- Home

- »

- Medical Devices

- »

-

Life Sciences BPO Market Size, Share, Trends Report, 2030GVR Report cover

![Life Sciences BPO Market Size, Share & Trends Report]()

Life Sciences BPO Market (2023 - 2030) Size, Share & Trends Analysis Report By Services (Pharmaceutical Outsourcing, Medical Devices Outsourcing, Contract Sales And Marketing Outsourcing, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-959-3

- Number of Report Pages: 275

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Sciences BPO Market Summary

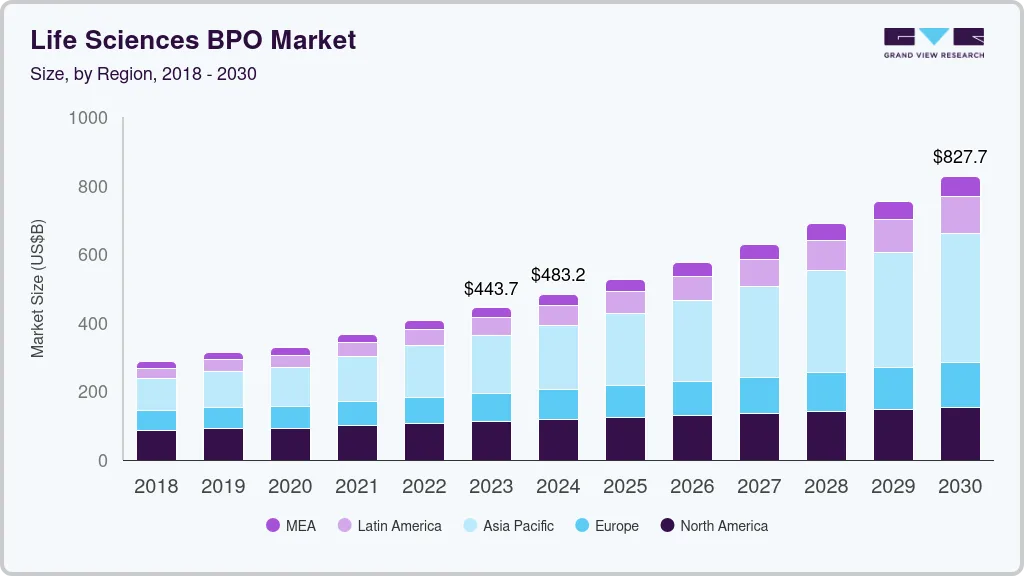

The global life sciences bpo market size was estimated at USD 407.8 billion in 2022 and is projected to reach USD 827.5 billion by 2030, growing at a CAGR of 9.3% from 2023 to 2030. Pharmaceutical and medical device companies are increasingly directing their attention towards their core competencies.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 36.8% in 2022.

- By service, the pharmaceutical outsourcing segment dominated the life sciences BPO market with the largest revenue share of 55.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 407.8 Billion

- 2030 Projected Market Size: USD 827.5 Billion

- CAGR (2024-2030): 9.3%

- Asia Pacific: Largest market in 2023

By outsourcing manufacturing, research, and marketing functions, these companies are able to streamline their operations, leading to significant time and cost savings. This strategic approach emerges as a key driving factor in the market, allowing companies to optimize their resources and enhance efficiency.During the COVID-19 pandemic, pharmaceutical and medical device companies were heavily dependent on contract manufacturing organizations (CMO) and contract research organizations (CRO) for the development and manufacturing of test kits and vaccines. This significantly boosted the market to a great extent. Owing to the decline in the cases of COVID-19 due to the growing vaccination drive, contract development & manufacturing organizations (CDMO) are focusing on developing drugs for cancer and other chronic and infectious diseases due to the high disease prevalence. For instance, in January 2022, Lonza partnered with HaemaLogiX, a developer of monoclonal antibodies, to manufacture myeloma drug candidate KappaMab, a monoclonal antibody. This is expected to improve the demand for the development and manufacturing of these drugs in the coming years.

In recent years, there has been a rise in mergers and acquisitions between CROs and CDMOs to strengthen their capabilities. For instance, in December 2021, Thermo Fisher Scientific, Inc. completed the acquisition of PPD, a clinical research services provider, to expand its service portfolio to include clinical research, analytical testing, and laboratory services, among others. Additionally, in February 2021, Charles River CRO completed the acquisition of Cognate BioServices, to strengthen its research capabilities in cell and gene therapy. Market players have adopted these strategies to expand their value chain in research and offer end-to-contract research organization (CRO) services. This approach has proven effective in enhancing the customer reach of companies, thereby generating positive implications for market growth. By broadening their range of services and establishing comprehensive solutions, these companies have been able to strengthen their market presence and foster favorable outcomes.

Pharmaceutical organizations are increasingly focusing on their R&D activities to stay competitive & flexible. According to a report by Evaluate Pharma, pharmaceutical R&D spending accounted for USD 182 billion, in 2018, whereas in 2021 it increased by 16.5% and accounted for USD 212 billion. The growing R&D spending is expected to improve the demand for life sciences BPO services. Growing demand for outsourcing drug development and manufacturing activities, particularly in emerging countries, such as China, India, and South Korea, where outsourcing is more cost-effective than in developed countries, is expected to boost the market growth in developing economies.

Furthermore, the changing regulatory landscape for developing pharmaceutical and medical devices is creating a challenge for pharmaceutical and medical device companies. Such challenges are likely to create growth opportunities for the market. Even after the decline in COVID-19 cases, the COVID-19 vaccines gained noteworthy importance. The fear of the emergence of new variants of COVID-19 increased the demand for COVID-19 vaccines. According to Clinicaltrials.gov, over 1,112 vaccines for COVID-19 were in development as of May 31st, 2022. This is likely to improve the demand for outsourcing COVID-19 vaccine manufacturing and development services.

A significant number of vaccines are being developed by small and medium-sized pharmaceutical companies. The demand for CDMO services for vaccine manufacturing and development has increased significantly because the majority of these companies lack the in-house capacity for vaccine development. Furthermore, there was a high demand for vaccines as a result of governments around the world placing large orders for COVID-19 vaccines. This has increased the demand for CDMO services for the development and manufacturing of COVID-19 vaccines globally.

Service Insights

The pharmaceutical outsourcing segment dominated the life sciences BPO market with the largest revenue share of 55.6% in 2022. Growing demand for low-cost drugs, increasing numbers of patent expirations, and rising awareness among the huge pharma companies to manage the overall company’s supply chain to maximize their profits are some of the factors that are responsible for the majority of market share. Moreover, increasing demand for reducing fixed costs among pharmaceutical companies, increasing pressure from regulatory bodies, and growing complexity in clinical trials are among a few factors that are expected to drive the segment’s growth during the forecast period.

Pharmaceutical contract research organizations are significantly contributing to the growth of this segment due to a growing interest by various public companies to focus on their core competencies rather than research. Apart from this, the surge in the geriatric population and the growing prevalence of various diseases, such as diabetes, cancer, and genetic disorders, are among a few factors that are expected to boost the demand for drugs over the forecast period, thus contributing to the demand for research.

The medical devices outsourcing segment is expected to grow at the fastest CAGR of 7.4% during the forecast period from 2023 to 2030. The complexities associated with medical device manufacturing and the strict regulatory landscape for medical device approval globally are the key factors responsible for the segment’s growth. Moreover, the increasing demand for medical devices combined with the rising price competition and the requirement to reduce costs is expected to drive the market during the forecast period.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 36.8% in 2022 and is expected to grow at the fastest CAGR of 12.2% over the forecast period from 2023 to 2030. The presence of untapped opportunities, constantly improving healthcare infrastructure, economic development, and an increasing number of skilled professionals are some of the factors driving the market growth. In addition, the presence of a significant number of CDMOs providing cost-effective research and manufacturing services is also contributing to Asia Pacific market growth. India and China are the key hubs for the life sciences outsourcing market. India and China account for the majority of the active pharmaceutical ingredients (APIs) and finished product exports across the globe.

The presence of a strong scientific community, the maximum number of U.S. FDA authorized manufacturing sites (outside the U.S.), and favorable government initiatives, such as “Make in India” are among the key factors expected to drive the regional market over the forecast period. For instance, in September 2022, Infosys Limited announced the acquisition of BASE life science. Through this acquisition, Infosys Limited endorses its dedication to assisting global life sciences companies in unlocking business value through cloud-first digital platforms and data. The objective is to accelerate the pace of clinical trials, facilitate the scaling of drug development, and achieve improved health outcomes. Additionally, the acquisition of BASE life science strengthens Infosys Limited’s presence in the Nordics region and enriches its talent pool with domain experts possessing comprehensive knowledge in areas such as commercial operations, medical expertise, digital marketing, clinical research, regulatory compliance, and quality assurance.

North America held a significant revenue share in 2022. An increasing geriatric population, growing demand for technologically advanced drugs, and a rising need for improved streamlining of the overall supply chain model of the pharmaceutical and medical device industry to reduce costs are among a few factors that are expected to drive the segment growth during the forecast period. Moreover, growing R&D cycle time and the rising need for speed-to-market drugs, clinical trials, and other services are some of the factors that are expected to boost the adaptation rate of BPO services in North America.

Key Companies & Market Share Insights

The outsourcing service providers globally are undergoing expansions, acquisitions, and partnerships in the market to stay competitive. In February 2023, Accenture announced the acquisition of Bionest, a strategy and consulting firm specializing in providing comprehensive solutions for strategic decision-making to prominent biopharmaceutical companies. Bionest excels in navigating complex challenges in cutting-edge scientific domains, including precision medicine, diagnostics, oncology, cell and gene therapy (CGT), and rare diseases. With this acquisition, Accenture strengthened its capabilities by incorporating Bionest's team of 46 highly knowledgeable consultants, industry executives, and specialists. This expansion bolsters Accenture's ability to assist clients in expediting and streamlining the process of delivering therapeutic interventions to patients, thereby enhancing efficiency and speed in the healthcare industry.

In January 2023, Avantor, Inc. announced that it has signed into a multi-year supply and services partnership with Catalent, Inc. Avantor will be Catalent's major supplier of manufacturing materials, clinical and laboratory supplies, and services which will help in expanding their existing relationship. In May 2022, ArisGlobal announced the acquisition of Boehringer Ingelheim's digital innovation. It played a critical role in advancing pharmacovigilance and patient safety across the industry. In March 2022, Lonza signed a manufacturing agreement with a pharmaceutical company, Oasmia Pharmaceutical AB, for manufacturing ovarian cancer drug candidate cantrixil. Some prominent players in the global life sciences BPO market include:

-

Atos SE

-

Boehringer Ingelheim International GmbH

-

Catalent, Inc

-

Labcorp Drug Development

-

Genpact

-

ICON plc

-

Infosys Limited

-

IBM

-

Lonza

-

Parexel

-

IQVIA Inc

Life Sciences BPO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 443.6 billion

Revenue forecast 2030

USD 827.5 billion

Growth Rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Atos SE; Boehringer Ingelheim International GmbH; Catalent, Inc; Labcorp Drug Development; Genpact; ICON plc; Infosys Limited; IBM; Lonza; Parexel; IQVIA Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Sciences BPO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global life sciences BPO market based on services and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical outsourcing

-

Contract manufacturing market

-

API

-

Finished dose form

-

Packaging

-

-

Contract research organizations

-

Drug discovery

-

Preclinical studies

-

Clinical trial studies

-

Regulatory services

-

Pharmacovigilance

-

-

-

Medical devices outsourcing

-

Contract manufacturing market

-

Electronic manufacturing services

-

Finished goods

-

Raw materials/components

-

-

Contract research organizations

-

Regulatory consulting services

-

Product design and development services

-

Product testing services

-

Product implementation services

-

Product upgrade services

-

Product maintenance services

-

-

-

Contract sales & market outsourcing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life sciences BPO market size was estimated at USD 407.8 billion in 2022 and is expected to reach USD 443.6 billion in 2023.

b. The global life sciences BPO market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 827.5 billion by 2030.

b. Asia Pacific dominated the life sciences BPO market with a share of 39.0% in 2022. This is attributable to the presence of a significant number of CDMOs providing cost-effective research and manufacturing services is also contributing to Asia Pacific market growth.

b. Some key players operating in the life sciences BPO market include Accenture plc, Atos SE, Boehringer Ingelheim GmbH, Catalent, Inc., Covance, Inc. (Labcorp), Genpact Ltd., ICON plc, Infosys Limited, Lonza Group, PAREXEL International Corporation, IQVIA, and International Business Machines Corporation.

b. Key factors that are driving the life sciences BPO market growth include the increasing prevalence of various diseases, high healthcare expenditures, and the rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.