facilities.

The South Africa long-term care software marke is expected to grow at a significant CAGR over the forecast period.An increase in the adoption of IT in healthcare is expected to boost the market. The eHealth strategy in South Africa’s public health sector is expected to accelerate the deployment of LTC solutions, focusing on enhancing the efficiency and effectiveness of the national health information system through a patient-centric approach. For instance, in March 2024, the government of South Africa announced the budget for the financial year 2024-2025 with USD 127.6 billion, out of which USD 15.29 billion (R271.9 billion) for health. This strategic emphasis is to contribute significantly to the advancement of the market.

Key Long-term Care Software Company Insights

The market is fragmented, with the presence of many country-level LTC software providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Long-Term Care Software Companies:

The following are the leading companies in the long-term care software market. These companies collectively hold the largest market share and dictate industry trends.

- Veradigm LLC (Allscripts Healthcare, LLC)

- Cerner Corporation (Oracle)

- Netsmart Technologies, Inc.

- MatrixCare (ResMed Inc.)

- Yardi Systems, Inc.

- VITALS SOFTWARE (ALINE)

- PointClickCare

- Medtelligent, Inc.

- AL Advantage, LLC

- Genexod Technologies LLC

- Revver, Inc.

- Homecare Homebase, LLC.

- eClinicalWorks

- Kareo, Inc.

Recent Developments

-

In May 2024, MatrixCare (ResMed Inc.) entered into a strategic partnership with NHS Management, LLC, a provider of administrative & consulting services for skilled nursing and rehabilitative facilities in the Southeast. This collaboration aims to enhance out-of-hospital healthcare solutions through MatrixCare (ResMed Inc.)’s innovative technology.

-

In March 2024, MatrixCare (ResMed Inc.), a global postacute technology provider, announced that it would integrate HEALTHCAREfirst’s revenue cycle management, coding, and clinical documentation review services with its software suite.

-

In January 2024, Aline, a provider of senior living software, acquired VITALS SOFTWARE, expanding its enterpris -scale solutions to Vitals customers while continuing to support their existing platform.

Long-Term Care Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.58 billion

Revenue forecast in 2030

USD 8.21 billion

Growth rate

CAGR of 8.02% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report Updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, mode of delivery, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; and Kuwait

Veradigm LLC (Allscripts Healthcare, LLC); Cerner Corporation (Oracle); Netsmart Technologies, Inc.; MatrixCare (ResMed Inc.); Yardi Systems, Inc.; VITALS SOFTWARE (ALINE); PointClickCare; Medtelligent, Inc.; AL Advantage, LLC; Genexod Technologies LLC; Revver, Inc.; Homecare Homebase, LLC.; eClinicalWorks; and Kareo, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Long-Term Care Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global long-term care software market report based on application, mode of delivery, end use, and regions.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Health Records (EHR)

-

Staff Management

-

Revenue Cycle Management (RCM)

-

Resident Care

-

Electronic Medication Administration Record (eMAR)

-

Others (Scheduling Software, Document Management Systems (DMS), Analytics & reporting tools, Compliance & regulatory reporting, etc.)

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Based

-

Web Based

-

On Premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Healthcare Agencies

-

Hospice & Palliative care

-

Nursing Homes

-

Assisted living facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global long-term care software market size was estimated at USD 5.13 billion in 2024 and is expected to reach USD 5.58 billion in 2025.

b. The global long-term care software market is expected to grow at a compound annual growth rate of 8.02% from 2025 to 2030 to reach USD 8.21 billion by 2030.

b. North America dominated the long-term care software market with the highest share of over 50% in 2024. This is attributable to the favorable reimbursement of LTC and rapid of adoption software in hospitals.

b. Some key players operating in the long-term care software market include Veradigm LLC (Allscripts Healthcare, LLC), Cerner Corporation (Oracle), Netsmart Technologies, Inc., MatrixCare (ResMed Inc.), Yardi Systems, Inc., VITALS SOFTWARE (ALINE), PointClickCare, Medtelligent, Inc., AL Advantage, LLC, Genexod Technologies LLC, Revver, Inc., Homecare Homebase, LLC., eClinicalWorks, and Kareo, Inc.

b. Key factors driving the long-term care software market growth include rising adoption of EHRs by the LTC providers, increasing prevalence of chronic diseases, especially among the elderly population, technological advancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.