- Home

- »

- Advanced Interior Materials

- »

-

Knitted Fabric Market Size, Share, Global Industry Report, 2019-2025GVR Report cover

![Knitted Fabric Market Size, Share & Trends Report]()

Knitted Fabric Market (2019 - 2025) Size, Share & Trends Analysis Report By Product (Weft-knit, Warp-knit), By Application (Technical, Household), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-204-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Knitted Fabric Market Summary

The global knitted fabric market size was estimated at USD 23.8 billion in 2018 and is projected to reach USD 35.7 billion by 2025, growing at a CAGR of 6.0% from 2019 to 2025. The growing apparel industry is one of the major factors driving the market.

Key Market Trends & Insights

- Asia Pacific dominated the knitted fabric market and accounted for 70.2% share of the total revenue.

- By product, weft-knit fabric dominated the industry with a share of more than 60.0% in 2018.

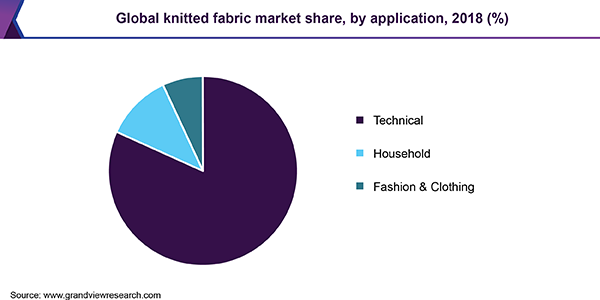

- By application, the technical application segment held the largest share of over 80.0%.

Market Size & Forecast

- 2018 Market Size: USD 23.8 Billion

- 2025 Projected Market Size: USD 35.7 Billion

- CAGR (2019-2025): 6.0%

- Asia Pacific: Largest market in 2018

Furthermore, the increasing importance of knitted fabric in the automobile, construction, manufacturing, and medical sectors is expected to fuel market demand over the forecast period.

Shifting consumer preference for lightweight and high-performance knitwear is fueling the demand for feathery raw materials including polypropylene, linen, silk, faux fur, and synthetic fibers. Woven fabrics have been replacing bulked yarns made knitted fabrics. Over the past few years, the apparel industry has been witnessing steady growth in demand for the loop stitch jackets, cardigans, large shawls, and scarfs. In terms of color, grey, classic black, brown, and beige have been gaining significant popularity across the world.

Furthermore, demand for feather-light circular knit fabrics has increased in the hosiery market due to its better breathability of the material. Lightweight knitted textile has also gained significant traction in the protective clothing market. Sponge-like, anti-tear, and durable materials are applied in single or double layers in the protective clothes. Similarly, featherweight textile, along with high compression, chlorine resistant, and moisture management property, has witnessed high demand in the sportswear industry.

In addition, the application of knitted fabric has been increasing in denim garments, as consumer preference is shifting towards wrinkle-resistant, flexible, soft, and comfortable textile. The rising importance of synthetic fibers in the construction and apparel industries is expected to propel the growth of the market in the upcoming years. Application of the fiber has been expanding in the construction industry as geotextiles in roof, walls, dams, and roads.

Moreover, thermal insulation and dust-resistant features of synthetic fiber make it ideal for the production of curtains, napkins, carpets, and table clothes. The implementation of artificial intelligence (AI) has been increasing in this industry. It helps to predict the properties and the quality of the product before manufacturing the actual textile. AI plays an important role in the quality inspection of textile, which reduces errors and expenses.

The fast adoption of 3D knitting machines in the industry has increased the productivity of the manufacturers. This machine can knit multiple yarns at the same time by using digitally stored information. This technology makes customization easier and saves both operating time and costs. These technological developments are expected to foster market growth over the world. However, rising cotton price and counterfeit products can hamper the growth of the industry in the near future.

Product Insights

Weft-knit fabric dominated the industry with a share of more than 60.0% in 2018. Low cost, better elasticity, and simpler production process make it more preferable among the manufacturers. It includes different types of stitches such as plain or jersey, rib, purl, interlock, double knit, and circular knitting. Weft knitting is commonly used for underwear, pajamas, jumpers, scarves, hats, and gloves. Over the past few years, circular knitting machines have gained significant importance in the seamless hosieries and underwear manufacturing industry.

The warp-knit products are expected to witness the fastest CAGR of 6.4% from 2019 to 2015. Warp knitting is used in several industries including apparel, inner wears, shoes, household, automotive, and industrial. The rapid growth of the automotive, construction and manufacturing industries is expected to fuel the segment growth. Different types of warp knitting include tricot knits, raschel knit, crochet knit, and Milanese knit.

Application Insights

As of 2018, the technical application segment held the largest share of over 80.0%. Packaging, automotive, manufacturing, household, construction, and medical are the major applications in the technology sector. The raschel and crocheting knitting technology ensures safe and scratches free handling of sensitive components due to its knots free property. Therefore, it gained significant popularity in the packaging industry. Knitted bags and sacks are used for the shipment of industrial and food products.

One of the major applications of the product also lies in the automotive industry. The spacer fabric is widely used in the production of car seats, airbags, protective lining over wires, and roof due to its cushioning feature. These textiles are used in tires, filters, mats, seat belts, and soundproof engine. Rapid growth of the automobile industry is expected to boost the demand for the product in the near future.

Knitted fabric has a wide application as home textiles in the household sector, including products such as home cushion, curtains, carpets, dust bags, dust covers, and door mattress. Synthetic material is gaining popularity in curtain manufacturing due to its light resistance property. Rising per capita income in developing countries is anticipated to fuel the demand for home textile in the upcoming years.

The product has gained significant importance in medical textiles. It has a wide application in the production of bandage, plasters, hospital laundry bags, wheelchairs covers and seating, medical mattresses, and orthopedic support by using the 3D spacer, 4D spacer, meshes, plain, and brushed fabrics. Furthermore, these fabrics have a wide usage as implantable medical textiles such as artificial ligaments, artery, veins, sutures, hernia sheets, artificial elbows, and hip joints. The rapid progress of the medical industry is projected to boost the demand for the product.

Regional Insights

As of 2018, Asia Pacific dominated the knitted fabric market and accounted for 70.2% share of the total revenue. China holds the largest share of all the countries in the world. This nation is one of the top exporters of the clothing industry across the world. It represents one-third textile and apparel import of Europe. Manufacturers in this country are shifting towards automation and digitalization for high high-quality knitting textiles.

Other than China, India and Bangladesh are also prominent markets for knitwear. Favorable regulatory frameworks, government initiatives, and low labor costs have accelerated the growth of the industry in this region. In addition, growing manufacturing, construction, and automotive industries in the region is expected to fuel the demand for the product in the near future.

Key Companies & Market Share Insights

Key players of this industry include Baltex; Jong Stit Co., Ltd.; Georg and Otto Friedrich GmbH; Zhejiang Chaoda Warp Knitting Co., Ltd.; ABHINANDAN KNITS PVT LTD.; Haining Jinmao Warp Knitting Co., Ltd.; Guilford; Loyal Textile Mills Ltd.; TORAY INDUSTRIES, INC.; Pacific Textiles Holdings Limited; Teejay Lanka PLC; and SSM Industries. It is a highly fragmented market, which includes a large number of small producers and a few large producers.

However, the large players hold a significant share in the market. Over the past few years, manufactures of this industry are focusing on product development to widen the application sector. For instance, a U.K. based company, Baltex has been focusing on the innovation of Advanced Surface Technology (AST), especially on 3XD Spacer Fabrics. Furthermore, the company is developing sustainable fabrics by using biopolymers.

Knitted Fabric Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 25.3 billion

Revenue forecast in 2025

USD 35.7 billion

Growth Rate

CAGR of 6.0% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; Netherlands; China; India; Brazil; UAE

Key companies profiled

Baltex; Jong Stit Co., Ltd.; Georg and Otto Friedrich GmbH; and Zhejiang Chaoda Warp Knitting Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels, and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global knitted fabric market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Weft-knit

-

Warp-knit

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Technical

-

Household

-

Fashion & Clothing

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global knitted fabric market size was estimated at USD 25.3 billion in 2019 and is expected to reach USD 28.4 billion in 2020.

b. The global knitted fabric market is expected to grow at a compounded annual growth rate of 6.0% from 2019 to 2025 to reach USD 35.7 billion in 2025.

b. Asia Pacific dominated the knitted fabric market with a share of 72.6% in 2019. Favorable regulatory frameworks, government initiatives, and low labor cost have accelerated the growth of the industry in this region.

b. Some key players operating in the knitted fabric market include Baltex; Jong Stit Co., Ltd.; Georg and Otto Friedrich GmbH; and Zhejiang Chaoda Warp Knitting Co., Ltd.

b. Key factors driving the knitted fabric market growth include increasing importance of knitted fabric in the automobile, construction, manufacturing, and medical sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.