- Home

- »

- Medical Devices

- »

-

Laser Hair Removal Market Size, Industry Report, 2030GVR Report cover

![Laser Hair Removal Market Size, Share & Trends Report]()

Laser Hair Removal Market (2024 - 2030) Size, Share & Trends Analysis Report By Laser Type (Diode, Nd:YAG, Alexandrite), By End-use (Beauty Clinics, Dermatology Clinics, Home Use), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-131-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laser Hair Removal Market Summary

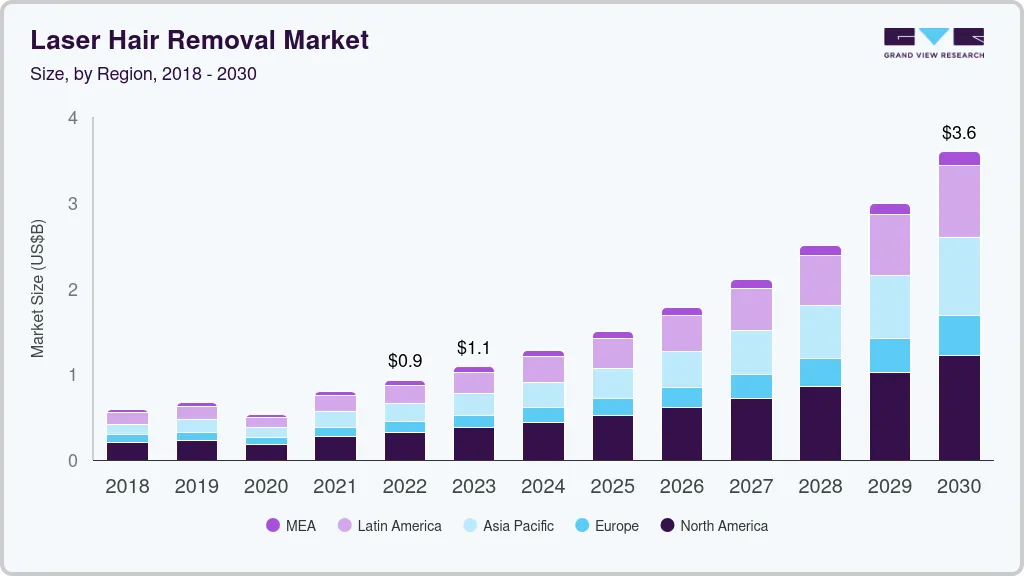

The global laser hair removal market size was estimated at USD 1,087.5 million in 2023 and is projected to reach USD 3,595.1 million by 2030, growing at a CAGR of 18.8% from 2024 to 2030. The shifting trend toward maintaining optimal aesthetic beauty is one of the major drivers of the market.

Key Market Trends & Insights

- North America dominated the global laser hair removal market in 2023 with market share of 34.4%

- Based on end use, the beauty clinics segment held the largest revenue share of around 54.4% in 2023.

- By laser type, diode lasers segment held the largest revenue share of 38.9% of the laser hair removal market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,087.5 Million

- 2030 Projected Market Size: USD 3,595.1 Million

- CAGR (2024-2030): 18.8%

- North America: Largest market in 2023

Moreover, increasing awareness regarding the safety offered by aesthetic lasers is fueling market growth. Growing technological advancements in aesthetic lasers are fueling the growth of the market. For instance, the mixing of modalities, founded by Quanta Systems in the Thunder MT system, is one of the recent innovations witnessed. This technology is also effective for other treatments such as blue veins, which cannot be treated with Nd: YAG solely. Mixing modalities are increasingly gaining popularity with great results in just one treatment. It allows the specialists to operate photo-rejuvenation facials in only 15 minutes.

The U.S Nd:YAG Laser Type segment is expected to grow at a compound annual growth of 18.6% during the forecast period. Increasing demand for laser hair removal devices, especially by women for the use of the device at home, is also propelling the market growth. Real genie technology is increasingly being used in laser hair removal devices. Therefore, the easy availability of these devices in medical stores offering personal care products is augmenting the demand, thereby driving the market. A growing number of FDA-approved products is impacting the market growth. Products such as Veet Infini’Silk Pro, Remington IPL6000 I-Light Pro, and Silk’n Flash&Go are approved by the FDA owing to their safety, efficiency, and comfort to users at home. Moreover, these products are used by both women and men.

The high cost of hair removal treatment at beauty centers or dermatology clinics is restraining the market growth. Nevertheless, a growing number of hair removal devices are cleared by the FDA and are comparatively cheaper than the procedures. For instance, in February 2019, Alma Lasers launched a new hair removal device Soprano Titanium which delivers three different wavelengths of 755nm, 1064nm, and 810nm treating all skin types which is approved by the FDA.

This is, in turn, creating a growth opportunity for the market growth. In addition, increasing disposable income and untapped regions in the Asia Pacific are other factors offering growth opportunities for the market players.

The market witnessed a minor setback during the first half of 2020 as most aesthetic clinics were mandated to shut down operations. For instance, in 2020, around 271,628 hair removal procedures were carried out in the U.S., and they were among the top three most common procedures carried out in the country, as per the International Society of Aesthetic Plastic Surgery. However, the market witnessed double-digit growth by the end of 2020 regarding procedure volume, as per the International Society of Aesthetic Plastic Surgery. Companies such as Cutera and Alma Laser, among the key manufacturers of laser hair removal systems, reported around a 56% increase in their aesthetic business in 2021, indicating that the market is on the path to significant recovery.

End-use Insights

The beauty clinics segment held the largest revenue share of around 54.4% in 2023 and is anticipated to grow at a CAGR of 20% over the forecast period. Along with the adoption of technologically advanced laser hair removal products, experts at beauty clinics are also getting familiar. This can be attributed to the increase in demand for treatment among the elderly population as well as adults.

In addition, the high demand for non-invasive hair removal treatment on a global scale is propelling segment growth. Laser treatments are painless in comparison with traditional methods, such as waxing and hair plucking. Hence, the increased popularity of targeted aesthetic treatment is influencing segment growth.

Beauty centers are increasingly adopting FDA-approved laser hair removal devices due to the growing demand for painless hair removal. This treatment is effective with the integration of advanced technologies. For instance, in July 2019, the TempSure firm handpiece and a small mask for SculpSure submental treatments were two new products that Hologic's Cynosure division announced. These treatments add to the company's expanding line of cutting-edge aesthetic treatments. The U.S. Food and Drug Administration (FDA) has recently approved SculpSure submental treatments.

Laser Type Insights

Diode lasers segment held the largest revenue share of 38.9% of the laser hair removal market in 2023 owing to the high precision offered. Diode lasers can selectively target a particular body part and effectively remove the hair without harming the surrounding skin area. Moreover, the reasonable time required for removing hair according to the body area and volume of hair is augmenting the product demand.

These lasers are most effective for dark terminal hair and are comparatively less effective on skin with a lighter complexion. However, efforts are being taken by the manufacturers for a similar effect on light terminal hair as well. They cover larger areas of the body and have fast repetition rates. This attractive feature of the diode lasers is expected to impact the market growth significantly in the future.

Nd: YAG laser segment is expected to grow at a CAGR of 20.1% over the forecast period. Nd: YAG lasers are longer wavelength lasers emitting 1064nm wavelength. These types of lasers are best for darker skin phototypes. Nd: YAG lasers are producing safer and better results on terminal and intermediate hairs, thus fueling the growth of this segment.

Regional Insights

North America dominated the global laser hair removal market in 2023 with market share of 34.4%, owing to an increased demand for hair removal treatments, well-established dermatology clinics, and the growing number of skilled professionals in the region. Professionals in North America make widespread use of aesthetic lasers for various purposes. In 2019 around 457 thousand laser hair removal operations were carried out in the USA. Moreover, the presence of many players in the region is expected to be one of the major factors fueling the market growth in the region. For instance, In June 2020, Venus Concept, a global medical aesthetic technology leader, announced that it had received FDA 510(k) clearance to market and sell Venus Epileve. It is intended to treat hair removal, permanent hair reduction, and pseudofolliculitis barbae. Solta Medical, a key player in the U.S., announced in March 2021 the launch of the Clear+Brilliant Touch laser, delivering a customized and more comprehensive treatment protocol by providing patients of all ages and skin types.

Asia Pacific is expected to be the fastest-growing segment with a CAGR of 18.8% over the forecast period owing to the increasing population and growing incidences of skin damage, especially in China and India. In addition, changing lifestyles, the rising spending power of consumers, and growing medical tourism in the emerging economies of Asia Pacific are influencing market growth. According to the plaza clinic, the best laser hair removal surgeries are carried out in the U.S. and Japan.

Key Companies & Market Share Insights

Key players in the market are focusing on adopting growth strategies, such as mergers and acquisitions, developing existing devices, promotional events, and technological advancements. For instance, in June 2020, Cynosure announced the U.S., European and Australian launch of the Elite iQ platform, the next generation of the Elite iQ Aesthetic Workstation that offers customized laser hair removal treatment and allows faster treatments with higher max energy compared to previous generation devices. In 2020, Lira Style introduced the medical device Cervello. This device offers hair removal treatment tailored to the needs of all skin types by combining the power of Alexandrite laser diode ND: YAG laser.

Key Laser Hair Removal Companies:

- Cynosure

- Alma Lasers

- Solta Medical, Inc.

- Cutera

- Candela Corporation

- Viora

- Lumenis Be Ltd

- Syneron Medical Ltd.

- Venus Concept

Laser Hair Removal Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,087.5 million

Revenue forecast in 2030

USD 3,595.1 million

Growth rate

CAGR of 18.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Laser type, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cynosure; Alma Lasers; Solta Medical, Inc.; Cutera; Candela Corporation; Viora; Lumenis Be Ltd; Syneron Medical Ltd.; Venus Concept

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Laser Hair Removal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global laser hair removal market on the basis of laser type, end-use and region:

-

Laser Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Diode

-

Nd: YAG

-

Alexandrite

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Beauty Clinics

-

Dermatology Clinics

-

Home Use

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laser hair removal market size was estimated at USD 1,087.5 million in 2023.

b. The global laser hair removal market is expected to grow at a compound annual growth rate of 18.8% from 2024 to 2030 to reach USD 3,595.1 million by 2030.

b. North America dominated the laser hair removal market with a share of 34.4% in 2023. This is attributable to the increasing demand for hair removal treatments, the presence of a number of well-established dermatology clinics, and the quick adoption of advanced technologies.

b. Some key players operating in the laser hair removal market include Syneron Medical Ltd.; Sciton, Inc.; Alma Lasers, Ltd.; Cynosure, Inc.; Cutera, Inc.; Lumenis Ltd.; Lutronic Corp.; Lynton Lasers Ltd.; Solta Medical, Inc.

b. Key factors that are driving the laser hair removal market growth include increasing awareness regarding the safety offered by laser devices and the growing number of FDA-approved products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.