- Home

- »

- Advanced Interior Materials

- »

-

Knitting Yarn Ball Retail Market Size, Industry Report, 2033GVR Report cover

![Knitting Yarn Ball Retail Market Size, Share & Trends Report]()

Knitting Yarn Ball Retail Market (2025 - 2033) Size, Share & Trends Analysis Report By Channel (Physical Stores, Online Channels), By Material (Cotton, Wool, Silk), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-052-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Knitting Yarn Ball Retail Market Summary

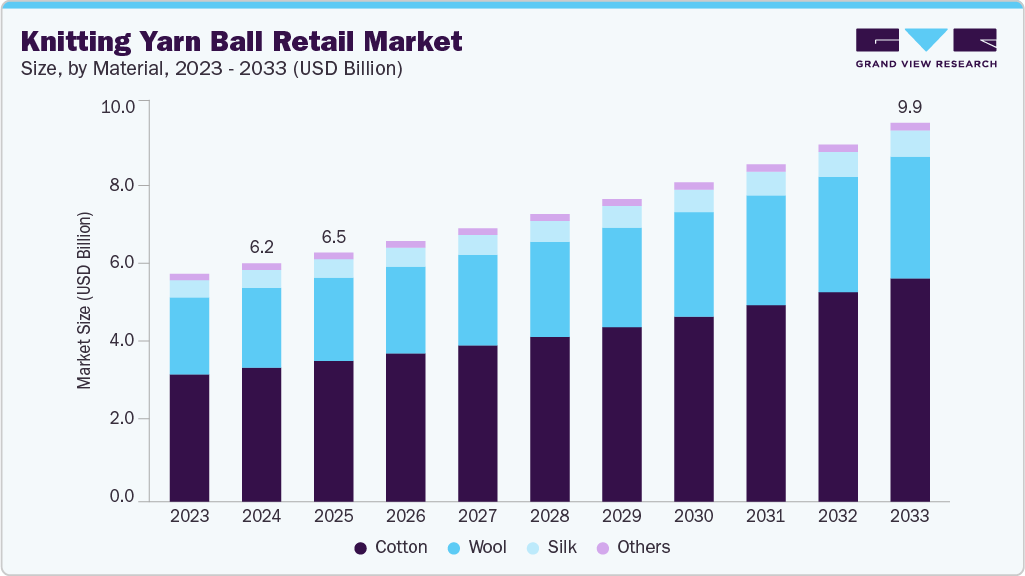

The global knitting yarn ball retail market size was estimated at USD 6.21 billion in 2024 and is projected to reach USD 9.89 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The growing interest of young people in the knitting activity, coupled with the rising trend of displaying their art and new patterns on social media, is bolstering the growth of globally knitting yarn ball retail industry.

Key Market Trends & Insights

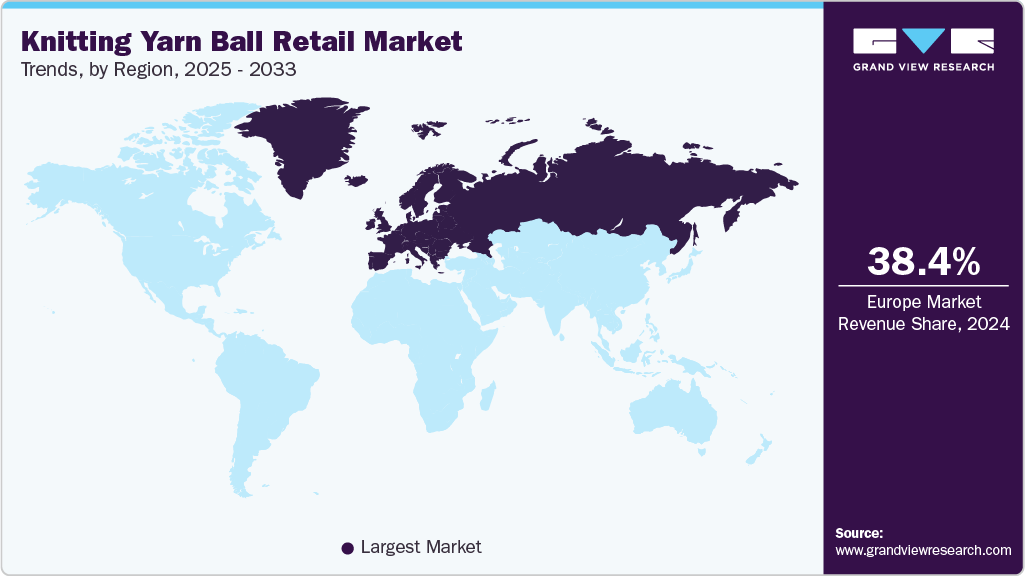

- Europe dominated the global knitting yarn ball retail industry with the largest revenue share of 38.4% in 2024.

- By distribution channel, the online channel segment is expected to grow at the fastest CAGR of 6.6% over the forecast period.

- By material, the wool segment is expected to grow at the fastest CAGR of 5.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6.21 Billion

- 2033 Projected Market Size: USD 9.89 Billion

- CAGR (2025-2033): 5.4%

- Europe: Largest market in 2024

Cotton fiber is one of the major material used for manufacturing the yarn balls for the knitting of tanks, tunics, tees, and pullovers owing to its high breathable and absorbent properties. In addition, the softness and ability of drape offered by cotton yarn ball make it ideal for producing formal wear. People also utilize cotton yarn balls for knitting soft toys, which is expected to further propel the market growth.Technological advancements in fiber processing and dyeing techniques also play a significant role in driving the market growth. Innovations in spinning and color treatment have improved yarn softness, durability, and colorfastness, making knitting more enjoyable and products more durable. These enhancements are leading to premiumization in the retail sector, where consumers are willing to pay higher prices for superior quality yarns. In addition, the integration of smart textile technology and specialty yarns, such as metallic or temperature-responsive fibers, is expanding the creative possibilities for hobbyists and designers alike.

The market’s growth is further bolstered by the expansion of e-commerce and online craft retail platforms. Digital retailing has revolutionized product accessibility, enabling small and large brands to reach global audiences. Online tutorials, virtual workshops, and subscription-based craft boxes are also contributing to rising engagement in knitting activities. Retailers are increasingly leveraging digital marketing strategies, social media influencers, and craft content creators to target niche consumer segments, thereby expanding the customer base and overall sales.

Market Concentration & Characteristics

The global knitting yarn ball retail industry exhibits a moderate-to-low level of market concentration, with a mix of established international brands and numerous small-to medium-sized local producers. The degree of innovation in the market is steadily increasing, driven by advances in fiber technology, eco-friendly dyeing processes, and the development of novel yarn blends incorporating organic, recycled, or specialty fibers. Manufacturers are focusing on product differentiation through color variety, texture enhancement, and sustainable production methods to appeal to environmentally conscious and design-oriented consumers. While innovation remains a key competitive factor, the market’s fragmented structure encourages niche specialization rather than dominance by a few players, ensuring diversity and flexibility in product offerings across regions.

Mergers and acquisitions in the knitting yarn sector occur at a moderate level, often aimed at expanding product portfolios, entering new regional markets, or acquiring sustainable manufacturing capabilities. Regulatory impacts primarily concern product labeling, sustainability standards, and import-export compliance related to textile fibers, dyes, and chemicals. Environmental regulations promoting sustainable production and restrictions on synthetic materials have encouraged a shift toward natural and biodegradable fibers. Service substitutes are relatively limited, as handmade knitting offers a tactile and creative experience that cannot be easily replaced by automated textile production. End-user concentration is low, with demand distributed among hobbyists, craft enthusiasts, and small-scale apparel makers worldwide, contributing to a stable and diversified consumer base within the retail knitting yarn market.

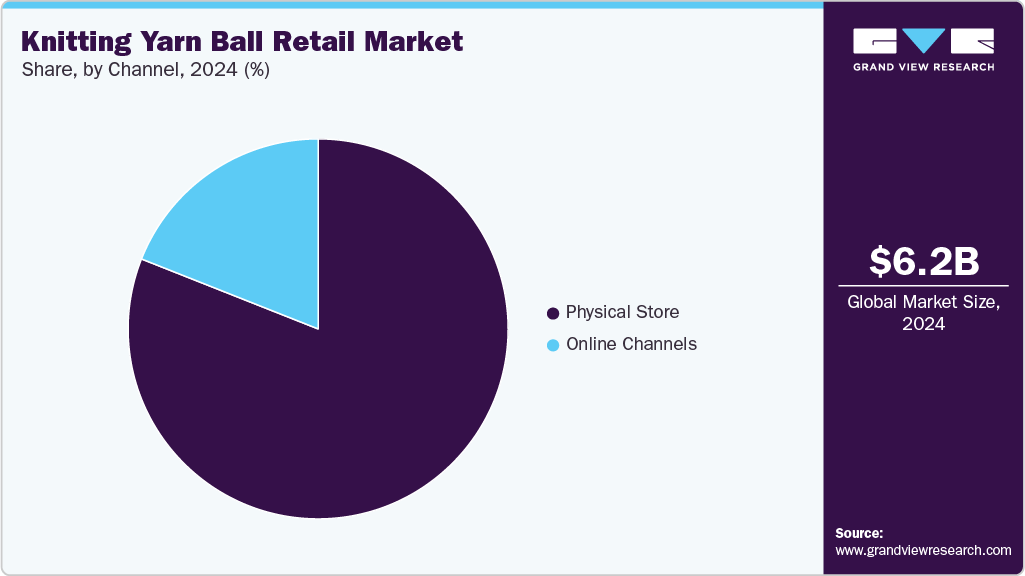

Channel Insights

The physical store segment led the market and accounted for the largest revenue share of 81.0% in 2024, driven by consumers’ preference for tactile shopping experiences, where they can feel the texture, weight, and quality of yarns before purchase. Craft enthusiasts often seek personalized guidance from in-store experts and enjoy the community aspect of local knitting shops, which frequently host workshops and events. The ability to instantly access products without delivery times enhances convenience for immediate projects. In addition, premium yarn brands are partnering with boutique stores to showcase exclusive collections, further supporting foot traffic. The sensory engagement and customer service offered by physical retail outlets continue to play a vital role in maintaining strong sales within this segment.

The online channel segment is expected to grow at the fastest CAGR of 6.6% over the forecast period, driven by the expanding reach of e-commerce platforms and digital craft marketplaces that provide global accessibility to a diverse range of yarns. Convenience, wide product selection, and competitive pricing make online shopping particularly appealing to both novice and experienced knitters. The growth of virtual craft communities, tutorials, and social media influencers has also increased online engagement and brand visibility. Retailers offering subscription boxes, virtual knitting classes, and customizable yarn kits are gaining popularity among younger consumers. Furthermore, the integration of advanced logistics and fast delivery systems is enhancing customer satisfaction, solidifying the online channel’s dominance in market expansion.

Material Insights

The wool segment dominated the market and accounted for the largest revenue share of 56.2% in 2024, driven by fiber’s natural warmth, durability, and versatility, making it a preferred choice for hand-knitted apparel and accessories. Consumers increasingly value wool for its breathability and biodegradability, aligning with global sustainability trends. The resurgence of handmade fashion and slow fashion movements has further elevated the appeal of natural fibers like wool. Technological innovations in spinning and dyeing have improved wool’s softness and colorfastness, expanding its use across different yarn blends. In addition, the availability of ethically sourced and certified wool varieties has strengthened consumer trust and brand differentiation within this segment.

The cotton segment is expected to grow significantly at a CAGR of 4.9% over the forecast period. The cotton segment benefits from the fiber’s softness, lightweight nature, and year-round usability, making it ideal for garments suited to warm and humid climates. Its hypoallergenic and breathable properties appeal to consumers seeking natural and skin-friendly materials. The rise in eco-conscious consumers has driven demand for organic and sustainably farmed cotton yarns. Moreover, advancements in yarn processing have enhanced cotton’s strength and color retention, broadening its applications in both apparel and home décor. The affordability and versatility of cotton yarns continue to attract a large portion of hobbyists and professional knitters worldwide.

Regional Insights

The Asia Pacific knitting yarn ball retailindustry is witnessing rapid growth due to increasing disposable incomes, urbanization, and a rising appreciation for artisanal and handcrafted goods. Countries such as Japan, South Korea, and India are experiencing a surge in hobby-based crafts, supported by a growing online craft culture. Local manufacturers are offering affordable yarn options while global brands introduce premium and sustainable yarns to meet evolving consumer preferences. The expansion of e-commerce and social media marketplaces has made knitting supplies more accessible to consumers in emerging economies. Furthermore, government initiatives promoting small-scale textile and handicraft industries are indirectly supporting retail demand for knitting yarn balls across the region.

China knitting yarn ball retail industry is driven by a resurgence in handmade crafts and growing consumer interest in sustainable lifestyle products. The country’s strong textile manufacturing base ensures abundant raw material availability and a wide variety of yarn products at competitive prices. Increasing awareness of Western DIY and home décor trends through social media platforms like Douyin (TikTok China) has encouraged younger consumers to adopt knitting as a creative pursuit. Moreover, domestic e-commerce giants such as Alibaba and JD.com have expanded the accessibility of craft supplies, contributing to higher retail sales. The rise in home-based businesses focused on handmade products further strengthens market demand in China.

North America Knitting Yarn Ball Retail Market Trends

The North America knitting yarn ball retail industry is driven by the growing popularity of DIY culture, crafting hobbies, and sustainable fashion movements across the U.S. and Canada. Consumers are increasingly engaging in knitting and crocheting as creative and stress-relieving leisure activities, especially among younger demographics and retirees. The availability of premium, eco-friendly, and organically sourced yarns is further encouraging consumers to pursue environmentally responsible crafting. Online craft communities and digital retail platforms have made it easier for consumers to access diverse yarn varieties and tutorials. In addition, the region’s strong inclination toward handmade and personalized products continues to boost demand for knitting yarn balls in both physical and online retail stores.

U.S. Knitting Yarn Ball Retail Market Trends

The knitting yarn ball retailindustryin the United States is largely fueled by a revival of traditional handcrafts combined with modern design aesthetics. The rise of the “slow fashion” trend has led consumers to seek sustainable, handcrafted apparel, driving interest in knitting with natural fibers such as wool, alpaca, and cotton. E-commerce platforms and influencer-led craft tutorials are fostering a new generation of hobby knitters who value creativity and personalization. Moreover, the increasing presence of independent yarn retailers and subscription-based yarn clubs is enhancing consumer accessibility and engagement. The country’s strong focus on eco-conscious lifestyles and local craftsmanship is further strengthening the retail demand for knitting yarn balls.

Europe Knitting Yarn Ball Retail Market Trends

The Europe knitting yarn ball retail industry dominated the global market and held a 38.4% revenue share in 2024, driven by a deep-rooted cultural heritage of knitting and weaving, combined with a growing focus on sustainability. Consumers in countries such as the UK, France, and Italy are showing increasing preference for organic, ethically sourced yarns that align with the region’s environmental goals. The demand for premium-quality wool and specialty fibers has led to innovation in yarn blending and dyeing techniques. In addition, the region’s mature e-commerce infrastructure supports easy access to international brands and niche artisanal suppliers. The trend toward slow fashion and handmade apparel continues to strengthen Europe’s position as a leading market for knitting yarn balls.

Germany knitting yarn ball retail industry is propelled by strong consumer appreciation for high-quality, sustainable textile materials. The country’s environmentally conscious population prefers natural fibers such as organic wool and cotton, aligning with its broader green consumption patterns. Local and regional craft fairs, knitting workshops, and community initiatives have also contributed to reviving traditional crafting skills. German manufacturers are investing in innovative yarn technologies that enhance texture and durability while maintaining eco-friendly production. Furthermore, the rise of online specialty stores and customizable yarn kits is expanding accessibility and consumer engagement in Germany’s knitting market.

Latin America Knitting Yarn Ball Retail Market Trends

The Latin American knitting yarn ball retail industry is expanding due to the revival of traditional textile crafts and the growing popularity of handmade apparel. Countries such as Brazil, Argentina, and Peru have strong cultural roots in weaving and knitting, supported by abundant availability of natural fibers like alpaca and cotton. Increasing participation in craft-based entrepreneurship, particularly among women, is stimulating retail demand. The influence of online marketplaces and craft tutorials is introducing younger consumers to knitting as both a hobby and a business opportunity. In addition, regional trade initiatives promoting local textile industries are helping strengthen the availability and diversity of yarn products.

Middle East & Africa Knitting Yarn Ball Retail Market Trends

The Middle East & Africa knitting yarn ball retail industry is driven by growing interest in creative home-based hobbies and expanding online access to international craft products. Rising disposable incomes and the influence of Western DIY trends are encouraging consumers, particularly women, to engage in knitting and crocheting activities. Local artisans are increasingly incorporating knitting into traditional handicrafts, blending cultural designs with contemporary aesthetics. The availability of imported yarns and expanding craft retail chains is enhancing market accessibility. Moreover, the region’s emerging focus on sustainable and handmade textile goods is supporting long-term growth in knitting yarn ball retail sales.

Key Knitting Yarn Ball Retail Company Insights

Some of the key players operating in market include Ballyarn and Sullivans USA

-

Ballyarn is a Spain-based company specializing in sustainable textile products, particularly recycled and eco-friendly yarns. The company focuses on producing yarn balls made from high-quality recycled textile waste, promoting circular economy principles. Its product range includes t-shirt yarns, macramé cords, and cotton blends designed for knitting, crocheting, and home décor crafts.

-

Sullivans USA is a prominent American manufacturer and distributor of craft and textile supplies, catering to hobbyists and professional crafters alike. The company offers a wide selection of knitting yarns, embroidery threads, and decorative accessories through both retail and online platforms. Its yarn product line includes acrylic, cotton, and blended fibers in various colors and textures, appealing to a broad creative audience.

Ganga Acrowools and Vardhman Group are some of the emerging market participants in knitting yarn ball retail industry.

-

Ganga Acrowools, based in India, is a leading manufacturer of premium knitting and crochet yarns known for their softness and color variety. The company produces a diverse range of yarns made from acrylic, wool, cotton, and blended fibers suited for garments, accessories, and crafts. Its products are distributed both domestically and internationally, reflecting a strong presence in the global yarn retail market.

-

Vardhman Group is one of India’s largest integrated textile manufacturers with a strong presence in yarn, fabrics, and garments. The company’s knitting yarn division offers an extensive portfolio of acrylic, cotton, and wool-blend yarns for both hand-knitting and industrial applications. Vardhman emphasizes innovation, quality, and sustainability in its manufacturing processes, catering to both domestic and export markets.

Key Knitting Yarn Ball Retail Companies:

The following are the leading companies in the knitting yarn ball retail market. These companies collectively hold the largest market share and dictate industry trends.

- Ballyarn

- Sullivans USA

- Ganga Acrowools

- Vardhman Group

- Gomitolatura Albatros di Chen Xiaoqun

- Gedifra

- Hobbii

- The Yarnery

- King Cole

- Rowan

Knitting Yarn Ball Retail Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.50 billion

Revenue forecast in 2033

USD 9.89 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million units, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

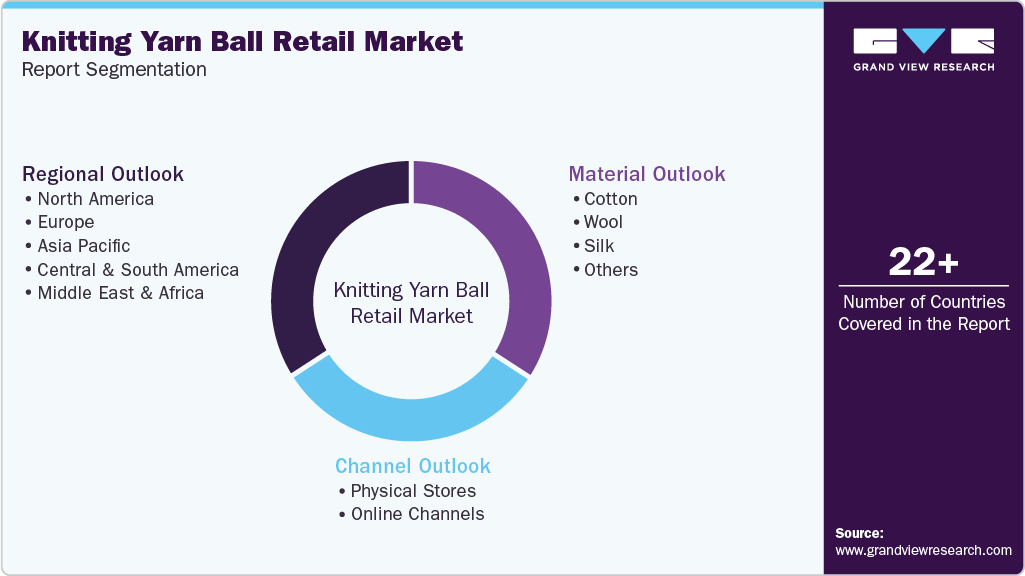

Segments covered

Channel, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Netherlands; Russia; Iceland; Scandinavia; China; India; Japan; South Korea; Australia; New Zealand

Key companies profiled

Ballyarn; Sullivans USA; Ganga Acrowools; Vardhman Group; Gomitolatura Albatros di Chen Xiaoqun; Gedifra; Hobbii; The Yarnery; King Cole, Rowan

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Knitting Yarn Ball Retail Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the knitting yarn ball retail market report based on channel, material, and region:

-

Channel Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Physical Stores

-

Online Channels

-

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Cotton

-

Wool

-

Merino Wool

-

Alpaca

-

Cashmere

-

-

Silk

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Netherlands

-

Russia

-

Iceland

-

Scandinavia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global knitting yarn ball retail market size was estimated at USD 6.21 billion in 2024 and is expected to reach USD 6.50 billion in 2025.

b. The global knitting yarn ball retail market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 9.89 billion by 2033.

b. Physical store segment led the market and accounted for the largest revenue share of 81.0% in 2024, driven by consumers’ preference for tactile shopping experiences, where they can feel the texture, weight, and quality of yarns before purchase.

b. Some of the prominent companies in the knitting yarn ball retail market include Michelin Group, Bridgestone Corporation, Continental AG, Pirelli & C. S.p.A., Apollo Tyres Ltd., JK Tyre & Industries Ltd., Maxxis International, CEAT Limited, TVS Srichakra Limited

b. Key factors driving the knitting yarn ball retail market include rising two-wheeler ownership, growing demand for electric mobility, technological advancements in tire materials and design, expanding aftermarket services, and increasing focus on safety and fuel efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.