- Home

- »

- Electronic Devices

- »

-

Laptop Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Laptop Market Size, Share & Trends Report]()

Laptop Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Traditional, 2-in-1), By Screen Size, By Price, By End-use (Personal, Business, Gaming), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-475-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laptop Market Summary

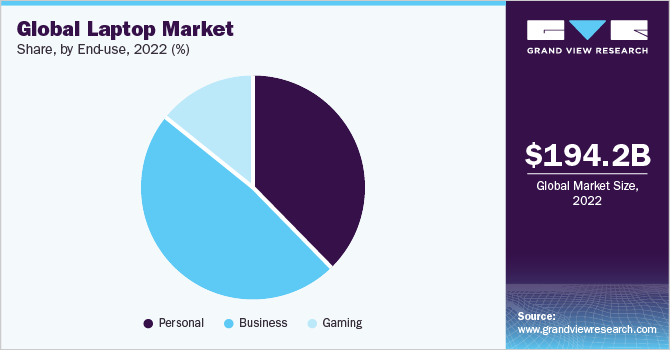

The global laptop market size was estimated at USD 194.25 billion in 2022 and is projected to reach USD 334.51 billion by 2030, growing at a CAGR of 6.9% from 2023 to 2030. The market is continuously expanding owing to rising disposable incomes, growing internet connectivity, and the increasing inclination of consumers toward advanced laptops with respect to system performance and design.

Key Market Trends & Insights

- The North American regional market dominated the market with a share of 28.5% in 2022.

- By end use, the business segment held a market share of 48% in 2022 and is expected to dominate the market by 2030.

- By price, the USD 501 to USD 1000 segment held a market share of 35.8% in 2022.

- By screen size, the 15.0” to 16.9” segment accounted for the largest market share of 48% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 194.25 Billion

- 2030 Projected Market Size: USD 334.51 Billion

- CAGR (2023-2030): 6.9%

- North America: Largest market in 2022

Furthermore, the increasing price-performance ratio and increased hardware life of laptops have resulted in their growing adoption among consumers, especially in developing countries such as India and Brazil. In addition, the market is witnessing high sales volume due to the huge demand for gaming laptops, high-speed graphic cards, and ultra-thin body designs. The increased use of the Internet across the globe is driving market growth. According to the Internet and Mobile Association of India, 346 million Indians use the Internet for e-commerce, digital payments, and other online transactions; however, in the U.S., the number stood at 331 million users engaged in digital transactions. Such a high number of internet users has been a significant factor driving the growth of the laptop inustry. Improved internet infrastructure across the globe is also expected to influence the growth of the market indirectly. For instance, Asia Pacific, home to over 60% of the world’s population, has the fastest-growing internet market in the world. The region has the highest e-commerce adoption rate and is expected to have double-digit growth in e-commerce spending over the forecast period. Thus, the imminent need for a communication device capable of accessing the Internet is expected to impact laptop sales over the forecast period.

Several companies are developing affordable Android laptops targeting consumers in countries with less purchasing power, which is expected to attract huge numbers of customers from this region, thereby driving the growth of the laptop industry. For instance, in March 2023, Optiemus Electronics (OEL) announced the manufacturing of 100,000 affordable Android laptops named "Primebook" by March 2024. The laptop would support 4G and run on an Android-based PrimeOS OS. Primebook also licenses PrimeOS to OEMs separately. Such initiatives taken by companies in the market are driving the market’s growth.

Digital transformation is having a significant impact on education globally. The education sector is witnessing a paradigm shift in terms of training and education methods. Digital classrooms have a powerful attraction for students. The concepts of Bring Your Own Devices (BYOD), Artificial Intelligence (AI), and personalized learning are evolving and have changed the way of teaching, learning, and assessments. These technologies are reshaping the education space while creating immersive experiences for students, enhancing their interactive learning, and increasing their visual and technological potential.

Post-COVID-19 pandemic, laptop manufacturers have started shifting the manufacturing of laptops to other countries aimed at improving the supply chain network, which is expected to drive the growth of the market for laptop. For instance, in December 2022, DeKUT, in partnership with ASYTECH, developed a public-private partnership for laptop manufacturing. This initiative would provide an ecosystem for the African market, from design to manufacturing made-in-Kenya laptops for Africa. The laptop is manufactured and has a specification of 11th generation IntelliSense Intel Core i3, i5, and i7 processors, Intel Array Plus brand 655, and a 256GB M.2 solid state drive, among others. Another recent case is the announcement made by Optiemus Electronics (OEL) in March 2023 of adding laptop manufacturing to its portfolio. According to OEL, the company would manufacture 100,000 units of affordable laptops named “Primebook” by March 2024 at its facility in Noida, India.

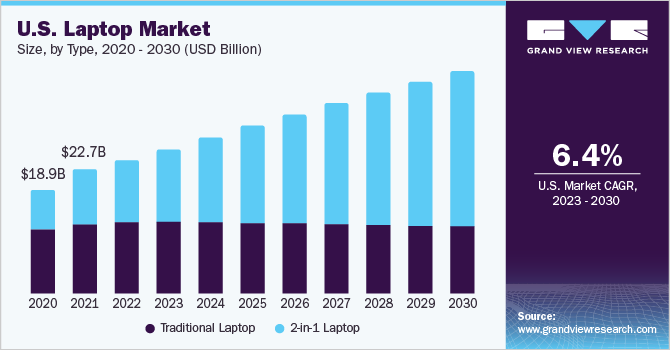

Type Insights

The traditional laptop segment accounted for the largest market share of 56% in 2022. The segment growth can be attributed to steady growth in the demand from the commercial segment, especially the gaming industry. The scope of the traditional laptop segment includes laptops/notebooks used for personal use, mobile workstations, and gaming laptops. Traditional laptops are still preferred owing to more powerful components compared to their counterparts (hybrid or 2-in-1 laptops). On the contrary, the ongoing major countries with China increase uncertainty outlooking the coming years for laptop demand across countries such as India and the U.S.

The 2-in-1 Laptop segment is expected to grow at a CAGR of 12.5% during the forecast period. The growing preference for mobility (carrying capability) and greater computing power are some of the major factors driving the demand for 2-in-1 laptops worldwide. In addition to superior benefits offered in terms of multitasking, ports and docking, flexibility, and processing speed, over the last few years, 2-in-1 laptops have been witnessing increased demand amongst working professionals who are increasingly replacing their full-keyboard laptops with 2-in-1 laptops ideal for touchscreen data entry, presentations, and note-taking.

Screen Size Insights

The 15.0” to 16.9” segment accounted for the largest market share of 48% in 2022. The segment growth is attributed to the benefits offered by 15-inch or higher laptops, which include being suitable for multitasking, slim and sleek design, high storage capacity, and ideal for gaming and business purposes, among others. All these attributes of the 15-inch display laptops, along with the increased availability of laptops under this display size, are expected to drive the growth of the segment over the forecast period.

The 11" to 12.9" segment is expected to grow at a CAGR of 8.4% over the forecast period. The 11" to 12.9" segment is witnessing growth owing to companies in the market developing laptops that offer enhanced capabilities. As the tourism industry has flourished, travelers opt for laptops that can be easily carried during travel. Companies in the laptop market have also been introducing laptops of 11" to 12.9", attracting customers. For instance, in June 2022, Apple announced the launch of 12-inch laptops, which will be available by the end of 2023.

Price Insights

The USD 501 to USD 1000 segment held a market share of 35.8% in 2022 and is expected to dominate the market by 2030. This segment growth can be attributed to the availability of laptops under this price range for gamers, owing to the basic specifications offered by these laptops required to support games. Some of the major laptop brands offering gaming laptops in the range of USD 501 to USD 100 include ASUS, Acer, and Dell. The increase in the use of laptops for business purposes post the COVID-19 pandemic resulted in the growth of the BYOD and CYOD trends, resulting in consumers seeking laptops suited for personal and professional uses. To cater to this demand, laptop providers are offering laptops with enhanced capabilities, such as Dell Inspiron 14 5425 and Dell XPS 13 9370 laptops.

The USD 1001 to USD 1500 segment is expected to have significant growth at a CAGR of 7.1% over the forecast period. The growth of the USD 1501 to USD 2000 segment can be attributed to the laptops' enhanced capabilities, as most of the laptops under this segment include Intel Core i7 processors, which enables these laptops to be used for applications with higher hardware and software demands. Moreover, under this segment, many gaming laptops are capable of handling most of the games that pose high hardware and software requirements.

End-use Insights

The business segment held a market share of 48% in 2022 and is expected to dominate the market by 2030. The growth of the business segment can be attributed to the work-from-home model adopted during the COVID-19 pandemic. It resulted in businesses acquiring laptops to be given to employees for working from home. Moreover, the BYOD trends have also contributed to the adoption of business laptops among individuals as they purchased laptops that can be used for both personal and business purposes.

The personal segment is expected to grow at a CAGR of 6.7% over the forecast period.The outbreak of the COVID-19 pandemic resulted in an increased demand for personal laptops as people were impelled to use digital channels as a source of entertainment owing to lockdowns and travel restrictions. Moreover, the pandemic also resulted in increased online shopping activities, which resulted in easy accessibility of laptops to consumers. Furthermore, several laptop companies started manufacturing their laptops in other countries, resulting in increased availability of laptops for consumers. All these factors contributed to the growth of the personal segment.

Regional Insights

The North American regional market dominated the market with a share of 28.5% in 2022. The region is home to some of the major companies in the laptop industry, including Apple Inc.; Dell Inc.; and HP Development Company, L.P., offering customers easy access to innovative products. Moreover, the well-established digital infrastructure and high GDP per capita in the region have further enabled the rapid adoption of laptops. Apart from being the home to major laptop companies, the market growth is also driven by the rising initiatives taken by the U.S. government to improve the ecosystem for consumer electronics. For instance, in July 2022, Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor design, research, and manufacturing for fortifying the economy and national security and reinforcing the U.S. semiconductor chips supply chain.

Europe is anticipated to rise as the second fastest-developing regional market at a CAGR of 6.69%. The growth of the European market can be attributed to various government initiatives aimed at improving digitalization in the education sector in Europe. For instance, in April 2023, Poland’s Ministry of Digitization announced a public tender for laptops; 363,035 laptops for students in the 4th grade will be purchased by 2023, and the tender will be divided into 73 orders. The investment is worth around USD 232 million and is covered under the National Recovery Plan. The European countries such as the U.K. government has been at the forefront of the digitalization of the education sector. For instance, in January 2021, the U.K. government announced providing 300,00 tablets and laptops to help young people and disadvantaged children learn at home. The initiative is part of the Get Help with Technology Programme 2022, that aims to help disadvantaged young people of up to 1.3 million. Such initiatives are expected to propel the growth of the U.K. laptop industry over the forecast period.

Key Companies & Market Share Insights

The key players in the market are investing resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, product benchmarking, key business strategies, and recent strategic alliances. Companies can be seen engaging in mergers & acquisitions, and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development and enhancement of existing products to acquire new customers and capture more market shares. For instance, in May 2023, ASUSTeK Computer Inc. the company’s gaming laptop division, ASUS Republic of Gamers (ROG), announced a multiyear partnership renewal with KOI e-sports to provide them with advanced gaming laptops and PCs for competitions. The company would also assist in training KOI e-sports staff to handle ASUS gaming systems more efficiently. Some prominent players operating in the global laptop market include:

-

Acer Inc.

-

Apple Inc.

-

ASUSTeK Computer Inc.

-

Dell

-

HP Development Company, L.P.

-

Huawei Technologies Co., Ltd.

-

LG

-

Lenovo

-

Micro-Star International Co., Ltd. (MSI)

-

Microsoft Corporation

-

Panasonic Corporation

-

Razer Inc.

-

Samsung Electronics Co., Ltd.

-

Sony Corporation

-

TOSHIBA COPRORATION

Laptop Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 210.13 billion

Revenue forecast in 2030

USD 334.51 billion

Market volume in 2023

282.72 million units

Volume forecast in 2030

398.08 million units

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion, Volume in million units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, screen size, price, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; China; India; Japan; Malaysia; Australia; South Korea; Brazil; Mexico; UAE; South Africa

Key companies profiled

Acer Inc.; Apple Inc.; ASUSTeK Computer Inc.; Dell; HP Development Company, L.P.; Huawei Technologies Co., Ltd.; LG; Lenovo; Micro-Star International Co., Ltd. (MSI); Microsoft Corporation; Panasonic Corporation; Razer Inc.; Samsung Electronics Co., Ltd.; Sony Corporation; TOSHIBA COPRORATION

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laptop Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laptop market report based on type, screen size, price, end-use, and region:

-

Type Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

Traditional Laptop

-

2-in-1 Laptop

-

-

Screen Size Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

Upto 10.9"

-

11" to 12.9"

-

13" to 14.9"

-

15.0" to 16.9"

-

More than 17"

-

-

Price Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

Up to USD 500

-

USD 501 to USD 1000

-

USD 1001 to USD 1500

-

USD 1501 to USD 2000

-

Above USD 2001

-

-

End-use Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

Personal

-

Business

-

Gaming

-

-

Regional Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The traditional laptop segment accounted for the largest market share of 56% in 2022. The segment growth can be attributed to steady growth in the demand from the commercial segment, especially the gaming industry. The scope of the traditional laptop segment includes laptops/notebooks used for personal use, mobile workstations, and gaming laptops.

b. Some key players operating in the laptop market include Acer Inc.; Apple Inc.; ASUSTeK Computer Inc.; Dell; HP Development Company, L.P.; Huawei Technologies Co., Ltd.; LG; Lenovo; Micro-Star International Co., Ltd. (MSI); Microsoft Corporation; Panasonic Corporation; Razer Inc.; Samsung Electronics Co., Ltd.; Sony Corporation; TOSHIBA CORPORATION among others.

b. Key factors that are driving the market growth include rising disposable incomes, growing internet connectivity, and the increasing inclination of consumers toward advanced laptops with respect to system performance and design.

b. The global laptop market size was estimated at USD 194.25 billion in 2022 and is expected to reach USD 210.13 billion in 2023.

b. The global laptop market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 334.51 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.