- Home

- »

- Medical Devices

- »

-

Japan Hemostats Market Size, Share, Industry Report, 2030GVR Report cover

![Japan Hemostats Market Size, Share & Trends Report]()

Japan Hemostats Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Thrombin-based Hemostats, Combination Hemostats), By Application (Orthopedic Surgery), By Formulation (Matrix & Gel Hemostats), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-215-6

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Hemostats Market Size & Trends

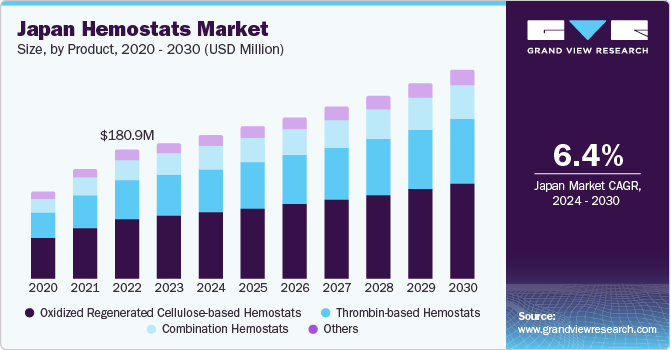

The Japan hemostats market size was valued at USD 190.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.40% from 2024 to 2030. Factors such as the growing aging population, the increasing prevalence of chronic conditions, and the rising number of surgical procedures in Japan are anticipated to boost the demand for effective hemostatic solutions across various medical interventions in Japan. Increase in chronic diseases like cardiovascular diseases, cancer, arthritis, osteoporosis, chronic respiratory diseases, & neurological diseases that necessitate the surgeries is anticipated to propel the industry growth. Various surgical interventions are available for medical concerns associated with these diseases. These surgeries use hemostatic agents to stop bleeding, which is anticipated to support market growth.

A recent study by Japan's Ministry of Health, Labor, and Welfare revealed a steady increase in the prevalence of chronic diseases among the Japanese population over the past decade. The study found that approximately 40% of Japanese adults suffer from at least one chronic condition, with cardiovascular diseases, diabetes, and cancer being the most common. This growing burden of chronic diseases is expected to fuel the demand for hemostatic products in Japan.

Moreover, the large number of surgical procedures being conducted across Japan is also expected to boost the demand for hemostats in the country. According to the article published by the Asian Plastic Surgery Sydney in April 2022, approximately 222,642 surgical procedures were performed in Japan in 2020.

Continuous development of innovative hemostats with improved efficacy, safety, and ease of use attracts healthcare providers and patients alike. Biodegradable hemostats, hemostatic foams, and hemostatic sealants hold the potential for market expansion. Furthermore, the growing adoption of MIS procedures, which cause less tissue damage and faster recovery, creates demand for hemostats specifically designed for these minimally invasive techniques. Japan has a high acceptance rate for MIS, further driving the market for compatible hemostats.

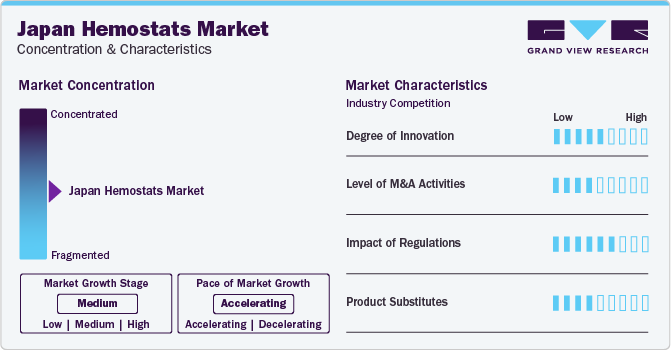

Market Concentration & Characteristics

Market growth stage is medium, and the pace of the market growth is accelerating due to the rising development of advanced products and increased adoption of these products across the country.

Manufacturers and companies operating in the country continuously innovate to provide advanced products. They are focusing on offering novel products. For instance, in March 2020, Ethicon, a business division of Johnson & Johnson, revealed the expected launch of SURGICEL POWDER ABSORBABLE HEMOSTAT in Japan. This hemostat is available in powdered form and is designed to stop bleeding fast.

The market is also witnessing several merger and acquisition activities. Companies are undertaking acquisitions & mergers to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Some of the major companies that have adopted this strategy include Integra LifeSciences, Medtronic, and Baxter.

Regulations for medical devices, including hemostats, are overseen by the regulatory authority of the country, the Pharmaceuticals and Medical Devices Agency (PMDA). Moreover, the Ministry of Health, Labour and Welfare (MHLW) is also involved in regulating the medical devices in Japan. These regulatory authorities ensures the quality, efficacy, and safety of medical devices

In the Japan hemostats market, sutures & staples, surgical energy devices, compression devices among others serve as substitutes.

Key market players such as Johnson & Johnson, Pfizer, B. Braun Melsungen AG, BD, Baxter, and Medtronic hold substantial share in the market. Their dominant presence is largely due to their well-established brands, financial position, and extensive distribution networks. For instance, Johnson & Johnson Services, Inc offers diverse products like SURGICEL Absorbable Hemostat, ENSEAL G2 Tissue Sealer, and Hemopatch Absorbable Hemostatic Patch among others.

Product Insights

The oxidized regenerated cellulose-based hemostats segment dominated the market and accounted for the largest market share of 46.46% in 2023. The dominance of this segment can be due to the proven efficacy and widespread adoption of these products. This segment is expected to remain dominant owing to its established effectiveness and wide range of applications. Furthermore, the cost-effectiveness of these hemostatic agents, relative to their clinical benefits, is a key factor contributing to their market dominance.

The combination hemostats segment is anticipated to show the fastest CAGR over the forecast period. The growth of the segment can be attributed to the advancements in this segment, including the launch of innovative products to address specific surgical needs. Furthermore, the increasing investments to develop new hemostat products and the advantages associated with using combination hemostats are driving this segment's growth.

Formulation Insights

The matrix and gel hemostats segment dominated the market and accounted for 37.82% revenue share of the market in 2023. This is attributed to its ease of application and effective control of bleeding in various surgical procedures. Its adaptability across different medical scenarios and efficient hemostatic properties contribute significantly to its leading position in the market.

The sponge hemostats segment is anticipated to grow fastest over the forecast period. The demand for sponge hemostats is expected to be driven by their wide application in various surgical processes such as orthopedic, general, and cardiovascular surgeries. Furthermore, the ease of use, biocompatibility, and effectiveness associated with sponge hemostats are anticipated to increase their popularity among end-users.

Application Insights

The orthopedic surgery segment held the largest revenue share of 31.82% in 2023. These surgeries often involve complex surgeries, such as joint replacements, fracture repairs, or spinal surgeries, which may result in significant bleeding. Thus, orthopedic surgery is a significant area where hemostatic agents are crucial in managing bleeding. Furthermore, the large number of orthopedic surgeries being conducted in Japan is anticipated to boost the segment growth in the coming years. According to the study published by the PLOS in December 2023, in Japan, 142,931 cruciate ligament (CL) surgeries were conducted from 2014 to 2021. The study further reports that the incidence of CL surgery in Japan has increased in these seven years.

The cardiovascular surgery segment shows the fastest CAGR over the forecast period. This is due to the increasing focus of companies operating in the market on developing advanced hemostatic & tissue-sealing agents tailored for cardiac surgeries. In addition, the rising prevalence of heart diseases and the subsequent rise in associated surgical interventions is expected to boost the segment growth in the coming years.

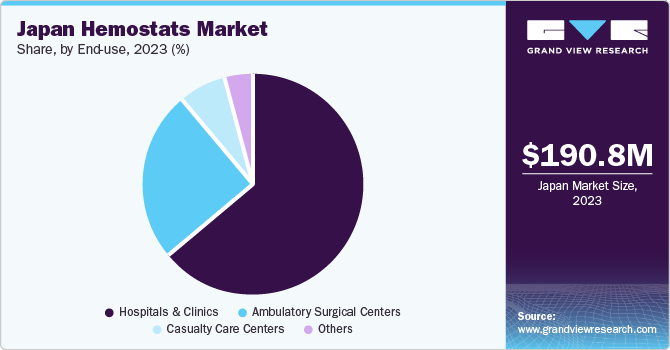

End-use Insights

The hospitals & clinics segment held the largest revenue share of 63.37% in 2023 in the Japan hemostats market. The segment growth can be attributed to the extensive utilization of hemostatic products during various surgeries and procedures such as general surgery, orthopedics, neurosurgery, cardiovascular surgery, obstetrics, gynecology, and emergency medicine in hospital settings. In these diverse medical specialties, hemostatic agents are essential for effectively managing bleeding during various surgical procedures, which boosts the demand for hemostatic agents in hospital settings.

The ambulatory surgical centers segment shows the fastest CAGR over the forecast period in the Japan hemostats market. This is due to the growing number of minimally invasive surgical procedures performed in ASCs, the surging demand for cost-effective healthcare alternatives, and the increasing preference for outpatient care among patients. Hemostats play a pivotal role within ASCs, ensuring effective bleeding control and facilitating healing across various surgical procedures, such as orthopedics, general surgery, and gynecology.

Key Japan Hemostats Company Insights

The competitive scenario in the Japan hemostats market is driven by both new entrants and established players. The industry participants are undertaking various strategies such as collaborations, expansions, and launches to strengthen their market position. In addition, the companies operating in the industry are acquiring other hemostats market participants to enhance their product portfolios.

Key Japan Hemostats Companies:

- Johnson & Johnson Services, Inc.

- CryoLife, Inc

- Integra LifeSciences Corporation

- Cohera Medical, Inc.

- Pfizer

- Cohesion Technologies

- B. Braun Melsungen AG

- Baxter

- Medtronic

- BD

Recent Developments

-

In November 2023, Johnson & Johnson Services, Inc. (Ethicon) launched ETHIZIA, a hemostatic sealing patch clinically validated to stop bleeding effectively. It is a hemostatic matrix developed to be equally active and effective on both sides.

-

InDecember 2022, Integra LifeSciences concluded the acquisition of Surgical Innovation Associates, marking a strategic expansion in its surgical solutions portfolio. This acquisition enhanced Integra's position in the medical device market and reinforced its commitment to advancing surgical innovation.

Japan Hemostats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 201.7 million

Revenue forecast in 2030

USD 292.6 million

Growth rate

CAGR of 6.40% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, end-use, application

Country scope

Japan

Key companies profiled

Johnson & Johnson Services, Inc.; CryoLife, Inc; Integra LifeSciences Corporation; Cohera Medical, Inc.; Pfizer; Cohesion Technologies; B. Braun Melsungen AG; Baxter; Medtronic; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Japan Hemostats Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Japan hemostats market report on the basis of end-use, product, application, and formulation:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Thrombin-based Hemostats

-

Oxidized Regenerated Cellulose-based Hemostats

-

Combination Hemostats

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Matrix & Gel Hemostats

-

Sponge Hemostats

-

Powder Hemostats

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Casualty Care Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

General Surgery

-

Neurological Surgery

-

Cardiovascular Surgery

-

Others

-

Frequently Asked Questions About This Report

b. The Japan hemostats market size was estimated at USD 190.8 million in 2023 and is expected to reach USD 201.7 million in 2024.

b. The Japan hemostats market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 292.6 million by 2030.

b. Based on product, oxidized regenerated cellulose based hemostats dominated the Japan hemostats market with a share of 46.5% in 2023. This is attributable to established effectiveness, wide range of applications and proven efficacy and widespread adoption of these products

b. Some key players operating in the Japan hemostats market include Johnson & Johnson Services, Inc., CryoLife, Inc, Integra LifeSciences Corporation, Cohera Medical, Inc., Pfizer, Cohesion Technologies, B. Braun Melsungen AG, Baxter, Medtronic, and BD

b. Key factors that are driving the Japan hemostats market growth include the government support for quality healthcare, rising number of surgical procedures in Japan, and increasing prevalence of chronic conditions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.