- Home

- »

- Homecare & Decor

- »

-

Knife Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Knife Market Size, Share & Trends Report]()

Knife Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Folding Blade, Fixed Blade, Side Slide), By Material (Steel, Titanium, Ceramic), By Size, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-949-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Knife Market Summary

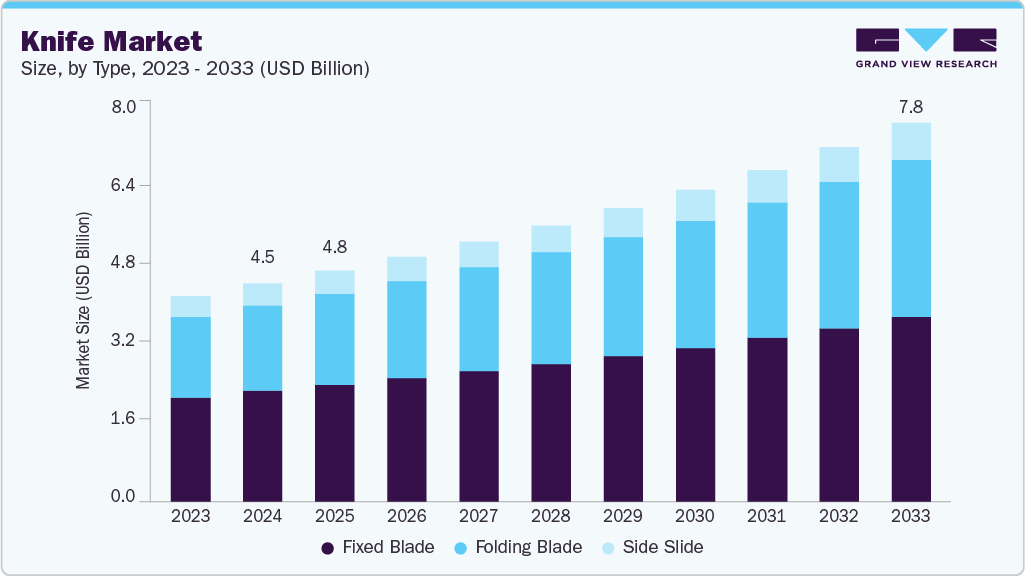

The global knife market size was estimated at USD 4,482.3 million in 2024 and is projected to reach USD 7,790.2 million by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The rising number of restaurants and eateries across major regions is expected to drive the growth of the knife industry.

Key Market Trends & Insights

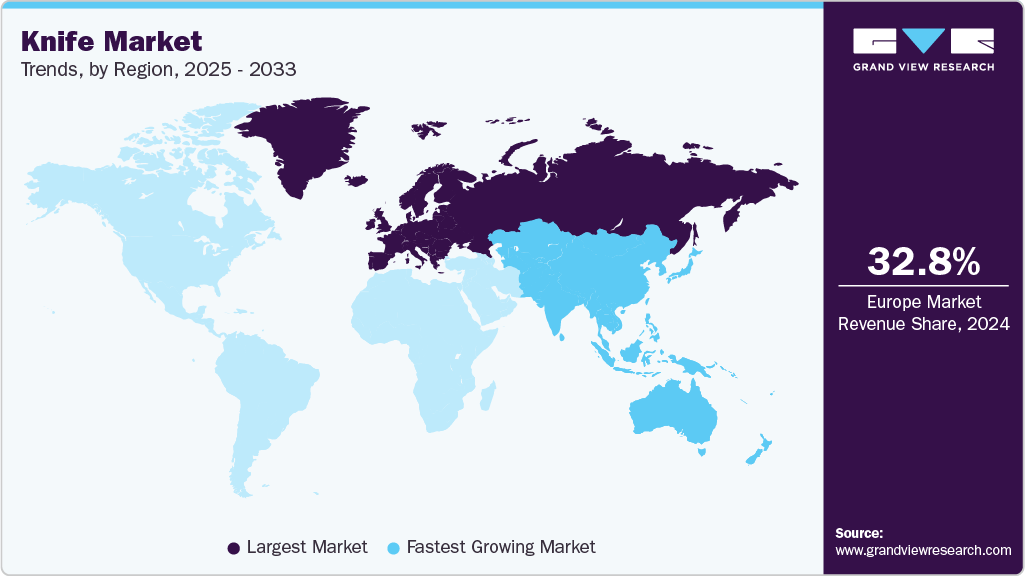

- The knife market in Europe held the largest market share of 32.76% in 2024.

- The knife market in the UK is expected to grow at a significant CAGR from 2025 to 2033.

- By type, the fixed blade segment accounted for a revenue share of 50.66% in 2024.

- By size, the 6-9 inch knives segment held the largest share of 49.27% in 2024.

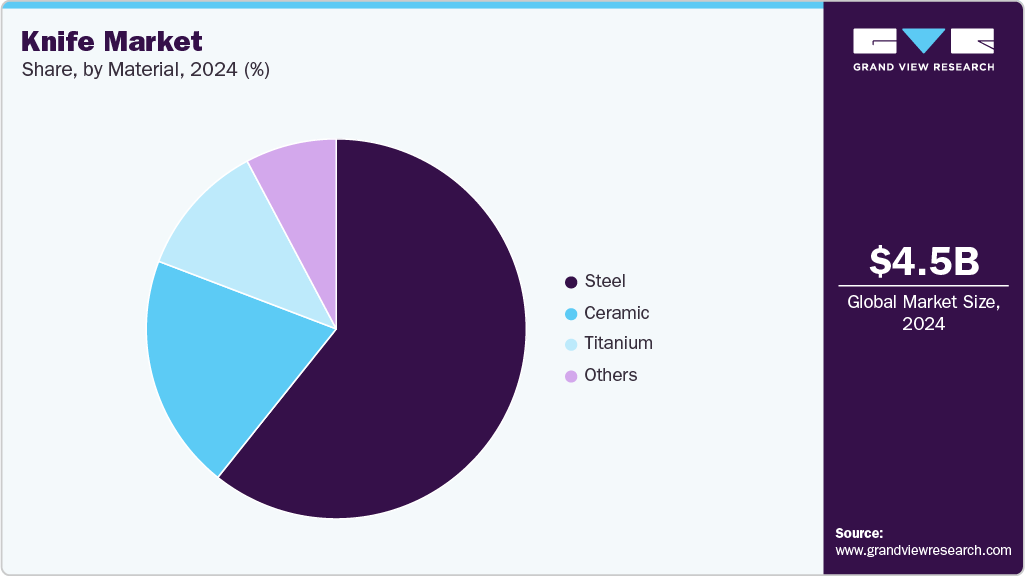

- By material, the steel material segment accounted for a revenue share of 60.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,482.3 Million

- 2033 Projected Market Size: USD 7,790.2 Million

- CAGR (2025-2033): 6.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Increased knife applications, combined with the availability of a diverse range of knives for various purposes, are expected to boost the global market. The construction industry extensively uses retractable and folding knives. As a result, significant development in the construction industry is expected to drive market growth. In addition, the increased importance of visual appeal in various dishes is expected to drive the demand for kitchen knives over the forecast period. Knives create unusual cuts such as brunoise, chiffonade, julienne, and macedoine, a common global trend. The introduction of advanced knives with various blades is likely to impact the knife industry over the forecast period.A growing interest in camping is expected to increase the demand for special kinds of knives essential in these situations. The most commonly used knives in these scenarios are dagger knives, Swiss Army knives, and pocket knives. Campers commonly use knives made from high-carbon stainless steel, which provides sturdiness, is lightweight, and comes with a sheath and grip handle. The Dyrt is an app for camping and a source for getting camping information.

According to a camping report published by Dyrt in 2022, over 66 million individuals went camping in the U.S. in 2021, with over 8.3 million trying camping for the first time. A camper visited The Dyrt every second during this period of increased camping. Due to increased camping activities, the demand for camping equipment such as camping knives has also increased as they help chop food, build a fire, build a tent or shelter. Thus, increased camping activities are expected to drive market growth over the forecast period.

The growing popularity of dining in restaurants and cafes presents attractive expansion potential for eating establishments worldwide. As the number of restaurants grows, so does the demand for modern cutlery and culinary gear, such as knives. Consumers’ need for convenience, socializing, and high-quality food and service has contributed to the expansion of the restaurant industry. As a result, restaurant owners are investing in new, high-quality cooking equipment.

The rapid development of urban areas, coupled with consumers’ preference for a wide variety of cuisines, has increased the number of cafes, specialty coffee shops, and quick-service restaurants (QSRs) globally. Moreover, the rising purchasing power of consumers, backed by the trend of dining out, most notably in emerging economies such as India, China, Indonesia, and Japan, is expected to positively impact the global market over the forecast period.

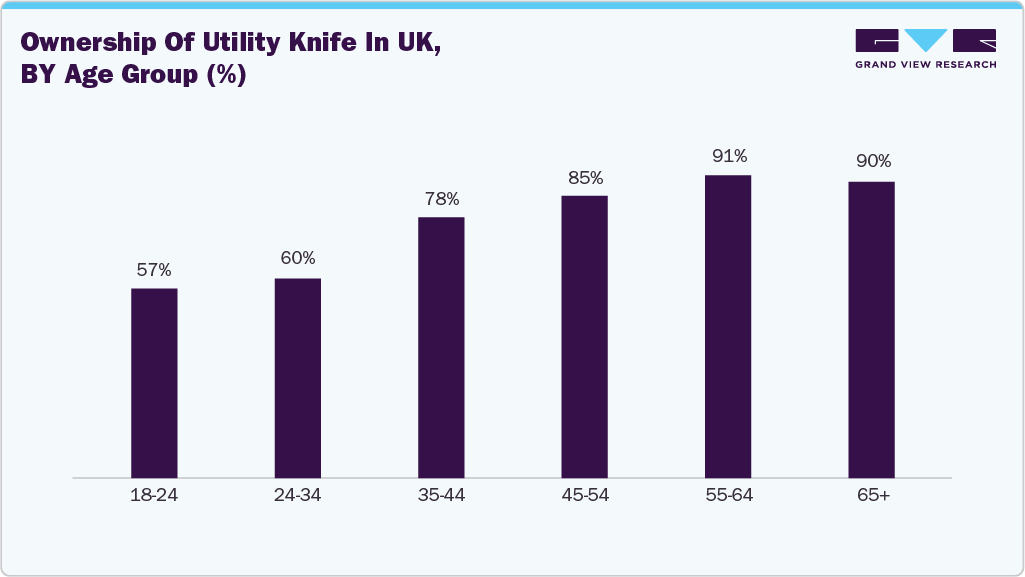

Consumer Surveys & Insights

The household ownership of Stanley or similar utility knives in the United Kingdom exhibited notable variation across different age groups. Among individuals aged 18 to 24, approximately 57% reported having such a tool at home, while this figure slightly increased to 60% among the 25-34 age group. Ownership levels rose more significantly in middle-aged segments, with 78% of respondents aged 35-44 and 85% in the 45-54 bracket indicating possession. The highest ownership rates were recorded among older adults, with 91% in the 55-64 age group and 90% among those aged 65 and above. The trend indicates a positive correlation between age and the likelihood of owning a utility knife.

The gender-based preferences for eating utensils during Asian meals in the United States revealed notable differences. Among male respondents, 73% favored using a fork and knife, while 27% chose chopsticks. Conversely, a larger proportion of female participants, 80%, preferred using a fork and knife, whereas only 20% opted for chopsticks. These insights reflect a stronger inclination among women toward traditional Western utensils in such dining scenarios.

Trump Tariff Impact

In February 2025, President Trump issued an executive order escalating tariffs on imported steel and aluminum from 25 % to 50 %, under Section 232 of the Trade Expansion Act. This tariff adjustment directly affects manufacturers reliant on foreign-sourced metals, including producers of EDC and kitchen knives. Small American brands such as WESN, Buck Knives, and The James Brand, which import critical steel alloys from Sweden, China, and Europe, have cautioned that although immediate price increases have been avoided via absorbing costs, prolonged policy implementation may compel consumer retail pricing to rise or provoke a shift to domestic sourcing channels.

Notably, even U.S.-produced steel is expected to inflate in cost due to increased domestic demand and limited supply, offsetting tariffs and echoing trends observed during the 2018 tariff regime. Should these tariffs persist, the market is likely to undergo a notable cost shift. Both imported and domestically produced blades could see price increases passed to consumers, particularly affecting premium and mid-range segments where steel composition constitutes a higher total cost.

Type Insights

The fixed blade category accounted for a revenue share of 50.66% in 2024. Due to their strength, they are preferred for hard outdoor activities such as hunting, prying windows, and cutting wood. Also, apart from widespread use in food preparation for cutting vegetables and meat, fixed-blade knives are used as cutlery knives. The growing number of restaurants, the increasing trend for eating out, and the surge in household demand are some prominent factors that positively drive market growth.

The folding blade segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033. The Swiss Army Knife is a widely popular folding blade knife, which is still in demand due to its multi-tool capabilities. Victorinox, Europe’s largest knife manufacturer, produces around 10 million Swiss pocket knives yearly and exports to more than 120 countries. The increasing popularity of camping and other adventure activities contributes positively to the demand for folding blade knives.

Size Insight

The 6-9 inch knives category held the largest share of 49.27% in 2024. This size range is particularly favored for its versatility, suitable for slicing, dicing, and chopping, making it a preferred choice among home cooks and culinary professionals. With increased interest in home cooking and gourmet meal preparation post-pandemic, demand for medium-sized chef knives and multipurpose blades has steadily grown. Moreover, the rising culinary content across social media platforms, where professional chefs often endorse 6-9 inch knives as essential tools for precision and control, is one of the factors driving market growth.

The sale of 3-6 inch knives is expected to grow at a CAGR of 7.1% from 2025 to 2033, driven by growing consumer preference for knife sets rather than individual purchases, where smaller blades are often included. In addition, younger consumers and urban households are leaning toward compact, multifunctional kitchen tools due to space constraints and changing cooking habits. Small knives are also gaining traction in outdoor and EDC (everyday carry) applications, supported by increasing interest in do-it-yourself (DIY) activities and recreational camping. Innovations in blade materials and ergonomic handle designs have fueled this category’s growth, further driving the knife industry's growth.

Application Insights

The knives used in the kitchen held the largest share of 46.24% in 2024. The growing restaurant industry has been one of the primary reasons for the rise in demand for kitchen knives. With the surge in demand for eating out, the number of establishments has been growing in the restaurant industry. Furthermore, the demand for kitchen knives from households has increased due to the increasing global population. The increase in demand for knives across various kitchens is driving market growth.

The sale of knives for outdoor/survival/hunting applications is expected to grow at a CAGR of 7.1% from 2025 to 2033. Survival knives are widely used during camping and adventure activities. The popularity of camping and adventure activities has been growing globally, especially among the young population. The growing interest in camping, trekking, and other adventure activities is expected to surge the demand for survival knives in the coming years. Thus, the rising demand for knives for outdoor activities is expected to drive the growth of the kitchen industry over the forecast period.

Distribution Channel Insights

Knives distributed through supermarkets & hypermarkets accounted for a revenue share of 38.06% of the knife industry in 2024. These retail environments offer broad product visibility, physical access for trial or comparison, and seasonal discounts that drive high-volume sales. These channels remain essential for mass-market and entry-level knives, especially in emerging economies where offline retail still commands consumer trust. Their prominence is supported by strategic product placements, bundle deals, and the growing trend of cross-category selling, knives being sold alongside kitchenware, groceries, or cooking appliances, thus reinforcing footfall and conversion rates.

Knives distributed through online/e-commerce channels are expected to grow at a CAGR of 8.4% from 2025 to 2033. Digital platforms provide an expansive assortment of brands, consumer reviews, and competitive pricing, enabling informed purchase decisions. The rise of direct-to-consumer (D2C) knife brands and subscription-based culinary kits has accelerated this shift, further driving market growth. Online sales have been further stimulated by influencer marketing, unboxing content, and targeted advertisements on social media. Furthermore, logistics advancements and easy return policies have reduced the perceived risk of buying knives without physical inspection, making online retail a robust growth engine for premium and specialty knife segments. These factors are expected to drive global market growth over the forecast period.

Material Insights

The steel material segment accounted for a revenue share of 60.72% in 2024. Carbon steel is increasingly being replaced with stainless steel knives. The stainless steel material is widely available and less expensive than other knife materials. With a growing demand for stainless steel knives, companies have been continuously investing in increasing the production of stainless steel knives. Damascus steel is another type of steel blade gaining traction in the knife industry. The Damascus steel knives are extremely strong and sharp. As a result, their demand has been surging in the global market, further driving the growth of the knife industry.

The ceramic material segment is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033. Ceramic knives are lightweight and made from Zirconium Dioxide, one of the hardest substances on Earth, so their blades remain sharp for a longer period compared to other materials. Ceramic knives have supreme sharpness and are suitable for dicing and chopping with precision in the kitchen. For these purposes, ceramic knives have found a separate place in the market, and hence, players continue to invest in manufacturing and launching ceramic knives.

Regional Insights

The knife market in Europe held the largest market share of 32.76% in 2024. An increase in the number of outdoor activities, including camping and hiking, that require different kinds of knives is positively impacting the growth of the European market. Moreover, growing urbanization and increasing expenditure on home renovation projects drive the demand for knives in Germany. Furthermore, major factors driving market growth are growing household expenditure on cookware and cutlery, including knives, a flourishing hospitality industry, and a stay-at-home mindset that has motivated people to invest more in kitchen items.

UK Knife Market Trends

The knife market in the UK is expected to grow at a significant CAGR from 2025 to 2033. In the UK, the growing number of nuclear families and single-person households, coupled with the increasing number of households undergoing kitchen remodeling and renovation projects, is expected to generate significant demand for knives over the forecast period. The availability of numerous players offering various types of knives is expected to drive market growth. For instance, Heinnie Haynes, one of the prominent suppliers of fixed-blade knives in the UK, offers fixed blade knives of various brands, including WÜSTHOF, Kai Europe GmbH, Buck, Mercer Tool Corp., and Civivi, among others.

North America Knife Market Trends

The knife market in North America is experiencing growth driven by several key factors. The increasing demand for stylish, sleek, and comfortable knives is fueling the growth of the North American market. There has been a rising preference for knives made from steel as these are easy to handle for various applications, including kitchen, sporting, and adventure. This trend will continue to drive innovation and new product development among players, thereby fueling the knife industry's growth.

Asia Pacific Knife Market Trends

The knife market in Asia Pacific is expected to grow at the fastest CAGR of 7.5% during the forecast period. The increased popularity of hand-forged knives in countries such as India, Myanmar, and Bangladesh can be ascribed to increased demand for knives in the region. Furthermore, in nations such as Japan and China, the popularity of specialty knives, such as the Japanese set of knives, used in cooking, is also growing. This is expected to drive the Asia Pacific market growth over the forecast period. In addition, urban consumers in Southeast Asia have grown accustomed to the convenience of food delivery. Thus, an increase in residential and commercial kitchens will drive the market for kitchen knives.

Key Knife Company Insights

The knife industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in the market are Victorinox AG, Ed. Wüsthof Dreizackwerk KG, Zwilling J.A. Henckels AG, Yoshikin Global Corporation, Kai Corporation, MAC Knife, Inc, and others. Leading brands like Victorinox AG, Ed. Wüsthof Dreizackwerk KG and Zwilling J.A. Henckels AG focus on premium product offerings and innovations, targeting affluent consumers who prioritize quality and durability.

-

Victorinox AG is a Swiss-based company renowned globally for its iconic Swiss Army knives. Founded in 1884 and headquartered in Ibach, Switzerland, the firm has expanded into kitchen cutlery, watches, travel gear, and fragrances. Victorinox manufactures over 120,000 knives daily and exports to more than 120 countries. Its products are known for multifunctionality, durability, and precision engineering. The company remains family-owned and emphasizes sustainable production practices and long-term steel and handle materials innovation, particularly within its kitchen knife division.

-

Ed. Wüsthof Dreizackwerk KG, commonly known as Wüsthof, is a German knife manufacturer founded in 1814 and based in Solingen-Germany’s historic blade-making city. The company is best known for its forged kitchen knives, especially the Classic and Ikon lines. Wüsthof’s knives are produced using precision robotics and laser-controlled sharpening processes, ensuring consistency and edge retention. With global distribution in over 80 countries, the brand is a staple in both professional kitchens and upscale home culinary markets.

Key Knife Companies:

The following are the leading companies in the knife market. These companies collectively hold the largest market share and dictate industry trends.

- Victorinox AG

- Ed. Wüsthof Dreizackwerk KG

- Zwilling J.A. Henckels AG

- Yoshikin Global Corporation

- Kai Corporation

- MAC Knife, Inc.

- Dalstrong Inc.

- Cutco Corporation

- Mercer Tool Corp.

- Dexter-Russell, Inc.

Recent Developments

-

In June 2025, MAC Knife, Inc. launched the Matsato Knife, a premium control Japanese chef knife. Through advanced ergonomic knife design and traditional Japanese forging techniques, the Matsato Knife sets new standards in culinary precision.

-

In July 2024, Yoshikin Global Corporation launched the new color “GLOBAL CAMP Black series” from “GLOBAL CAMP”. The newly added GLOBAL CAMP Black series has two types: Utility Knife and Serrated Knife. GLOBAL CAMP Black series knives use a processing technique called “oxidation coloring” to change the thickness of the stainless steel’s passive film, giving it the black color.

-

In February 2024, Victorinox launched the Carving Knife Damast. This knife is made of Damasteel, produced in layers for incredible toughness, and is part of the Victorinox household knives range. With its lively Thor pattern, the Damasteel used for this knife cleverly combines corrosion resistance and superior strength.

Knife Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 4,753.6 million

Revenue forecast in 2033

USD 7,790.2 million

Growth rate (revenue)

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, size, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Victorinox AG; Ed. Wüsthof Dreizackwerk KG; Zwilling J.A. Henckels AG; Yoshikin Global Corporation; Kai Corporation; MAC Knife, Inc.; Dalstrong Inc.; Cutco Corporation; Mercer Tool Corp.; Dexter-Russell, Inc

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Knife Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global knife market based on type, material, size, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Folding Blade

-

Fixed Blade

-

Side Slide

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Steel

-

Titanium

-

Ceramic

-

Others

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

3-6 Inches

-

6-9 Inches

-

9-12 Inches

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Kitchen

-

Outdoor/Survival/Hunting

-

Tactical/Military

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Department Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global knife market was estimated at USD 4,482.3 million in 2024 and is expected to reach USD 4,753.6 million in 2025.

b. The global knife market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 7,790.2 million by 2033.

b. Europe dominated the knife market in 2024 with a share of about 32.76%. European consumers prioritize quality craftsmanship and functionality, supporting demand for forged knives and high-grade materials. Additionally, the region benefits from structured retail networks, rising interest in premium kitchenware, and culinary tourism.

b. Key players in the knife market are Victorinox AG, Ed. Wüsthof Dreizackwerk KG, Zwilling J.A. Henckels AG, Yoshikin Global Corporation, Kai Corporation, MAC Knife, Inc, Dalstrong Inc, Cutco Corporation, Mercer Tool Corp., and Dexter-Russell, Inc, among others.

b. Key factors that are driving the knife market growth include rising demand for outside food due to hectic work schedules, the rising number of restaurants, and increased knife applications, combined with the availability of a diverse range of knives for various purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.