- Home

- »

- Advanced Interior Materials

- »

-

Laser Debonding Equipment Market, Industry Report, 2030GVR Report cover

![Laser Debonding Equipment Market Size, Share & Trends Report]()

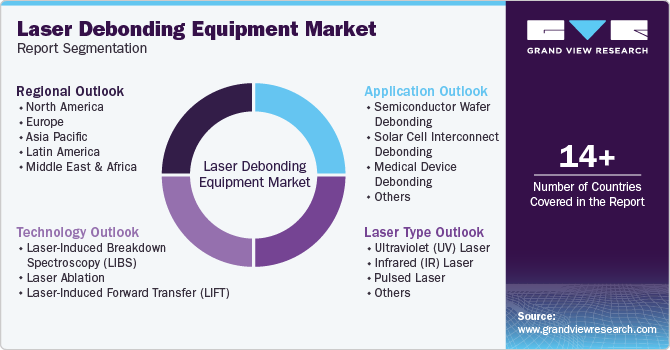

Laser Debonding Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Laser Ablation, Laser-Induced Forward Transfer), By Laser Type (UV Laser, IR Laser), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-476-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laser Debonding Equipment Market Summary

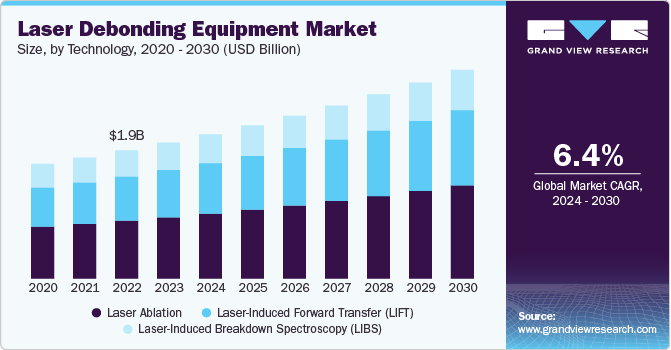

The global laser debonding equipment market size was estimated at USD 2,237.2 million in 2024 and is projected to reach USD 3,237.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. Laser debonding technology is becoming increasingly popular due to its precision, efficiency, and application in industries like semiconductors, solar energy, and medical devices.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- In terms of segment, laser induced breakdown spectroscopy (libs) accounted for a revenue of USD 2,237.2 million in 2024.

- Laser Induced Breakdown Spectroscopy (LIBS) is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,237.2 Million

- 2030 Projected Market Size: USD 3,237.2 Million

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

The ability of laser systems to debond materials without causing damage to sensitive components is a key factor driving demand.

The laser debonding process is essential in applications where traditional mechanical debonding methods are not effective, offering high precision and low material wastage. It is widely adopted in industries that require intricate material handling, such as semiconductor wafer debonding and medical device debonding. The market is poised to witness strong growth due to increasing advancements in laser technologies and expanding applications in industrial processes.

Technological advancements are driving innovation in laser Debonding equipment, with newer technologies such as Laser-Induced Breakdown Spectroscopy (LIBS), laser ablation, and Laser-Induced Forward Transfer (LIFT) becoming more prevalent. These technologies offer greater precision, faster processing times, and improved material handling capabilities. The development of multi-functional laser systems that can handle complex tasks like wafer debonding and solar cell interconnect debonding in a single process step is pushing the boundaries of efficiency and scalability in the market.

The primary drivers of the market include the growing demand for advanced semiconductor manufacturing, increased adoption in renewable energy sectors such as solar, and rising needs for miniaturized, high-performance medical devices. As industries prioritize precision, efficiency, and environmental sustainability, laser debonding technology is becoming increasingly essential in achieving these objectives.

Opportunities for market growth are largely driven by innovations in laser technology, particularly in terms of material processing capabilities. The development of versatile laser Debonding systems capable of handling various applications across semiconductor, medical, and solar industries presents significant market potential. In addition, the rise in automation and AI-enabled systems to enhance operational efficiency is creating further opportunities for market expansion.

Technology Insights

The laser ablation segment led the market and accounted for the largest revenue share of 45.8% in 2024. Laser Ablation, which involves removing material using laser beams, is widely used in medical device debonding and semiconductor processes. Its precision and non-contact nature make it ideal for applications that demand minimal material damage during debonding. As industries move towards more precise manufacturing processes, the demand for laser ablation technology is expected to grow rapidly.

The laser-induced forward transfer (LIFT) segment is expected to grow at a CAGR of 7.1% over the forecast period, owing to its high-precision material deposition, ideal for complex 3D microstructures in electronics and biomedicine. In addition, its ability to handle solid/liquid phases without clogging meets the demand for miniaturization and customization.

Laser Type Insights

The ultraviolet (UV) laser segment dominated the global laser debonding equipment market with the largest revenue share of 39.5% in 2024. Ultraviolet (UV) lasers are known for their short wavelength, enabling precise material removal with minimal thermal impact. UV lasers are widely used in applications requiring fine feature debonding, such as semiconductor wafer debonding and medical device fabrication. The ability of UV lasers to process materials with high accuracy and reduced damage to surrounding components makes them highly suitable for industries where precision and quality are paramount.

Pulsed lasers are expected to grow at a CAGR of 6.7% over the forecast period. Pulsed lasers offer high peak power in short bursts, making them ideal for precision debonding applications in industries such as semiconductors and medical devices. Pulsed lasers are effective in applications that require controlled energy delivery, allowing for precise material removal without damaging surrounding areas. The growing trend of miniaturization and the increasing demand for precision-driven applications are boosting the adoption of pulsed laser technology in the market.

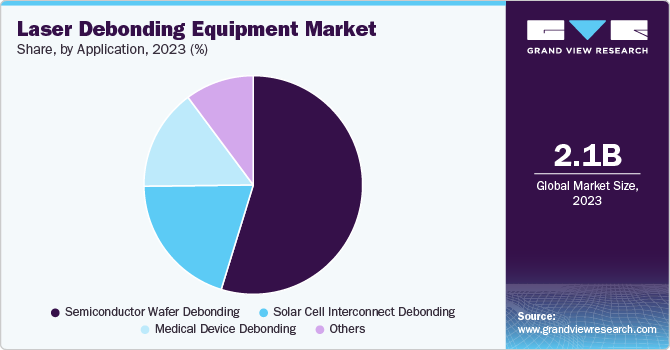

Application Insights

The semiconductor wafer debonding segment held the dominant position in the market and accounted for the largest revenue share of 54.3% in 2024, driven by the rapid advancements in semiconductor technology. As the demand for smaller and more efficient electronic devices grows, the need for precise debonding of wafer layers is becoming critical. Laser debonding equipment offers high precision and speed in semiconductor wafer debonding, reducing the risk of damage to delicate components and improving production efficiency.

The medical device debonding is expected to grow at a significant CAGR of 6.5% from 2025 to 2030, owing to the growing demand for advanced medical devices and equipment. Laser debonding technology enables precise and controlled removal of materials in medical devices, ensuring high-quality end products. The increasing trend toward miniaturized medical devices and the need for precision in manufacturing processes are contributing to the growth of this application.

Regional Insights

North America laser debonding equipment market dominated the global market with the largest revenue share of 35.0% in 2024, with the U.S. leading in terms of adoption and innovation. The region's robust semiconductor industry, combined with advancements in medical device manufacturing, is driving demand for laser debonding equipment. The presence of key market players and high R&D investments in new laser technologies further contribute to the market's growth in North America.

U.S. Laser Debonding Equipment Market Trends

The laser debonding equipment market in the U.S. led the North American market and held the largest revenue share in 2024, driven by its advanced technological infrastructure and a strong presence in semiconductor and medical device manufacturing. The country's focus on innovation, coupled with significant R&D investments, is driving the development and adoption of cutting-edge laser Debonding technologies. The U.S. also benefits from a well-established industrial base, contributing to the continued market growth.

Asia Pacific Laser Debonding Equipment Market Trends

Asia Pacific laser debonding equipment market is expected to grow at the fastest CAGR of 6.9% over the forecast period, owing to rapid industrialization and the increasing demand for advanced semiconductor manufacturing technologies. Countries like China, Japan, and South Korea are major hubs for electronics production, driving demand for high-precision laser debonding systems. The growing emphasis on renewable energy in the region is also contributing to the market's expansion, particularly in solar cell manufacturing.

The laser debonding equipment market in China led the Asia Pacific market with the largest revenue share in 2024, due to its vast electronics manufacturing base. The push for smaller devices and advanced semiconductor packaging boosts the need for precise debonding.

Europe Laser Debonding Equipment Market Trends

The European laser debonding equipment market is expected to remain strong, particularly in industries such as pharmaceuticals, automotive, and renewable energy. The region's focus on environmental sustainability and its well-established manufacturing base in high-tech industries contribute to the increasing adoption of laser Debonding systems. Countries such as Germany, France, and the UK are key players in the European market due to their emphasis on innovation and precision-driven manufacturing.

The laser debonding equipment market in Germany is expected to grow significantly, driven by its prominent automotive and electronics sectors. In addition, the surge in electric vehicles and autonomous systems increases the demand for laser debonding in battery and electronics production.

Key Laser Debonding Equipment Company Insights

Some of the key players operating in the global market include Shin-Etsu Engineering Co., LTD., EV Group (EVG), SUSS MicroTec SE, CWI Technical, Kingyoup Enterprises Co., Ltd, Optec S.A., among others.

-

SUSS MicroTec SE specializes in photolithography, wafer bonding, and laser Debonding technologies. The company’s laser Debonding systems are used in applications such as wafer-level packaging and advanced semiconductor processing, where precision and throughput are critical

-

EV Group (EVG) is a global leader in wafer bonding, lithography, and metrology equipment for the semiconductor, MEMS, and nanotechnology markets. The company’s portfolio includes advanced laser Debonding systems designed for high-precision applications in semiconductor wafer processing and MEMS manufacturing. EVG is renowned for its innovation and customization capabilities, offering flexible solutions that cater to both large-scale production and specialized, niche markets

-

Shin-Etsu Engineering Co., LTD. specializes in advanced material processing technologies that cater to industries such as semiconductors, electronics, and solar energy. Shin-Etsu's laser debonding equipment is recognized for its precision, reliability, and ability to handle complex wafer debonding processes.

Key Laser Debonding Equipment Companies:

The following are the leading companies in the laser debonding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Shin-Etsu Engineering Co., LTD.

- EV Group (EVG)

- SUSS MicroTec SE

- CWI Technical

- Kingyoup Enterprises Co., Ltd

- Optec S.A.

- Brewer Science, Inc.

- Tokyo Electron Limited

- SuperbIN Co. Ltd.

- Han's Laser Technology Industry Group Co., Ltd

Recent Developments

-

In June 2024, EV Group (EVG), a prominent provider of wafer bonding and lithography equipment for the MEMS, nanotechnology, and semiconductor industries, announced a strategic partnership with Fraunhofer IZM-ASSID (All Silicon System Integration Dresden), a division of Fraunhofer IZM known for its cutting-edge research in 3D wafer-level system integration. Together, they aim to develop and optimize alternative bonding and debonding technologies for advanced CMOS and heterogeneous integration applications, including quantum computing.

-

In May 2024, EV Group announced a significant advancement in its semiconductor layer transfer technology, doubling its throughput. EVG's LayerRelease technology employs an IR laser and inorganic release materials to achieve laser debonding on silicon carriers with nanometer-level precision in production environments. This approach effectively resolves issues related to temperature sensitivity and glass carrier compatibility. By eliminating the need for glass substrates and organic adhesives, the innovative process ensures compatibility with front-end processes for ultra-thin layer transfer and subsequent downstream operations.

Laser Debonding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.38 billion

Revenue forecast in 2030

USD 3.24 billion

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, laser type, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa.

Key companies profiled

Shin-Etsu Engineering Co., LTD.; EV Group (EVG); SUSS MicroTec SE; CWI Technical; Kingyoup Enterprises Co., Ltd; Optec S.A.; Brewer Science, Inc.; Tokyo Electron Limited; SuperbIN Co. Ltd.; Han's Laser Technology Industry Group Co., Ltd

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laser Debonding Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global laser debonding equipment market report based on, technology, laser type, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser-Induced Breakdown Spectroscopy (LIBS)

-

Laser Ablation

-

Laser-Induced Forward Transfer (LIFT)

-

-

Laser Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultraviolet (UV) Laser

-

Infrared (IR) Laser

-

Pulsed Laser

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Semiconductor Wafer Debonding

-

Solar Cell Interconnect Debonding

-

Medical Device Debonding

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.