- Home

- »

- Communications Infrastructure

- »

-

Location Of Things Market Size, Share Analysis Report, 2030GVR Report cover

![Location Of Things Market Size, Share & Trends Report]()

Location Of Things Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Integrated Platform/Workload Systems, Integrated Infrastructure Systems), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-582-3

- Number of Report Pages: 132

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Location Of Things Market Summary

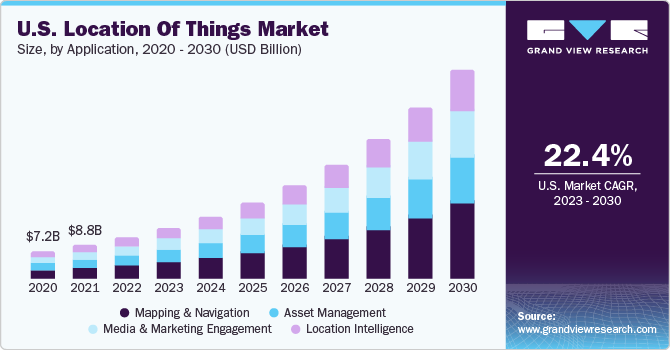

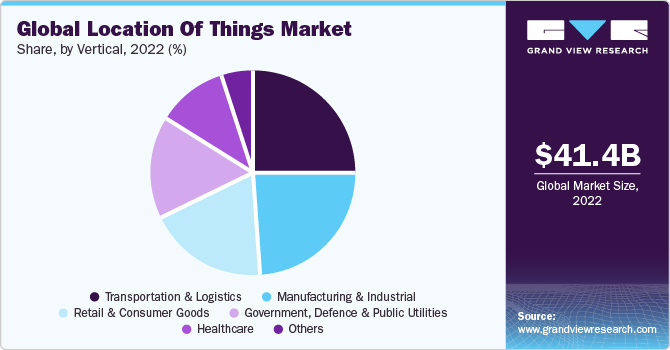

The global location of things market size was estimated at USD 41.36 billion in 2022 and is projected to reach USD 216.68 billion by 2030, growing at a CAGR of 23.0% from 2023 to 2030. The increasing penetration of the Internet of Things (IoT) and connected device technologies and the rising demand for location-based verticals are presumed to bolster the market's growth.

Key Market Trends & Insights

- North America dominated the global market and accounted for the largest revenue share of 30.3% in 2022.

- Asia Pacific is expected to register the highest CAGR of 24.7% over the forecast period.

- Based on type, the hardware segment led the market and accounted for 47.0% of the global revenue in 2023.

- Based on application, the mapping and navigation segment accounted for the highest revenue share of around 33.3% in 2022 and is estimated to register the fastest CAGR of 24.2% over the forecast period.

- Based on vertical, the transportation and logistics segment accounted for the largest revenue share of around 24.8% in 2022 and is estimated to register the fastest CAGR of 24.4% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 41.36 Billion

- 2030 Projected Market Size: USD 216.68 Billion

- CAGR (2023-2030): 23.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Rising investments in IoT technologies and increased demand for location-based verticals are expected to accelerate market growth. Companies such as Samsung, Intel, and Qualcomm are investing significantly in creating innovation labs focusing on IoT technologies and IoT-enabled verticals. Innovative technology start-ups such as Pixie Technology, Filament, and Greenwave Systems have secured significant funding through various venture capitalists and collaborations with technology firms.

However, in this connected environment, issues pertaining to privacy and security, such as unauthorized access, fraud, system malfunctions, and other risks, can hinder market growth. Various networking challenges related to speed, capacity, complexity, and availability are also anticipated to affect the industry's growth.

Application Insights

Based on application, the market is segmented into mapping and navigation, asset management, location intelligence, and media and marketing engagement. The mapping and navigation segment accounted for the highest revenue share of around 33.3% in 2022 and is estimated to register the fastest CAGR of 24.2% over the forecast period. IoT enables location tracking and monitoring to connect different appliances and devices through the internet. It also enables real-time communications with users. The mapping and navigation technology enables users to track and monitor the movement of various physical devices. This technology is most commonly used in navigation verticals, where users can find the shortest and best route between destinations.

The media and marketing engagement segment is estimated to grow significantly over the forecast period. The LoT market leverages geolocation data from connected devices and sensors to deliver location-based verticals and experiences. This integration of physical and digital realms enables marketers to target consumers based on their real-time location, enabling more relevant and contextual advertising and engagement strategies. Furthermore, the advent of new technologies such as augmented reality (AR), virtual reality (VR), and mixed reality (MR) has opened up exciting possibilities for enhancing engagement in the media and marketing space.

Mobile location technology has gained traction for social engagements such as location-based marketing, advertising, location finders, and points of interest. Location technologies have various potential uses in industrial sectors, offering applications such as asset management and location intelligence verticals. Technology firms and vertical providers are innovating and deploying various solutions for organizations that can deliver operational efficiencies.

Vertical Insights

Based on vertical, the market is segmented into retail and consumer goods, government, defense, and public utilities, manufacturing and industrial, transportation and logistics, healthcare, and others. The transportation and logistics segment accounted for the largest revenue share of around 24.8% in 2022 and is estimated to register the fastest CAGR of 24.4% over the forecast period. Advancements in sensor technology, network communication, and location techniques have enabled various innovative location-based solutions. The increasing demand for end-to-end supply chain visibility and customer-centric services is driving the adoption of LoT in transportation and logistics. LoT enables companies to provide proactive notifications, delivery updates, and estimated arrival times, enhancing customer satisfaction and loyalty. Tracking goods throughout the supply chain also helps identify potential bottlenecks or delays, enabling proactive problem-solving and efficient resource allocation.

The manufacturing and industrial segment is estimated to grow significantly over the forecast period. The rising adoption of automation and robotics in manufacturing drives the demand for LoT solutions. As factories become more automated, seamless integration and coordination between machines and equipment becomes critical. Location-based technologies play a vital role in optimizing the movement and positioning of robotic systems, improving efficiency, and minimizing collisions or bottlenecks.

Other verticals have found ways to incorporate location technologies to optimize business processes and offer differentiated products. IoT technologies enable the collection of various data, with location data being one of the aspects. Organizations utilize this data to identify trends and patterns regarding customer behavior to offer personalization, location-based content, and reduced time-to-delivery.

Regional Insights

North America dominated the global market and accounted for the largest revenue share of 30.3% in 2022. Technology proliferation, increased penetration of smartphones, and enhanced network connectivity have led to a faster adoption rate in North America than in other regions. The presence of major technology players, such as Google LLC, Apple, Inc., Qualcomm Technologies, Inc., and HERE, has led to the market's growth.

Asia Pacific is expected to register the highest CAGR of 24.7% over the forecast period owing to the increased spending on connected devices, investments in various IoT technologies, and increasing demand for personalized services. Organizations are realizing the potential uses of IoT for creating new services and generating new revenue streams, which would ensure future market growth.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2023, In India, Reliance Jio Infocomm Ltd. launched JioTag, a low-cost item-tracking device. With a double tap on the tracking device, users can locate misplaced things and ring a silent phone. JioTag is especially useful for locating tiny objects like wallets, key rings, and car keys within a 20-50 meter range.

Key Location Of Things Companies:

- ESRI

- Wireless Logic

- HERE

- Navizon, Inc.

- Bosch.IO GmbH

- Pitney Bowes Inc.

- TIBCO (Cloud Software Group, Inc.)

- Trimble Inc.

- Qualcomm Technologies, Inc.

Recent Developments

-

In June 2023, Google LLC launched precise location support for its AI chatbot Bard. This integration allows Bard to offer more pertinent information about nearby restaurants and other points of interest. Additionally, users can request Bard to provide concise summaries of articles or stories and quick explanations of various topics without delving into excessive detail.

-

In June 2021, Verizon announced the acquisition of Senion, a company known for its indoor positioning platform that utilizes machine-learning sensor fusion technology to provide highly accurate positioning and navigation with sub-meter precision. With his acquisition, Senion's Location Technology team is part of Verizon's New Business Incubation, which is dedicated to expanding new automation businesses. Senion's capabilities complement Verizon's ongoing Digital Space Orchestration offering development through the Location Technology team.

Location Of Things Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 50.87 billion

Revenue forecast in 2030

USD 216.68 billion

Growth rate

CAGR of 23.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

ESRI; Wireless Logic; HERE; ; Navizon, Inc.; Bosch.IO GmbH; Pitney Bowes Inc.; TIBCO (Cloud Software Group, Inc.), Trimble Inc; Qualcomm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Location Of Things Market Report Segmentation

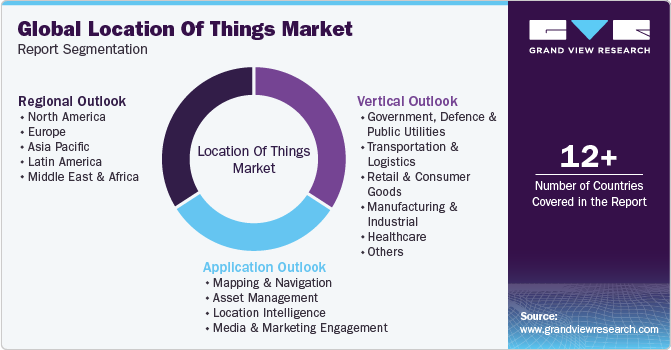

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global location of things market report on the basis of application, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Mapping And Navigation

-

Asset Management

-

Location Intelligence

-

Media And Marketing Engagement

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Government, Defence And Public Utilities

-

Transportation And Logistics

-

Retail And Consumer Goods

-

Manufacturing And Industrial

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East And Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global location of things market size was estimated at USD 41.36 billion in 2022 and is expected to reach USD 50.87 billion in 2023.

b. The global location of things market is expected to grow at a compound annual growth rate of 23.0% from 2023 to 2030 to reach USD 216.68 million by 2030.

b. North America region dominated the location of things market with a share of 30.3% in 2022. This is attributable to the technology advancements, increased penetration of smartphones, and robust network infrastructure in the region. The presence of major technology players, such as Google LLC, Apple, Inc., Qualcomm Technologies, Inc., and HERE, has led to the market's growth.

b. Some key players operating in the location of things market include ESRI, Wireless Logic, HERE, CSC, Navizon, Inc., Bosch.IO GmbH, Pitney Bowes Inc., TIBCO (Cloud Software Group, Inc.), Trimble Inc., and, Qualcomm Technologies, Inc.

b. Key factors that are driving the market growth include the increasing penetration of smartphones coupled with rising demand for personalized services. Rising investments in IoT technologies and increased demand for location-based verticals are expected to accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.