- Home

- »

- Organic Chemicals

- »

-

L-Cysteine & Derivatives Market Size, Industry Report, 2030GVR Report cover

![L-Cysteine & Derivatives Market Size, Share & Trends Report]()

L-Cysteine & Derivatives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Source, By Application (Food & Beverage, Supplements), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-532-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

L-Cysteine & Derivatives Market Trends

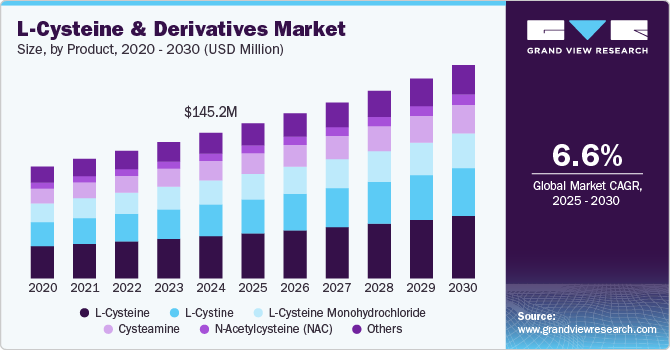

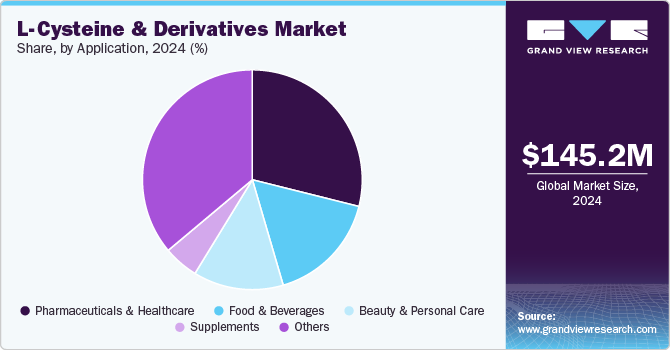

The global L-cysteine & derivatives market size was anticipated to reach USD 145.2 million in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The L-cysteine & derivatives industry is driven by rising demand in the food and beverage industry, particularly as a dough conditioner and flavor enhancer. Growth in the pharmaceutical sector also fuels demand due to its role in drug formulations, antioxidant properties, and respiratory treatments.

Cysteine is a sulfur-containing amino acid with a chemically reactive hydroxyl group, giving it unique properties. It plays a crucial role in protein stability by forming disulfide bridges. This allows for the formation of strong fiber strands, such as those found in hair, wool, and feathers, as well as in horns, hooves, and nails. These structures are composed of proteins with a high cysteine content, with feathers being the primary source of cysteine.

Cysteine can also be extracted from human hair, bristles, and swine hooves. The product for extracting cysteine from feathers involves boiling them in hydrochloric acid. Wacker Chemie AG has developed a method for producing L-cysteine using bacterial fermentation.

N-acetyl-L-cysteine (NAC) is the most taken form of cysteine as a supplement. Once ingested, NAC is converted into cysteine, which is further transformed into glutathione, a powerful antioxidant. Antioxidants are essential for protecting cell membranes and DNA from harmful compounds in the body.

Drivers, Opportunities & Restraints

The food and beverage industry is witnessing a rising demand for L-Cysteine and its derivatives due to their essential role as flavor enhancers and bread-conditioning agents. This amino acid is particularly valued for its ability to improve texture and extend shelf life in various products, including baked goods and processed foods. In addition, as consumer preferences shift towards cleaner-label products, L-Cysteine’s plant-based sourcing is becoming increasingly appealing. Consequently, this trend contributes to the growth and diversification of the L-Cysteine market.

High production costs represent a significant market restraint for L-Cysteine and its derivatives. The complex processes in sourcing and extracting this amino acid, particularly from plant-based sources, can lead to elevated expenses. These costs can be passed on to consumers, making products less competitive than alternatives. In addition, fluctuations in raw material prices and stringent regulatory requirements further exacerbate production challenges, hindering market growth.

The increasing demand for vegan products presents a significant market opportunity for L-Cysteine and its derivatives. As consumers increasingly seek plant-based alternatives, sourcing L-Cysteine from non-animal sources aligns well with this trend. This shift opens new avenues for product development and positions companies to cater to a growing demographic that prioritizes ethical and sustainable consumption. As a result, investing in the production of plant-based L-Cysteine could enhance market competitiveness and drive growth in this segment.

Product Insights

The L-cysteine segment led the market with the largest revenue market share of 28.97%, in 2024 and is expected to continue to dominate the industry over the forecast period. This growth is attributed to well-established and is widely used in food processing as a dough conditioner and flavor enhancer. It is also essential in pharmaceuticals for respiratory treatments, antioxidant formulations, and drug synthesis. In addition, its applications in cosmetics, biotechnology, and animal nutrition contribute to its growing demand across multiple industries.

The L-Cystine segment is anticipated to register at the fastest CAGR of 7.0% during the forecast period. They are primarily used in pharmaceuticals for protein synthesis, wound healing, and immune support. It also finds applications in dietary supplements, cosmetics, and hair care products due to its role in keratin formation. In addition, L-Cystine is utilized in biotechnology and animal nutrition, driving its demand across multiple industries.

Source Insights

Based on source, the natural segment led the market with the largest revenue market share of 64.17% in 2024 and is expected to continue to dominate the industry over the forecast period. This growth is driven by the increasing demand for plant and microbial-based fermentation methods as sustainable alternatives to traditional animal-derived sources. This shift is fueled by consumer preference for clean-label, non-GMO, and vegan-friendly products, especially in food, pharmaceuticals, and cosmetics. Advancements in biotechnology and regulatory support for non-animal sourcing further accelerate market growth.

The synthetic segment is gaining traction due to advancements in chemical synthesis and biotechnology, offering an alternative to animal-derived sources. It provides high purity and consistent quality, making it suitable for pharmaceuticals, food processing, and cosmetics. Increasing demand for vegan-friendly and non-GMO products further supports the growth of synthetic L-Cysteine production.

Application Insights

Based on application, the others segment led the market with the largest revenue share of 36.11% in 2024. The market is driven by its applications in drug formulations, respiratory treatments, and antioxidant therapies. L-cysteine is widely used in acetylcysteine-based medications for conditions like chronic obstructive pulmonary disease (COPD) and liver detoxification. In addition, L-cystine supports protein synthesis and wound healing, making it valuable in dietary supplements and medical nutrition.

The beauty & personal care is expected to register at the fastest CAGR of 6.7% during the forecast period. The rising demand for personal care and cosmetics is increasing globally, leading to increased demand for L-cysteine & derivatives, which are used in personal care & cosmetics manufacturing, leading to rising demand for the product market during the forecast period.

Regional Insights

The L-cysteine & derivatives market in North America is a key regional segment, driven by strong demand in the pharmaceutical, food, and cosmetics industries. The region benefits from advanced biotechnological production methods, growing consumer preference for clean-label and vegan-friendly products, and stringent regulatory standards. In addition, expanding applications in dietary supplements and personal care products contribute to market growth.

U.S. L-Cysteine & Derivatives Market Trends

The L-cysteine & derivatives market in the U.S. is anticipated to grow at a significant CAGR during the forecast period.The country benefits from advanced biotechnology, increasing adoption of non-animal-derived sources, and stringent FDA regulations ensuring high-quality production. In addition, the growing trend toward clean-label and vegan-friendly products further supports market expansion.

Asia Pacific L-Cysteine & Derivatives Market Trends

Asia Pacific dominated the L-cysteine & derivatives market with the largest revenue share of 50.67 in 2024. This is driven by expanding pharmaceutical, food processing, and cosmetics industries. The region benefits from large-scale production facilities, increasing demand for clean-label ingredients, and rising adoption of biotechnology-based fermentation methods. In addition, growing health awareness and a strong presence of key manufacturers in countries like China and Japan support market growth.

Europe L-Cysteine & Derivatives Market Trends

The L-cysteine & derivatives market in Europe is expected to grow at the fastest CAGR during the forecast period. This is driven by strict regulatory standards, growing demand for clean-label and vegan-friendly products, and advancements in biotechnology-based production. The region sees strong usage in pharmaceuticals, food processing, and cosmetics, with increasing adoption of non-animal-derived sources. In addition, rising consumer preference for functional foods and dietary supplements supports market expansion.

Latin America L-Cysteine & Derivatives Market Trends

The L-cysteine & derivatives market in Latin America is expected to grow at a steady CAGR over the forecast period. This is driven by growing demand in the pharmaceutical, food, and cosmetics industries. Increasing health awareness and expanding food processing activities, particularly in Brazil and Mexico, are boosting market growth. In addition, the rising adoption of biotechnology-based production and regulatory shifts toward clean-label ingredients support the region's expansion.

Middle East & Africa L-Cysteine & Derivatives Market Trends

The L-cysteine & derivatives market in the Middle East and Africa is expected to witness at a steady CAGR over the forecast period, due to increasing food and beverages production in the region. The Middle East & Africa is expected to create high demand for L-cysteine & derivatives in the region.

Key L-Cysteine & Derivatives Company Insights

Some of the key players operating in the market include Evonik Industries AG, and Wacker Chemie AG.

-

Evonik Industries AG is a global specialty chemicals company and has been in the industry for more than 150 years. Evonik's products and solutions are used across various industries, from automotive and construction to pharmaceuticals and agriculture, making it a significant player in the global specialty chemicals sector. The company has a strong presence in research and development, with operations and/or sales in Asia Pacific, Europe, Latin America, North America, and Middle East & Africa. The company has over 40 research facilities worldwide, with 23,000 patents and pending patents.

-

Wacker Chemie AG is a German multinational chemical company. Over the years, Wacker expanded its product portfolio to include acetone, vinyl acetate, polyvinyl acetate, and PVC. The company's ownership structure has been controlled by the Wacker family, holding more than 50% of the shares, with significant changes in shareholding over the years, including a partnership with Farbwerke Hoechst AG. Wacker Chemie AG has grown into a global player with over 25 production sites across Europe, Asia, and the Americas. The company is a prominent supplier of silicones, silicon wafers for semiconductors, and binders based on polyvinyl acetate. Its products are used in various industries, including construction, automotive, electronics, and medical technology.

Key L-Cysteine & Derivatives Companies:

The following are the leading companies in the l-cysteine & derivatives market. These companies collectively hold the largest market share and dictate industry trends.

- Wacker Chemie AG

- Ajinomoto Co. Inc.

- Evonik Industries AG

- Zhejiang NHU Co., Ltd.

- Merck KGaA

- CJ CHEILJEDANG CORP.

- Fengchen Group Co., Ltd

- NIPPON RIKA CO., LTD

- Shine Star (Hubei) Biological Engineering Co., Ltd.

- Glentham Life Sciences Limited

Recent Developments

-

In May 2023, Evonik launched cQrex KC, a new peptide designed to boost performance in cell culture media for biopharmaceutical production. This peptide is significantly more soluble than L-cystine at a neutral pH, making it easier to supply L-cystine to cells. As part of Evonik's cQrex portfolio, cQrex KC helps optimize cystine supply, increase cell culture productivity, and improve the overall efficiency of producing biological drugs like monoclonal antibodies and vaccines. Evonik aims to expand its share of System Solutions, which are tailored to specific customer needs, to over 50% by 2030. cQrex KC addresses the challenge of L-cystine's low solubility in cell culture media, enabling higher antibody titers and simplifying complex production processes.

-

In February 2023, CJ CHEILJEDANG CORP launched its business unit called CJ Food & Nutrition Technology (CJ FNT) to target the global food and nutrition market. CJ FNT combines CJ's food ingredients and nutritional solutions businesses, including alternative and cultured proteins, with the objective of becoming a "total solutions provider." The business unit is expected to focus on developing next-generation ingredients, such as clean-label solutions like 'TasteNrich' and FlavorNrich' to meet the growing demand for healthy food ingredients

L-Cysteine & Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 154.56 million

Revenue forecast in 2030

USD 212.70 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; and South Africa.

Key companies profiled

Shine Star (Hubei) Biological Engineering Co., Ltd.; Evonik Industries AG; Zhejiang NHU Co., Ltd.; CJ CHEILJEDANG CORP.; Fengchen Group Co., Ltd; NIPPON RIKA CO., LTDs; Ajinomoto Co. Inc.; Merck KGaA; Wacker Chemie AG; Glentham Life Sciences Limited

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

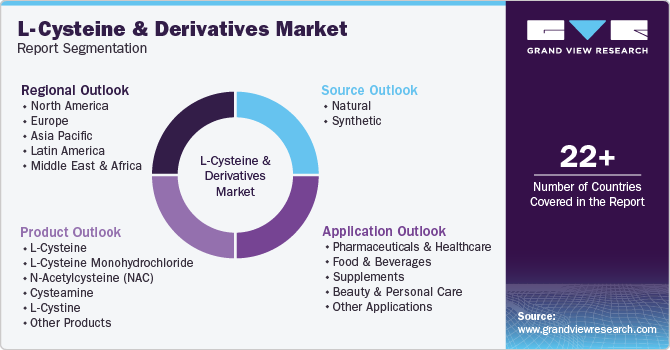

Global L-Cysteine & Derivatives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global L-cysteine & derivatives market report based on the product, source, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

L-Cysteine

-

L-Cysteine Monohydrochloride

-

N-Acetylcysteine (NAC)

-

Cysteamine

-

L-Cystine

-

Other Products

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals & Healthcare

-

Food & Beverages

-

Supplements

-

Beauty & Personal Care

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global L-cysteine & derivatives market size was estimated at USD 145.2 million in 2024 and is expected to reach USD 154.56 million in 2025.

b. The global L-cysteine & derivatives market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030, reaching USD 212.7 million in 2030.

b. Asia Pacific dominated the L-cysteine & derivatives market in the food & beverages market with a share of 50.7% in 2024. The Asia Pacific region is expected to grow, driven by expanding pharmaceutical, food processing, and cosmetics industries. The region benefits from large-scale production facilities, increasing demand for clean-label ingredients, and rising adoption of biotechnology-based fermentation methods.

b. Some key players operating in the L-cysteine & derivatives market include Shine Star (Hubei) Biological Engineering Co., Ltd., Evonik Industries AG, Zhejiang NHU Co., Ltd., CJ CHEILJEDANG CORP., Fengchen Group Co., Ltd, NIPPON RIKA CO., LTDs, Ajinomoto Co. Inc., Merck KGaA, Wacker Chemie AG, and Glentham Life Sciences Limited.

b. Rising demand in the food and beverage industry, particularly as a dough conditioner and flavor enhancer, is a key factor driving demand. Growth in the pharmaceutical sector also fuels demand due to its role in drug formulations, antioxidant properties, and respiratory treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.