- Home

- »

- Homecare & Decor

- »

-

Landscaping Products Market Size, Industry Report, 2030GVR Report cover

![Landscaping Products Market Size, Share & Trends Report]()

Landscaping Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ground Coverings, Planting Material, Hardscaping), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-603-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Landscaping Products Market Summary

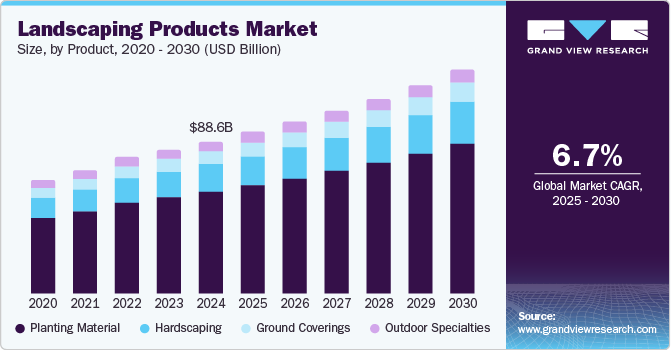

The global landscaping products market size was valued at USD 88.64 billion in 2024 and is projected to reach USD 129.98 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. Increasing commercial and residential building development rates, particularly in emerging economies such as India, China, and Brazil, have highlighted the importance of solutions that can enhance the visual appeal of such locations while complying with sustainability norms.

Key Market Trends & Insights

- North America accounted for a leading revenue share of 34.6% in 2024.

- The U.S. accounted for a dominant revenue share in 2024, owing to an increased focus on home improvement, sustainability, and outdoor living among homeowners.

- Based on product, the planting material segment had a leading revenue share of 67.0% in 2024.

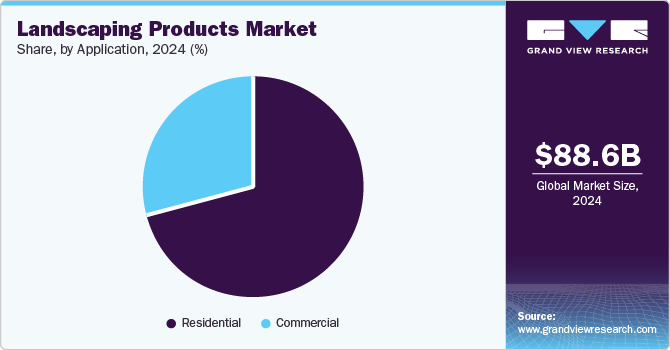

- Based on application, the residential segment accounted for the largest revenue share in the global landscaping products industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 88.64 Billion

- 2030 Projected Market Size: USD 129.98 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the emergence of gardening as a popular hobby among middle-aged and younger demographics, particularly over the past decade, has led homeowners to purchase planting materials such as shrubs, trees, and vines, which offer aesthetic and ecological benefits. The implementation of regulations by government bodies, particularly for commercial establishments to ensure that they meet sustainability standards, provides further opportunities for industry players.

As environmental awareness continues to grow, there is a steadily increasing demand for sustainable landscaping products. Consumers are more concerned about reducing their environmental footprint, leading to a rise in eco-friendly landscaping preferences. Native plants, xeriscaping (drought-resistant landscaping), and low-water-use plants are increasingly becoming popular for residential gardens, requiring less water and maintenance. Home gardening trend, which has surged since the COVID-19 pandemic, has resulted in substantial sales of products such as plants, soil, seeds, organic fertilizers, and compost. Do-it-yourself (DIY) landscaping has gained popularity as homeowners become involved in small landscaping projects. This drives sales of products such as landscape fabric, mulch, pavers, decorative stones, and planters.

Innovations and technological enhancements are expected to define the expansion of the landscaping products industry during the forecast period. A major trend in residential landscaping has been the emergence and adoption of smart irrigation systems. Homeowners are leveraging technology to ensure that their gardens are watered efficiently. These systems use sensors, weather data, and smartphone apps to automate irrigation schedules, ensuring that plants are watered only when needed, saving water and money. Artificial grass is gaining popularity in residential landscaping, especially in regions with water restrictions or dry climates. Synthetic turf provides a low-maintenance and evergreen lawn that maintains its appearance without the need for mowing, watering, or fertilizing. Landscape lighting is another aspect that is expected to create substantial market appeal. Homeowners increasingly opt for smart outdoor lighting systems that can be controlled remotely through smartphones or integrated with home automation systems. These products help homeowners highlight key features in their gardens, create ambiance, and improve security.

Product Insights

The planting material segment had a leading revenue share of 67.0% in 2024. These materials have become vital in creating a successful landscaping project across residential, commercial, and public spaces. Plants perform a critical role in enhancing a landscape's aesthetic value, environmental sustainability, and functionality. The use of native plants is an essential practice in sustainable landscaping. They are well-adapted to the local climate and soil conditions, requiring less water, fertilizers, and pesticides. Plants also support local wildlife, such as pollinators, birds, and other beneficial insects, contributing to biodiversity. Moreover, landscaping with quality planting materials can increase the market value of a property. Well-designed landscapes enhance curb appeal and attract potential buyers or renters. Residential spaces with attractive landscapes can have a higher resale value than those with poor or no landscaping, highlighting the importance of such landscaping products.

Meanwhile, the hardscaping segment is expected to expand at the fastest CAGR from 2025 to 2030. Hardscaping refers to the non-plant elements of landscape design, such as patios, walkways, retaining walls, driveways, fencing, paving, outdoor kitchens, and water features. These elements complement components such as plants, trees, and grass in properties to create well-designed, sustainable, and low-maintenance landscapes. Innovations in designing these landscape components have expanded the consumer base in this segment. For instance, permeable pavers allow rainwater to seep through the surface and return to the groundwater table, reducing stormwater runoff and mitigating flooding in urban environments. This is especially important in areas that face water shortages or implement sustainable stormwater management practices. Integrating hardscaping with planting materials is an emerging trend, with landscape designs combining stone walls with lush vegetation or paved patios surrounded by flowering plants.

Application Insights

The residential segment accounted for the largest revenue share in the global landscaping products industry in 2024. Over the past few years, an increasing number of residential projects globally and the modernization of housing societies have acted as major contributors to market revenue. Homeowners are increasingly interested in improving their outdoor spaces by adding patios, decks, outdoor kitchens, and fire pits. Additionally, they are becoming conscious of environment-friendly initiatives and consequently focusing on creating green spaces at home, leading to a notable surge in home gardening activities. This trend is particularly prevalent among millennials and Gen Z, who seek to cultivate vegetable gardens, herb gardens, and flowering landscapes. According to the 2023 National Gardening Survey report, participation in gardening activities in the U.S. reached a 5-year high of 80% in 2022, while spending on these activities reached USD 616 per household, which was an increase of USD 74 in the previous year. Such positive trends are anticipated to create promising growth opportunities for the market.

The commercial segment is anticipated to expand at the fastest CAGR from 2025 to 2030. The increasing development of commercial spaces such as hotels, office buildings, and malls has necessitated the need for attractive aesthetics in such locations, driving the demand for landscaping services. Proper landscaping in these settings creates visually appealing environments while also providing functional spaces, adhering to sustainability standards, and improving brand image. Landscaping products are further used to reflect a business's characteristics and distinct features. For example, tech-focused companies may use modern, minimalist designs with green walls and native plants to convey sustainability, while luxury hotels generally incorporate lush gardens, water features, and elegant hardscaping to create a sense of high-end luxury. The renovation and modernization of existing structures, such as government buildings, provide further avenues for market competitors to promote their solutions in this segment.

Regional Insights

North America accounted for a leading revenue share of 34.6% in 2024. Growing urbanization in the region and the expansion of residential projects have created several growth avenues for regional companies providing landscaping solutions. Moreover, the increasing popularity of trends such as the conversion of outdoor spaces into extended living areas and the use of these spaces for hosting parties and gatherings has resulted in a substantial demand for aesthetically appealing products. Homeowners are investing in landscaping solutions that enhance outdoor aesthetics and functionality, such as outdoor furniture, lighting, fire pits, and hardscaping materials. Additionally, the development of green buildings and sustainability-focused projects is expected to drive the appeal of innovative offerings such as permeable paving materials, recycled stone, and eco-friendly landscaping materials in the coming years.

U.S. Landscaping Products Market Trends

The U.S. accounted for a dominant revenue share in 2024, owing to an increased focus on home improvement, sustainability, and outdoor living among homeowners. Furthermore, the presence of several major multinational corporations has boosted the viability of commercial landscaping services. The trend of home improvement projects has remained popular in recent years, with homeowners looking to improve their outdoor spaces and create functional living areas. Additionally, gardening has witnessed a steady rise in popularity, with products such as soil, mulch, compost, seeds, and plant fertilizers experiencing strong demand. As per the 2023 National Gardening Survey published in April 2023, around 33% of the respondents stated that they anticipated an increase in their spending on gardening and lawn products in 2023 when compared to 2022. These trends are expected to continue witnessing positive momentum in the coming years, driving the demand for landscaping products.

Europe Landscaping Products Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. Several European cities are investing in urban green development initiatives driven by environmental concerns and a desire to improve citizens' quality of life. The European Union (EU) has promoted sustainability policies that encourage the development of green roofs, green walls, urban parks, and recreational green spaces. This has created strong demand for landscaping products such as plants, trees, soil, and hard-scaping materials. In many economies, particularly in Western Europe, homeowners are investing in transforming their gardens, creating outdoor rooms, and adding features such as fire pits, outdoor kitchens, and seating areas. This has aided a substantial demand for solutions such as garden furniture, lighting, outdoor structures, and decorative items.

Asia Pacific Landscaping Products Market Trends

The Asia Pacific region is anticipated to grow at the fastest CAGR from 2025 to 2030. The fast pace of modernization and urbanization in regional economies such as India and China and the development of major commercial projects have created a major market for landscaping products. Furthermore, the increasing rate of development of residential properties and growing disposable income levels of consumers have encouraged homeowners to undertake home improvement projects, driving industry expansion. Governments and private developers are investing heavily in creating smart cities with integrated green spaces, sustainable architecture, and eco-friendly infrastructure. This has driven a significant demand for landscaping solutions that involve tree planting, green walls, green roofs, and public parks.

Key Landscaping Products Company Insights

Some major companies involved in the global landscaping products industry include Griffon Corporation, Kafka Granite, and The QUIKRETE Companies, among others.

- Griffon Corporation is a management and holding company that manufactures and distributes products and offers services through several subsidiaries to commercial, industrial, and residential end-users. The company mainly conducts its operations through 2 segments - Home and Building Products (Clopay Corporation) and Consumer and Professional Products (CPP).

Key Landscaping Products Companies:

The following are the leading companies in the landscaping products market. These companies collectively hold the largest market share and dictate industry trends.

- Griffon Corporation Inc.

- Haddonstone

- Home Depot

- Kafka Granite, LLC

- Heidelberg Materials

- Oldcastle APG, a CRH company

- The QUIKRETE Companies

- The Monarch Cement Company

- Henri Studio

- ecoDynamics

Recent Developments

-

In August 2024, Oldcastle APG announced the acquisition of Master Block, Inc., an Arizona-based company that manufactures single-site concrete blocks. The acquisition of Master Block’s manufacturing assets is expected to complement Oldcastle APG’s existing portfolio of masonry, hardscapes, and fencing offerings in Arizona.

-

In July 2024, Griffon Corporation announced that The AMES Companies, Inc., its subsidiary, had completed the acquisition of Pope, a major residential watering solutions provider in Australia, from The Toro Company.

Landscaping Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 93.95 billion

Revenue forecast in 2030

USD 129.98 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia

Key companies profiled

Griffon Corporation Inc.; Haddonstone; Home Depot; Kafka Granite, LLC; Heidelberg Materials; Oldcastle APG, a CRH company; The QUIKRETE Companies; The Monarch Cement Company; Henri Studio; ecoDynamics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Landscaping Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global landscaping products market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground Coverings

-

Planting Material

-

Hardscaping

-

Outdoor Specialties

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.