- Home

- »

- Next Generation Technologies

- »

-

Japan Anime Market Size, Share & Growth, Report, 2030GVR Report cover

![Japan Anime Market Size, Share & Trends Report]()

Japan Anime Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment), By Genre (Action & Adventure, Sci-Fi & Fantasy), And Segment Forecasts

- Report ID: GVR-4-68040-208-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Anime Market Size & Trends

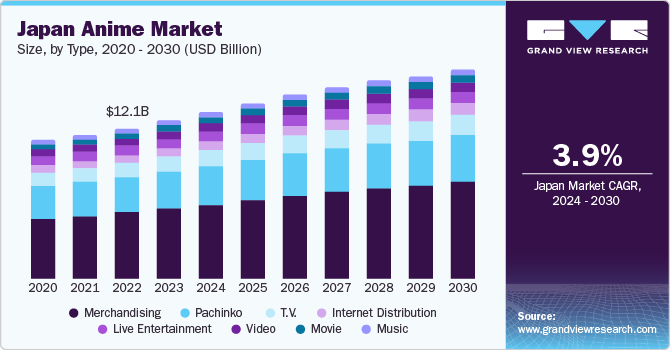

The Japan anime market size was estimated at USD 12.72 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. The increasing popularity, emerging digital distribution, and rise of otaku culture are the key factors driving the market growth. Due to the aging population and their changing preferences, Japan has witnessed a significant diversification in terms of anime content, delivery, and adaptations.

The widespread adoption of anime on a global scale is contributing to the growth of Japan anime market as multinational entertainment companies are obtaining copyrights and acquiring Japan-based anime streaming firms. For instance, in August 2021, Sony Pictures Entertainment announced the successful acquisition of AT&T's subsidiary, Crunchyroll LLC, an anime organization, through Funimation Global Group, LLC. Funimation, an alliance between Sony Music Entertainment's subsidiary, Aniplex Inc., and SPE has expanded distribution for content partners and fan-centric offerings, catering to more than 120 million registered users in more than 200 territories worldwide.

The Otaku culture plays a significant role in the Japanese anime market, influencing trends, consumer behavior, and industry landscape. Otaku refers to a person passionate about manga, anime, video games, and other properties of Japanese pop culture. These enthusiastic fans often drive the demand for anime-related products and contribute substantially to the market's growth.

Japanese manga, a form of illustrated book developed for diverse age groups, is deeply ingrained in the local culture and is expected to play a pivotal role in promoting related anime, thereby fueling growth of the Japan anime industry. Additionally, other forms of entertainment media, such as anime-based video games are anticipated to further accelerate the market development. Animes such as Pokemon, Mobile Suit Gundam, One Piece, Naruto Shippuden, and Attack on Titans have a wealth of popular game adaptations.

Live-action adaptations of popular Japan anime series are attracting new viewers who may avoid anime due to its cartoonish presentation style. This filmography branch utilizes real-life characters instead of cartoon animations to recreate the original anime series. Netflix's One Piece, a successful live-action adaptation, topped the charts in 60 countries for weeks after its debut in August 2023. This success illustrates the potential of live-action adaptations to appeal to a broader audience, including those unfamiliar with anime, and is anticipated to increase the Japan anime market value in the near future.

The outbreak of COVID-19 adversely impacted anime production worldwide, resulting in the implementation of lockdown measures. However, this unprecedented situation led to a surge in the number of viewers, primarily attributed to the temporary halt in work and the resultant increase in overall entertainment consumption.

Market Concentration & Characteristics

Japan's anime market growth stage is low and the pace is accelerating. The country’s anime market is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive culture. One prominent feature is the increasing adoption of online streaming services across several smart devices, including smartphones, tablets, and smart TVs.

Karaoke, the popular recreational activity of singing along to famous tunes, has had a notable impact on the anime market in Japan. It is because anime productions significantly emphasize producing memorable theme songs, also known as Anison, to stimulate further and sustain the market. The widespread acceptance of Karaoke has thus influenced the anime industry.

The Japanese government extends cultural grant assistance as an Official Development Assistance (ODA) component to foster culture pertaining to anime, sports, and higher education in developing nations. In 2022, five projects worth approximately USD 4.5 million were carried out, focusing on preserving and exhibiting equipment for facilities that protect cultural heritage. In addition, the 20 Grant Assistance for Cultural Grassroots Projects, aimed at promoting sports and Japanese language studies, were executed to enhance mutual understanding and friendly relationships between Japan and the respective countries.

Comiket is a biannual doujinshi fair held in Japan, one of the world's largest conventions. It showcases self-published manga and fan works and is located at the Tokyo Big Sight Convention Center. The event attracts a massive crowd, with hundreds of thousands of attendees who browse and purchase various merchandise. Comiket also features cosplay, a popular activity where attendees dress up as anime characters. Established in 1975, Comiket celebrates creativity, otaku culture, and artistic expression within the manga and anime community. The 102nd Comiket held in August 2023 recorded an impressive 260,000 attendees, which highlights the significant fanbase for anime in Japan.

Type Insights

The merchandising segment accounted for the largest revenue share of 44.1% in 2023 and is expected to continue its dominance from 2024 to 2030. The growth of the merchandising segment can be attributed to factors such as rising anime fanbase, creative and personalized product demand, and rising disposable income. The organizations can influence more fans, leading to increased viewership and consumers, enhancing the market's growth.

The internet distribution segment is anticipated to witness the fastest growth during the forecast period. This growth can be attributed to the emergence of technology and the increasing demand for streaming services. The consumption of anime series and episodes on various Japanese anime websites and streaming services, such as Crunchyroll, Netflix, Funimation, and Aniplus Asia, is rising. In October 2023, Sony's Crunchyroll launched a free ad-based anime streaming channel to cater to a broader consumer base.

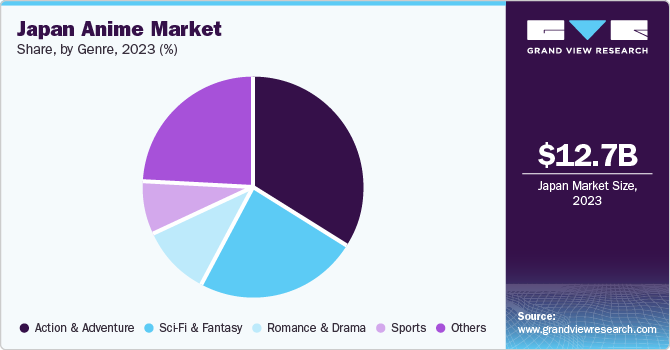

Genre Insights

Based on genre, the market is segmented into action and adventure, sci-fi and fantasy, romance and drama, sports, and others. The action and adventure segment held the largest revenue share in 2023. The genre is driven by thrilling narratives and action-packed scenes capable of appealing to a wider audience range.

On the other hand, the sci-fi & fantasy segment is expected to witness the fastest CAGR from 2024 to 2030. Sci-fi & fantasy anime present an opportunity to explore new and intriguing possibilities, particularly for those seeking respite from the stresses of daily life, driving the segment. Several new anime are being launched by this demand, for instance, Cyberpunk: Edgerunners, a sci-fi anime launched by Studio Trigger, an anime producer, in collaboration with CD Projekt, a game developer, in September 2022, to capture an audience for both, the series as well as the game, Cyberpunk 2077.

Key Japan Anime Company Insights

Some of the key market players includeToei Animation Co., Ltd.; Studio Ghibli; Sunrise, Inc.; Pierrot Co., Ltd.; Production I.G, Inc.; MADHOUSE; Crunchyroll; Kyoto Animation Co., Ltd., Inc.; Ufotable Co., Ltd.; Bones Inc.; and Progressive Animation Works Co., Ltd.

-

Studio Ghibli, known for its extraordinary animations, offers a variety of merchandise, including plush toys, apparel, stationery, home decor, and kitchenware. They also provide art, collectibles, books, and media, and their museum in Mitaka, Japan, showcases their artwork.

-

Toei Animation, a renowned anime studio, offers a wide range of products apart from its popular series, including merchandise, games, music, streaming services, theme parks, and events, including collectibles like figures and statues. Furthermore, the studio produces soundtracks and live shows.

-

Kyoto Animation (KyoAni) is an anime studio focused on a niche genre, slice-of-life. Apart from anime the company also offers products such as anime merchandise, light novels, manga adaptations, music, soundtracks, and limited-edition goods.

Key Japan Anime Companies:

- Pierrot Co., Ltd.

- Production I.G, Inc.

- Studio Ghibli, Inc.

- Sunrise, Inc. (Bandai Namco Filmworks)

- Toei Animation Co., Ltd.

- Bones Inc.

- Kyoto Animation Co., Ltd.

- MADHOUSE, Inc.

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Progressive Animation Works Co., Ltd. (PA Works)

- Sentai Holdings, LLC (AMC Networks)

- Ufotable Co., Ltd.

Recent Developments

-

In October 2023, Toei Animation announced the launch of Dragon Ball DAIMA, a continuation series of its most famous anime franchise, Dragon Ball. The series commemorates the 40th anniversary of Dragon Ball and is speculated to be released in 2024.

-

In February 2023, Toei Animation Co., Ltd. announced a new collaborative project called DenDekaDen in association with Strata Co., Ltd. This newly established creative organization leverages technology to empower and elevate creativity. In this project, Toei introduced a new set of characters poised to take the next step towards the further development of Web 3.0. The project was born from a shared vision to create a new franchise expected to gain popularity worldwide.

Japan Anime Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 16.84 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, genre

Key companies profiled

Pierrot Co., Ltd.; Production I.G, Inc.; Studio Ghibli, Inc.; Sunrise, Inc. (Bandai Namco Filmworks); Toei Animation Co., Ltd.; Bones Inc.; Kyoto Animation Co., Ltd.; MADHOUSE, Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Progressive Animation Works Co., Ltd. (PA Works); Sentai Holdings, LLC (AMC Networks); Ufotable Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Anime Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan animemarketreport based on type, and genre:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

T.V.

-

Movie

-

Video

-

Internet Distribution

-

Merchandising

-

Music

-

Pachinko

-

Live Entertainment

-

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Action & Adventure

-

Sci-Fi & Fantasy

-

Romance & Drama

-

Sports

-

Others

-

Frequently Asked Questions About This Report

b. The Japan anime market size was estimated at USD 12.72 billion in 2023 and is expected to reach USD 13.37 billion in 2024

b. The Japan anime market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 16.84 billion by 2030

b. The merchandising segment held the largest revenue share in 2023. It can be attributed to factors such as rising anime fanbase, creative and personalized product demand, and rising disposable income.

b. Some key players operating in the Japan anime market include Pierrot Co., Ltd.; Production I.G, Inc.; Studio Ghibli, Inc.; Sunrise, Inc. (Bandai Namco Filmworks); Toei Animation Co., Ltd.; Bones Inc.; Kyoto Animation Co., Ltd.; MADHOUSE, Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Progressive Animation Works Co., Ltd. (PA Works); Sentai Holdings, LLC (AMC Networks); Ufotable Co., Ltd.

b. The increasing popularity, emerging digital distribution, and rise of otaku culture are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.