- Home

- »

- Medical Devices

- »

-

Laboratory Centrifuges Market Size & Share Report, 2030GVR Report cover

![Laboratory Centrifuges Market Size, Share & Trends Report]()

Laboratory Centrifuges Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Accessories), By Model (Floor-Standing Centrifuges, Benchtop Centrifuges), By Intended Use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-347-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Centrifuges Market Summary

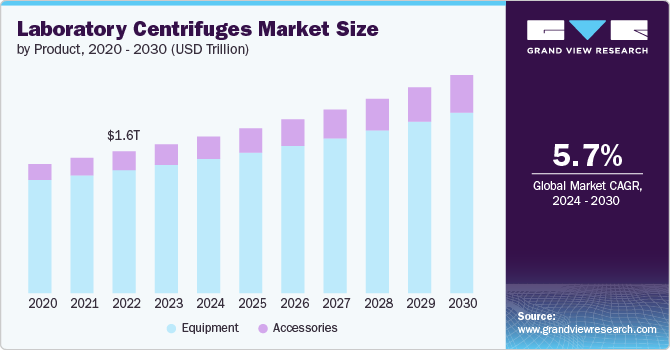

The global laboratory centrifuges market size was estimated at USD 1.73 billion in 2023 and is projected to reach USD 2.54 billion by 2030, growing at a CAGR of 5.70% from 2024 to 2030, due to advancements in application and increased research activities. Laboratory centrifuge is essential in separating mixtures based on density, making them crucial in various fields such as biotechnology, pharmaceuticals, and clinical diagnostics.

Key Market Trends & Insights

- North America laboratory centrifuges market dominated the global market and accounted for the 35.10% revenue share in 2023.

- The U.S. laboratory centrifuges market held a significant share of the North America market in 2023.

- Based on product, the equipment segment held the largest share of 82.63% in 2023.

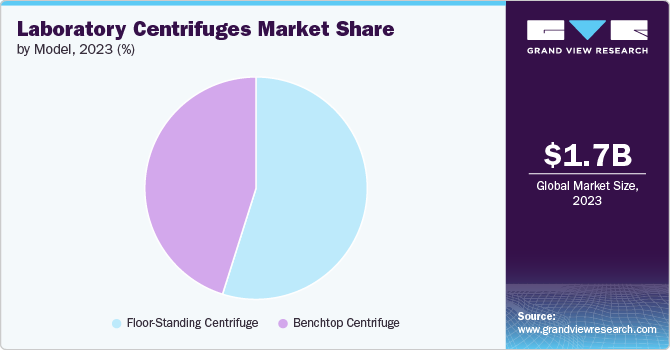

- Based on model, floor-standing centrifuge segment held the largest share of 54.88% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.73 3 Billion

- 2023 Projected Market Size: USD 2.54 Billion

- CAGR (2023-2030): 5.70%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing demand for personalized medicine and advancements in genomics and proteomics is anticipated to fuel the demand for centrifuge equipment. Moreover, the rise in the prevalence of chronic diseases, growing diagnostic testing, and increasing developments of advanced products are anticipated to propel the market growth in the coming years. For instance, in February 2022, Beckman Coulter Life Sciences introduced the Allegra V-15R Benchtop Centrifuge. This new model has ten rotor configurations and 50 programmable runs, complemented by a wide range of adapters. Its versatile design enables a variety of workflows and model types, including blood separation and high-throughput screening.

Furthermore, technological advancements are anticipated to influence the laboratory centrifuges market over the forecast period. Innovations such as automated and high-speed centrifuges have improved efficiency and accuracy, which are critical in laboratory settings. The development of compact and user-friendly models has also made these devices more accessible to smaller labs and research facilities. For instance, in April 2021, Eppendorf launched the Centrifuge 5910 Ri, a new model designed to boost laboratory efficiency. This centrifuge offers scientists advanced features to streamline and expedite their workflow. Its innovative touchscreen interface allows for rapid parameter settings, while three levels of user management options enhance security and traceability. Such technological advancements and novel developments are anticipated to drive the laboratory centrifuges market.

In addition, advancements in digital interfaces and integration with laboratory information management systems (LIMS) have streamlined operations, enhancing productivity and data management. Various products are available in the industry with advanced digital interface. For instance, Corning LSE Mini Microcentrifuge , features digital control interface and high-speed performance for quick nucleic acid and protein separations. Thus, the availability of such advanced equipment is anticipated to drive the market growth over the forecast period.

In addition, the increasing focus on research and development (R&D) in the pharmaceutical and biotechnology sectors is anticipated to propel the laboratory centrifuges market. Both governments and private entities are investing more in R&D to create new drugs, therapies, and technologies. For example, in September 2023, the Minister of Health & Family Welfare, Government of India, introduced the Scheme for Promotion of Research and Innovation in the Pharma MedTech Sector (PRIP). As part of this scheme, the Department of Pharmaceutical has proposed a PRIP scheme with a budget outlay of USD 598.89 million. Thus, growing investment in research activities by government bodies is expected to drive the demand for advanced laboratory equipment, such as centrifuges, to support a wide range of experimental and analytical processes.

Furthermore, the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is expected to boost the demand for laboratory centrifuges. For instance, according to data published by the WHO in February 2024, more than 35 million new cancer patients are projected in 2050, a 77% rise from the estimated 20 million patients in 2022.

Moreover, as per the World Heart Vision 2030 report published by the World Heart Federation, cardiovascular disease (CVD) deaths are projected to increase from an estimated 18.9 million in 2020 to more than 22.2 million and 32.3 million in 2030 and 2050, respectively. These chronic diseases, such as cancer, require extensive diagnostic testing and monitoring, often involving centrifuges for sample preparation and analysis. As the global burden of chronic diseases continues to rise, healthcare providers need to expand their diagnostic capabilities, thereby driving the need for advanced laboratory equipment.

Product Insights

The equipment segment held the largest share of 82.63% in 2023, driven by advancements in technology and the growing focus of key industry participants on developing novel equipment. High demand for efficient and accurate sample separation techniques is anticipated to support the segment growth. Key players such as Thermo Fisher Scientific, Eppendorf, and Beckman Coulter provide laboratory centrifuges equipment. Moreover, major companies are focusing on broadening their laboratory centrifuge equipment portfolio. For instance, in March 2020, Eppendorf expanded its centrifuge portfolio by acquiring the centrifugation business of Koki Holdings Co., Ltd. With this acquisition, the company gained the himac brand portfolio of Koki Holding Co. Ltd. himac brand offers centrifuges. Such acquisitions and expansion focusing on the laboratory centrifuges equipment are anticipated to propel the segment growth in the coming years.

The accessories segment is projected to grow fastest in the coming years, driven by the increasing demand for specialized and high-performance components. Essential accessories such as rotors, tubes, and adapters enhance the functionality and versatility of centrifuges, catering to diverse laboratory needs. Key players such as Hettich Instruments offer numerous centrifuge accessories, including buckets, rotors, and adapters for laboratory applications. Thus, the availability of such accessories from key industry players is anticipated to drive the segment growth.

Model Insights

The floor-standing centrifuge segment held the largest share of 54.88% in 2023, driven by advancements in technology and continuous innovation. Due to increased demand for high-capacity and high-speed centrifugation in research and clinical labs. These centrifuges are popular for handling larger sample volumes and delivering precise results. Innovations in rotor design, growing automation, and rising investments in biomedical research are anticipated to propel the demand for floor-standing centrifuges.

The benchtop centrifuge segment is anticipated to grow fastest. Modern benchtop centrifuges are now equipped with enhanced features such as digital interfaces, programmable settings, and high-speed capabilities, making them indispensable in laboratories. Innovations such as automated balancing, noise reduction, and improved rotor designs are improving their efficiency and ease of use. The growing adoption of benchtop centrifuges in clinical diagnostics, biotechnology, and pharmaceutical research due to their compact size, versatility, and reliability is anticipated to drive the segment growth.

In addition, the growing launches of advanced benchtop centrifuges are anticipated to boost the segment growth. For instance, in November 2023, Haier Biomedical introduced a series of benchtop high-speed refrigerated centrifuges. This series features easy-to-use, built-in rotor balance detection, low maintenance, low noise levels, and real-time vibration monitoring centrifuges. Such developments are anticipated to drive the segment growth.

Intended Use Insights

The clinical centrifuge segment dominated the market with a share of 45.78% in 2023. The clinical centrifuge market is a rapidly growing sector of the healthcare industry, driven by the increasing demand for accurate and efficient diagnostic testing in hospitals, research laboratories, and clinical settings. Clinical centrifuges are essential equipment in medical settings, as they play a crucial role in separating various components of biological samples, such as blood, urine, and tissue, to diagnose and treat diseases. With the rise of molecular diagnostics and genetic testing, the demand for high-speed centrifuges that can process small sample volumes with precision and accuracy has increased significantly.

The preclinical centrifuges segment is growing at the fastest CAGR over the forecast year due to the increasing number of clinical trials across the pharmaceutical and biotechnology sectors. As per the article published by CenterWatch, A WCG Company, in November 2023, the Center for the Study of Drug Development (CSDD) study reports that the number of active biotech products in phase 3 trials has increased 400 percent in the last ten years. Preclinical centrifuges play a crucial role in preclinical research, facilitating the separation and analysis of biological samples critical for drug development and testing. The growing demand for accurate and efficient laboratory equipment and the increasing focus of manufacturers on developing advanced centrifuge technologies that can be employed in preclinical studies is anticipated to drive segment growth in the coming years.

Application Insights

The microbiology segment held the largest share of 34.3% in 2023. Due to the growing need for rapid and accurate detection of microorganisms in various applications such as clinical diagnostics, pharmaceutical research, and food safety testing. Laboratory centrifuges for microbiology are used to isolate and concentrate microorganisms from samples, allowing for accurate identification and quantification of microbial populations. The growing need for reliable and efficient methods for detecting antimicrobial resistance and emerging pathogens is also driving the demand for high-performance laboratory centrifuges in microbiology applications.

The diagnostics segment is anticipated to grow fastest due to the increasing prevalence of chronic disorders and rising demand for early diagnosis. Laboratory centrifuges are crucial for separating and analyzing biomarkers and specimens for accurate diagnostic testing. In addition, a growing number of laboratory testing is anticipated to support the segment growth. According to the article published by OriGen Biomedical , Inc. in April 2024, around 260,000 certified laboratories across the U.S. conduct approximately 14 billion laboratory tests annually.

Regional Insights

North America laboratory centrifuges marketdominated the global market and accounted for the 35.10% revenue share in 2023. The dominance of the regional market can be attributed to technological advancements and growing developments of innovative products by the key industry participants operating in the region. For example, in September 2022, Thermo Fisher Scientific Inc., a key market player, introduced the DynaSpin Single-Use Centrifuge system. This system is uniquely tailored to offer an efficient single-use solution for harvesting large-scale cell cultures. Moreover, increasing investments in research and development, particularly in the biotechnology and pharmaceutical sectors, are anticipated to support the regional market growth.

U.S. Laboratory Centrifuges Market Trends

The U.S. laboratory centrifuges market held a significant share of the North America market in 2023, driven by the increasing demand from clinical trials and diverse laboratory testing needs. In addition, key industry participants such as Thermo Fisher Scientific, Inc. and Beckman Coulter, Inc. are anticipated to support the segment growth in the coming years. Moreover, the rising prevalence of tuberculosis is anticipated to drive the country’s market growth. According to the report published by the CDC in March 2024, around 9,615 tuberculosis cases were reported in the U.S. in 2023, demonstrating a 16% increase from 2022. The tuberculosis laboratory needs centrifuges for the sedimentation and concentration of tubercle bacilli within body fluids or liquefied sputa. Thus, the growing patient population for tuberculosis is anticipated to drive the laboratory centrifuges market in the U.S.

Europe Laboratory Centrifuges Market Trends

The Europe laboratory centrifuges market is experiencing significant growth driven by several factors, such as increased funding in research, particularly in the biotechnology and pharmaceutical sectors, and the rising prevalence of chronic diseases. Moreover, technological advancements in centrifuge design and capabilities are enhancing efficiency and throughput in laboratories. These factors are anticipated to boost the demand for laboratory centrifuges in Europe.

Asia Pacific Laboratory Centrifuges Market Trends

The Asia Pacific laboratory centrifuges market is experiencing the fastest growth due to the increasing focus of key players in the Asia Pacific market. Companies focus on expanding their market presence through strategic partnerships, acquisitions, and investments in innovative technologies. For instance, in March 2023, DKSH initiated a new distribution partnership with Hettich for Australia and New Zealand. This collaboration aligns with DKSH Business Unit Technology's strategic goal to strengthen its position as a premier integrated solutions provider in the scientific instrumentation market.

The Latin America laboratory centrifuges market is anticipated to grow significantly due to the rising prevalence of chronic disorders and the expansion of laboratory facilities. According to a study published by the National Library of Medicine in February 2024, Brazil is classified as one of the 30 nations with the highest tuberculosis burden worldwide, with a mortality rate of 2.3 deaths and an incidence of 36.3 cases per 100,000 inhabitants in 2022. The growing patient population across the region is anticipated to drive the demand for laboratory centrifuges in the regional market.

Middle East And Africa Laboratory Centrifuges Market Trends

The Middle East and Africa laboratory centrifuges market is anticipated to witness notable growth due to increasing clinical trials and research and development activities. Enhanced funding for research initiatives is driving demand for advanced centrifugation technologies. The laboratory centrifuges play a critical role in supporting diagnostic and research efforts to address healthcare challenges and advance medical discoveries in the region.

Key Laboratory Centrifuges Company Insights

The laboratory centrifuges market is highly competitive, with presence of several small, medium and large industry players. Some of the key participants operating in the market include Andreas Hettich GmbH & Co. KG; Danaher Corporation (Beckman Coulter, Inc.); Eppendorf SE; Thermo Fisher Scientific Inc.; HERMLE Labortechnik GmbH; KUBOTA Corporation; Sartorius AG; Sigma Laborzentrifugen GmbH; QIAGEN and Cardinal Health. The major companies are undertaking various strategies such as new product launches, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Laboratory Centrifuges Companies:

The following are the leading companies in the laboratory centrifuges market. These companies collectively hold the largest market share and dictate industry trends.

- Andreas Hettich GmbH & Co. KG

- Danaher Corporation (Beckman Coulter, Inc.)

- Eppendorf AG

- Thermo Fisher Scientific Inc.

- HERMLE Labortechnik GmbH

- KUBOTA Corporation

- Sartorius AG

- Cardinal Health

- Sigma Laborzentrifugen GmbH

- QIAGEN

Recent Developments

-

In July 2024, the Hettich Group, a key player offering laboratory centrifuges, formed a growth partnership with Bregal Unternehmerkapital. Under this partnership, Bregal Unternehmerkapital will utilize its international network to support the organic and inorganic expansion of the Hettich Group, especially in Asia and the U.S.

-

In January 2024, Hettich Group acquired Kirsch Medical, which manufactures cooling and freezing solutions for laboratories and healthcare. This strategic acquisition is anticipated to support the novel developments of laboratory centrifuges by the Hettich Group.

-

In April 2023, Eppendorf launched the Centrifuge 5427 R, its first microcentrifuge featuring hydrocarbon cooling, to promote a more sustainable laboratory environment. This refrigerated device utilizes a natural cooling agent with an almost zero Global Warming Potential (GWP), enabling customers to conduct various molecular and cell biology applications while minimizing environmental impact.

-

In August 2023, Boekel Scientific launched a new product line featuring four families of centrifuges: general purpose, STAT, economy and Blood Bank. This line includes a total of 11 centrifuge models, each designed to combine durability and reproducibility while offering versatility in preanalytical specimen preparations. Suitable for laboratories of all sizes, these centrifuges come in various capacities with 6-place, 12-place, and 24-place options, all equipped with removable rotors to meet diverse operational needs.

Laboratory Centrifuges Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,822.4 million

Revenue forecast in 2030

USD 2.54 billion

Growth rate

CAGR of 5.70% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, intended use, application, model type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Andreas Hettich GmbH & Co. KG; Danaher Corporation (Beckman Coulter, Inc.); Eppendorf SE; Thermo Fisher Scientific Inc.; HERMLE Labortechnik GmbH; KUBOTA Corporation; Sartorius AG; Sigma Laborzentrifugen GmbH; QIAGEN; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Centrifuges Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the laboratory centrifuges market report on the basis of product, intended use, application, model, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Accessories

-

-

Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Floor-Standing Centrifuges

-

Benchtop Centrifuges

-

-

Intended Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Centrifuges

-

Preclinical Centrifuges

-

General Purpose Centrifuges

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbiology

-

Cellomics

-

Proteomics

-

Diagnostics

-

Genomics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory centrifuges market size was estimated at USD 1.73 billion in 2023 and is expected to reach USD 1,822.4 million in 2024.

b. The global laboratory centrifuges market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 2.54 billion by 2030.

b. The equipment segment held the largest share of 82.63% in 2023, driven by advancements in technology and the growing focus of key industry participants on developing novel equipment. High demand for efficient and accurate sample separation techniques is anticipated to support the segment growth.

b. Some of the key players operating in the global laboratory centrifuges market include Andreas Hettich GmbH & Co. KG; Danaher Corporation (Beckman Coulter, Inc.); Eppendorf SE; Thermo Fisher Scientific Inc.; HERMLE Labortechnik GmbH; KUBOTA Corporation; Sartorius AG; Sigma Laborzentrifugen GmbH; QIAGEN and Cardinal Health.

b. The increasing demand for personalized medicine and advancements in genomics and proteomics is anticipated to fuel the demand for centrifuge equipment. Moreover, the rise in the prevalence of chronic diseases, growing diagnostic testing, and increasing developments of advanced products are anticipated to propel the market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.