- Home

- »

- Communication Services

- »

-

K-12 Education Market Size, Share & Growth Report, 2030GVR Report cover

![K-12 Education Market Size, Share & Trends Report]()

K-12 Education Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Elementary School (K-5), Middle School (6-8), High School (9-12)), By Institution (Public, Private), By Delivery Mode (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-186-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

K-12 Education Market Summary

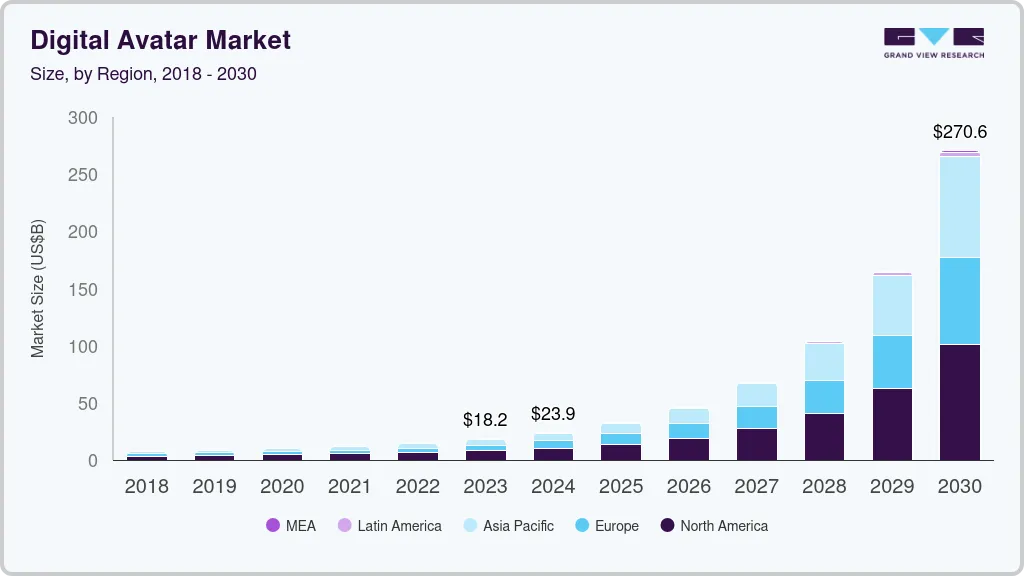

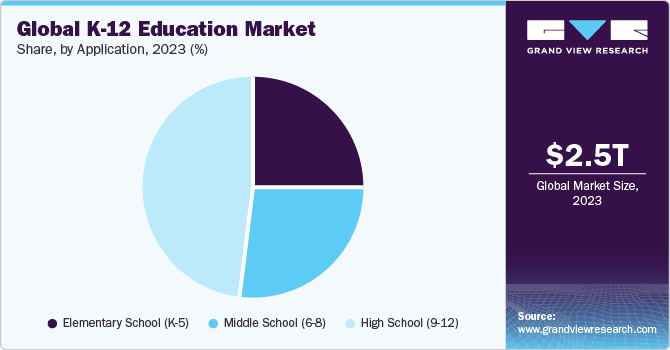

The global K-12 education market size was valued at USD 2.50 trillion in 2023 and is anticipated to reach USD 5.66 trillion by 2030, growing at a CAGR of 12.5% from 2024 to 2030. The market growth is driven by the growing adoption of game-based learning, which enhances engagement and motivation among students while fostering personalized learning experiences and developing essential skills such as problem-solving and critical thinking.

Key Market Trends & Insights

- North America dominated the market and accounted for a 36.5% share in 2023.

- By application, the high school (9-12) segment accounted for a revenue share of 47.7% in 2023.

- By institution, the public institutes segment accounted for the largest market revenue share in 2023.

- By delivery mode, the offline segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.50 Trillion

- 2030 Projected Market Size: USD 5.66 Trillion

- CAGR (2024-2030): 12.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the integration of advanced technologies, such as artificial intelligence, which enables personalized tutoring and real-time feedback, and virtual/augmented reality, creates immersive learning environments. Additionally, there is an increase in government initiatives globally, with a focus on increased funding for K-12 education, STEM education, and the implementation of educational reforms aimed at enhancing teaching methods and overall education quality.

EdTech solutions are increasingly being adopted for K-12 education to overcome challenges regarding student learning and make students more independent and self-directed. EdTech is transforming K-12 education through personalized learning platforms, interactive tools, and real-time feedback, addressing challenges, and enhancing the learning experience. For instance, in November 2021, a survey conducted by the National Center for Education Statistics (NCES) stated that about 35% of the public schools agreed that technology helped students’ self-pace their courses. The data also suggested that 40% of the schools mentioned their students learned more actively, and another 27% claimed technology increased critical thinking capabilities.

Increased government investment in K-12 education is a major driver of market growth, funding schools with additional resources for teachers, technology, and educational materials. This enhanced funding results in improved infrastructure, curriculum development, and teacher training, thus attracting more students and families to the education system. Governments are strategically allocating funds to specific areas such as early childhood education, STEM education, and vocational training, generating new demand for specialized services and products within the market. Furthermore, increased government funding often encourages private-sector partnerships, providing opportunities for businesses including educational technology companies, content creators, and service providers to meet the expanding needs of schools and students.

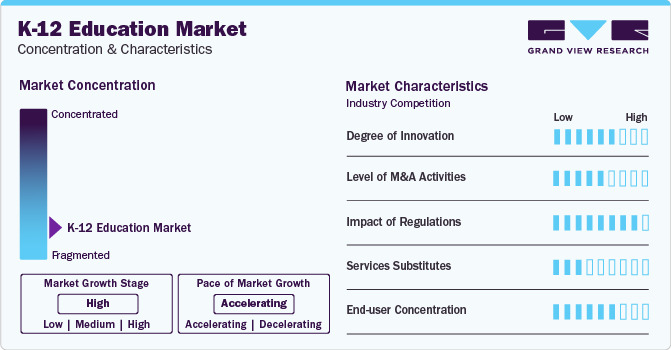

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements. Integration of innovations such as AI, AR/VR, and personalized learning platforms is facilitating more engaging and adaptive learning experiences for students. The curriculum is evolving to prioritize essential skills such as critical thinking, problem-solving, and digital literacy, preparing students for future employment. However, moving beyond the conventional approach of memorizing information through repetition, education is shifting towards project-based learning methodologies, encouraging hands-on projects and real-world problem-solving to foster deeper understanding and creativity. Additionally, there is a growing recognition of the importance of mental health and social-emotional skills, prompting the implementation of programs that promote resilience, empathy, and effective communication among students.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, including educational publishers, curriculum providers, and technology companies. Major entities are pursuing these strategies to expand their market share by acquiring new customer bases, diverse product portfolios, and additional distribution channels. The surge in educational technology (EdTech) is a significant driver of M&A, with companies acquiring smaller EdTech startups to integrate innovative technologies such as adaptive learning tools and personalized learning programs.

Regulations play a crucial role in the K-12 education system by ensuring standardized quality through minimum standards for curriculum, teacher qualifications, and student outcomes. This guarantees a basic level of education for all students, regardless of their geographical location or socioeconomic background. Additionally, regulations contribute to equity and access by promoting inclusive policies for special needs education, language minorities, and anti-discrimination measures, addressing historical inequalities.

There is no direct substitute for K-12 education as it fulfills essential roles in children's development. K-12 education imparts foundational knowledge and skills in core subjects like mathematics, language arts, science, and history, fostering critical thinking and effective communication skills essential for various career paths. Additionally, it plays a pivotal role in preparing students for higher education and the workforce by offering career counseling and guidance, facilitating the exploration of interests, and the development of skills relevant to future opportunities.

End-user concentration is a critical consideration in the market due to its limited and specific customer base focusing on students within a particular age range. Capturing and maintaining student attention is vital for effective learning, making strategies to improve concentration a priority for educators and product developers.

Application Insights

The high school (9-12) segment led the market and accounted for a revenue share of 47.7% in 2023. The segment's growth is driven by an increased focus on college and career readiness, prompting a demand for programs that cultivate critical skills such as problem-solving and communication. The integration of technological advancements, significantly in educational technology tools, places high schools at the forefront of personalized learning and academic improvement. Diversification in educational pathways, including vocational programs and internships, attracts a broader student base, while the pressure of standardized testing and college admissions fuels demand for test preparation services. Additionally, government initiatives investing in high school education contribute to the segment’s growth.

The middle school (6-8) segment is predicted to foresee significant growth in the forecast period. The rising demand for quality education is driving the segment's growth as parents increasingly recognize its crucial role in their children's academic achievement. Thus, the increased awareness leads to a greater demand for well-designed and effective educational programs. Moreover, the middle school segment benefits from the growing emphasis on STEM (science, technology, engineering, and mathematics) education globally, playing a key role in fostering strong STEM programs by introducing students to these subjects at an early stage. Thus, quality education and STEM education allow the middle school segment to expand in the forecast years substantially.

Institution Insights

The public institutes accounted for the largest market revenue share in 2023, propelled by government initiatives such as Sarva Shiksha Abhiyan (SSA) and the Right to Education (RTE) Act, aiming to universalize access to quality education. Increased funding for public schools has enhanced infrastructure, teacher training, and learning materials. Public schools offer education at a lower cost than private schools, specifically benefitting rural areas and low-income families. Furthermore, a focus on equity and inclusion, standardized curriculum, and quality control measures contribute to the growth of public schools, supported by government investments in teacher training programs for a more professional and competent teaching workforce.

The private segment is poised for significant growth, driven by a rising demand for quality education among parents who seek alternatives to public schools. Private schools, offering smaller class sizes, experienced teachers, and curriculum, appeal to parents aiming for academic excellence for their children. Private schools emphasize individualized learning, offering flexibility in curriculum and teaching methods to cater to each student's unique needs and learning styles. Furthermore, the private sector's focus on extracurricular activities and integration of educational technologies is driving the segment's growth in the market.

Delivery Mode Insights

The offline segment accounted for the largest market revenue share in 2023. Traditional offline classrooms play a crucial role in the social and emotional development of the K-12 age group, facilitating peer interaction, relationship building, and hands-on learning experiences. Parental preferences for the structure of traditional classrooms, concerns about online safety, and challenges related to regulatory compliance and accreditation contribute to the continued dominance of the offline segment. Additionally, the established infrastructure of offline schools and financial barriers for families to afford online courses further support the prominence of the offline education model.

The online segment is projected to witness significant growth in the coming years. Increased internet penetration and affordability are expanding access to online learning platforms, transcending geographical and socioeconomic boundaries. Growing awareness among parents and educators about the benefits of online learning, including personalized experiences, convenience, flexibility, and access to a diverse range of courses, is fueling the demand. Moreover, the COVID-19 pandemic has accelerated the demand for online education as a viable and preferable alternative to traditional classroom settings. Additionally, the online sector offers a broader array of specialized courses and accommodates diverse learning styles, further contributing to its anticipated growth.

Regional Insights

North America dominated the market and accounted for a 36.5% share in 2023. The region stands at the forefront of technological advancements in education, actively integrating digital tools and platforms such as interactive whiteboards and adaptive learning software. Investment in EdTech companies, supported by substantial venture capital and government funding, fosters innovation and diverse educational solutions. High internet penetration and digital infrastructure enable widespread access to technology, facilitating online learning opportunities, resource sharing, and remote collaboration.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period, driven by a vast and rapidly growing population, specifically in countries such as India and China. The surge in population fuels the demand for educational opportunities at all levels, with a focus on K-12 education. The region has witnessed increased internet and mobile device penetration, accelerated by the impact of the COVID-19 pandemic, resulting in the widespread adoption of cost-effective and accessible e-learning solutions in K-12 education. Additionally, several Asian governments actively invest in K-12 education improvement through initiatives such as curriculum modernization, teacher training programs, and digital infrastructure development, further supporting the growth of the K-12 education market.

Key Companies & Market Share Insights

Some of the key players operating in the market include BYJU’S; Microsoft Corporation; Adobe Inc; Pearson; Samsung Electronics Co., Ltd.

-

BYJU'S operates its business mainly through its mobile app, where it provides specified educational content according to the learning phase of students. BYJU'S functions as a brand name for Think and Learn Private Ltd. The company's primary offering includes educational content for school students from classes 1 to 12 (primary to higher secondary).

-

Microsoft, a global technology provider, has a substantial presence in the market, offering a range of products and solutions tailored to enhance learning experiences. The company provides a comprehensive suite of education-focused tools and applications, such as Microsoft 365, Teams, and OneNote Class Notebook. These tools facilitate collaborative learning, content creation, and communication among students and educators.

-

Nearpeer andCoding with Kids are some of the emerging market participants in the market.

-

Nearpeer focuses on providing affordable, high-quality online courses in Pakistan and the Middle East. They offer various test prep courses, skill-based courses, and high-school and intermediate-school curricula.

- Coding with Kids is a coding academy for kids and teens aged 5-18, offering educational programs both online and in-person at various locations across the U.S.

Key K-12 Education Companies:

- Oracle

- Pearson

- Samsung Electronics Co., Ltd.

- Adobe Inc.

- Microsoft

- D2L Corporation

- IBM Corporation

- McGraw Hill LLC

- Dell Inc.

- BYJU'S

Recent Developments

-

In November 2023, Arada, a property development company in the United Arab Emirates, joined forces with Innoventures Education, a private education provider, to launch a K-12 international school in Sharjah. The school was aimed to have a capacity of 2,000 students and will offer a curriculum encompassing both American and International Baccalaureate (IB) studies.

-

In November 2023, VIBGYOR Group of Schools, a CISCE, CBSE, and CAIE schools in India, partnered with the Bank of Baroda to provide K-12 education benefits to employees’ children. This collaboration streamlined the admission process for eligible students across all 36 VIBGYOR schools in India, making it easier for Bank of Baroda employees to access quality education for their kids.

-

In September 2023, Adobe Inc, partnered with the Union Education Ministry of India to provide free access to Adobe Express Premium for all K-12 schools. The platform enables creativity and essential digital skills in students, preparing them for various careers. It also enhances teaching by enabling educators to create dynamic learning materials and offers professional development opportunities for upskilling.

K-12 Education Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.79 trillion

Revenue forecast in 2030

USD 5.66 trillion

Growth rate

CAGR of 12.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, institution, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Australia; South Korea; New Zealand; Brazil; Mexico; KSA; UAE; South Africa.

Key companies profiled

Oracle; Pearson; Samsung Electronics Co., Ltd.; Adobe Inc.; Microsoft; D2L Corporation; IBM Corporation; McGraw Hill LLC; Dell Inc.; BYJU'S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

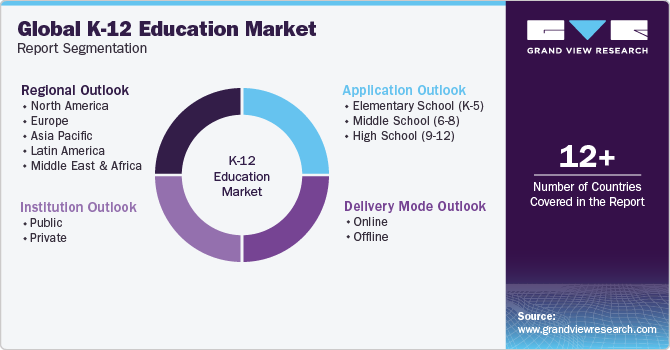

Global K-12 Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global K-12 education market report based on application, institution, delivery mode, and region:

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Elementary School (K-5)

-

Middle School (6-8)

-

High School (9-12)

-

-

Institution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public

-

Private

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global K-12 education market size was estimated at USD 2.50 trillion in 2023 and is expected to reach USD 2.79 trillion in 2024.

b. The global K-12 education market is expected to grow at a compound annual growth rate of 12.5% from 2024 to 2030 to reach USD 5.66 trillion by 2030.

b. North America dominated the market and accounted for a 36.5% share in 2023. The region stands at the forefront of technological advancements in education, actively integrating digital tools and platforms such as interactive whiteboards and adaptive learning software. Investment in EdTech companies, supported by substantial venture capital and government funding, fosters innovation and diverse educational solutions.

b. Some key players operating in the K-12 education market include Oracle; Pearson; Samsung Electronics Co., Ltd.; Adobe Inc.; Microsoft; D2L Corporation; IBM Corporation; McGraw Hill LLC; Dell Inc.; BYJU'S.

b. Key factors driving the K-12 education market growth include a growing emphasis on personalized learning approaches and increase in the use of EdTech solutions in both academic and non-academic sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.