- Home

- »

- Renewable Chemicals

- »

-

Liquid Fluoroelastomers Market Size And Share Report, 2030GVR Report cover

![Liquid Fluoroelastomers Market Size, Share & Trends Report]()

Liquid Fluoroelastomers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (FSR, FKM-Based Liquid Formulations), By Application (Oil & Gas, Pharmaceutical & Food Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-467-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Fluoroelastomers Market Trends

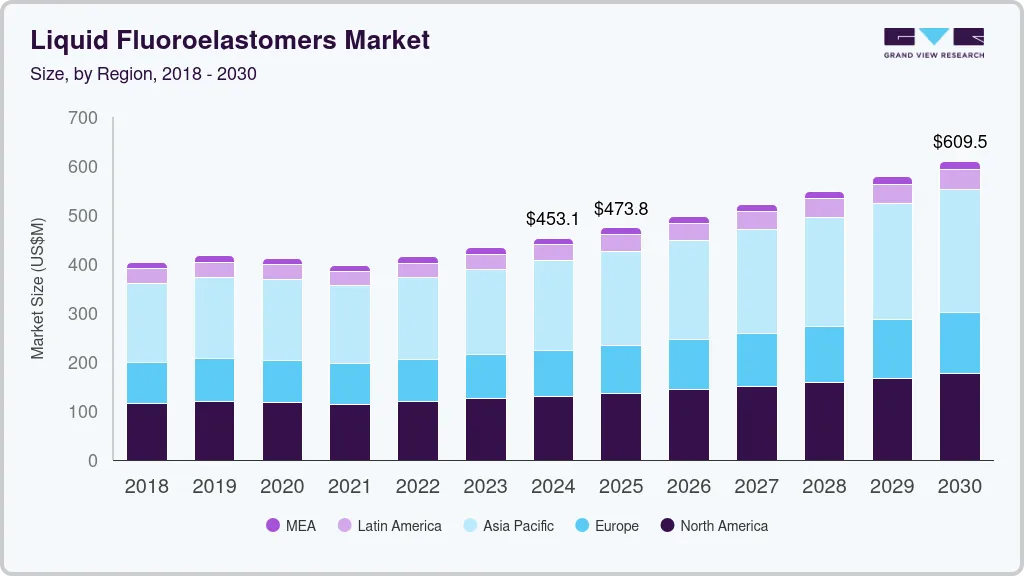

The global liquid fluoroelastomers market size was valued at USD 453.1 million in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The increasing demand for high-performance sealing solutions in the automotive and aerospace sectors, and the growing need for chemical-resistant materials in harsh industrial environments like oil & gas and chemical processing are spurring the market.

The market is experiencing an upward trend due to the increasing demand for high-performance sealing solutions in various industries. As companies in sectors such as automotive, aerospace, chemical processing, and oil & gas seek more durable materials to withstand harsh conditions like extreme temperatures and chemical exposure, liquid fluoroelastomers have gained popularity. This trend is further amplified by the rise in electric vehicles (EVs), which require advanced sealing technologies, driving innovation and adoption of liquid fluoroelastomers globally.

Drivers, Opportunities & Restraints

The growing need for high-temperature and chemical-resistant materials in industrial applications is fueling the growth of the market globally. Fluoroelastomers offer exceptional resistance to aggressive chemicals, oils, and solvents, making them ideal for use in industries like automotive and chemical processing, where reliability under extreme conditions is critical. Additionally, as environmental regulations tighten and industries push for more sustainable solutions, the long-lasting properties of fluoroelastomers help reduce maintenance costs and downtime, driving further demand.

A significant opportunity in the liquid fluoroelastomers market lies in the expansion of their applications within the healthcare and pharmaceutical sectors. As these industries continue to develop, there is a growing need for materials that can handle sterilization processes, maintain biocompatibility, and resist aggressive fluids used in medical devices and equipment. Manufacturers of liquid fluoroelastomers can capitalize on this opportunity by developing specialized products tailored to the unique requirements of these sectors, potentially opening new revenue streams.

Despite its potential, the liquid fluoroelastomers market faces challenges that could hinder its growth. One of the main restraints in the liquid fluoroelastomers market is the high production cost associated with these materials. Fluoroelastomers require complex manufacturing processes and specialized raw materials, leading to a higher price point compared to conventional elastomers. This cost factor can limit their adoption, especially in price-sensitive industries or regions with tighter budgets. Moreover, economic downturns or fluctuations in raw material supply can further exacerbate this issue, making it a challenge for manufacturers to maintain profitability while ensuring competitive pricing.

Product Insights

Based on product, the liquid fluorosilicone elastomers (FSR) segment led the market with the largest revenue share of 49.08% in 2023, attributable tothe growing need for materials that can perform reliably in extreme environmental conditions, particularly in industries such as aerospace, automotive, and electronics. FSR offers exceptional resistance to a wide range of temperatures, from very low to extremely high, while also resisting degradation from oils, fuels, and chemicals. This makes them a preferred choice for sealing, gasketing, and insulating applications where traditional materials would fail. As the demand for high-performance components in industries such as aviation and electric vehicles continues to rise, the unique properties of fluorosilicone elastomers make them essential for meeting strict operational and safety requirements.

The liquid fluorocarbon elastomers (FKM-based liquid formulations) segment is expected to grow significantly through the forecast period due to the increasing demand for high-performance sealing solutions in the oil & gas industry. As exploration and extraction activities move into harsher environments, such as deep-sea drilling and high-pressure oil fields, the need for materials that can withstand extreme temperatures, pressure, and exposure to aggressive chemicals is critical. Liquid fluorocarbon elastomers provide excellent resistance to these challenging conditions, ensuring the durability and reliability of seals, gaskets, and hoses used in oil rigs and refineries. This makes them indispensable for reducing equipment failure and minimizing maintenance costs in one of the world’s most demanding industries.

Application Insights

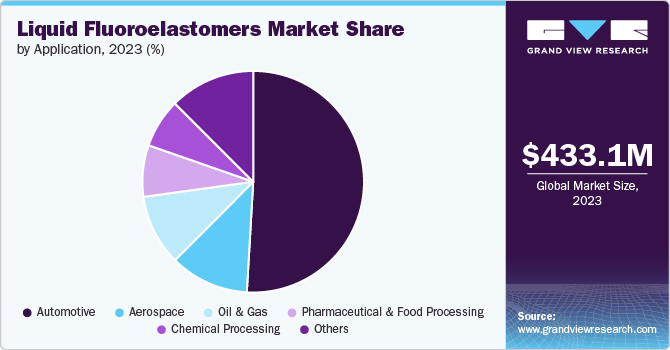

Based on application, the automotive segment led the market with the largest revenue share of 50.92% in 2023, owing to the increasing demand for vehicles in emerging economies. As modern vehicles, including electric and hybrid models, push the limits of performance with higher operating temperatures and exposure to aggressive chemicals such as oils, coolants, and fuels; traditional materials struggle to maintain durability. Liquid fluoroelastomers, with their excellent resistance to high temperatures and chemical degradation, offer a reliable solution for sealing and gasketing applications, improving the longevity and performance of critical automotive parts. This makes them indispensable as the automotive industry focuses on enhancing efficiency, reducing emissions, and complying with stricter environmental standards.

The aerospace segment is poised to grow at a substantial rate in terms of revenue from 2024 to 2030. The rising disposable income of individuals in various countries is driving the tourism industry which further is propelling the segment in the liquid fluouroelastomers market. With planes flying at high altitudes and dealing with rapid temperature fluctuations, parts like seals and gaskets must remain resilient under severe thermal stress. Additionally, exposure to jet fuels, hydraulic fluids, and other aggressive chemicals requires materials with high chemical resistance. Liquid fluoroelastomers meet these requirements, offering exceptional durability and stability in critical aerospace systems. As aircraft designs become more advanced, particularly with the focus on fuel efficiency and extended service life, the demand for such high-performance materials continues to rise within the aerospace sector.

Regional Insights

North America liquid fluoroelastomers market is growing due to the demand from the aerospace and defense sectors. With the region being a hub for aircraft manufacturing and military technology, there is an increasing need for high-performance materials that can endure extreme environments. Liquid fluoroelastomers, known for their resistance to chemicals and high temperatures, are essential for ensuring the reliability of components in these industries, where safety and precision are paramount.

U.S. Liquid Fluoroelastomers Market Trends

The liquid fluoroelastomers market in the U.S. is growing as the expanding electric vehicle (EV) market is a significant driver here. As automakers focus on improving the performance and durability of EV components, the demand for materials that can withstand high heat, chemical exposure, and long operational life is increasing. Liquid fluoroelastomers are critical in providing superior sealing and insulation solutions, particularly in advanced battery systems, driving their adoption in the U.S. automotive industry.

Asia Pacific Liquid Fluoroelastomers Market Trends

The liquid fluoroelastomers market in Asia Pacific dominated the global industry and accounted for the largest revenue share of 62.71% in 2023. The rapid industrialization and growth of the automotive and electronics sectors in the Asia Pacific are key drivers for the liquid fluoroelastomers market. Countries like Japan, South Korea, and India are witnessing increased production of high-tech electronics and advanced automotive systems, both of which require materials that can withstand extreme conditions. Liquid fluoroelastomers provide the necessary durability and chemical resistance, making them crucial in the region’s expanding industrial base.

Europe Liquid Fluoroelastomers Market Trends

The liquid fluoroelastomers market in Europe is driven by stringent environmental regulations and the push for sustainable industrial solutions. Industries such as automotive, chemical processing, and energy are increasingly adopting these elastomers due to their durability and ability to reduce emissions and waste through longer service life and fewer maintenance requirements. The region's focus on green technologies and compliance with environmental standards accelerates the demand for high-performance materials like liquid fluoroelastomers.

China liquid fluoroelastomers market is the booming chemical processing industry. As one of the world’s largest producers of chemicals, China demands high-performance materials that can handle aggressive chemical environments and high temperatures. Liquid fluoroelastomers, with their superior resistance to harsh chemicals and extreme conditions, are essential in ensuring the safe and efficient operation of equipment in chemical plants, driving strong demand in this sector.

Key Liquid Fluoroelastomers Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include 3M, DuPont, Shin-Etsu Chemical Co., Ltd., Solvay S.A., Daikin Industries, Ltd., Momentive Performance Materials Inc., Wacker Chemie AG, Dow, AGC Chemicals, and James Walker Group. The liquid fluoroelastomers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Liquid Fluoroelastomers Companies:

The following are the leading companies in the liquid fluoroelastomers market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- DuPont

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Daikin Industries, Ltd.

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Dow

- AGC Chemicals

- James Walker Group

Recent Developments

-

In October 2019, Solvay revealed its intention to expand the manufacturing capacity of Tecnoflon FKM, a peroxide-curable fluoroelastomer, at the Spinetta Marengo production facility in Italy. This move aims to meet the rising demand for sealing solutions in the automotive, oil & gas, and semiconductor sectors.

-

In May 2017, Asahi Glass Company introduced AFLAS 600X FEPM material, which provides superior performance and processing benefits compared to BRE, FKMs, and other AFLAS grades. This material is particularly well-suited for molded applications, including durable packers, bladders, gaskets, and O-rings.

Liquid Fluoroelastomers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 473.8 million

Revenue forecast in 2030

USD 609.5 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; South Korea; Australia; Indonesia; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3M; DuPont; Shin-Etsu Chemical Co., Ltd.; Solvay S.A.; Daikin Industries, Ltd.; Momentive Performance Materials Inc.; Wacker Chemie AG; Dow; AGC Chemicals; James Walker Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Fluoroelastomers Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid fluoroelastomers market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid Fluorosilicone Elastomers (FSR)

-

Liquid Fluorocarbon Elastomers (FKM-based liquid formulations)

-

Liquid Perfluoroelastomers (FFKM-based liquid formulations)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Oil & Gas

-

Pharmaceutical & Food Processing

-

Chemical Processing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liquid fluoroelastomers market size was estimated at USD 433.06 million in 2023 and is expected to reach USD 473.78 million in 2024.

b. The global liquid fluoroelastomers market is expected to grow at a compound annual growth rate of 5.07% from 2024 to 2030 to reach USD 609.48 million by 2030.

b. Based on product, the liquid fluorosilicone elastomers (FSR) segment led the market with a share of 49.08% in terms of revenue in 2023, attributable to the growing need for materials that can perform reliably in extreme environmental conditions, particularly in industries such as aerospace, automotive, and electronics.

b. Some key players are 3M; DuPont; Shin-Etsu Chemical Co., Ltd.; Solvay S.A.; Daikin Industries, Ltd.; Momentive Performance Materials Inc.; Wacker Chemie AG; Dow; AGC Chemicals; and James Walker Group.

b. The increasing demand for high-performance sealing solutions in the automotive and aerospace sectors, and the growing need for chemical-resistant materials in harsh industrial environments like oil & gas and chemical processing is spurring the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.