- Home

- »

- Next Generation Technologies

- »

-

Knowledge Process Outsourcing Market Size Report, 2030GVR Report cover

![Knowledge Process Outsourcing Market Size, Share & Trends Report]()

Knowledge Process Outsourcing Market (2023 - 2030) Size, Share & Trends Analysis Report By Service, By Application (BFSI, Healthcare, IT & Telecom, Manufacturing, Pharmaceutical, Retail, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-879-4

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geothermal Energy Market Summary

The global geothermal energy market size was estimated at USD 48.92 billion in 2022 and is projected to reach USD 169.78 billion by 2030, growing at a CAGR of 17.0% from 2023 to 2030. The increasing need for higher flexibility in Service Level Agreements (SLAs) and ease in change management practices along with cost-cutting is anticipated to boost the growth of the knowledge process outsourcing (KPO) industry.

Key Market Trends & Insights

- Asia Pacific accounted for the largest market share of 77.5% in 2022.

- Latin America is projected to demonstrate growth at the fastest CAGR of 17.5% over the forecast period.

- By service, the analytics & market research segment held the highest market share of 36.5% in 2022.

- By application, the BFSI segment dominated theknowledge process outsourcing market with a revenue share of 32.8% in 2022.

- By application, the IT & telecom segment is estimated to register the fastest CAGR of 19.3% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 48.92 billion

- 2030 Projected Market Size: USD 169.78 Billion

- CAGR (2023-2030): 17.0%

- Asia Pacific: Largest market in 2023

Outsourcing critical processes involved in their systems enables industries to save a significant amount of time and money. The rising demand for professional services such as training, research, managed services, and maintenance further accelerates the industry's growth. In emerging economies such as China, India, and the Philippines, highly skilled professionals such as engineers, lawyers, and architects, among others, are ready to provide professional services at lower costs than their Western counterparts.

The abundance of data across the globe has made it difficult to extract useful information from available sources. In such a case, companies approach KPO firms that hire knowledge experts in various fields and apply different tools for analyzing business processes and simplifying decision-making.

However, increasing regulations about unemployment in specific regions, owing to a lack of talent, are expected to hamper market growth. Moreover, the skilled workforce is paid average salaries and expected to perform tasks at a low cost as KPO firms face high attrition issues, posing a challenge to market growth.

The increased competition in global business has resulted in a shorter product and service introduction cycle time. Customers want high-quality services; therefore, businesses must implement processes and business models that increase operational efficiency and add strategic value to their products and services. KPO assists businesses in reducing design-to-market lead times, managing key hardware efficiently, conducting market research and competition, conducting product and service research, improving organizational efficiency in business administration, and dealing with changing business scenarios. KPO's value proposition is to offer enhanced services and customized solutions.

KPO service providers are a realistic choice for businesses. Various large and small businesses serve as third-party service providers enhancing KPO services. One of the main advantages of using third-party service vendors is that operations are scaled up according to the need. Third-party vendors, on the other hand, provide clients with more customization and flexibility.

One of the segments to showcase good growth is engineering design outsourcing, often known as Engineering Services Outsourcing (ESO), which is the practice of outsourcing engineering-related work to other organizations to take advantage of the cost advantage. In Europe, for example, an intensive automobile design costs USD 800 per person-hour, whereas, in India, it costs USD 60 per person-hour. ESO comprises outsourcing various tasks, including design, manufacture, and maintenance. Automotive, aerospace, hi-tech/telecom, utilities, and construction/industrial machinery are among the key industrial sectors that profit from ESO.

Almost all organizations today are data-driven, and this data aids firms in developing new goods and providing better service to clients. With the growing relevance of data in enterprises, every industry is observing an increase in demand for knowledge process outsourcing.

The KPO industry faces challenges like a shortage of workforce and knowledge issues, concerns for data security and poor infrastructure, and a rise in real estate costs. These combined factors are huge challenges for the industry to grow and prosper. For example, the KPO industry requires professionals with the right skill sets and domain knowledge, but there needs to be more such professionals, especially in developing economies.

COVID-19 had a severe and huge impact all around the globe. Outsourcing firms are shifting to cloud-based work platforms, which reduce manual labor, lead to job automation, and increase staff productivity. However, the IT industry will soon rebound, and outsourcing firms concentrate on long-term investments and retain contact with prospects and partners.

Service Insights

The analytics & market research segment held the highest market share of 36.5% in 2022. It is attributed to an increased demand for business intelligence and analytical tools that reduce employee burden. KPO providers often specialize in specific industries or domains, such as finance, healthcare, or technology. This specialized knowledge allows companies to access experts with in-depth understanding and insights into complex industry trends, regulations, and market dynamics. As businesses seek to leverage specialized expertise without investing in full-time resources, the demand for KPO services rises. The analytics & market research segment is further divided into customer & marketing analytics, operations & supply chain analytics, and competitive intelligence & industry analysis.

The legal process outsourcing segment is estimated to register the fastest CAGR of 20.0% over the forecast period, owing to the efficiency of services provided and the cost reduction. Legal processes often involve labor-intensive tasks, such as legal research, contract drafting, and document review. By outsourcing these tasks to KPO providers, businesses can benefit from cost savings. Similarly, other industries with complex knowledge-based operations find cost efficiencies in outsourcing tasks that require specialized skills and extensive training.

Other services, including engineering & design, financial processes, and research & development outsourcing, are expected to grow faster over the forecast period. Technological advancements have resulted in the development of new tools to provide knowledge-based services to clients.

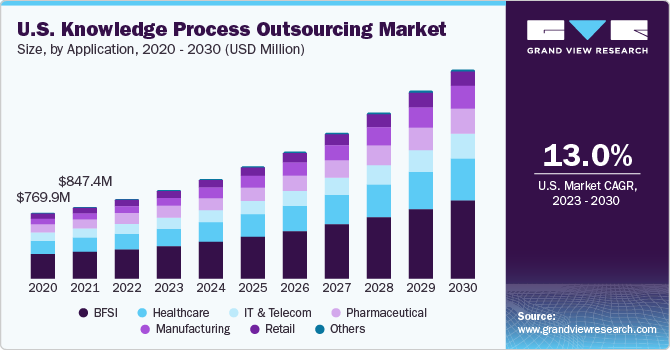

Application Insights

The BFSI segment dominated theknowledge process outsourcing market with a revenue share of 32.8% in 2022. The BFSI segment includes sensitive information regarding customers and the financial databases of numerous banks. To maintain information efficiently, companies outsource processes such as financial analytics, equity research, and data management, among others. A few companies that provide financial services to other firms are CRISIL Ltd., Credit Suisse Group AG., and WNS (Holdings) Ltd., among others.

The IT & telecom segment is estimated to register the fastest CAGR of 19.3% over the forecast period. Owing to the extensive database in the IT and Telecom sector, which is fragmented and increasing over some time, is expected to accelerate the market growth over the forecast period.

Regional Insights

Asia Pacific accounted for the largest market share of 77.5% in 2022. This growth is attributed to a rise in passenger vehicle sales in the region. It can be attributed to the rapid off-shoring of critical processes and professional services. The increasing presence of skilled professionals such as engineers, architects, and lawyers in emerging economies, such as India, China, and the Philippines, is driving market growth.

On the other hand, Latin America is projected to demonstrate growth at the fastest CAGR of 17.5% over the forecast period. Enterprises in the region are increasingly focusing on R&D and developing their analytical insights, which is estimated to propel market growth over the forecast period.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. Industry players primarily focus on exploring opportunities to develop newer ways and techniques to offer clients their services. To maintain a strong position in the market, companies have appointed different teams to perform research on tools and implement them while providing services to clients. For Instance, in July 2021, Accenture acquired HRC Retail Advisory to bolster its retail strategy capabilities. According to Accenture's official statement, the acquisition is motivated by HRC Retail Advisory's extensive track record of providing invaluable assistance to prominent retailers throughout North America.

Key Knowledge Process Outsourcing Companies:

- Accenture

- Genpact

- HCL Technologies Limited

- ExlService Holdings, Inc.

- McKinsey & Company

- Moody's Investors Service, Inc.

- THOMSON REUTERS

- Mphasis

- R.R. Donnelley & Sons Company

- Wipro

Recent Developments

-

In May 2022, Informatica Inc. and Wipro announced a strategic collaboration to provide cloud-based data analytics solutions to the market through the Wipro Fullstride cloud data platform. Leveraging Wipro's renowned expertise in analytics, data, and artificial intelligence (AI), in conjunction with Informatica's robust AI-powered data management solution, this partnership aims to facilitate cloud-based transformations and enable scalability.

-

In April 2022, HealthPartners (U.S.) chose ExlService Holdings, Inc. to design an advanced care management platform for them. This platform will allow HealthPartners to combine population health analytics with care management procedures. The outcome will be more precise, well-timed, and effective interventions, ultimately leading to heightened member engagement.

Knowledge Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 56.43 billion

Revenue forecast in 2030

USD 169.78 billion

Growth Rate

CAGR of 17.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Accenture; Genpact; HCL Technologies Limited; ExlService Holdings, Inc.; McKinsey & Company; Moody's Investors Service, Inc.; THOMSON REUTERS; Mphasis; R.R. Donnelley & Sons Company; Wipro

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Knowledge Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global knowledge process outsourcing market report based on service, application, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Analytics & Market Research

-

Customer & Marketing Analytics

-

Operations & Supply Chain Analytics

-

Competitive Intelligence & Industry Analysis

-

-

Engineering & Design

-

Financial Process Outsourcing

-

Legal Process Outsourcing

-

Publishing Outsourcing

-

Research & Development Outsourcing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Pharmaceutical

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key players in the market include Accenture, EXL Services, Genpact, McKinsey and Company, Moody’s Investors Service, Inc., Mphasis, RR Donnelley & Sons Company, Wipro Limited, and HCL, among others.

b. The factors driving the market growth include, rising demand for professional services such as training, research, managed services, and maintenance, and increasing need for higher flexibility in Service Level Agreements (SLAs).

b. The global knowledge process outsourcing market size was estimated at USD 48.92 billion in 2022 and is expected to reach USD 56.43 billion in 2023.

b. The global knowledge process outsourcing market is expected to grow at a compound annual growth rate of 17.0% from 2023 to 2030 to reach USD 169.78 billion by 2030.

b. Analytics & Market Research segment is expected to dominate the knowledge process outsourcing (KPO) market in 2022. The growth in the segment is attributed to an increased demand for business intelligence and analytical tools for quick information processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.