- Home

- »

- Healthcare IT

- »

-

Life Sciences Translation Services Market Size Report, 2033GVR Report cover

![Life Sciences Translation Services Market Size, Share & Trends Report]()

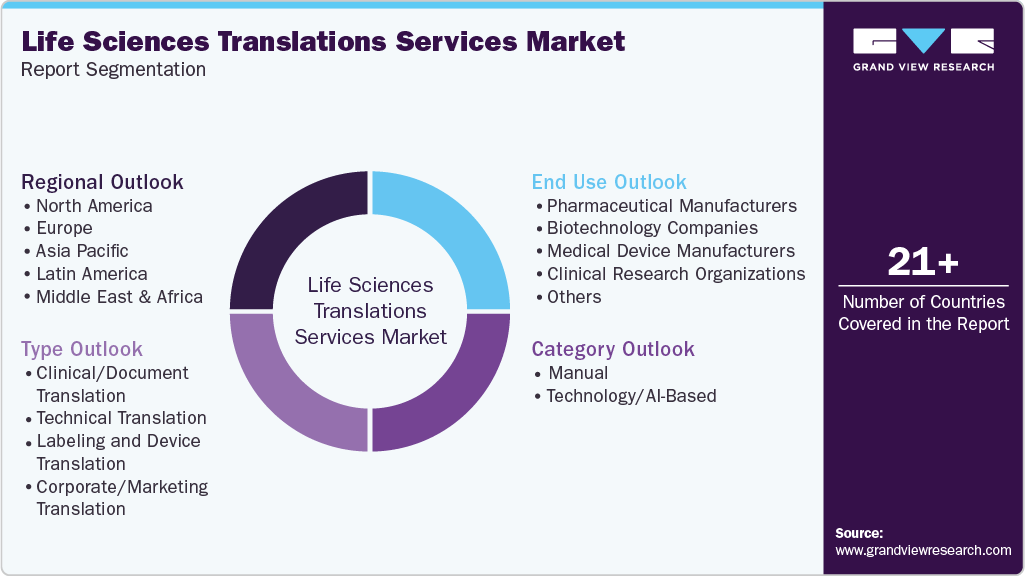

Life Sciences Translation Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Clinical/Document Translation, Technical Translation), By Category (Manual, Technology/AI-Based), By End Use (Pharmaceutical Manufacturers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-413-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Sciences Translation Services Market Summary

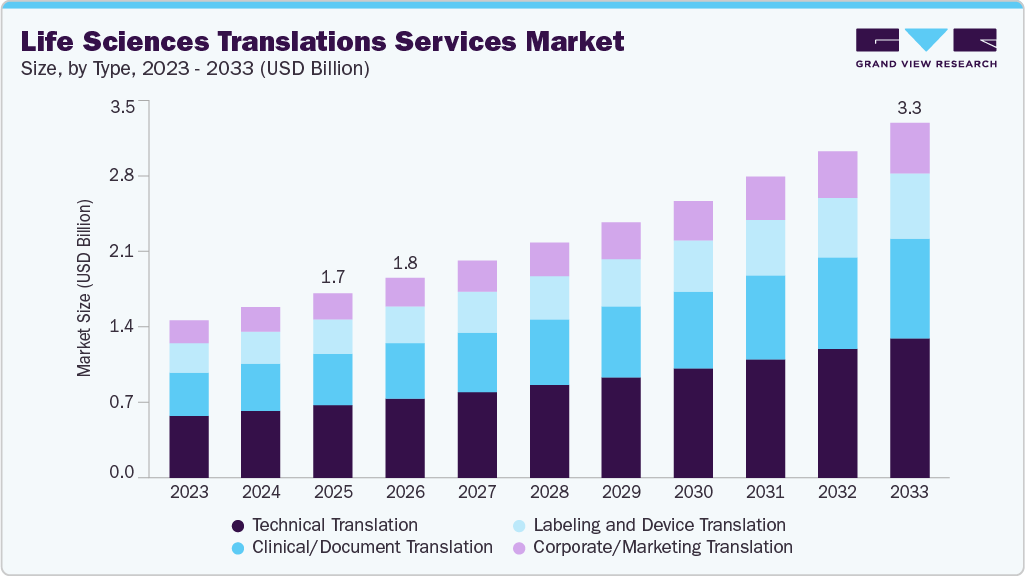

The global life sciences translation services market size was estimated at USD 1.70 billion in 2025 and is projected to reach USD 3.27 billion by 2033, growing at a CAGR of 8.55% from 2026 to 2033. The growing demand for clinical trials, the increasing need for Good Clinical Practice (GCP) and regulation compliance, and the globalization of the life sciences industry are some of the factors contributing to market growth.

Key Market Trends & Insights

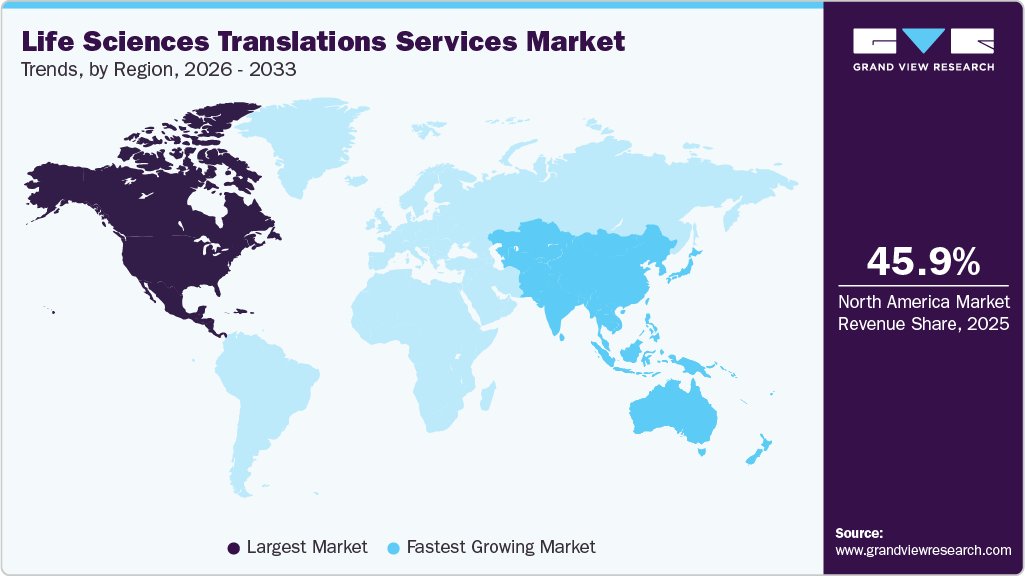

- North America life sciences translation services industry dominated globally, with the largest revenue share of 45.97% in 2025.

- The life sciences translation services industry in the U.S. held the largest share in 2025 in the North America region.

- By type, the technical translation segment dominated the market with the largest revenue share of 39.45% in 2025.

- By category, the technology/AI-based segment dominated the market with the largest revenue share of 67.21% in 2025.

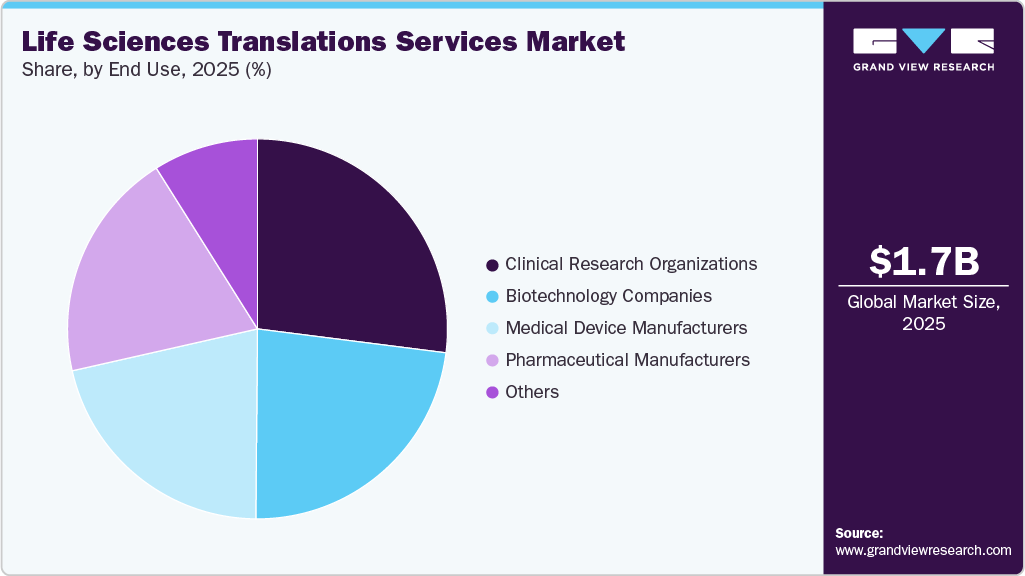

- By end use, the Clinical Research Organizations (CROs) segment dominated the market with the largest revenue share of 27.01% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.70 Billion

- 2033 Projected Market Size: USD 3.27 Billion

- CAGR (2026-2033): 8.55%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Translation and localization are integral to the life sciences industry due to its extensive scope. This encompasses translating regulatory documents, Instructions for Use (IFUs), package labeling, marketing materials, and more. For instance, in December 2025, Sesen launched TrialS, a next-generation regulatory translation validation platform for life sciences organizations. TrialS uses AI to ensure accuracy, consistency, and regulatory alignment in global clinical and labeling submissions, addressing compliance issues traditional translation workflows miss.“Global clinical and labeling submissions require absolute consistency. TrialS is designed to give companies regulatory confidence at scale. This launch reflects our commitment to building technology that directly solves the problems that matter most to sponsors and CROs.”

- Carl Yao, VP of AI Innovation and Global Business Strategy at Sesen.

Moreover, key drivers such as technological innovations in interpretation tools, increasing demand for interpreting services, and the growing need for culturally adapted medical marketing content are shaping the market. In addition, rising number of clinical trials is expected to propel market growth further. For instance, according to the National Library of Medicine, currently 563,278 studies are listed on the ClinicalTrials.gov with locations in all 51 U.S. States and in 225 countries and territories. Such factors are expected to drive the adoption of translation services in the coming years. Furthermore, advancements in translation technology, such as Neural Machine Translation (NMT) and Computer-Assisted Translation (CAT) tools powered by natural language processing (NLP), are increasingly narrowing the gap between human and automated translations, improving efficiency.

Furthermore, the rise of virtual medical practices and globalization have increased the demand for language interpreting services. Video Remote Interpretation (VRI) has become essential, providing a practical solution for multilingual patient communication and on-demand access while also providing contextual and non-verbal signs. Thus, as life sciences organizations expand into international markets, the need for culturally accurate medical marketing interpretations grows, which is expected to boost the market's growth.

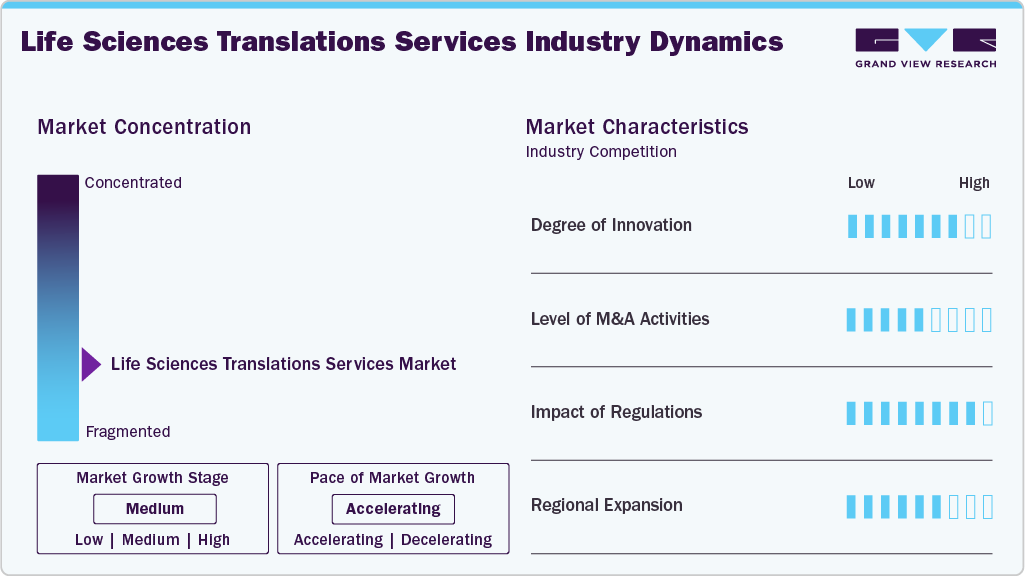

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, level of partnerships and collaboration activities, and regional expansion. In addition, the industry is highly fragmented, with the presence of many services and end users in the market. There is a high degree of innovation, moderate level of partnerships and collaboration activities, moderate level of impact of regulations, and high geographical expansion of the industry.

The industry is experiencing a high degree of innovation. Technological innovation is advancing with CAT tools, machine translation, and AI-driven solutions, which enhance efficiency. These technologies facilitate faster, more reliable translations and support the increasing global demands of the life sciences industry. Thus, market players are focusing on the introduction of technologically advanced solutions in the market. For instance, in June 2024, RWS, a company offering language services to the life science industry along with other solutions, introduced HAI, a self-service digital platform that combines RWS’ AI technology with its linguistic expertise. This platform allows users to translate content efficiently and securely while maintaining high-quality standards.

The industry is experiencing a high level of partnerships & collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market.

The regulatory framework for life sciences involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. This includes adhering to regulations set by agencies such as the FDA for clinical trials and medical documentation, The European Medicines Agency (EMA) in Europe, and various other national and international bodies mandate precise translation to meet legal and safety requirements. Furthermore, the market players acquire various certifications to adhere to the regulations. For instance, in August 2023, United Language Group achieved recertification for multiple ISO standards, including ISO 18587 for machine translation post-editing, ISO 17100 for translation services, and ISO 9001 for quality management. These recertifications affirm the company's commitment to high-quality service delivery and adherence to industry standards.

The industry is witnessing high geographical expansion. Companies within the life sciences translation services industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in October 2023, RWS Holdings plc acquired STComms Language Specialists Proprietary Limited, a language services provider based in Cape Town, South Africa. This acquisition establishes RWS' local presence in Africa, enhancing its capability to support clients seeking to expand into the African market. This acquisition can leverage local talent and expertise in over 40 African languages, enhancing RWS's global service offerings.

Case Study: Accelerating Access To Key Opinion Leaders Through International Secondary Research

A global biopharmaceutical company aimed to enhance its ability to engage with key opinion leaders (KOLs) more rapidly. The company faced challenges in identifying and reaching these influential experts efficiently due to the complexity and breadth of international markets. The goal was to accelerate engagement, improve the accuracy of KOL data, and ultimately support the company's global research and development efforts.

Solution:

-

Leverage Advanced Research Teams: Utilize specialized international secondary research teams to identify key opinion leaders (KOLs) efficiently. These teams bring local expertise and advanced research methodologies to provide comprehensive and accurate KOL data.

-

Implement Machine Translation Technologies: Employ advanced machine solutions to enhance the speed and efficiency of translating research materials and communications. This helps in quickly adapting content for diverse linguistic markets.

-

Integrate Computer-Assisted Translation (CAT) Tools: Use CAT tools to streamline translation processes, manage projects more effectively, and improve the consistency and quality of translated materials.

- Enhance Collaboration and Communication: Facilitate better collaboration and communication between teams by adopting tools that support real-time information sharing and project management, ensuring a smooth and efficient workflow in engaging with KOLs.

Results:

-

The time required to identify key opinion leaders was reduced by 40%, enabling quicker initiation of outreach and collaboration.

-

The accuracy of KOL information improved, leading to more effective and targeted engagement strategies.

-

The streamlined research process allowed the company to allocate resources more effectively and focus on strategic initiatives.

Type Insights

Based on type, the technical translation segment dominated the market with the largest revenue share of 39.45% in 2025. The growth is attributed to the increasing need for precise and specialized translation of complex scientific and technical documents. These documents include software strings, user manuals, patents, financial documents, and health and safety documents. Life sciences companies often require technical translations that exceed the standard medical services, engaging subject matter experts to ensure compliance and effectiveness. This specialized approach effectively addresses complex terminology and regulatory requirements, driving the market's growth.

However, the clinical/document translation segment is expected to experience significant growth in the forecast period. As businesses expand internationally, the need for accurate and culturally relevant translation services has increased. Therefore, companies are increasingly focusing on localizing their services to cater to diverse markets to enhance their competitive edge. This is expected to drive the segment's growth during the forecast period.

Furthermore, effective translation of trial documents is essential for patient recruitment and retention, ensuring that participants fully understand trial protocols and informed consent forms. Various documents are required to be translated, such as the Clinical Study Protocol, Clinical Study Reports, Investigator's Manual, Development Safety Update Reports, and Dossiers, among others. This precision facilitates smoother international trials and adherence to regulatory requirements, thus driving demand for specialized clinical document translation services.

Category Insights

Based on category, the technology/AI-based segment dominated the market with the largest revenue share of 67.21% in 2025 and is expected to grow at the fastest CAGR during the forecast period. AI and machine learning technologies improve translation efficiency and accuracy by automating complex processes and adapting to diverse linguistic needs. AI-powered tools can handle large amounts of data with precision, leading to faster and more reliable translations of clinical trial documents, regulatory submissions, and other technical operations. This has increased the availability of more advanced services in the market.

Furthermore, key companies are developing advanced AI solutions that address specific industry needs. For instance, in January 2024, Argos Multilingual introduced an enhanced version of its AI-driven Translation Memory (TM) cleanup service. This upgraded service facilitates the automatic analysis and large-scale cleanup of content within Translation Memories. Moreover, as the demand for fast and accurate translation services increases, AI and machine learning offer scalable solutions that support global life sciences operations and drive market expansion.

The manual segment is expected to grow at a significant CAGR during the forecast period. Manual translation involves human translators carefully handling complex and specialized documents such as clinical trial reports, regulatory submissions, and medical research. This approach ensures high accuracy and cultural relevance, addressing the nuanced terminology and context-specific requirements that automated systems may not fully comprehend. Manual translation is essential for maintaining the integrity of scientific content and meeting stringent regulatory standards.

End Use Insights

Based on end use, the Clinical Research Organizations (CRO) segment dominated the market with a revenue share of 27.01% in 2025 and is expected to register the fastest CAGR during the forecast period. The growth is attributed to its increased application in coordinating clinical trials, regulatory submissions, and global research activities. CROs require precise and accurate translations of complex documents, such as informed consent forms, patient information leaflets, and trial protocols, to comply with international regulations and ensure the success of multi-country studies. Thus, the increasing number of clinical trials is expected to drive the segment's growth. For instance, according to the WHO's latest updated data, in June 2024, almost 1.0 million clinical trials were conducted globally. Their reliance on specialized translation services to maintain quality and consistency across various markets drives the demand in this segment, making it a key factor in market growth.

The pharmaceutical manufacturers segment is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the need for accurate translation services to improve patient outcomes. Pharmaceutical companies must adhere to strict regulations imposed by local and international authorities when entering new markets. This includes translating all documentation related to a product's safety, efficacy, and quality into the target language. Regulatory bodies require that these translations meet specific safety and quality control standards before approving a product for sale. Failure to provide accurate translations can result in delays, increased costs, and potential rejections of product applications.

Regional Insights

North America life sciences translation services industry dominated globally, with the largest revenue share of 45.97% in 2025. The growing need for regulatory compliance, among other factors, is driving the regional market growth. For instance, in February 2024, KERN Global Language Services started to provide HIPAA-certified translation services as part of quality management. This new offering ensures that sensitive medical and patient information is translated while adhering to HIPAA regulations, enhancing trust and compliance in healthcare communications.

U.S. Life Sciences Translation Services Market Trends

The life sciences translation services industry in the U.S. held the largest share in 2025 in the North America region, owing to the diverse population in the country. According to the US Census Bureau, over 350 languages are spoken in the U.S., and nearly one in five individuals speak a language other than English at home. This trend emphasizes the importance of language services in ensuring that non-English-speaking patients can understand their medication instructions, which is critical for proper adherence and patient safety. In August 2024, RxTran, a division of Language Scientific, announced a new initiative to support the Limited English Proficiency (LEP) population.

Europe Life Sciences Translation Services Market Trends

The life sciences translation services industry in Europe is anticipated to grow significantly due to funding initiatives undertaken to increase the adoption of translation services in the region. For instance, in February 2022, the Swedish start-up Care to Translate, supported by EIT Health, secured USD 2.7 million (EUR 2.5 million) in early-stage venture capital funding. This investment would facilitate the app's expansion and address the shortage of interpreters in healthcare through its digital translation service.

UK life sciences translation services industry is expected to grow significantly over the forecast period. The growth is driven by increasing investments and innovations in translation solutions. For instance, in January 2024, RWS launched Evolve, a linguistic AI solution designed to enhance efficiency for global enterprises with extensive translation needs. Evolve represents a significant advancement in the translation industry by integrating human expertise with AI, streamlining translation processes, and reducing the time required to achieve high-quality results.

The life sciences translation services industry in Germany held the largest share in 2025. The market is experiencing significant advancements marked by initiatives to collaborate with various research institutes, further requiring effective translational services. For instance, in April 2021, Evotec SE announced the launch of beLAB2122, a translational BRIDGE initiative with an investment of USD 20 million in collaboration with Bristol-Myers Squibb. This project unites prominent academic institutions from the Rhine-Main-Neckar region of Germany to advance innovative therapeutic options across various areas into viable drug discovery and early.

Asia Pacific Life Sciences Translation Services Market Trends

The Asia Pacific life sciences translation services industry is expected to witness growth at the fastest CAGR over the forecast period. The market in the region is expanding due to increased healthcare investments, the growth of pharmaceutical and biotech industries, a rising patient population, and medical tourism. Strict regulatory requirements and technological advancements also contribute to market growth. In addition, the region’s diverse population, which speaks various languages, drives the demand for comprehensive and accurate translation services to address varied linguistic needs.

The life sciences translation services industry in India is driven by the increasing globalization of the pharmaceutical and healthcare industries, which requires accurate and regulatory-compliant translations of clinical trial documents, research materials, and patient information. India's expanding role as a hub for clinical trials and pharmaceutical research, coupled with a diverse linguistic landscape, amplifies the demand for specialized translation services. Furthermore, the need to meet stringent international regulatory standards and improve access to healthcare information for India's multilingual population fuels market growth.

Japan life sciences translation services industry is expected to grow significantly over the forecast period. The market growth is attributed to the partnerships and collaborations undertaken to introduce various healthcare documents requiring translation into the native language. For instance, in September 2023, iPark Institute Co., Ltd., in collaboration with Eleven Industry Partners, translated and released “A-CELL,” a crucial document on cellular drug manufacturing. The Japanese version will be an essential resource for researchers and manufacturing staff, providing comprehensive guidance on cellular drug production, regulations, quality control, and related topics.

Latin America Life Sciences Translation Services Market Trends

The life sciences translation services industry in Latin America is experiencing significant growth, driven by the increasing demand for accurate and culturally relevant translations in the pharmaceutical, biotechnology, and medical device sectors. The market is also being used more to ensure compliance with local regulations and facilitate effective communication across diverse linguistic and cultural areas.

Middle East and Africa Life Sciences Translation Services Market Trends

The life sciences translation services industry in the Middle East and Africa is primarily fueled by the expansion of pharmaceutical and biotechnology companies. These companies require accurate translations to meet regulatory standards and facilitate clinical trials across diverse languages and cultures.

Key Life Sciences Translation Services Company Insights

Key players operating in the life sciences translation services industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Life Sciences Translation Services Companies:

The following are the leading companies in the life sciences translation services market. These companies collectively hold the largest market share and dictate industry trends.

- Vistatec

- Language Scientific

- marstranslation

- BayanTech.

- Lionbridge Technologies, LLC.

- Conversis

- Morningside, Inc

- Crimson Interactive Inc.

- Welocalize Life Sciences

- ALM Translations Ltd

- Stepes

- Questel.

- BURG Translations

Recent Developments

-

In September 2025, Conversis, a life sciences translation specialist, launched a new brand, website, and SideKick, an AI-powered tools suite. SideKick enhances translation workflows by combining AI with human expertise, accelerating project kick-off, improving consistency, and automating administrative tasks for life sciences clients.

-

In June 2025, SESEN launched as a specialized language services provider focused on the life sciences sector. The company offers translation and localization services for clinical, regulatory, and commercial content.

-

In October 2024, Oracle introduced new AI-powered features in Oracle Argus Safety to automate the translation of adverse event reports. The enhancements accelerate safety case intake and processing, reduce manual effort, and improve consistency across global pharmacovigilance operations.

-

In March 2024, Language Scientific Inc. received certification to the ISO 27001:2013 standard for information security. This certification emphasizes the company's commitment to maintaining high standards of information security and reflects its ongoing efforts to enhance its security systems. By achieving this certification, Language Scientific demonstrates its dedication to protecting sensitive information, which is crucial for technical and medical translation services.

-

In February 2024, Milestone Localization, a global translation and localization service provider, established a new subdivision, Milestone Localization Life Sciences. This unit focuses on addressing the translation and localization needs specific to the life sciences sector, including medical devices, healthcare, and pharmaceuticals.

-

In February 2022, UpHealth, Inc. launched Martti Translation, a document translation service designed for community agencies and care providers. Martti, a telehealth platform, offers virtual care solutions with integrated language access. The platform is compatible with electronic health records (EHRs) and patient experience systems, providing 24/7 access to certified medical interpreters trained in over 250 languages and facilitating communication between patients and care teams.

Life Sciences Translation Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.84 billion

Revenue forecast in 2033

USD 3.27 billion

Growth rate

CAGR of 8.55% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Vistatec; Language Scientific; marstranslation; BayanTech.; Lionbridge Technologies, LLC.; Conversis; Morningside, Inc.; Crimson Interactive Inc. Welocalize Life Sciences; ALM Translations Ltd; Stepes; Questel.; BURG Translations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Sciences Translation Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global life sciences translation services market report based on type, category, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical/Document Translation

-

Technical Translation

-

Labeling and Device Translation

-

Corporate/Marketing Translation

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Technology/AI-Based

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Manufacturers

-

Biotechnology Companies

-

Medical Device Manufacturers

-

Clinical Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life sciences translation services market size was estimated at USD 1.70 billion in 2025 and is expected to reach USD 1.84 billion in 2026.

b. The global life sciences translation services market is expected to grow at a compound annual growth rate of 8.55% from 2026 to 2033 to reach USD 3.27 billion by 2033.

b. The technical translation segment dominated the market, with a share of over 39% in 2025. The growth is attributed to the growing need for precise and specialized translation of complex scientific and technical documents.

b. Some key players operating in the Barbados healthcare & medical tourism market include Vistatec; Language Scientific; marstranslation; BayanTech. Lionbridge Technologies, LLC.; Conversis; Morningside, Inc; Crimson Interactive Inc. Welocalize Life Sciences; ALM Translations Ltd; Stepes; Questel.; BURG Translations.

b. Key factors that are driving the life sciences translation services market growth include growing demand for clinical trials, the increasing need for Good Clinical Practice (GCP) and regulation compliance, and the globalization of the life sciences industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.